Stunning Info About Indirect Method Of Preparing Cash Flow Statement Financial Statements Starbucks

The indirect method is one of the two treatments for creating cash flow statements.

Indirect method of preparing cash flow statement. Using the balance sheet changes, the indirect. This is also where you add adjustments for finances, like asset depreciation, which you can insert in parentheses. The indirect method, as the name implies, looks at cash flow indirectly.

Understand how a statement of cash flows is prepared using the indirect method. Prepare a statement of cash flows using the indirect method. Instead, most companies use the indirect method to prepare the statement of cash flows.

Where do we start in preparing home store, inc.’s statement of. Highlights the statement of cash flows is prepared by following these steps: What is the indirect method to create a cash flow statement?

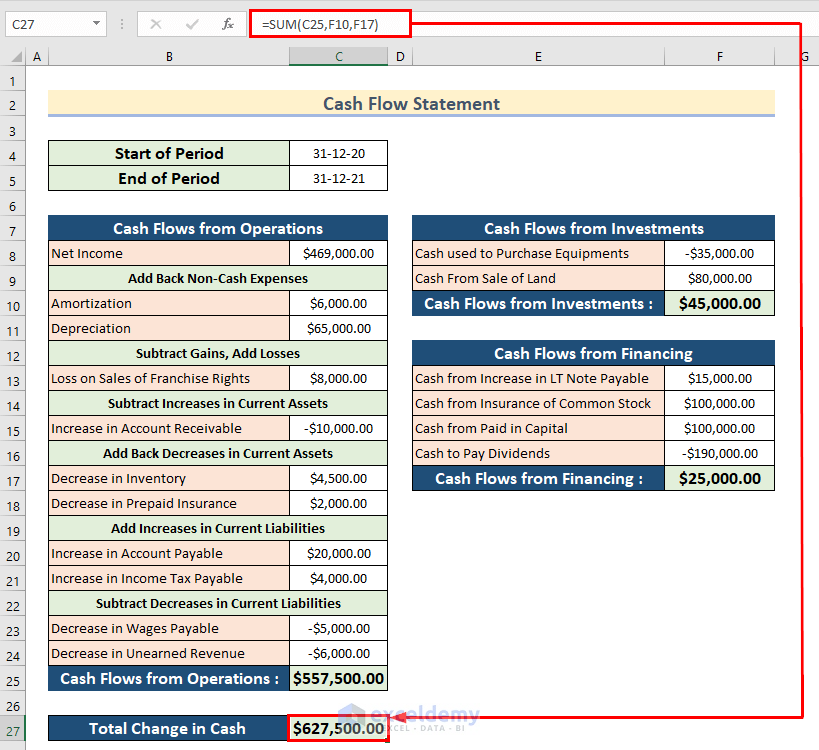

A balance sheet that shows assets and liabilities Pull your company’s net income from its income statement, and list it on the first line of the cash flow statement. A cash flow statement using the indirect method differs from the direct method of preparing a cash flow statement.

What you will learn to do: This approach requires less effort to complete than the direct method (which is discussed next),. The most commonly used format for the statement of cash flows is called the indirect method.

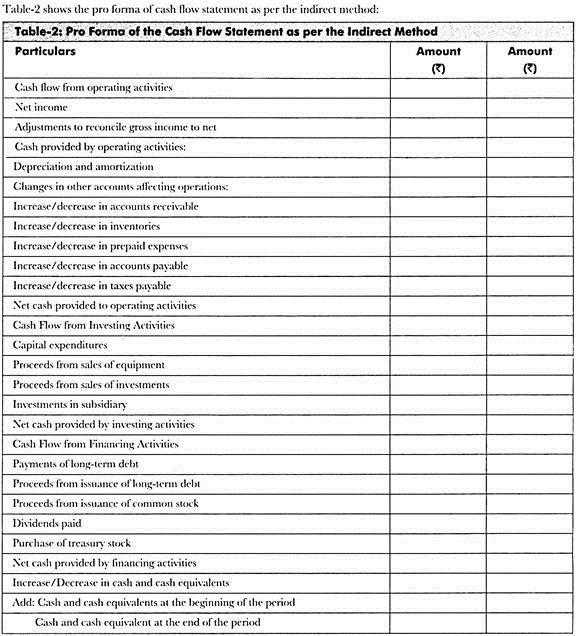

The two main documents you will need are: For instance, assume that sales are stated at $100,000 on an accrual basis. The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of cash generated by operating activities.

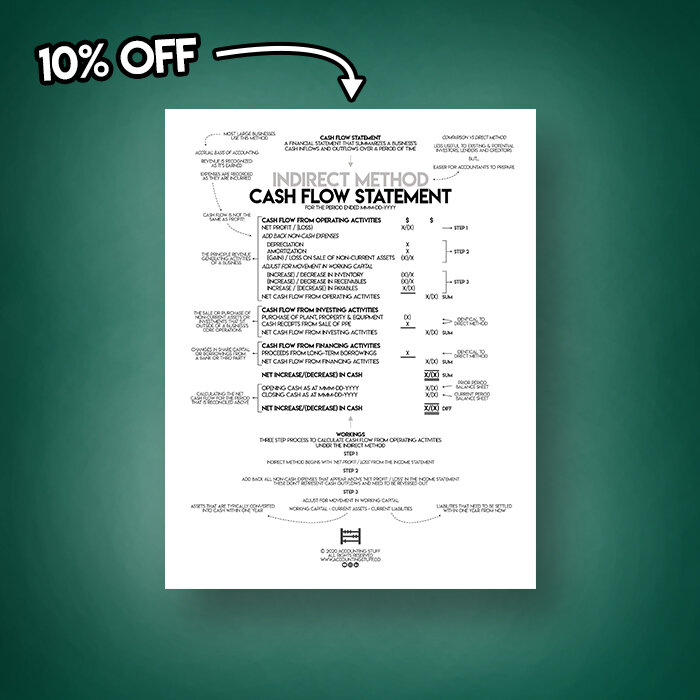

Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: How to create a cash flow statement using indirect method. Cash flows from operating activities show the net amount of cash received or disbursed during a given period for items that normally appear on.

In this article, we explore direct and indirect cash flow, highlight their most notable differences and provide an example of a cash flow statement using both methods. Each method has its own advantages and disadvantages that it's important to be aware of when making your decision. The indirect method for a cash flow statement is a way to present data that shows how much money a company spent or made during a certain period and from what sources.

The direct method converts each item on the income statement to a cash basis. What is the statement of cash flows indirect method? Cash flow statements are a measure of how money circulates throughout an organization.

Add back noncash expenses, such as depreciation, amortization, and depletion. The pros and cons of direct cash. Begin with net income from the income statement.