Impressive Tips About Marriott Financial Statements Complete Balance Sheet Example Significant Account Audit

(mar) including details of assets, liabilities and shareholders' equity.

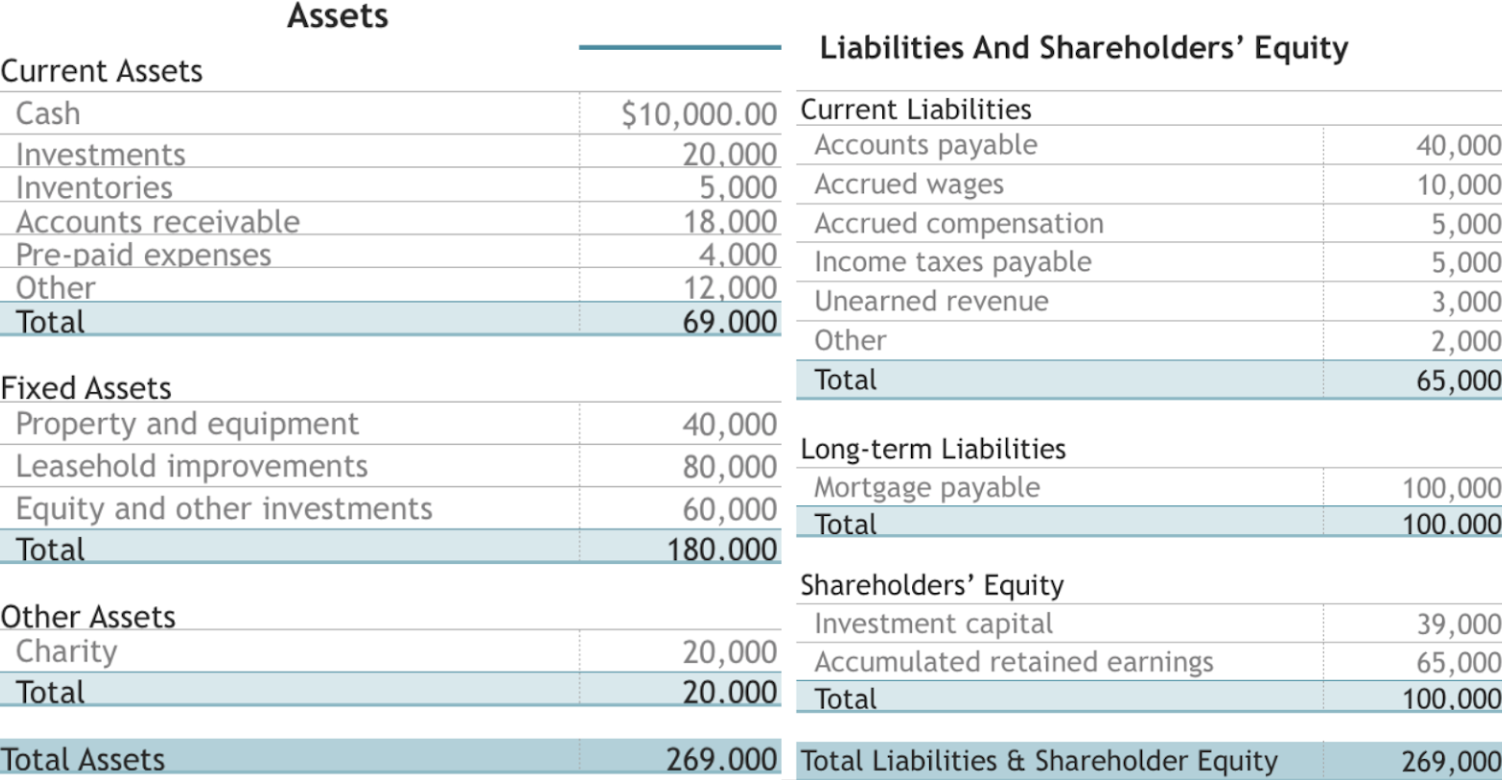

Marriott financial statements complete balance sheet example. Find out the revenue, expenses and profit or loss over the last fiscal year. Sum of the carrying amounts as of the balance sheet date of all assets that are expected to be realized in cash, sold or consumed after one year or beyond the normal operating cycle, if longer. We enhanced our liquidity, extended our average debt maturities, reduced operating costs and pared back investment spending.

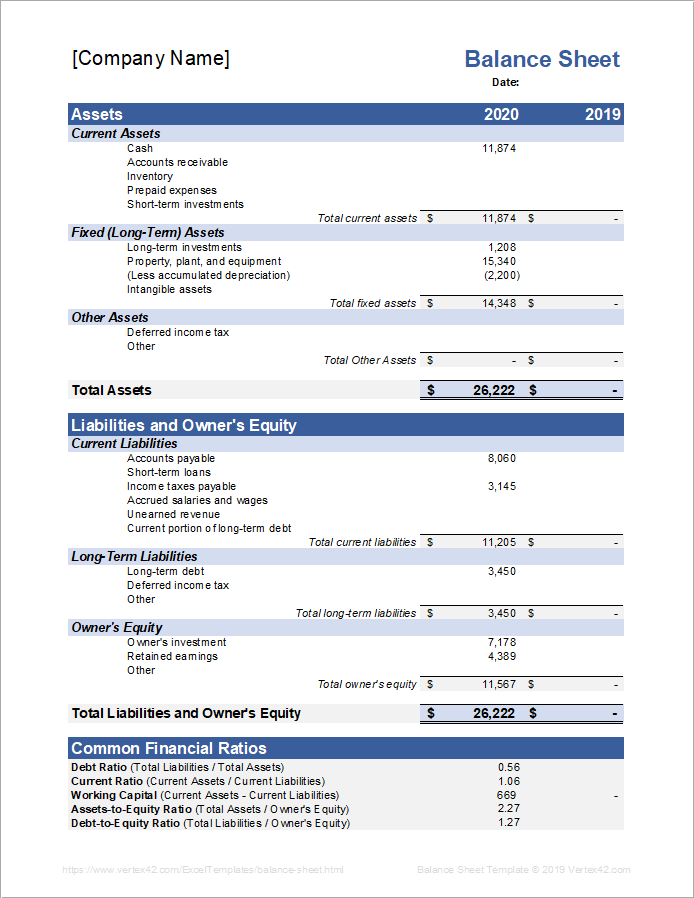

2022 financial highlights two years after experiencing the sharpest downturn in our company’s history, we reported record financial results in 2022. (mar), including cash, debt, assets, liabilities, and book value. The income statement summarizes the revenues, expenses and profit generated by a business over an annual or quarterly period.

Balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. Find a hotel for group (10+ rooms) browse by destination. Core values & heritage.

Get the annual and quarterly balance sheet of marriott international, inc. We also halted share repurchases in february and suspended our quarterly dividend beginning in the 2020 second quarter. View mar financial statements in full.

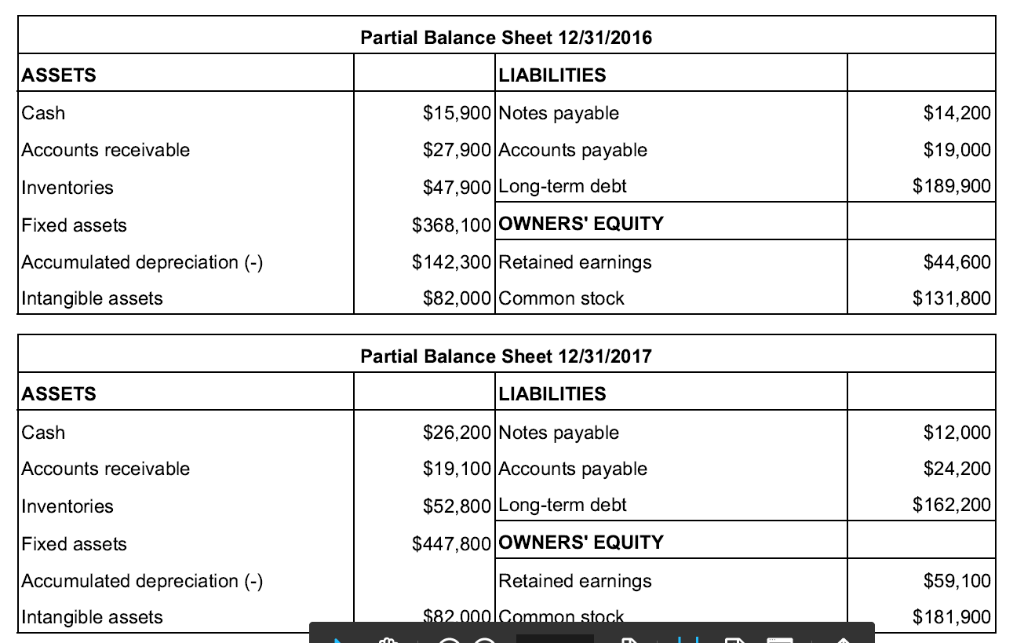

In this case, all the financial ratios are gathered from the annual balance sheet, income, and cash flow statements of the company from reuters.com to understand how emaar properties has. Income statements, balance sheets, cash flow statements and key ratios. View all mar assets, cash, debt, liabilities, shareholder equity and investments.

Shareholder services & transfer agent. Ten years of annual and quarterly income statements for marriott (mar). Fourth quarter global revpar rose 5 per cent compared to 2019, with occupancy down just 5.

View annual reports ten years of annual and quarterly financial statements and annual report data for marriott (mar). I worked on the financial statements of the marriott international i.e. Financial analysis is used to describe the impact of such a policy.

Strengthening our financial position and shoring up our balance sheet. The company repurchased 8.7 million shares of common stock in the 2022 fourth quarter for $1.4 billion. To enable marriott bonvoy members to earn loyalty points when hailing rides or ordering food delivery.

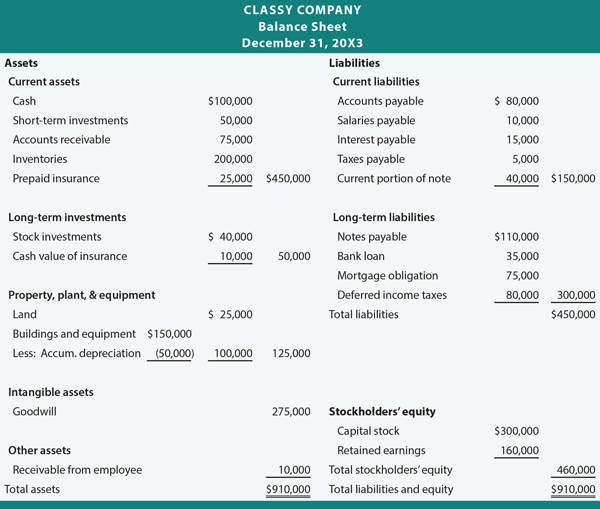

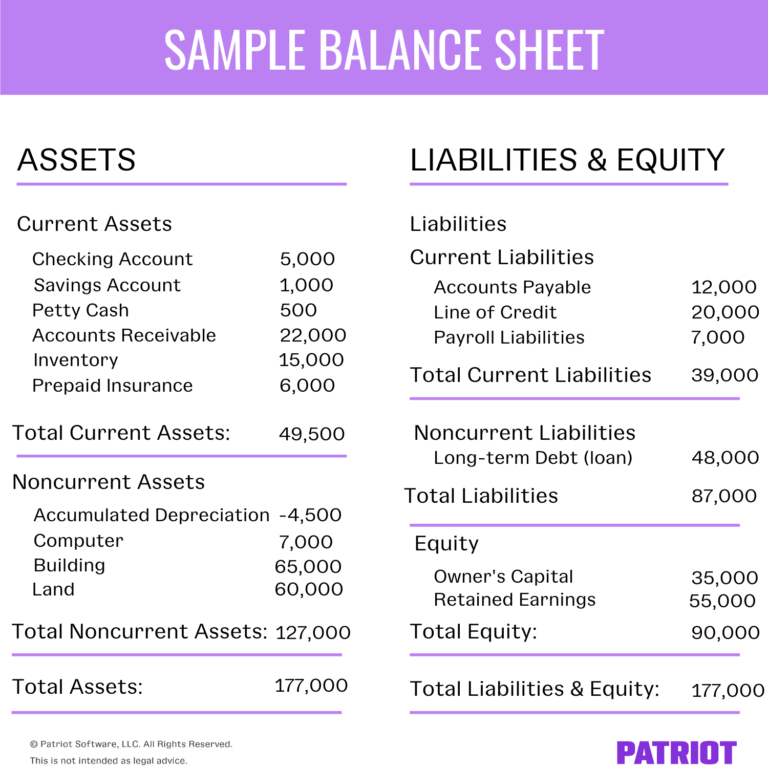

Detailed balance sheet for marriott international, inc. 10 some essential calculations in order to give you an idea about the financial stability of the organisation. Annual balance sheet by marketwatch.

Balance sheet of the firm and make. We have audited the accompanying consolidated balance sheets of marriott international, inc. (the company) as of december 31, 2020 and 2019, and the related consolidated statements of (loss) income, comprehensive (loss) income, stockholders’ equity and cash flows for each of the three fiscal years in the period ended december 31, 2020, and the r.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)