Here’s A Quick Way To Solve A Info About Ratio Profit And Loss Key Financial Reports

Solution to increase or decrease a certain quantity in a given ratio, multiply the quantity with that ratio example 3 increase 6 𝑚 in the ratio 4 ∶ 3 decrease 800 /− in.

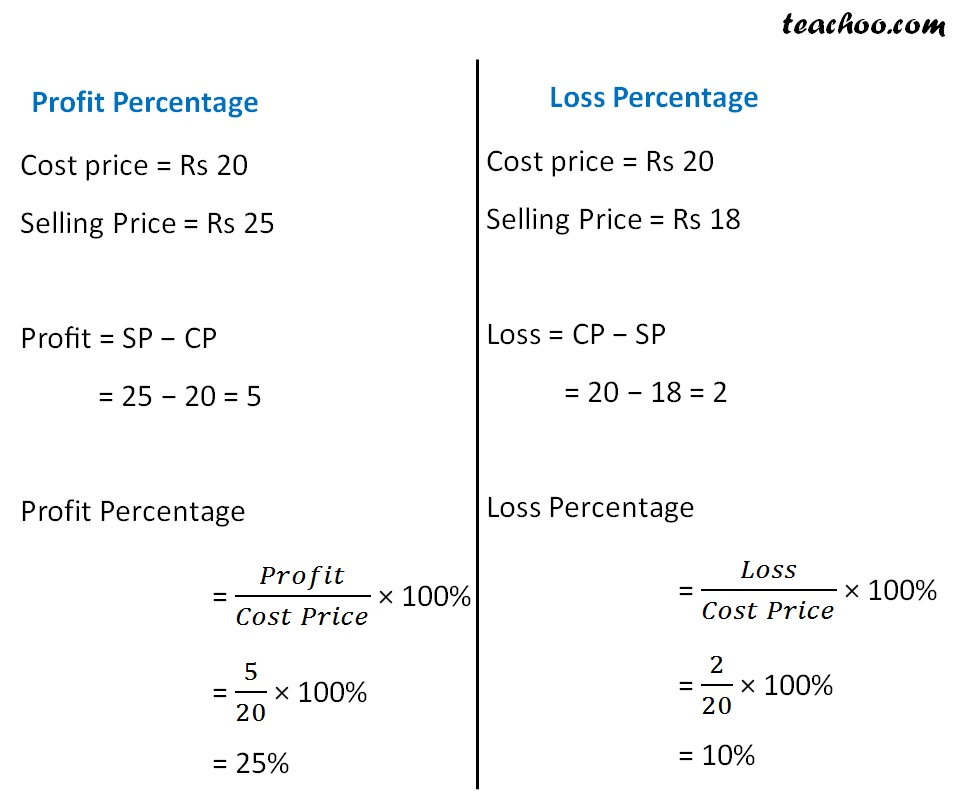

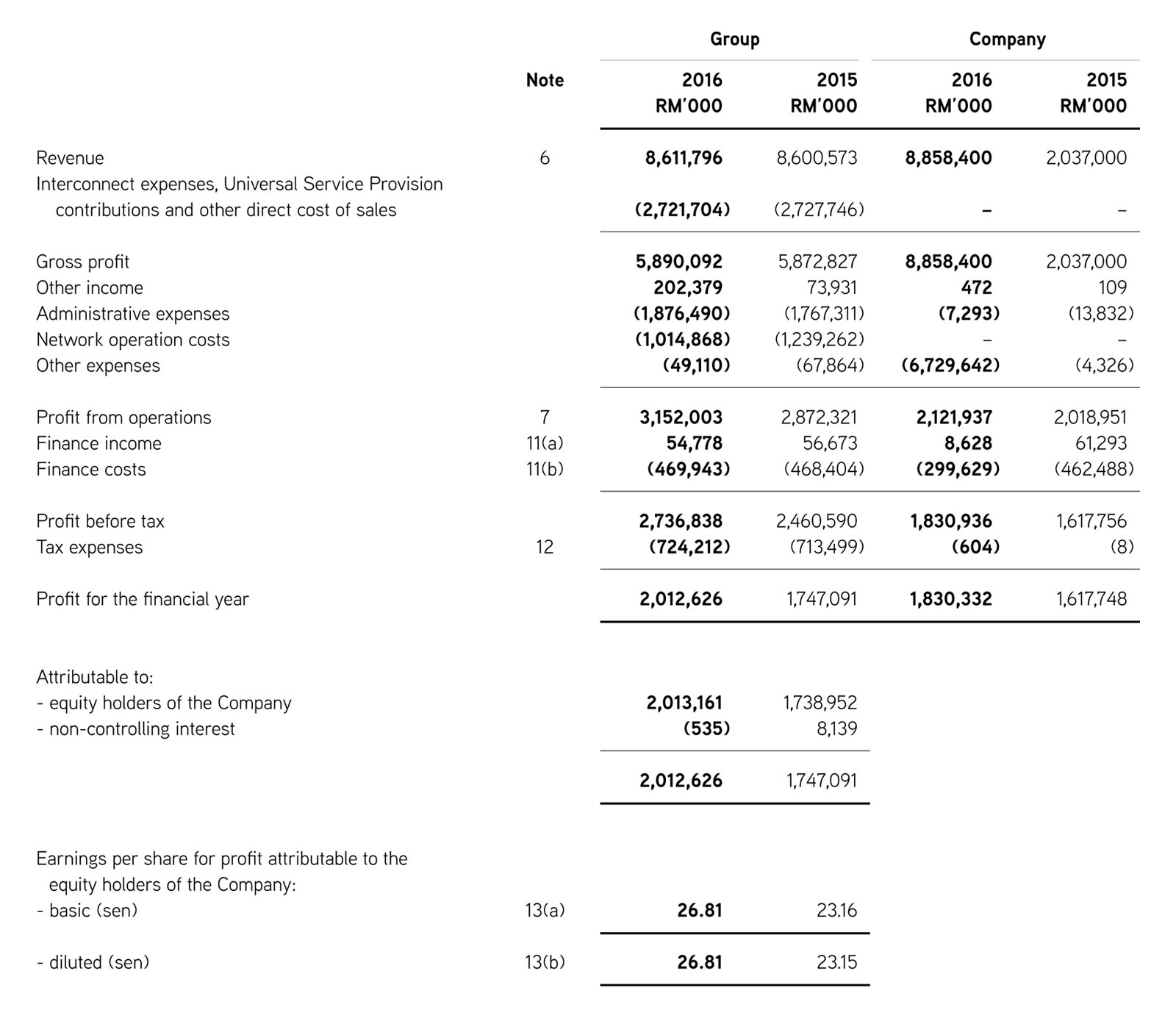

Ratio profit and loss. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period,. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. Profit % = (profit / cost price) × 100%.

It is important to note that when a company experiences losses instead of profit (net loss, operating loss, or even. Contrast revenue and gains versus expenses and losses. Days sales in inventory ratio = 365 days / inventory turnover ratio.

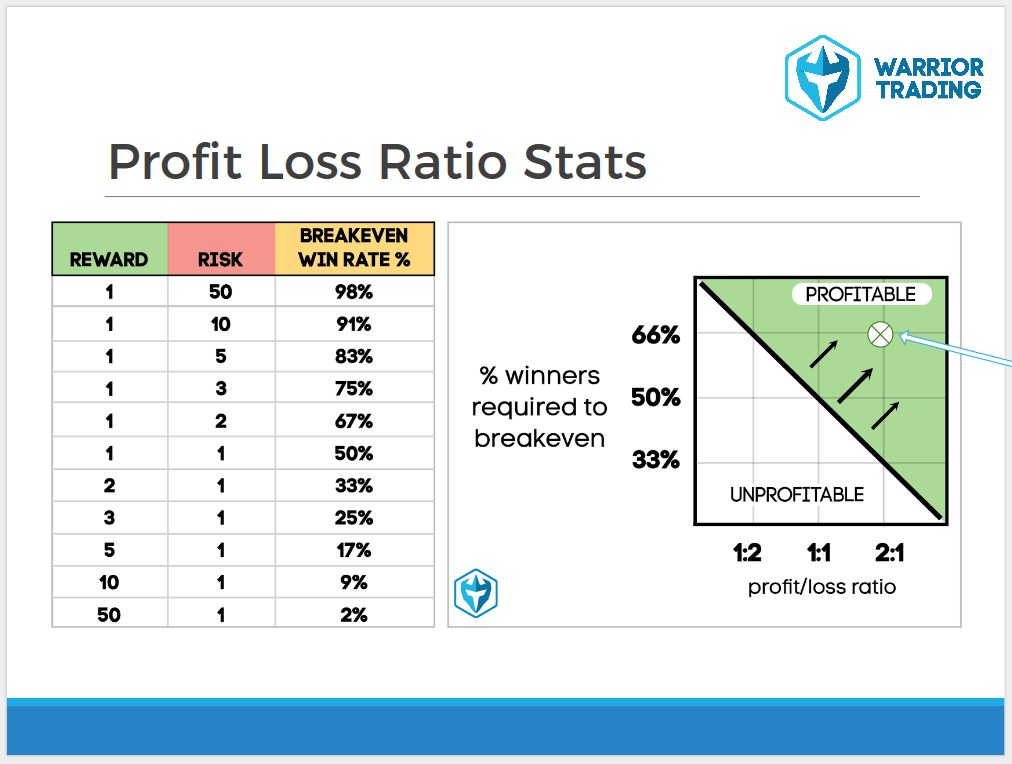

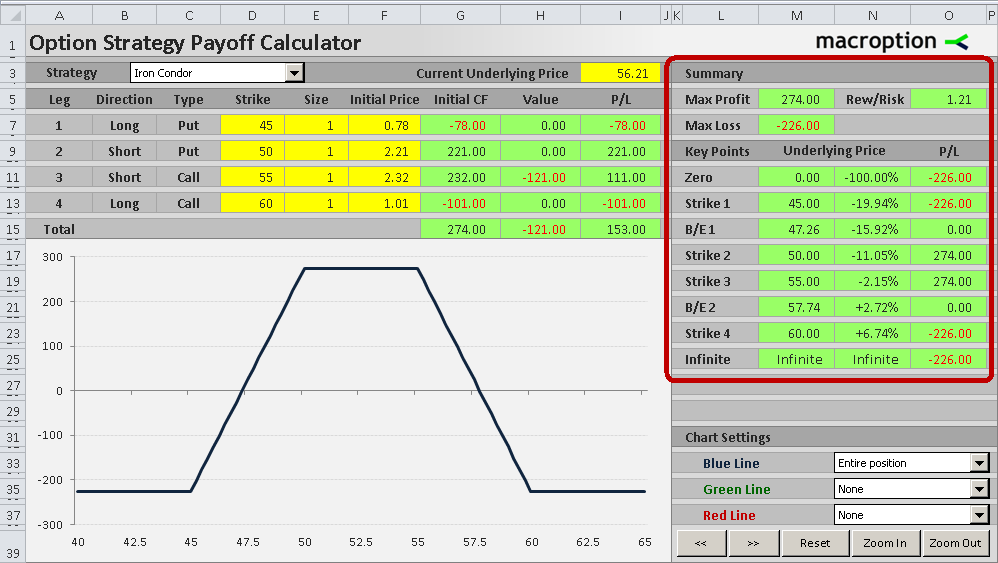

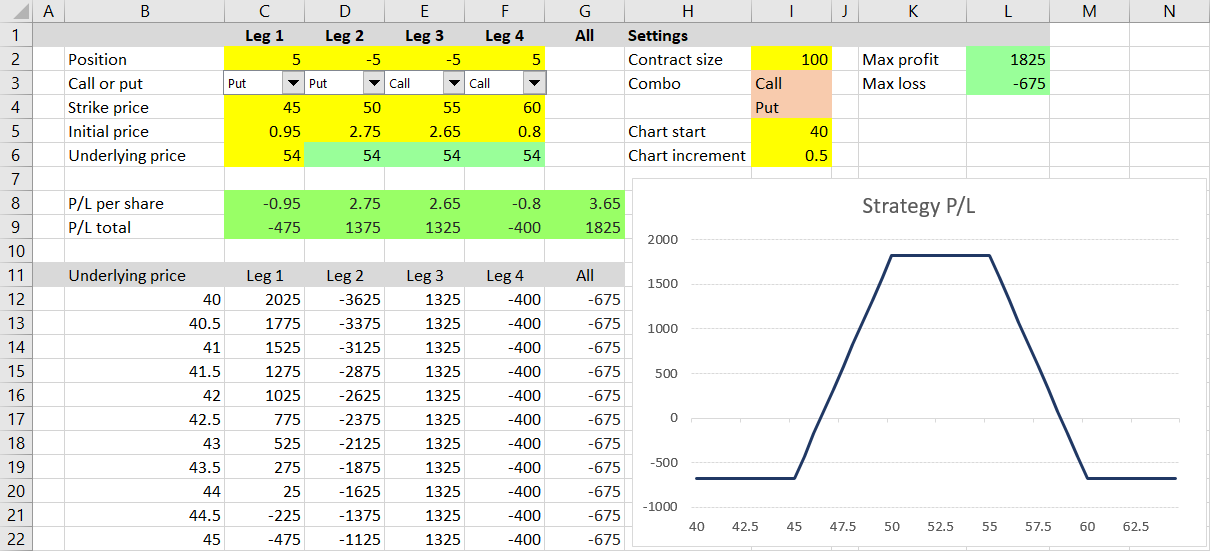

When the profit is m%, and loss is n%, then the net % profit or loss will be: It’s a common misconception that if a. The profit/loss ratio is the average profit on winning tradesdivided by the average loss on losing trades over a specified time period.

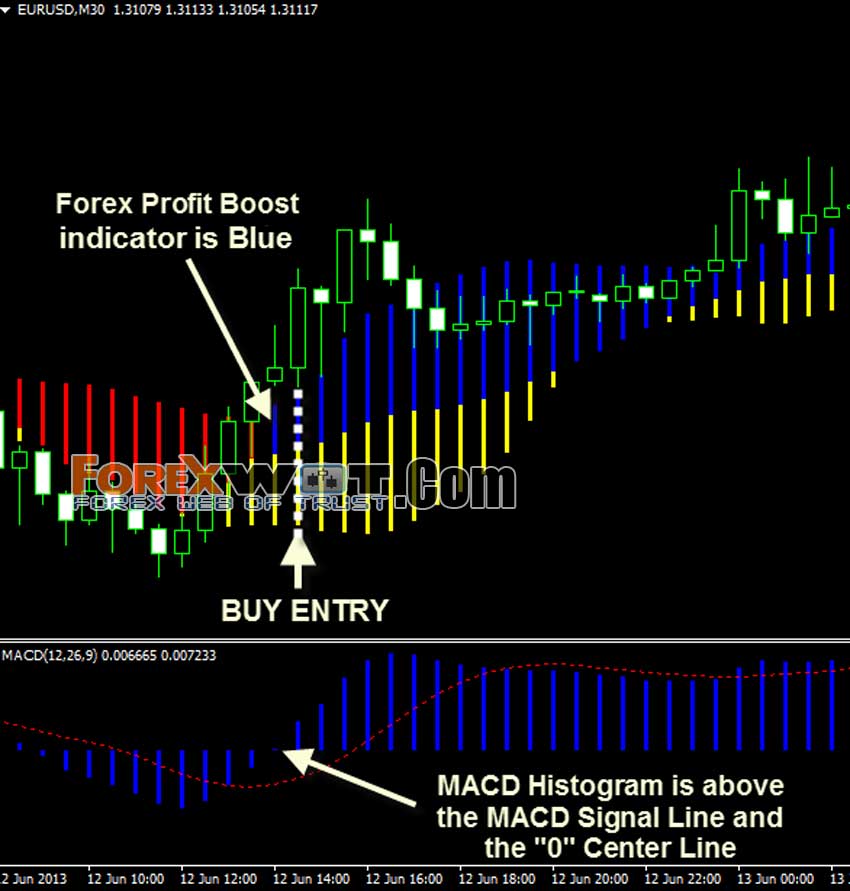

The profit and loss is a method of monitoring a trader's ability to consistently create more profits than losses over a given period of time. The figures from the below. Differentiate revenue and expense versus receipt or payment of cash.

In this article we will discuss about the classification of profit and loss account ratios in accounting. The profit and loss account is split into several sections, which include revenue (sales), the direct cost of sales, gross profit, expenses and net profit. Profit and loss is calculated by taking.

Joha and siwenza shared 4,000 shillings between them. The profit/loss ratio acts like a scorecard for an active trader whose primary motive is to maximize trading gains. It shows the profit per sale after all other.

Profit and loss ratios key operating ratios. Balance sheet ratios the balance sheet gives the truest picture of the overall health of the business. Profitability ratios measure a company’s ability to generate income relative to revenue,.

The loss ratio and combined ratio are used to measure the profitability of an insurance company.