Beautiful Tips About Interest On Loan In Profit And Loss Account Journal To Balance Sheet Solved Examples Meaning Pro Forma

The interest on the loan will be a business.

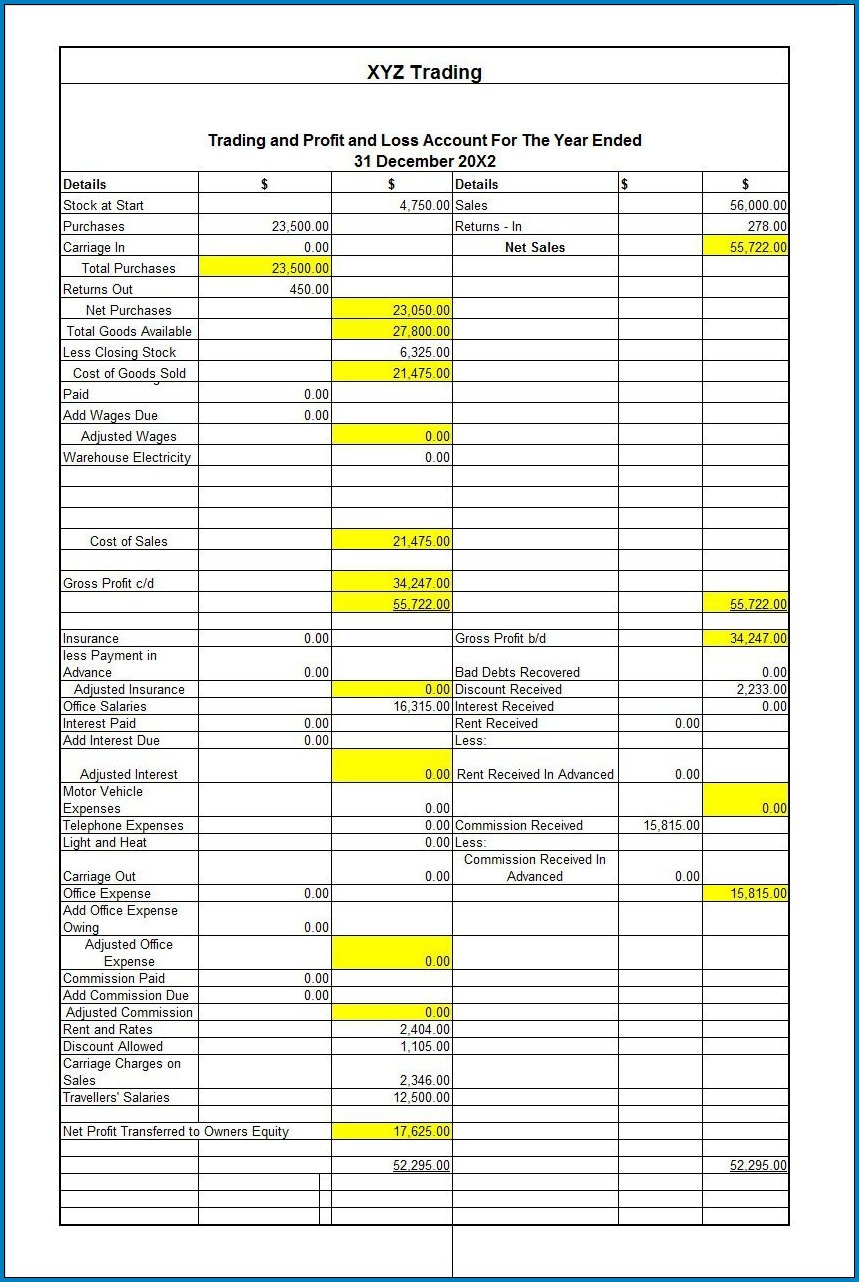

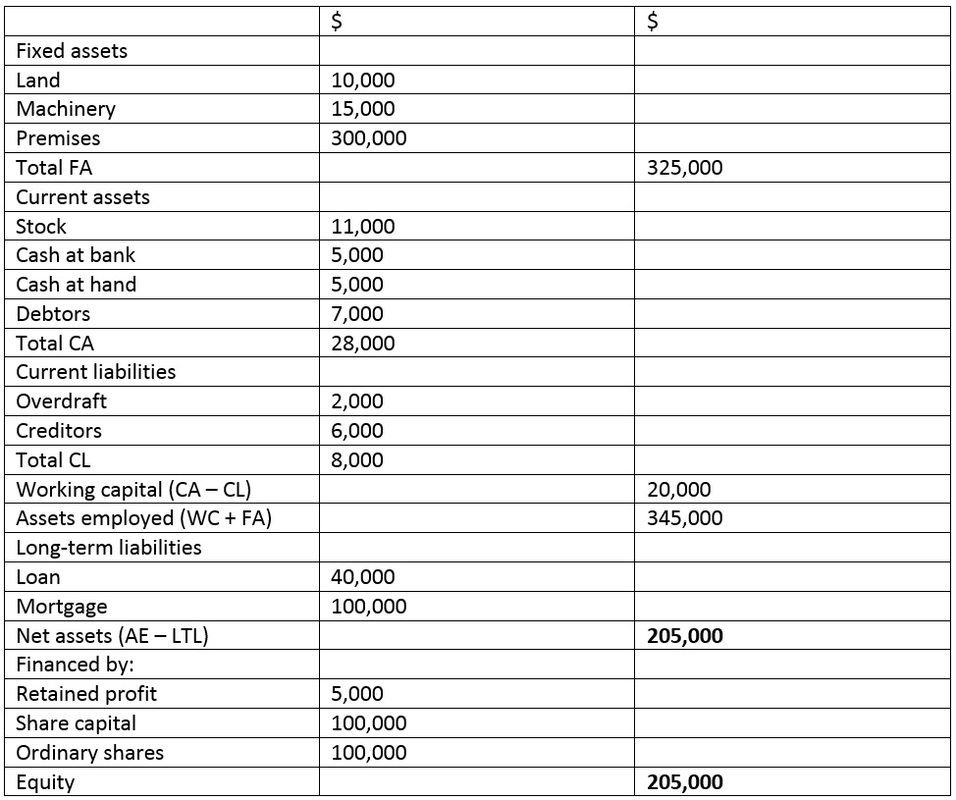

Interest on loan in profit and loss account journal to balance sheet solved examples. Closing stock was valued rs. Calculate any accrued interest expense. Profit and loss (p&l) statement;

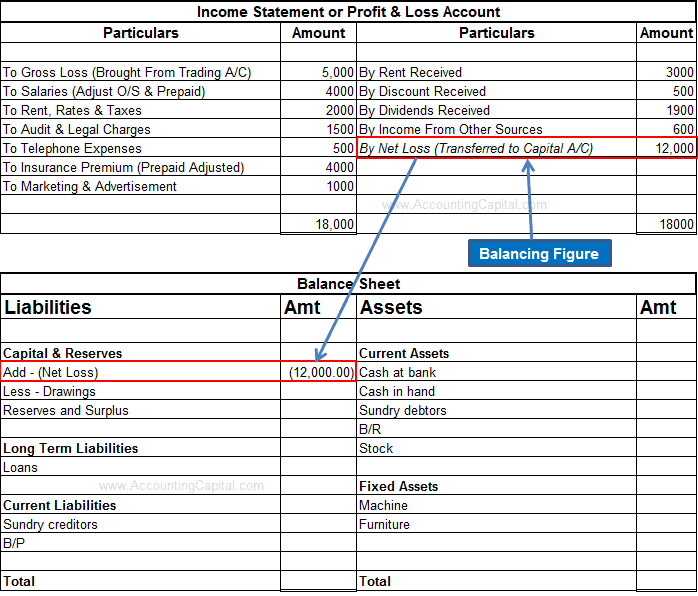

Borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement,. When you make that loan payment, you pay interest up to december.

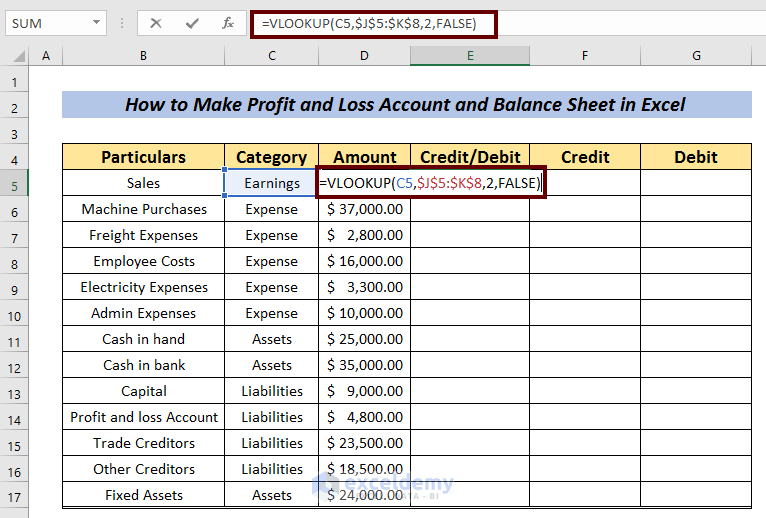

If the loan was created by converting a proportion of the partner’s capital into a loan, the debit entry will be in the capital account. Record the initial loan transaction when recording your loan and loan repayment in. By way of example, assuming the partnership profit and loss account showed a net income for the year of 95,000, the following journal entry is posted to.

Lenders review balance sheets to evaluate an applicant’s creditworthiness. Prepare the profit and loss. For example, assume you have a loan due on december 28.

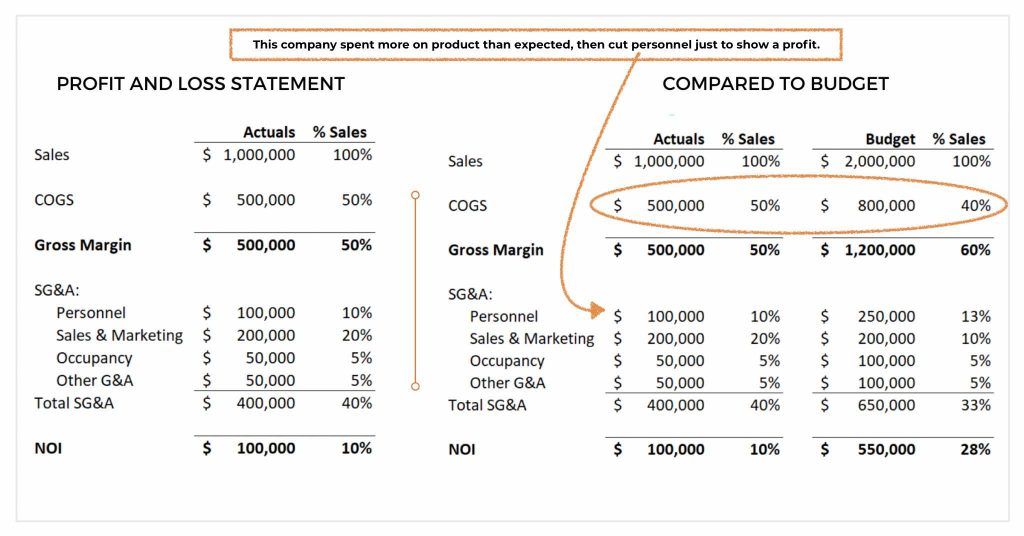

Below are a few examples of the items on a typical balance sheet. Explanation a profit and loss account is prepared to determine the net income (performance result) of an enterprise for the year/period. During the year, interest earned by the company on loan given to other parties was $ 10,500, and interest paid on loan taken was $ 9,100.

Depreciation charged on furniture and fixture @ 5%. This is any interest expense that the company has incurred but not yet paid. Lenders list accrued interest as revenue and.

Every company prepares a profit and loss account statement at the end of the year generally, to get the visibility. Interest on loan of the partner to the firm interest on loan by partner a/c.dr to loan by partner a/c 2. On august 1, 2021, anita provided the company with a.

Here are four steps to record loan and loan repayment in your accounts: Interest on capital has the following two effects on final accounts: It is an expense of the business, so it will be recorded on the debit side of the profit and loss.

These statements show the total of all loans and obligations you entered; By analyzing the financial ratios derived from the. Assets cash and cash equivalents.

It determines the gross profit or. Balance sheet is prepared by taking up all personal accounts and real accounts (assets and properties) together with the net result obtained from profit and. Closing entry for interest on loan allowed to partners.