Heartwarming Info About Amcor Financial Statements Vertical Balance Sheet Solved Problems Cash Inflow From Investing Activities

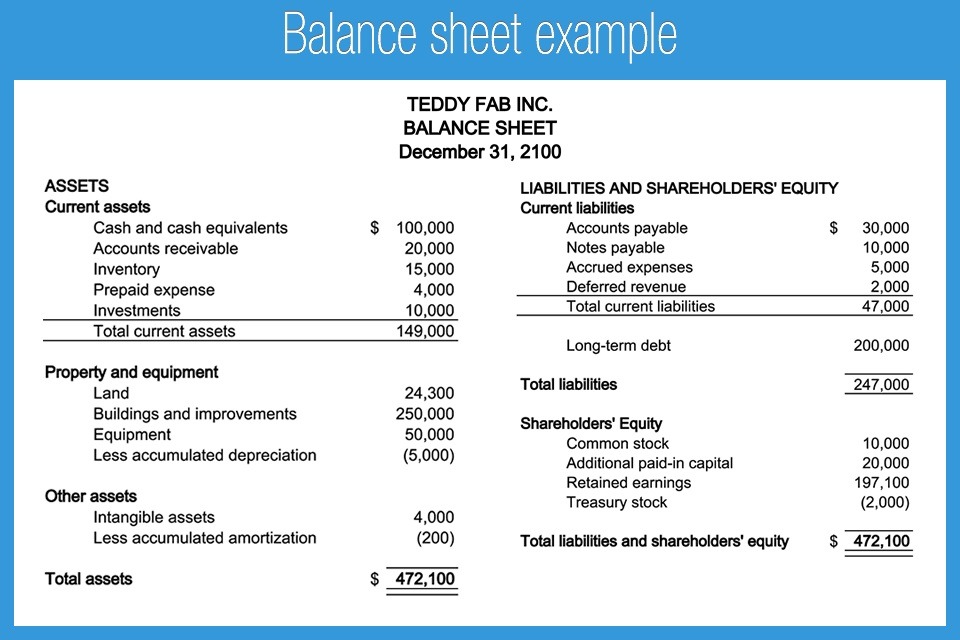

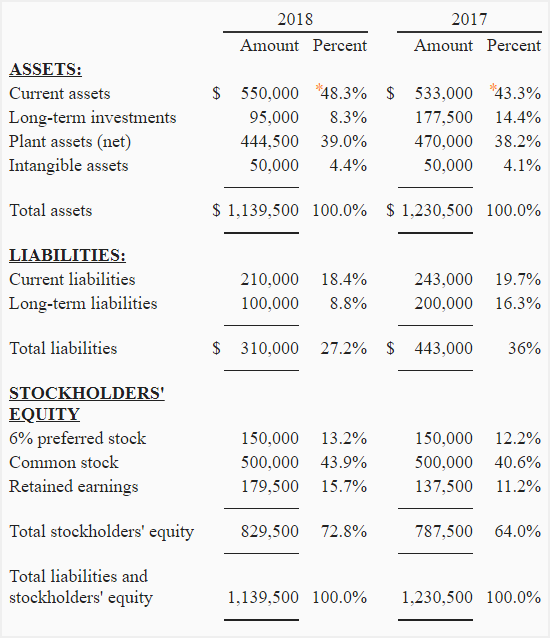

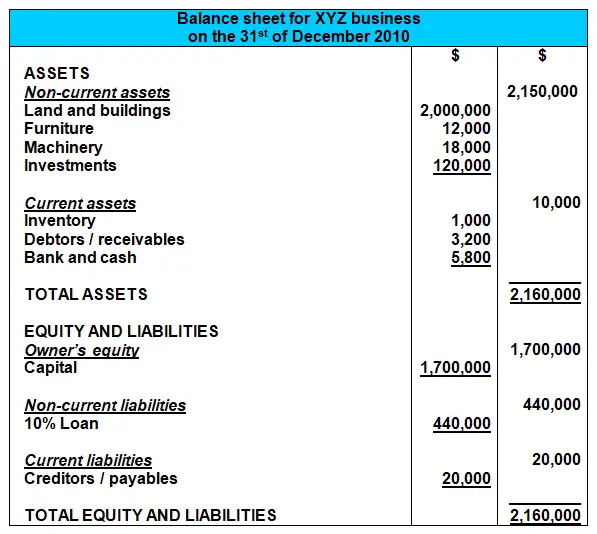

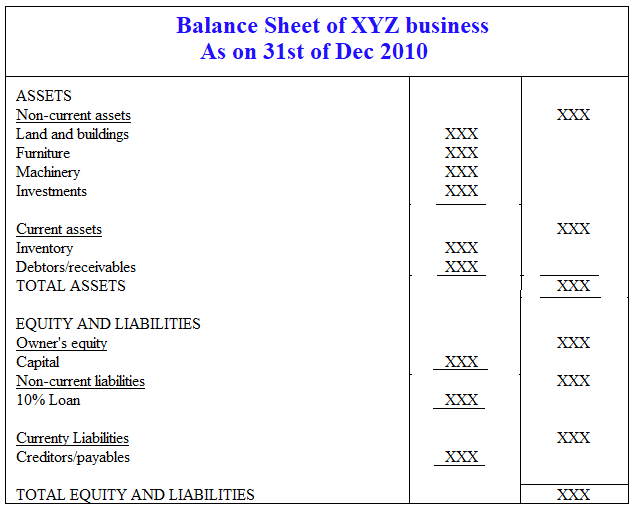

Vertical analysis of a balance sheet.

Amcor financial statements vertical balance sheet solved problems. 83 tower road north warmley, bristol, bs30. This is different from horizontal. Get the detailed quarterly/annual income statement for amcor plc (amcr).

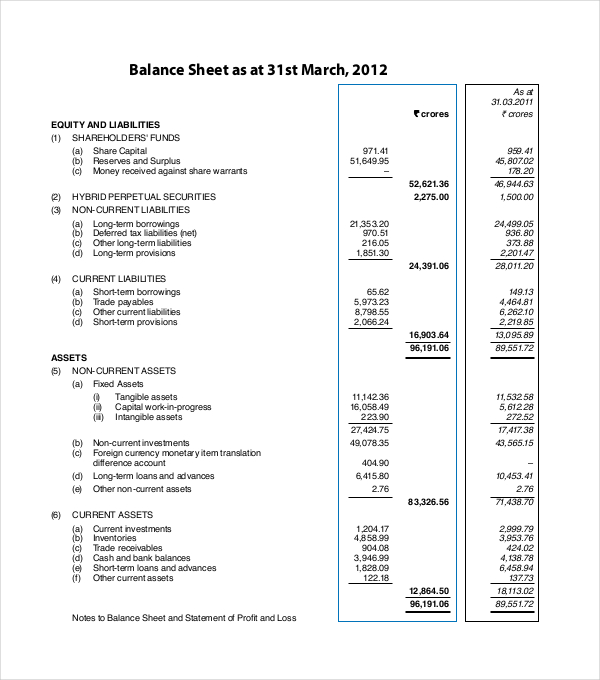

Adjustments inventory on 31 st,. View our catalog of detailed summaries for yearly performance and strategies. Detailed balance sheet for amcor (asx:

Access comprehensive insights into amcors financial performance and results when viewing our history of reports and presentations. Featured here, the balance sheet for amcor plc, which summarizes the company's financial position including assets, liabilities and shareholder equity for each of the latest. Up to 10 years of financial statements.

Yahoo finance plus essential access required. This allows a business to see what percentage of cash (the comparison line item) makes up total assets (the other line item) during the period. Get the detailed balance sheet for amcor plc (amcr).

Revenue (usd 9.3 billion), profit after taxes (usd 724 million) and earnings per share (eps, us 62.6 cents). However, balance sheets represent a firm's assets, liabilities, and owners' equity at a particular point in time. Ten years of annual and quarterly balance sheets for amcor (amcr).

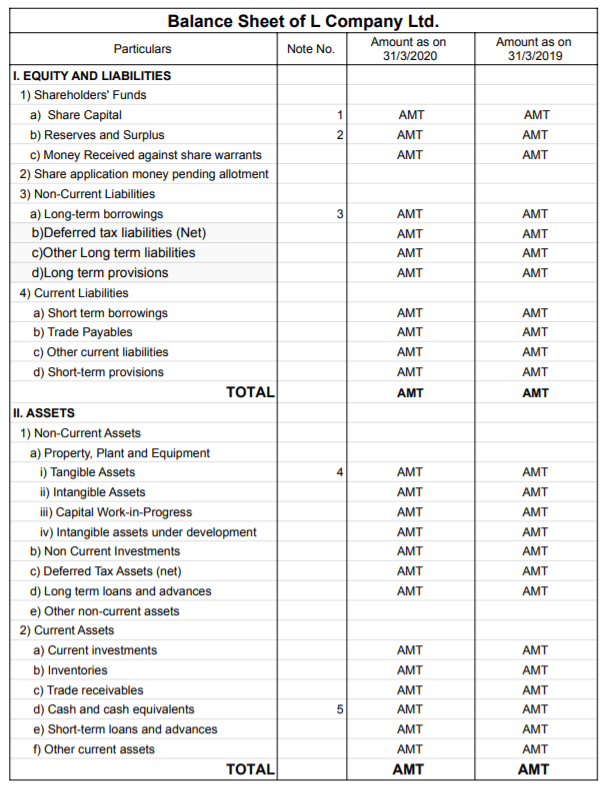

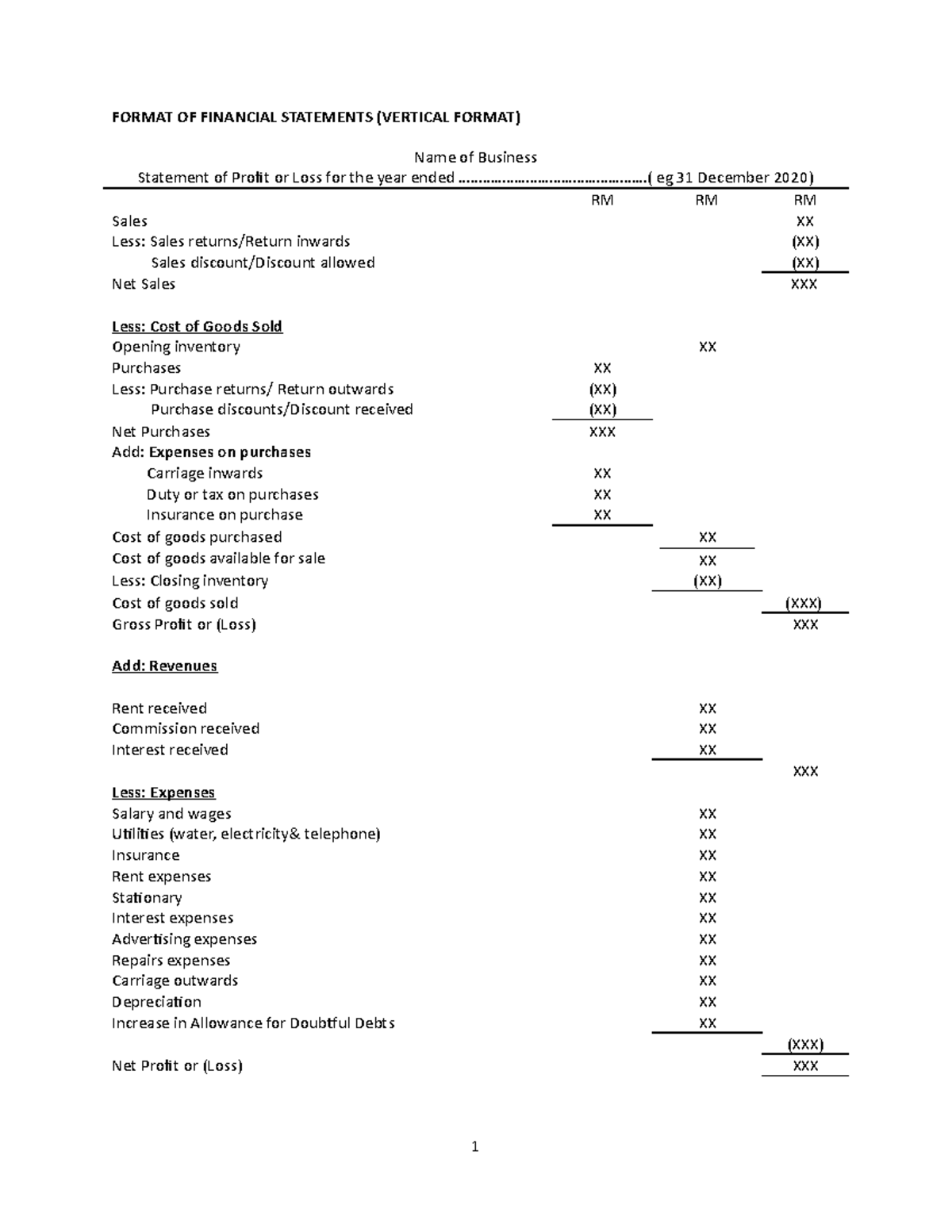

Amcor plc (amcr) financial statements (2024 and earlier) company profile. Vertical analysis is a proportional analysis of financial statements. Prepare adjustment entries, adjusted trial balance and three informal financial statements excluding cash flow statement.

Ten years of annual and quarterly financial statements and annual. Access comprehensive insights into amcors financial performance and results when viewing our history of reports and presentations. Amcor is scheduled to report earnings on.

From priority categories, emerging markets and innovation. What it owns), the liabilities. Vertical analysis of balance sheetsconsolidated balance sheets for winged manufacturing follow.required:1.

Amcor's market cap is currently ―. Adaptability of the amcor team. Amc), including cash, debt, assets, liabilities, and book value.

And it has a dividend yield of 5.24%. The company's eps ttm is $0.657; In primary consumer and healthcare packaging.