The Secret Of Info About Calculating Retained Earnings Balance Sheet An Adjusted Trial Quizlet

Calculating retained earnings on your balance sheet is very simple.

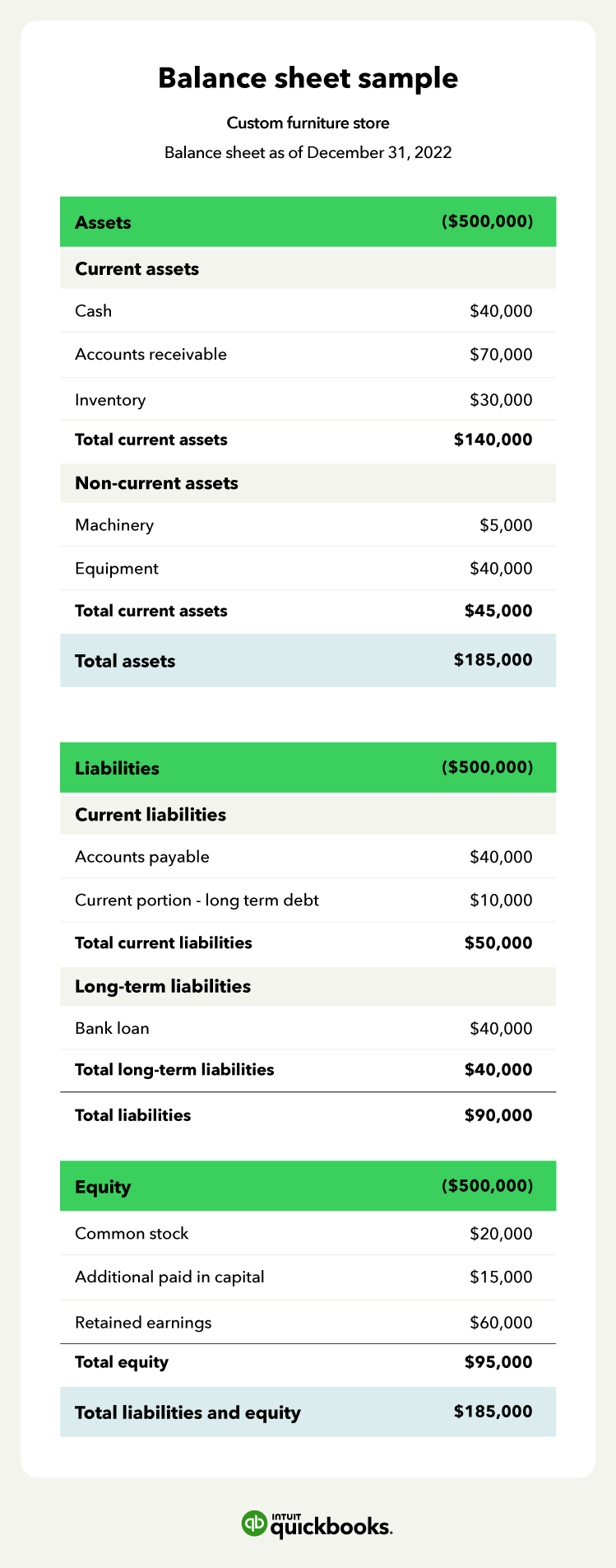

Calculating retained earnings balance sheet. You'll find retained earnings listed as a line item on a company's balance sheet under the shareholders' equity section. Calculating these figures together using a specific formula provides a statement of retained earnings. Most recent net income:

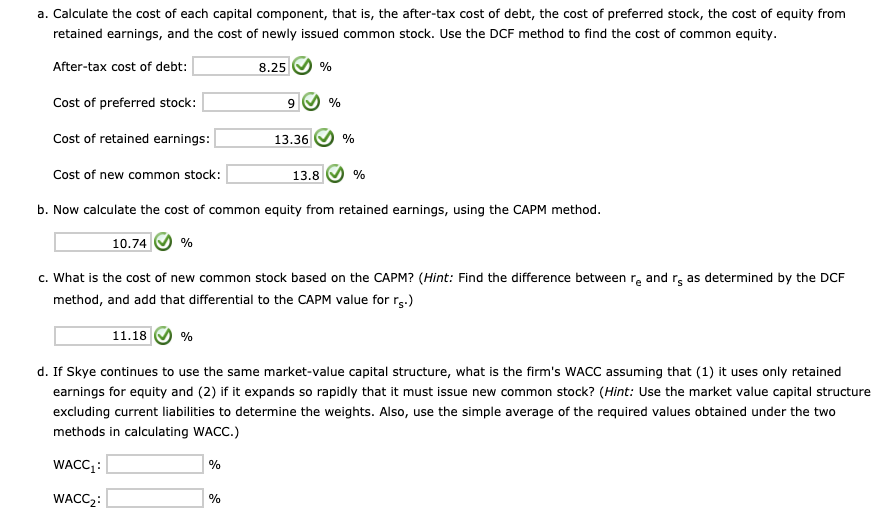

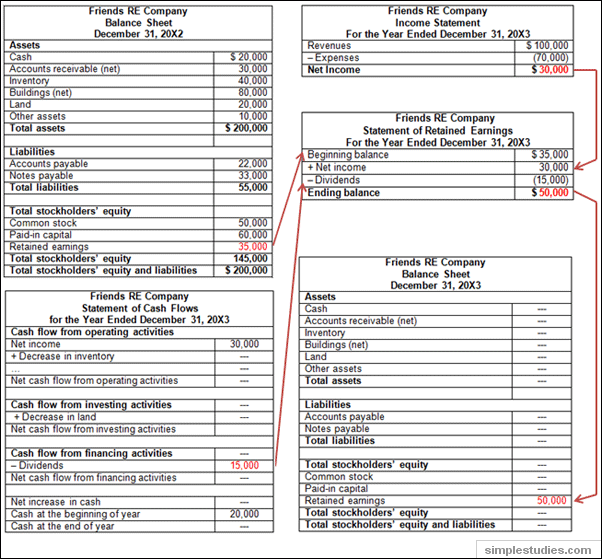

An accumulated deficit is when a company's debts total more than its reported earnings on a balance sheet. 4,725 and 5,207 shares, respectively. The steps to calculate retained earnings on the balance sheet for the current period are as follows.

You need to know your beginning balance, net income, net loss, and dividends paid out to calculate retained earnings. Use a balance sheet to calculate retained earnings. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period.

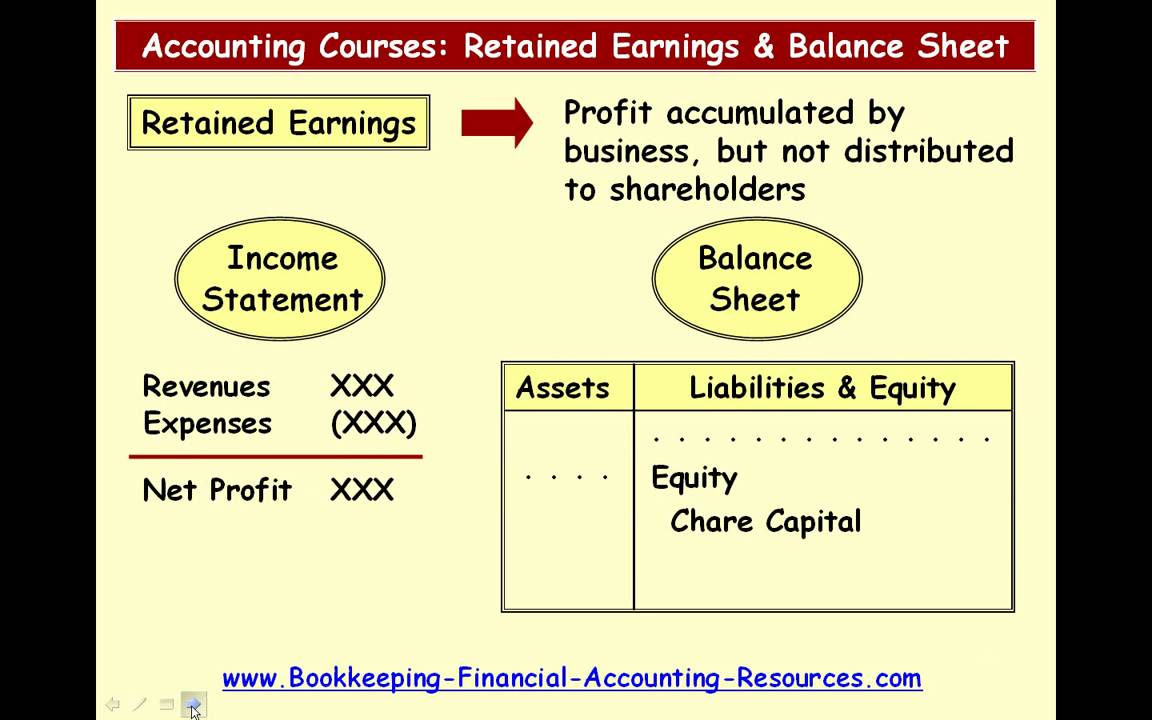

Retained earnings on a balance sheet are the amount of net income remaining after a company pays out dividends to its shareholders. Importance of retained earnings on a balance sheet formula for calculating retained earnings components of retained earnings calculation example of calculating retained earnings on a balance sheet factors affecting retained earnings conclusion introduction The decision to retain the earnings or.

Subtract dividends issued to shareholders; Retained earnings on a balance sheet represent the accumulated profits of a company. Here’s the basic formula for calculating retained earnings:

Assets = liabilities + equity. From there, subtract any dividends that were paid out during that period. It is an accumulation of all the historical profits percentages kept in the company’s reserves for different purposes.

Net income is the profit of a company that is calculated after payment of all the recurring expenses. Retained earnings are calculated by adding the current year’s net profit (if it’s a net loss, then subtracting the current period net loss) to (or from) the previous year’s retained earnings (which is the current year’s retained earnings at the beginning) and then subtracting. Retained earnings are a part of net income, but it does not correspond to only the income of the current financial period.

Your accounting software will handle this calculation for you when it generates your company’s balance sheet, statement of retained earnings and other financial. Accounting august 8, 2023 the business owner’s handbook: The next step to figuring out your retained earnings balance is using a balance sheet.

Unaudited condensed consolidated balance sheets (1) (in thousands, except par value amounts) january 31, 2024. Accountants use the formula to create financial statements, and each transaction must keep the formula in. Businesses generate earnings that they reflect on their balance sheet as negative earnings, or losses, and positive earnings, or profits.

Key takeaways retained earnings (re) are the amount of net income left over for the business after it has paid out dividends to its shareholders. To calculate retained earnings, the beginning retained earnings balance is added to the net income or loss and then dividend payouts are subtracted. You can use a basic accounting formula: