Amazing Tips About Investment Company Balance Sheet Airline Industry Financial Ratios

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

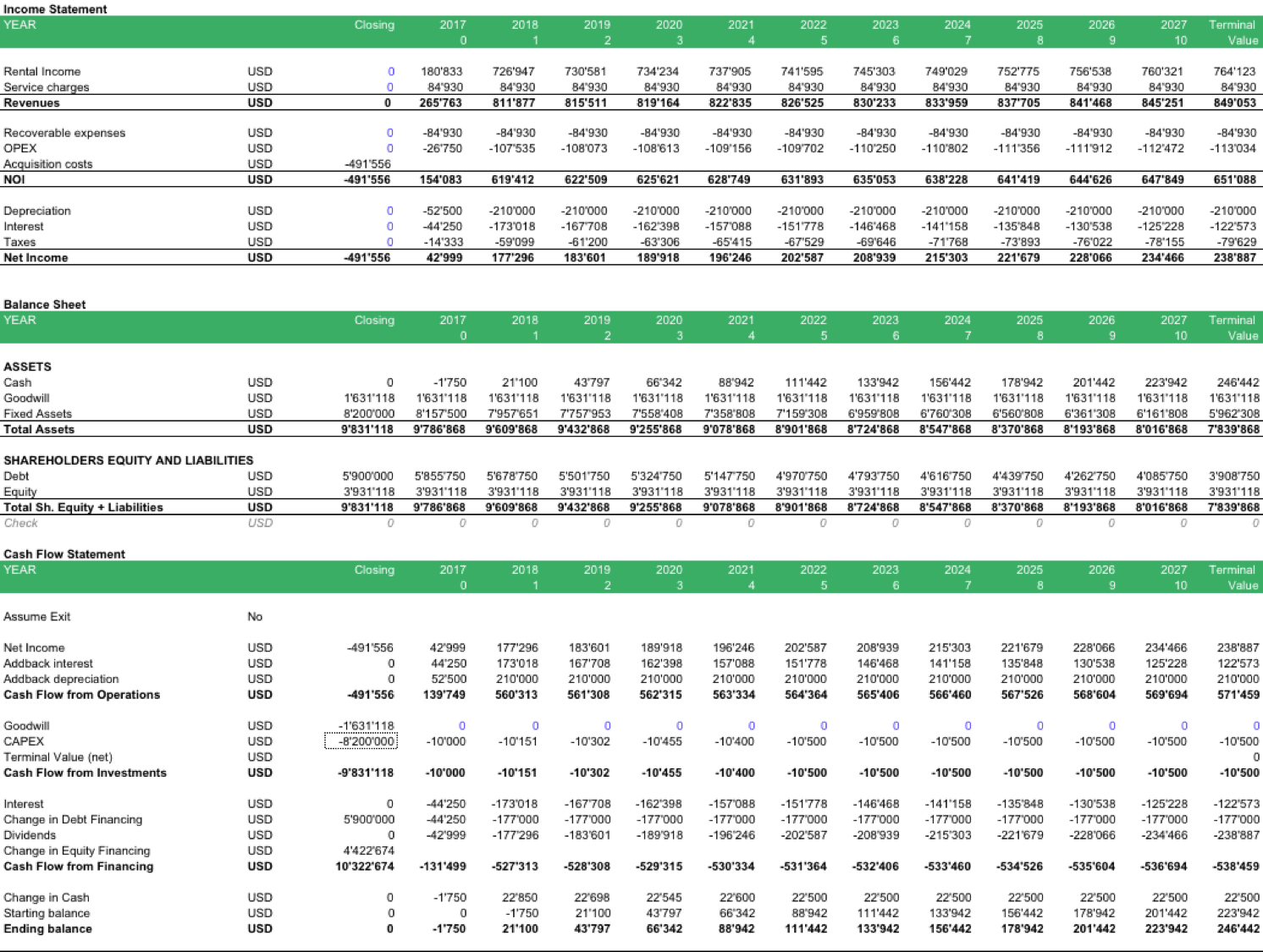

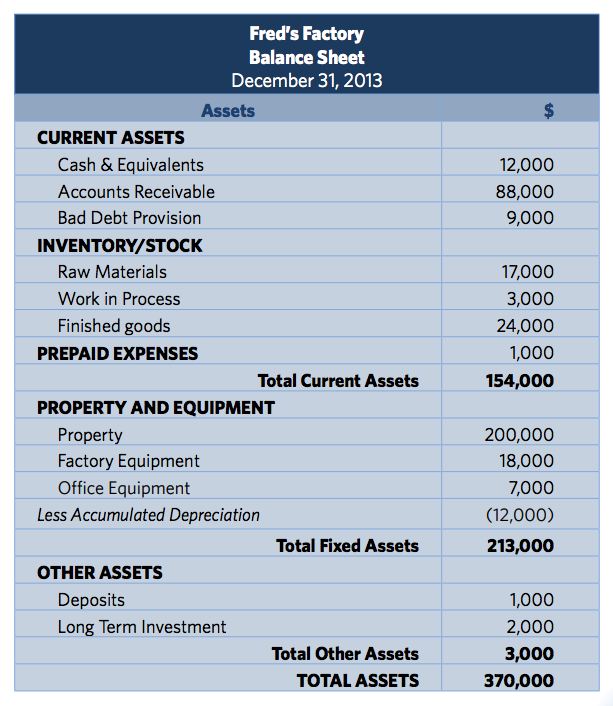

Fixed assets are shown net of accumulated depreciation on the balance sheet.

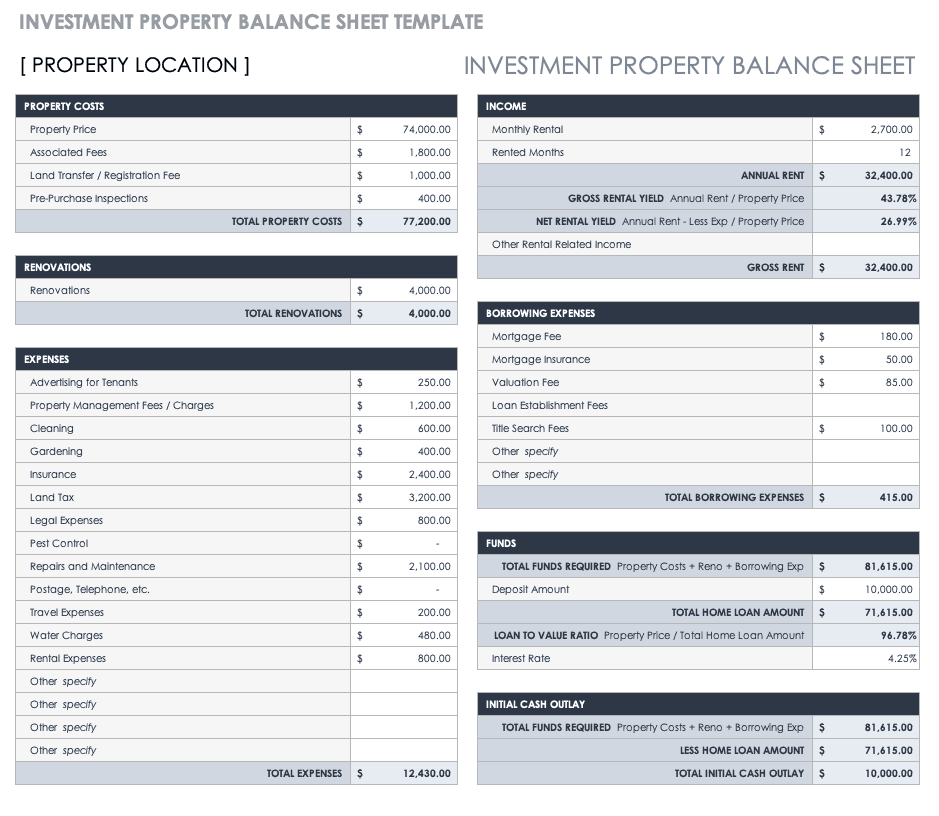

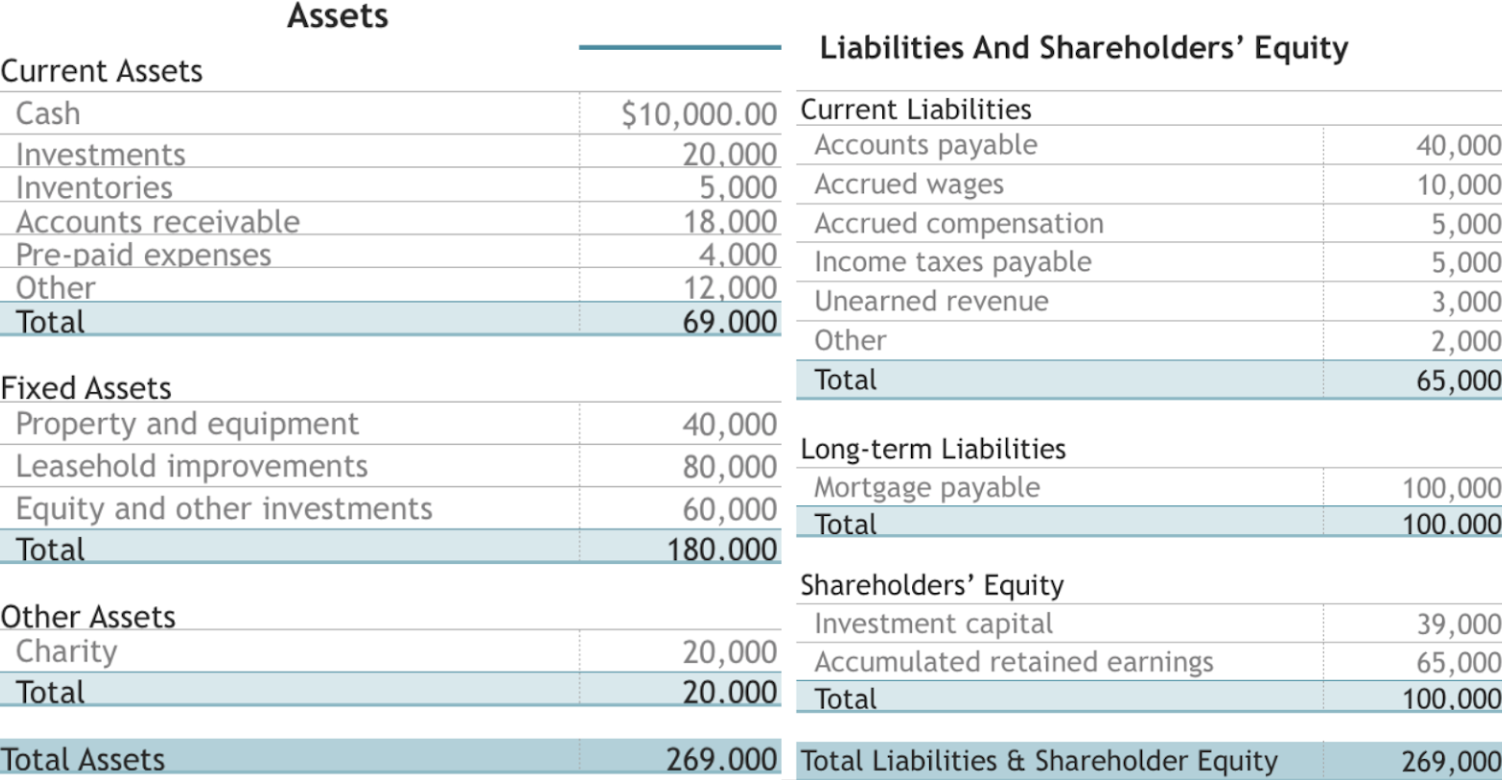

Investment company balance sheet. These parts include assets, liabilities, and equity. If an investment will be sold sooner, it belongs under “cash” on the balance sheet, and is then called a “marketable security.” Investments in excess of 50 percent.

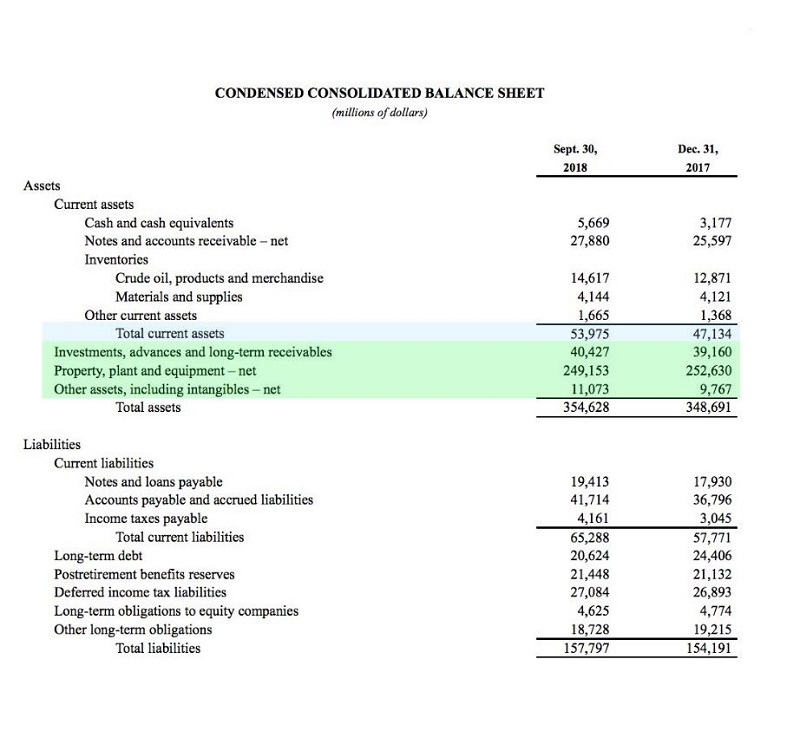

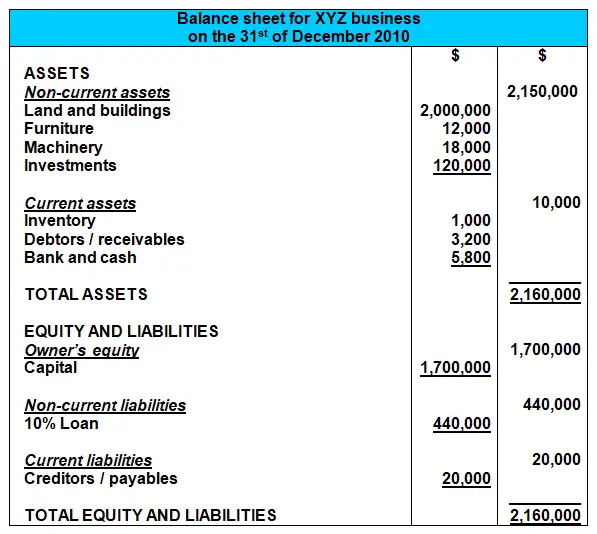

The balance sheet is an annual financial snapshot. A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment. On one side of the equals sign is your company's total assets.

The balance sheet, also known as the statement of financial position, is one of the three key financial statements. The balance sheet information can be used to calculate financial. A balance sheet or a statement of financial position indicates the intricate details of assets, liabilities, and equity, empowering stakeholders to gauge the company’s financial standing and make well.

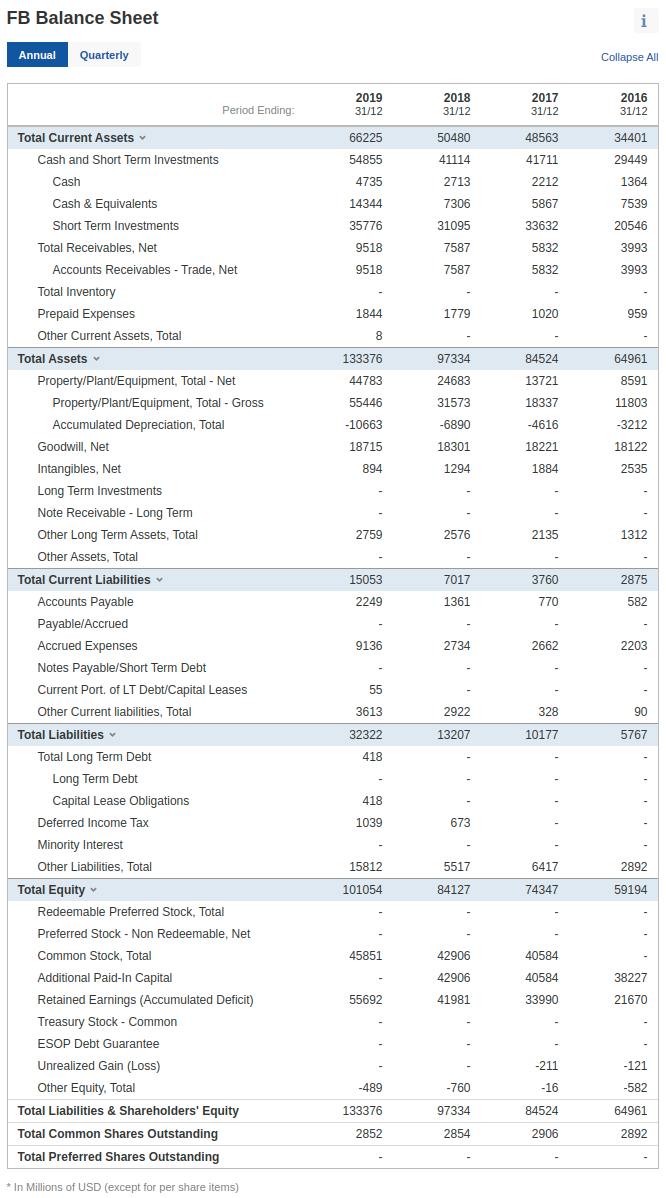

A company's financial statements—balance sheet, income, and cash flow statements—are a key source of data for analyzing the investment value of its stock. Cash in the bank, inventory, accounts receivable and investments all go on the balance sheet as assets. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

In essence, the balance sheet tells investors what a business owns (assets), what it owes (liabilities), and how much investors have invested (equity). Initially, investments are recorded for. It can also be referred to as a statement of net worth or a statement of financial position.

It is divided into three parts. This is a key metric of a firm's financial health. The balance sheet contains details about the organization's capital structure, liquidity, and viability.

Typically, investments are securities held for more than a year. Assets = liabilities + equity. Here are some companies that stand out as.

(many of the links in this article redirect to a specific reviewed product. A balance sheet covers a company’s assets as. The balance sheet is a reflection of the assets owned and the liabilities owed by a company at a certain point in time.

In my consulting career, i have seen many artificial intelligence (ai) initiatives fail as they are normally driven solely by the technology. The business can decide to invest in a range of financial assets, including equity securities, debt securities, or even hybrid securities. The balance sheet shows the carrying values of a company’s assets, liabilities, and shareholders’ equity at a specific point in time.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Balance sheets are useful tools for potential investors in a company, as they show the general financial status of a company. Balance sheet of kalyani investment company (in rs.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)