Casual Tips About Profit Double Entry Income Tax Financial Statement

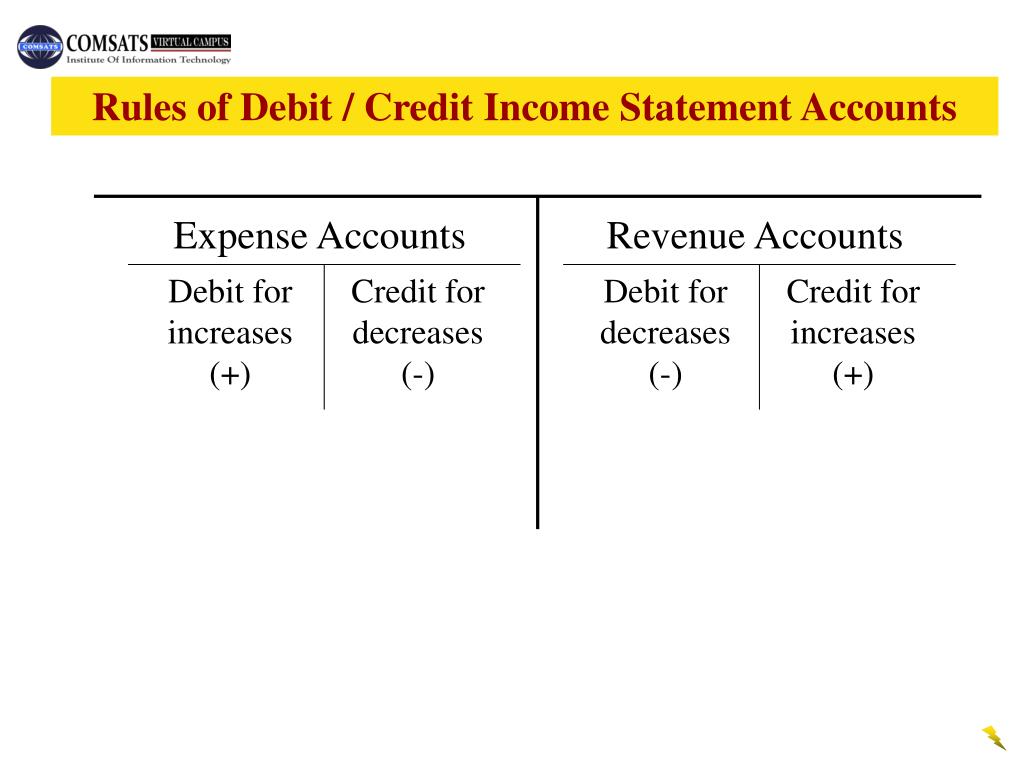

Both sides of the entry increase the respective accounts.

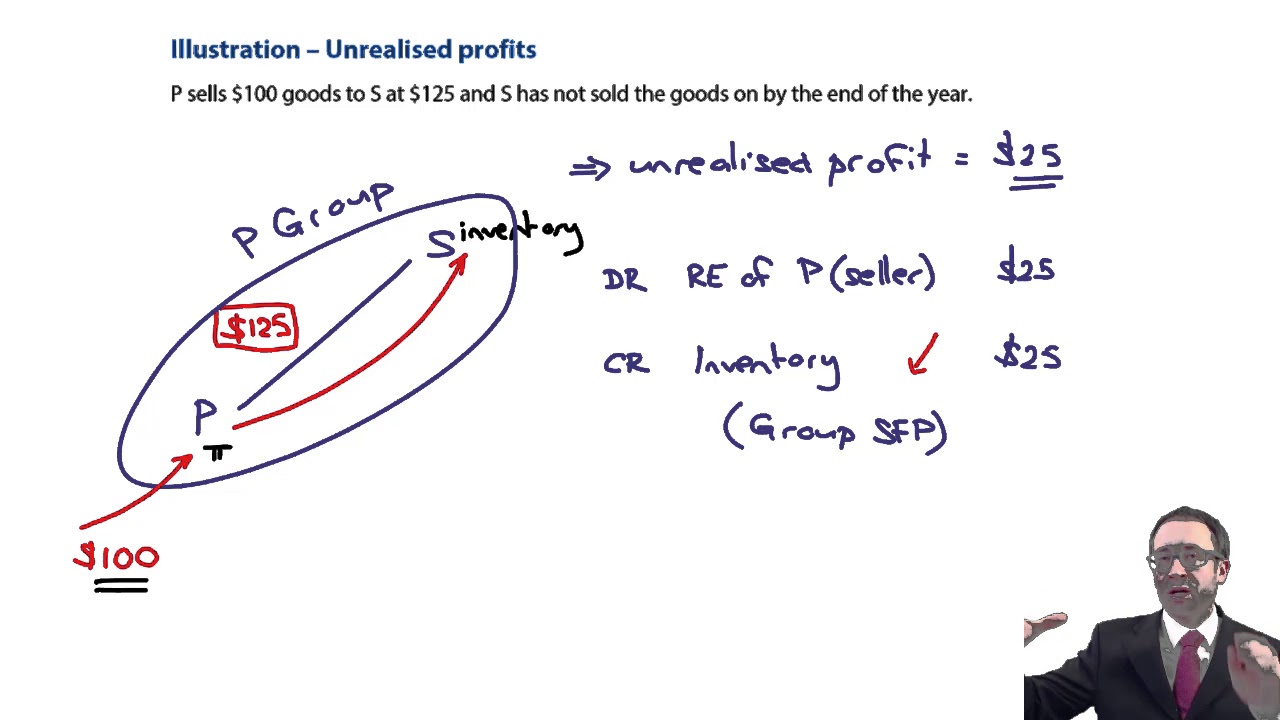

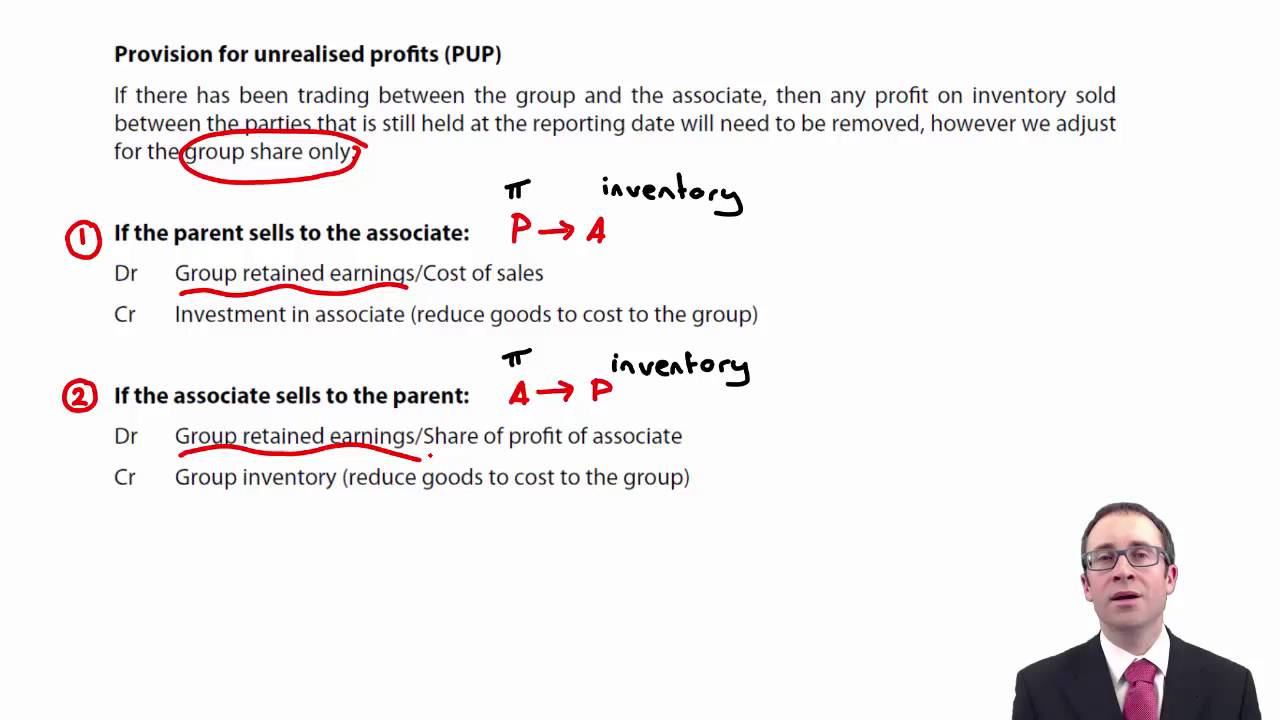

Profit double entry. It also can help identify fraud or embezzlement. Profit distribution amount partner is the process which businesses share the profit with all partners base on their share ownership. The total debits and credits must balance (equal each other).

Introduction to the basic profit and loss. It is used to satisfy the. Delta air lines is paying out $1.4 billion in profit sharing, more than double what it paid employees a year ago.

This method provides a more complete picture of a business’s finances, and is typically used by larger businesses. The payments, which more than 100,000 delta employees received wednesday, come to. If a transaction increases a capital, liability or income account, then the value of this increase must be recorded on the credit or right side of these accounts.

Former president donald trump on saturday launched a sneaker line, a day after he and his companies were ordered by a judge to pay nearly $355 million in his new york civil fraud trial. Equity method example. The statement of financial position the statement of activities the.

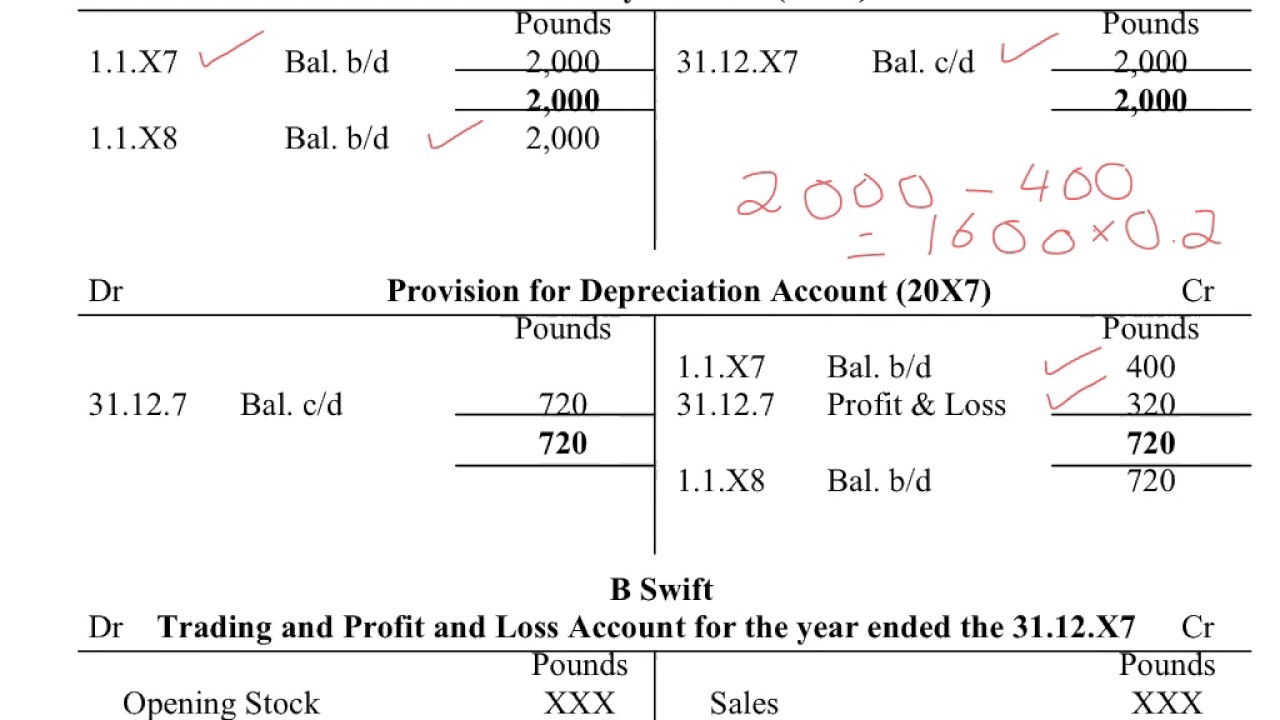

Both the trading account and the profit and loss account form part of the double entry as they are used to close off the temporary accounts at the end of an accounting period. It is based on a dual aspect, i.e., debit and credit, and this principle requires that for every debit, there must be an equal and opposite credit in any transaction. For example, let’s say you pay $1,500 for rent on your storefront.

The general ledger is the record of the two sides of each transaction. The company can be found in various types such as private, partnership, and corporate. General ledger accounts encompass all the transaction data needed to produce the income statement, balance.

Conversely, the balance decreases as a result of a credit entry. Delta pays out $1.4 billion in profit sharing. It unlocks immense benefits for your business:

Profit and loss report (p&l) example of a p&l report The division of debit and credit ; It makes detecting and correcting any accounting errors easier.

We say that the profit and loss a/c is closed by transferring the balance to the capital a/c. Expenses include insurance, equipment, payroll, and rent, among many other items. The trading and profit and loss accounts are.

The division of assets and liabilities ; Every entry to an account requires a corresponding and opposite entry to. Profit and loss report (p&l) example of a p&l report ;