Smart Info About Income Tax Department Form 26as 3 Statement Model Practice

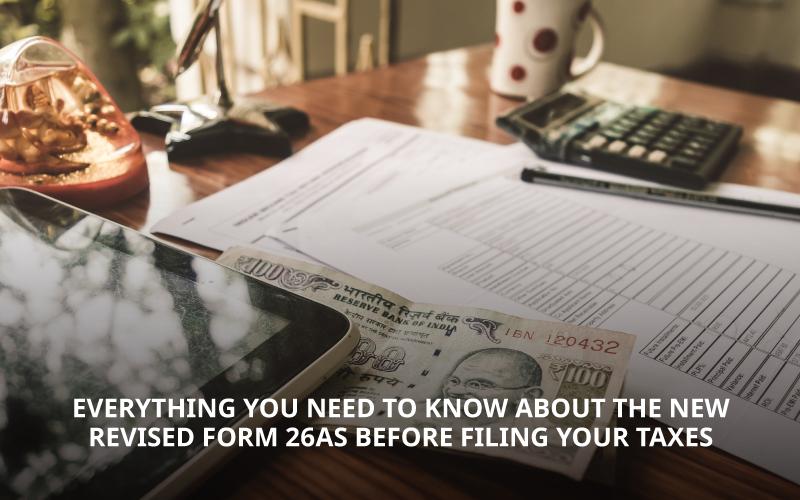

It will now include mutual fund purchases, foreign remittances, interest on income tax refund and more.

Income tax department form 26as. However, the income tax department has clarified that till this new statement is entirely. To access form 26as, taxpayers can leverage online methods offered by the income tax department. As soon as the income tax department processes the tds returns filed by the tds deductors, form 26as gets updated and 31st may of every year.

Eligible outstanding direct tax demands have been remitted and extinguished. What is form 26as ? How to get form26as form 26as can be.

What is form 26as? Income tax dept to introduce improved form 26as this year new form 26as: Click on the income tax forms tab.

Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer. The income tax department has notified new revamped form 26as on may 28, 2020 [1]. The income tax department has updated the form 26as.

Do not forget to check status of pan of the deductee. Form 26as is like a comprehensive report card for your taxes. The income tax department maintains the records for every taxpayer.

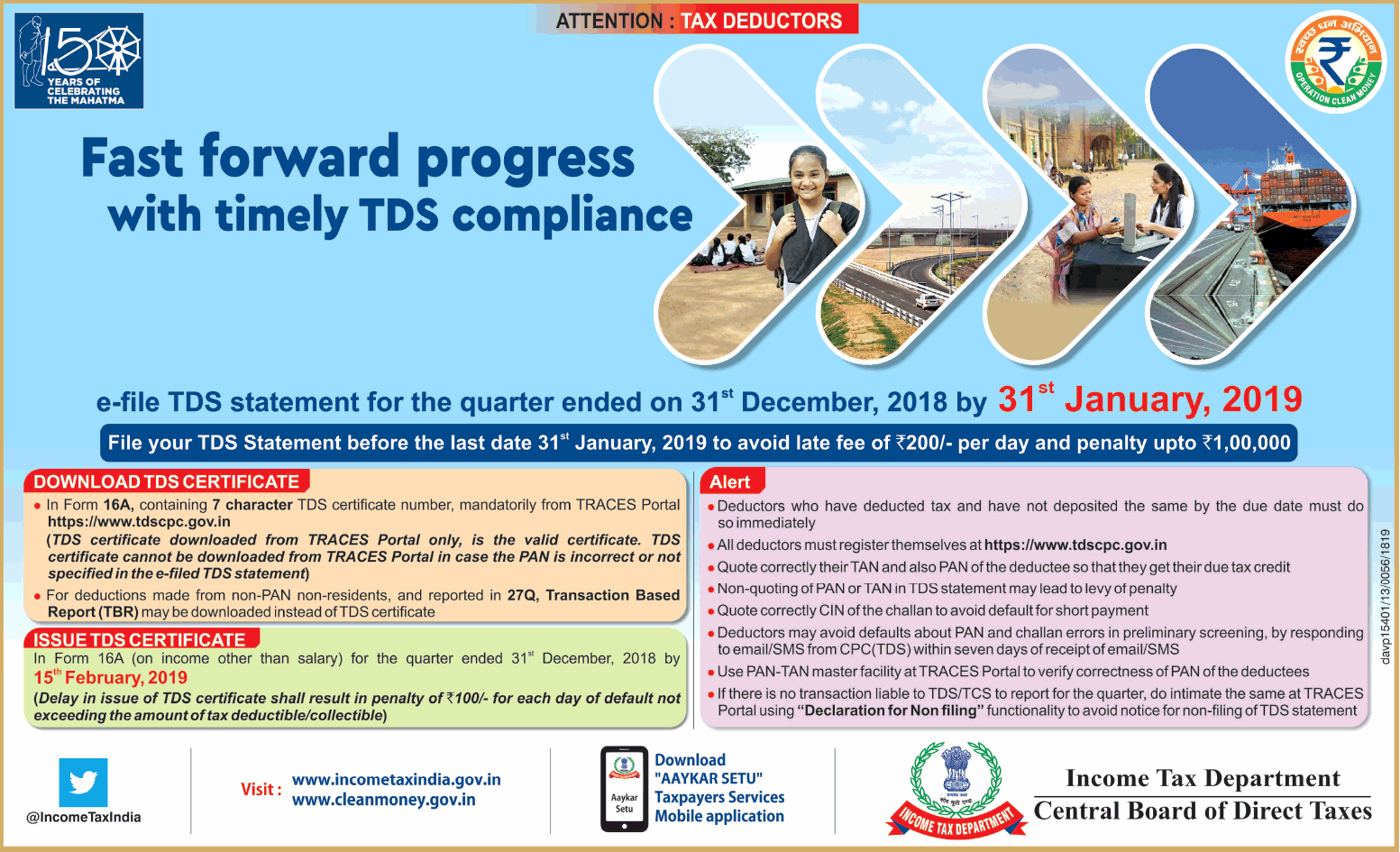

All you need to know about changes for income tax return purposes cbdt. Form 26as is a consolidated yearly tax statement that includes information on taxes deducted at source, taxes collected at source, assessee advance tax paid, and. As per cleartax, you can download and view form 26as through the traces website in eight simple steps:

Information (advance tax/sat, details of refund, sft transaction, tds u/s 194 ia,194 ib,194m, tds defaults) which were available in 26as will now be. The new ais statement is all set to replace the existing form 26as. The income tax department’s website provides an option.

Form 26as is a consolidated tax statement that contains details of tax deducted at source (tds), tax collected at source (tcs), advance tax, and. The website provides access to the pan holders to view the details of tax credits in form 26as. Latest updates in form 26as.

If you are not registered with traces, please refer to our e. It keeps records of tax paid and refunded against your. Old form 26as was used to contains information such as income.

Who provides form 26as? Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly contains the.