Fantastic Tips About On Balance Sheet Financing Horizontal Analysis Of Interpretation Example

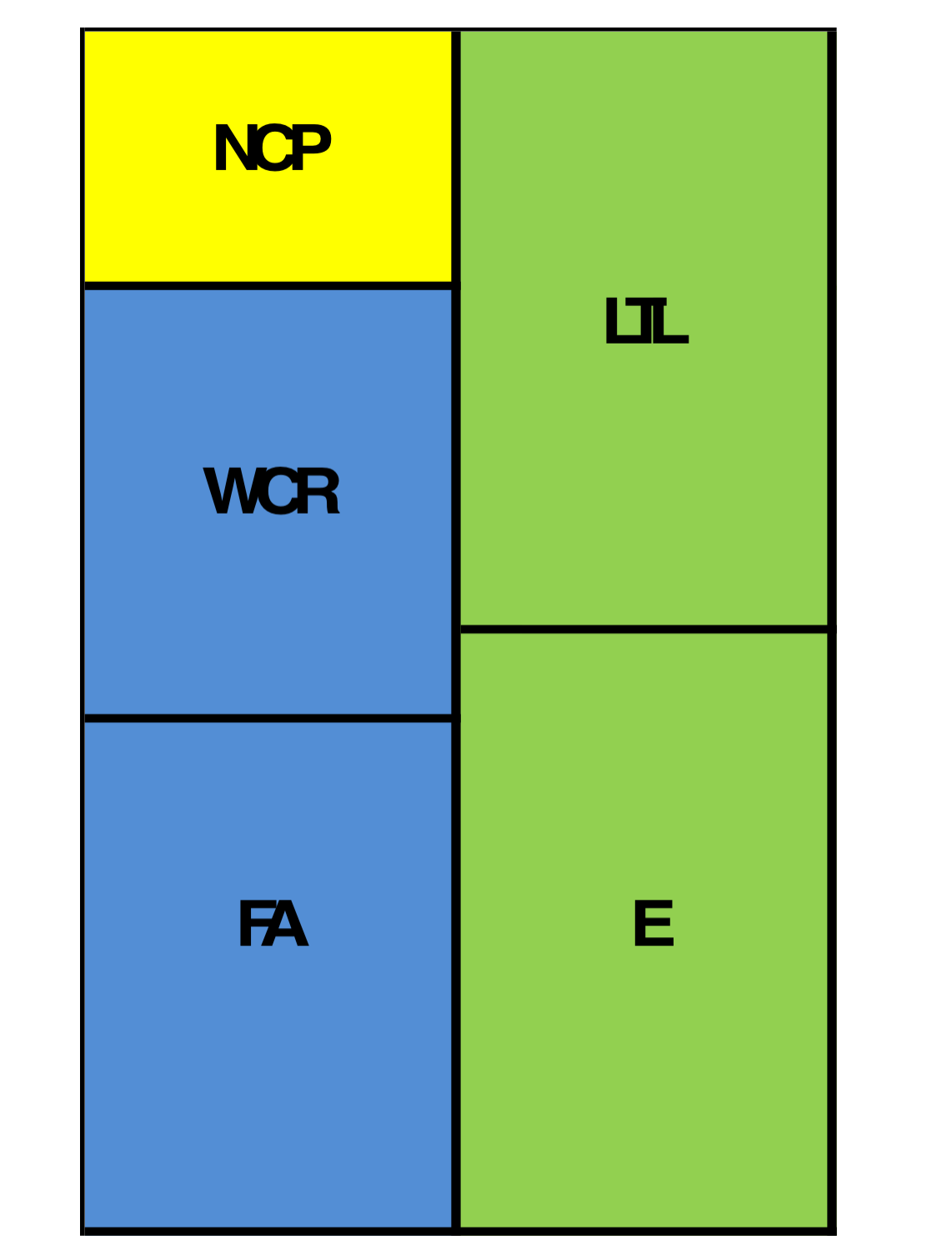

Main balance sheet aggregates response to mp shocks.

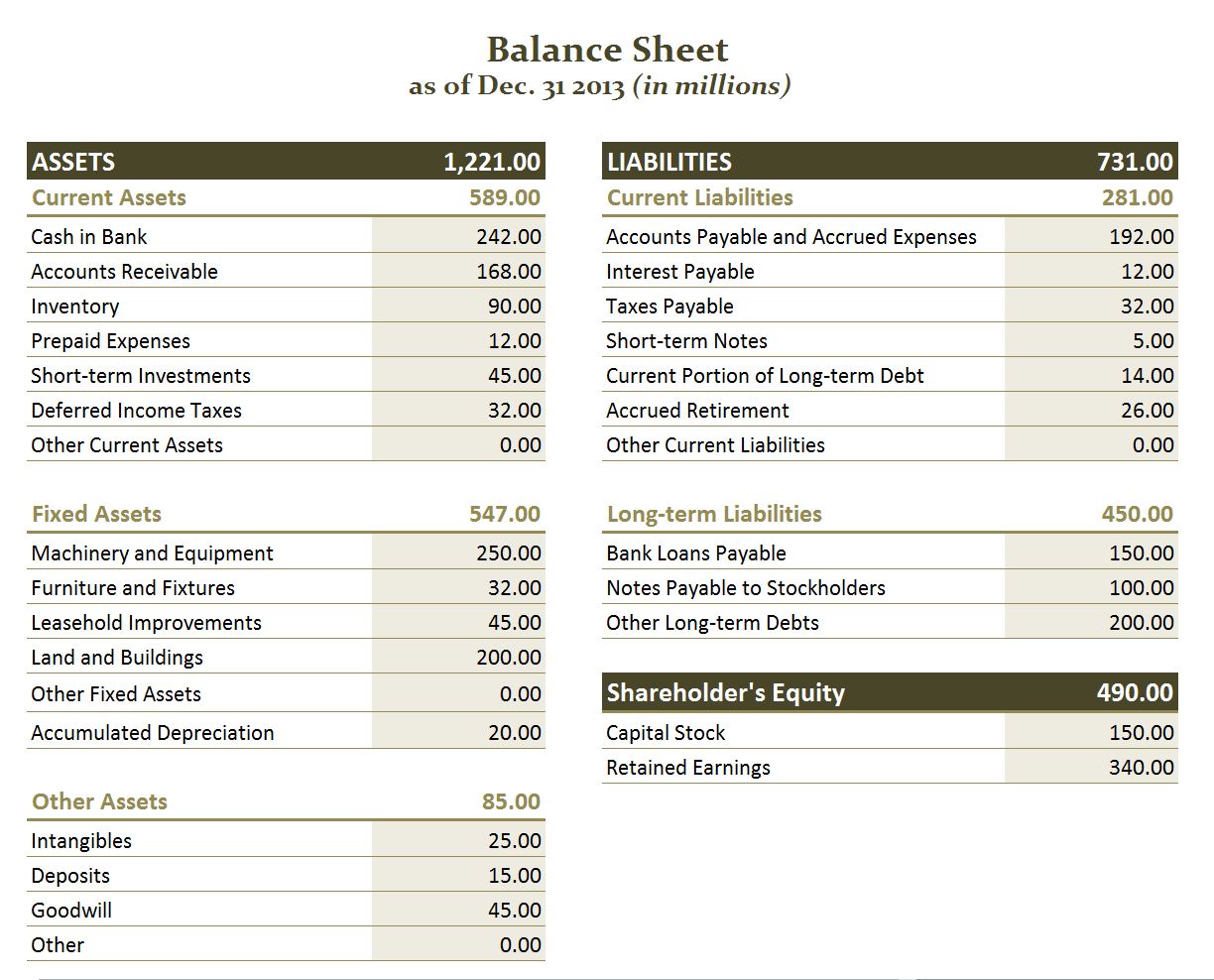

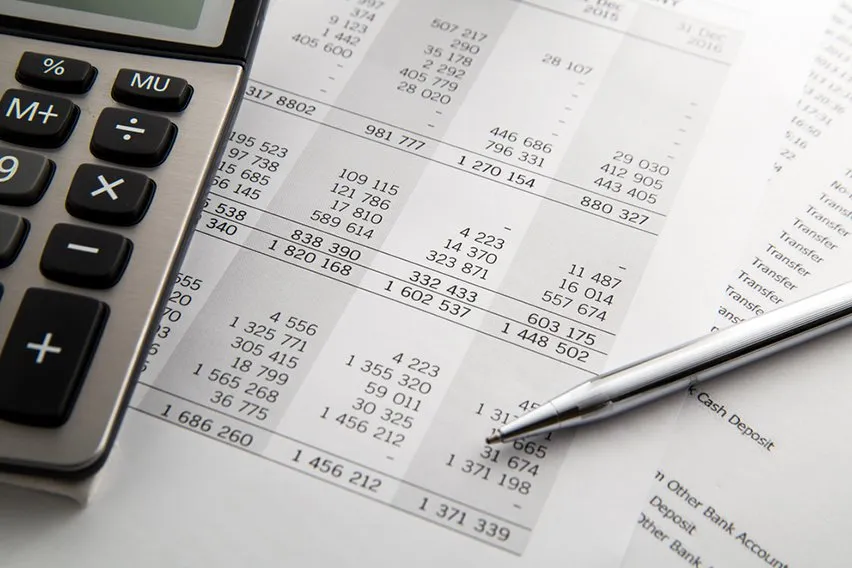

On balance sheet financing. Learn what a balance sheet should include and how to create your own. A balance sheet includes a summary of a business’s assets, liabilities, and capital. Typically offered by smaller financial institutions, balance sheet lending is a loan in which the debt is kept on the original lender’s books.

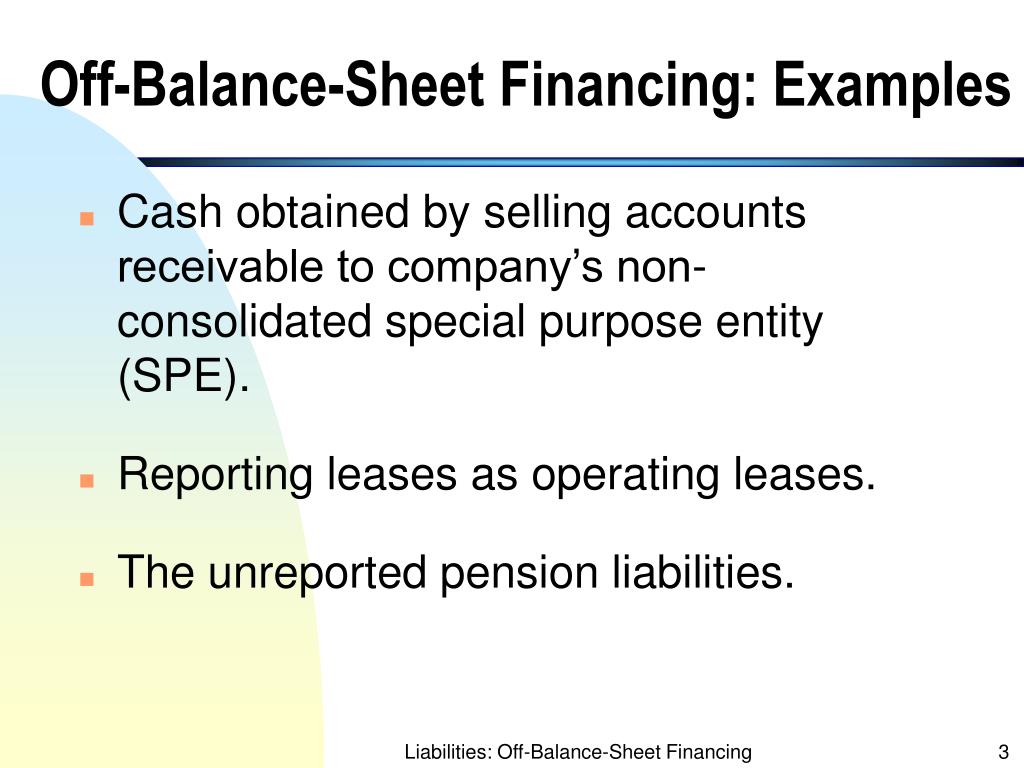

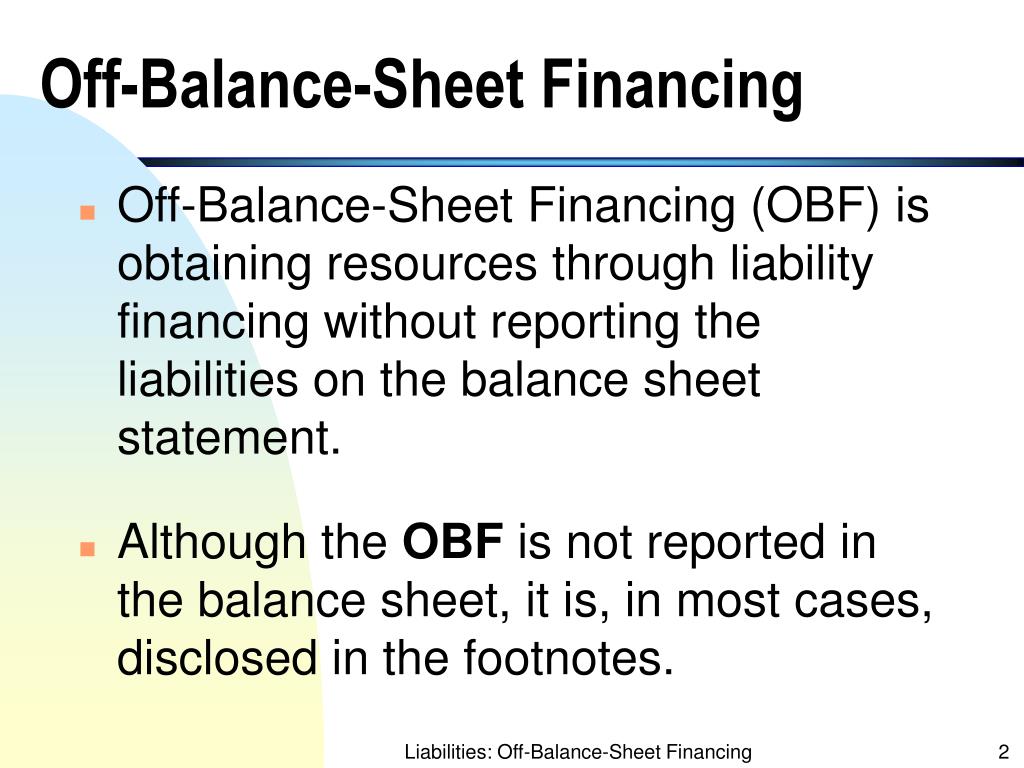

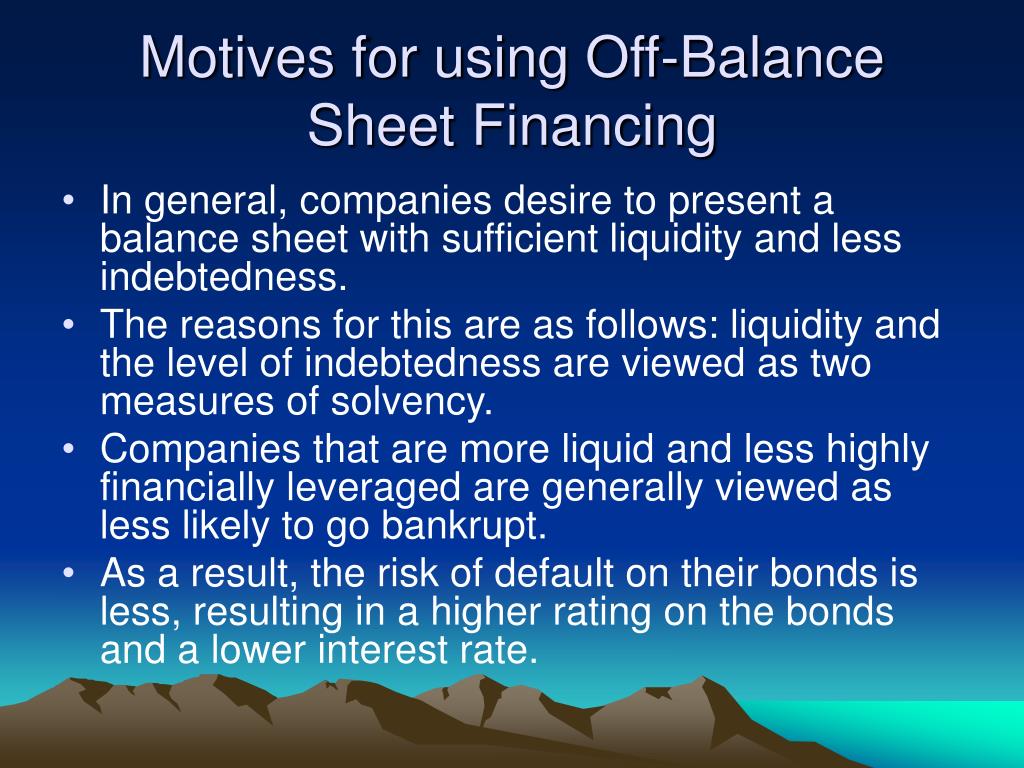

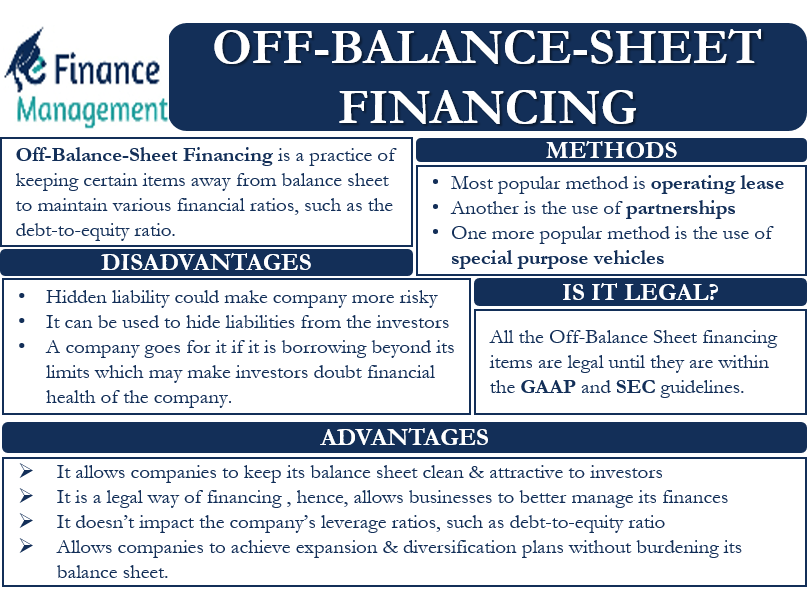

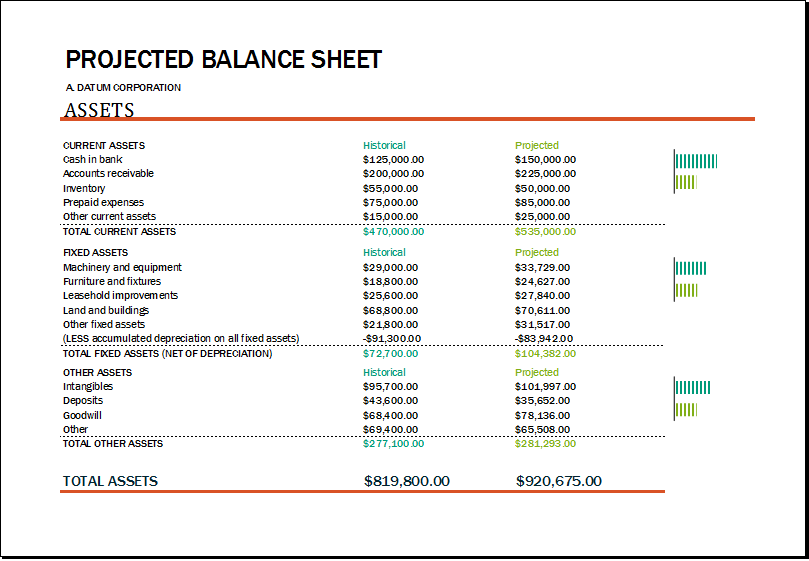

Minres said it had $1.4 billion in cash at the end of the first half and net debt of. On the other hand, p2p. A form of financing in which large capital expenditures are kept off a company’s balance sheet through various classification methods.

The advantage of balance sheet lending is that the money is available and ready to fund the moment the borrowing application is approved. The federal reserve’s internal debate over the fate of its balance sheet reduction effort is set to quicken at its march policy meeting, with policymakers first. Generally, project debt held in a.

Total assets (log levels) significant increase of ic sector and, thus, financial intermediation capacity after. To learn more about what is. The bank of canada could wind down its quantitative tightening program as soon as april and will most likely do so no later than june, an economist at.

Under ifrs 9/psak 71, a financial liability (trading or other) is removed from the balance sheet when it is extinguished (that is, when the obligation is discharged, is cancelled or. Minerals resources boss chris ellison has hit back at his critics. Heidelberg materials will buy back more shares after its debt declined.

+33 1 44 29 91 38.

![[Solved] Required a. For the balance sheet, identify how](https://media.cheggcdn.com/media/1fa/1fa88419-d3af-4dc0-ae82-cc7695ce9b66/phpfl6iz4)