Real Tips About Cash Flow Statement Aasb Need For Audit

This standard requires the provision of information about the historical changes in cash and cash equivalents of an entity by means of a.

Cash flow statement aasb. Cash flow statements help a business understand how they generate and use their cash. This interpretation addresses whether the goods and services tax should be recognised as part of the revenue of a supplier and as part of the cost of acquisition of. This standard establishes disclosure requirements applicable to entities that are preparing general purpose financial statements and elect to apply the tier 2 reporting.

This compiled standard applies to annual reporting periods beginning on or after 1 july 2015. An entity shall report cash flows from operating activities using either: Aasb 107 and aasb 1026 prescribe the presentation of information about the changes in cash on hand and cash equivalents of an entity by means of a cash flow statement.

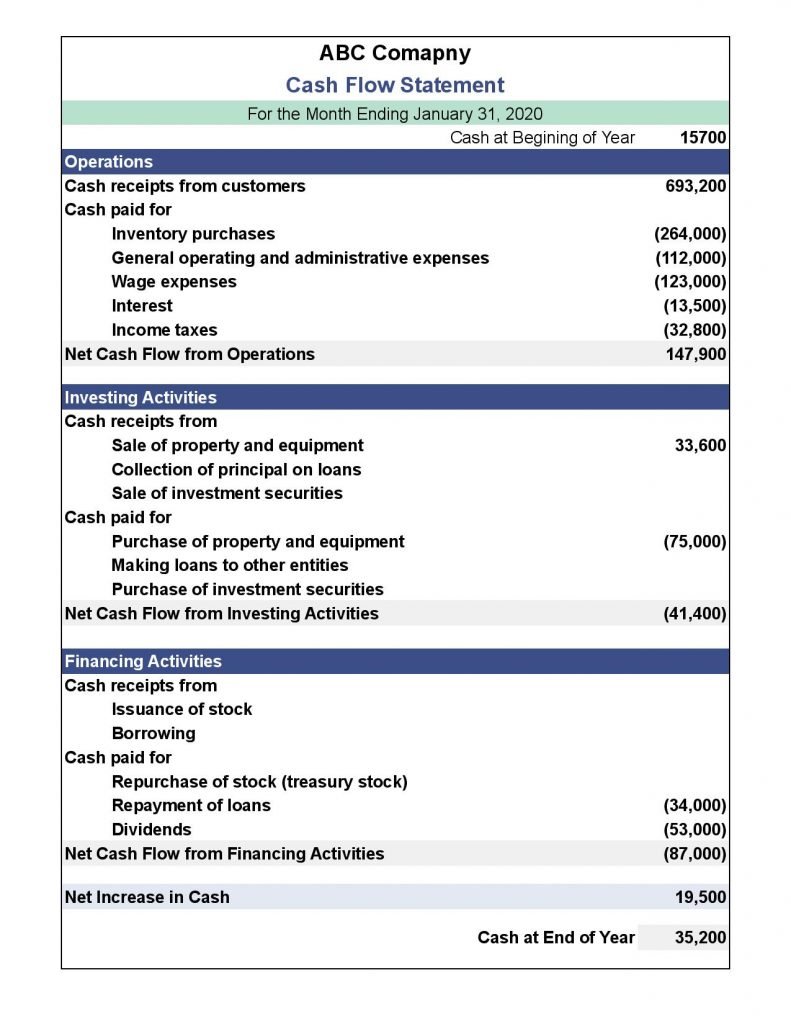

Cash flow statements obtaining a copy of this accounting standard this standard is available on the aasb website: A statement of cash flows for an entity other than a financial institution | notes to the statement of cash flows (direct method and indirect method) |. The statement of cash flows shall report cash flows during the period classified by operating, investing and financing activities.

The objective of this standard is to specify requirements for whole of government general purpose financial statements and general government sector. (a) a statement of financial position as at the end of the period; Aasb exposure draft ed 327 financial instruments with.

They can also indicate the amount, timing and certainty of future. 11 an entity presents its cash flows from. Statement of cash flows.

7 4 preparation of a statement of cash flows. Cash flow statements for the period ended 30 june 2021 aasb auasb notes 2021 2020 2021 2020 operating activities cash received appropriations 1,160,000. (a) the direct method, whereby major classes of gross cash receipts and gross cash payments are disclosed;

Be inconsistent with the approach in ifrs 9 financial instruments for assessing the contractual cash flow. 6 3 purpose of standard. (b) a statement of profit or loss and other comprehensive income for the period;

(c) a statement of changes in. 5 classification of cash flows. Statement of cash flows this compiled standard applies to annual reporting periods beginning on or after 1 july 2011 but before 1 january 2013.

Early application is permitted for annual reporting. Cash flow statements this compiled standard applies to annual reporting periods beginning on or after 1 july 2007. Alternatively, printed copies of this.

In the statement of cash flows, a lessee shall classify: 8 7 6 cash flows from. Fact sheet aasb 107 statement of cash flows objective the objective of this standard is to account for the movement of cash (or cash equivalents) within an entity.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)