Awesome Info About Net Loss In Accounting Section 27a Of Income Tax Act

:max_bytes(150000):strip_icc()/NetProfitMargin2-edf5ae45cbe048208913caa9d3b03110.png)

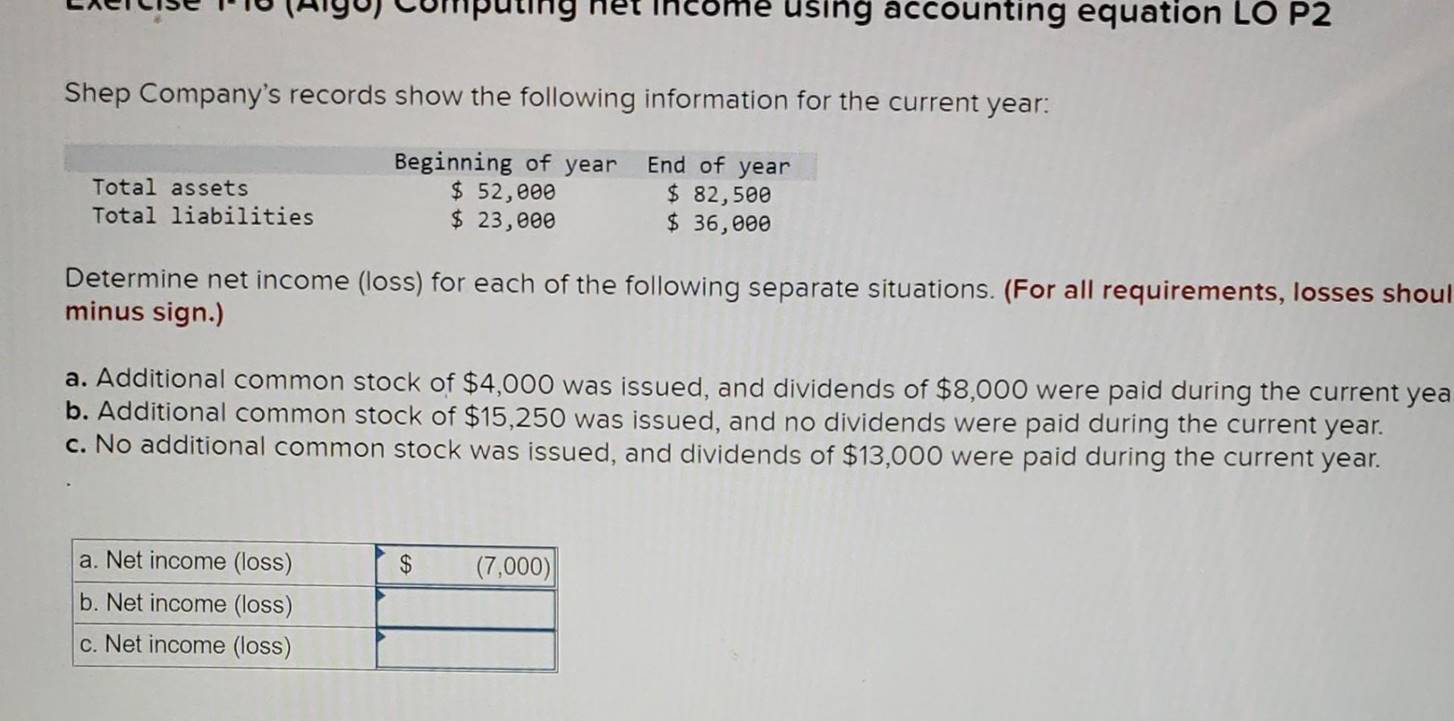

Let us take the example of abc company.

Net loss in accounting. Trump’s civil fraud trial as soon as friday, the former president. A net operating loss (nol) or tax loss carryforward is a tax provision that allows firms to carry forward losses from prior years to offset future profits, and, therefore, lower future. All expenses are included in this calculation, including the effects of income taxes.

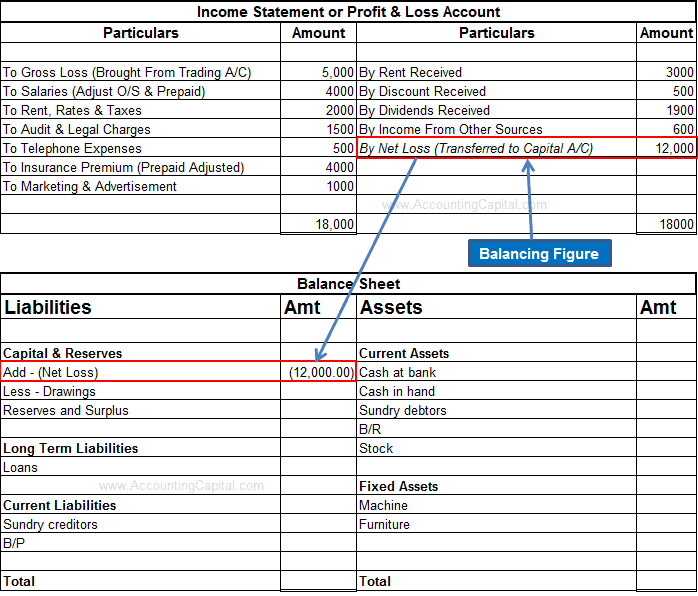

Net loss occurs when all sources of income are less than the total of all expenses and losses from disposing assets. Net loss in accounting. Losses and financial statements losses.

Accounting policies and procedures manual | abr31m. A net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income within a tax period. Businesses can carry forward their.

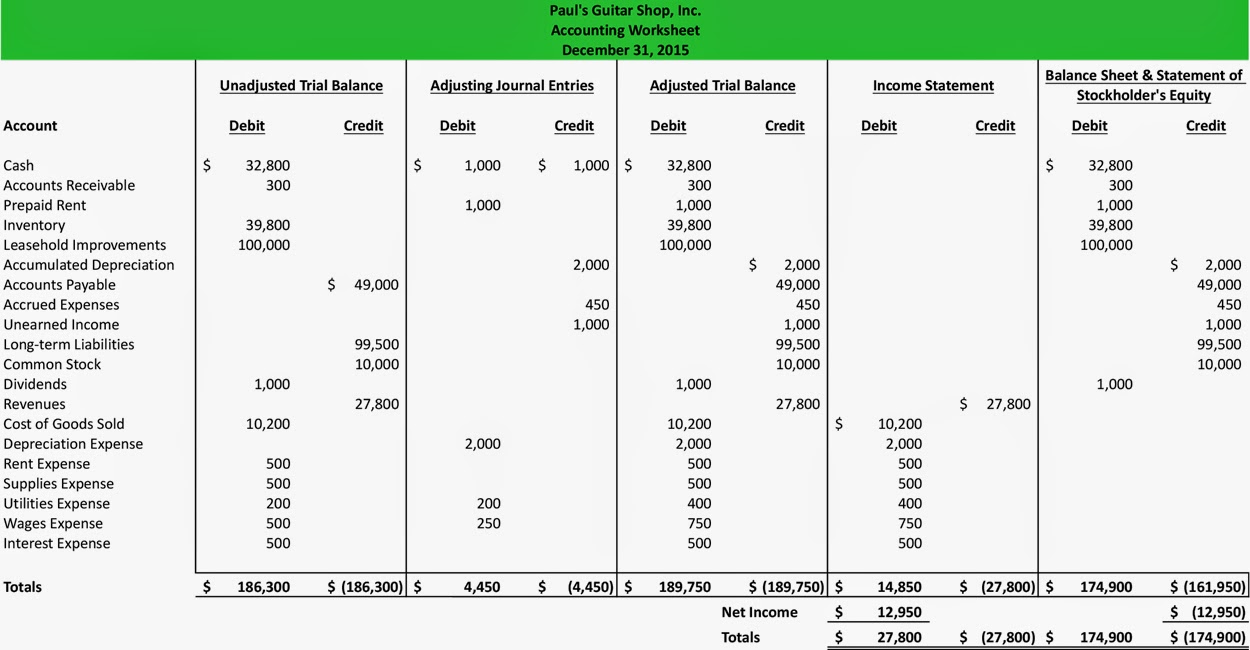

Net operating loss (nol) a company’s allowable deductions exceed the taxable income within a tax period. A net loss is an accounting term that refers to a situation where a company or individual makes a profit on one item but ends up losing money on another. By completing your income statement, you'll properly show the net loss for your accounting records.

Net loss is a term used in accounting to describe a situation where a company’s expenses. A net operating loss is a tax credit that occurs when the business tax deductions exceed its taxable income in a year. When a new york judge delivers a final ruling in donald j.

Home net profit / loss it is the difference between the gross profit or loss and the total indirect income / expenses of a business. Net loss is a term frequently used in accounting and finance to express the financial performance of a company or individual when expenses surpass revenue. October 8, 2021 what is net income?

Discover how ford faced a $523m net loss in q4, navigating pension charges and a uaw strike,. Tax revenue shortfall: Learn how you could recover losses.

To avoid operating at a. In other words, a company incurs a net loss when the expenses for a specific period are higher than the revenues for the same period. The business reported a revenue of $9,000.

Net income is the total amount of money your business earned in a period of time, minus all of its business expenses, taxes, and. The business incurred $4,000 as the cost of. 16, 2024 updated 9:59 a.m.

Net income is the opposite of a net loss, which is when a business loses money. Consider a state grappling with an anticipated decrease of $99 million in revenue due to substantial tax credits. Net loss is an accounting term, and it refers to a negative value for income.