Build A Tips About Ifrs Dividends Paid Provident Fund In Balance Sheet

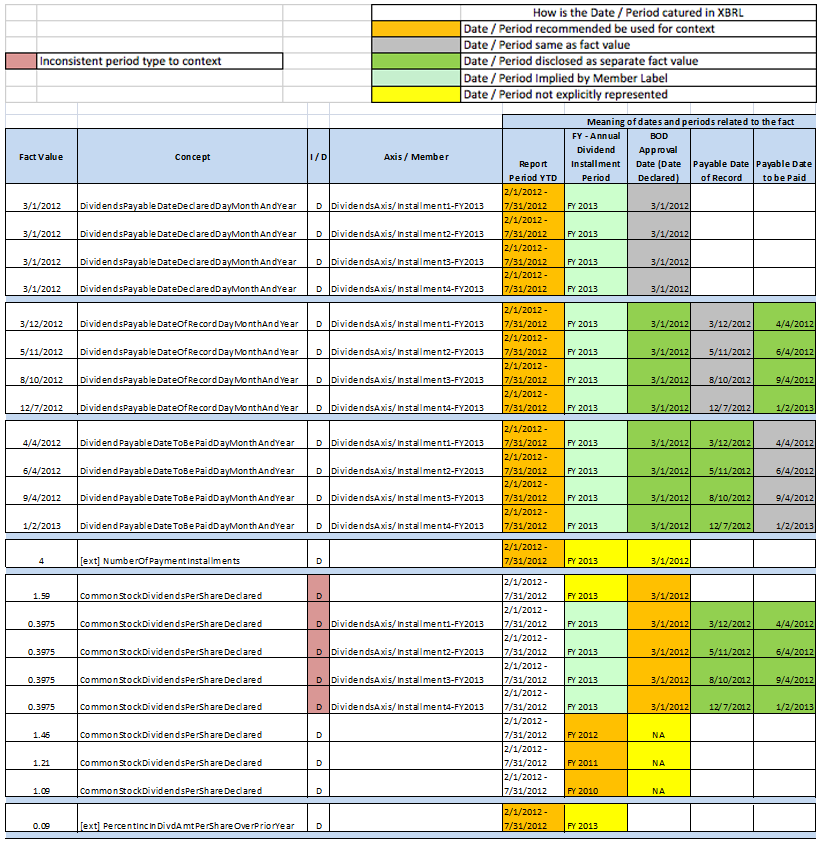

In 2023, amerigo returned $17.2 million to shareholders;

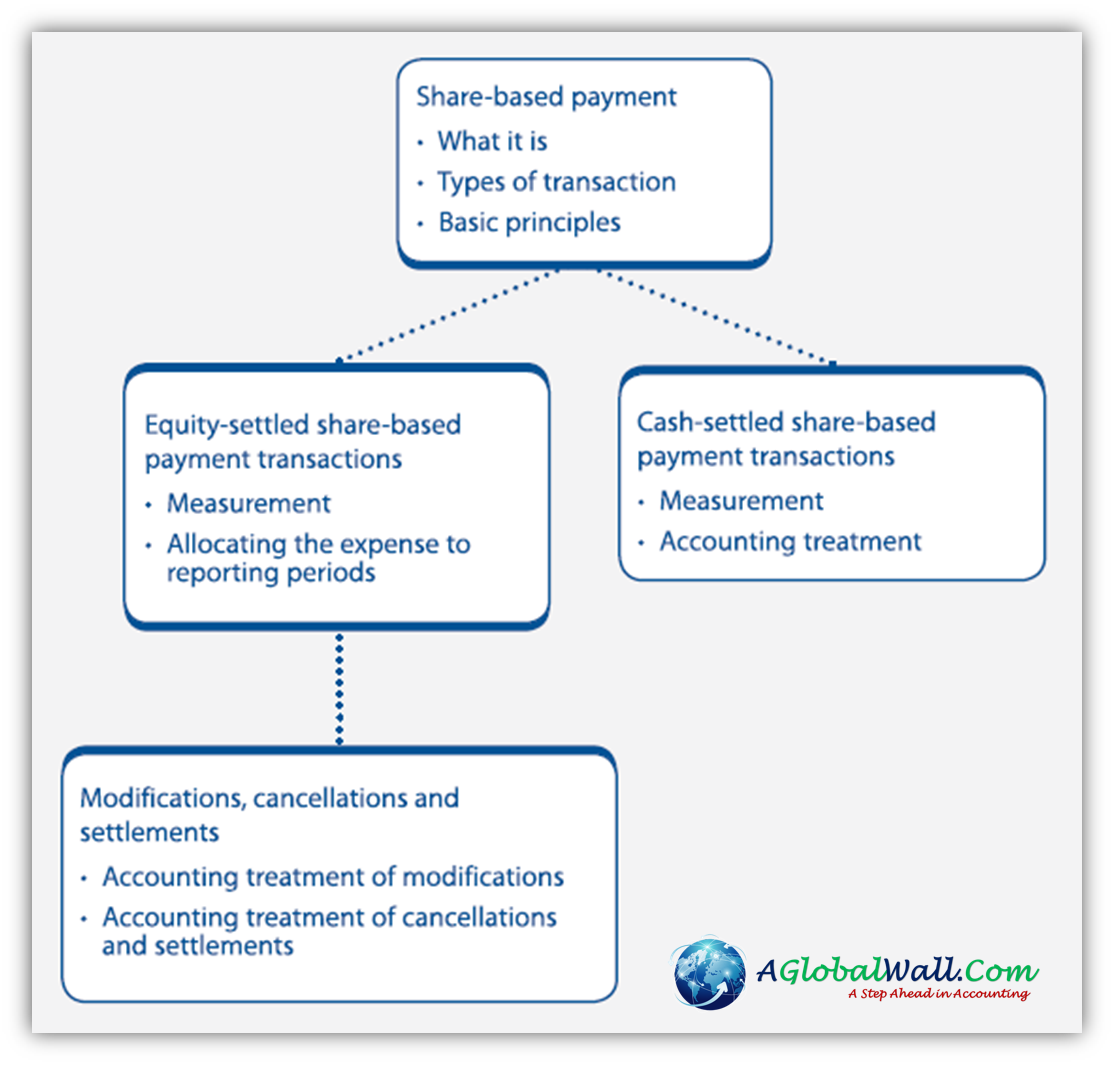

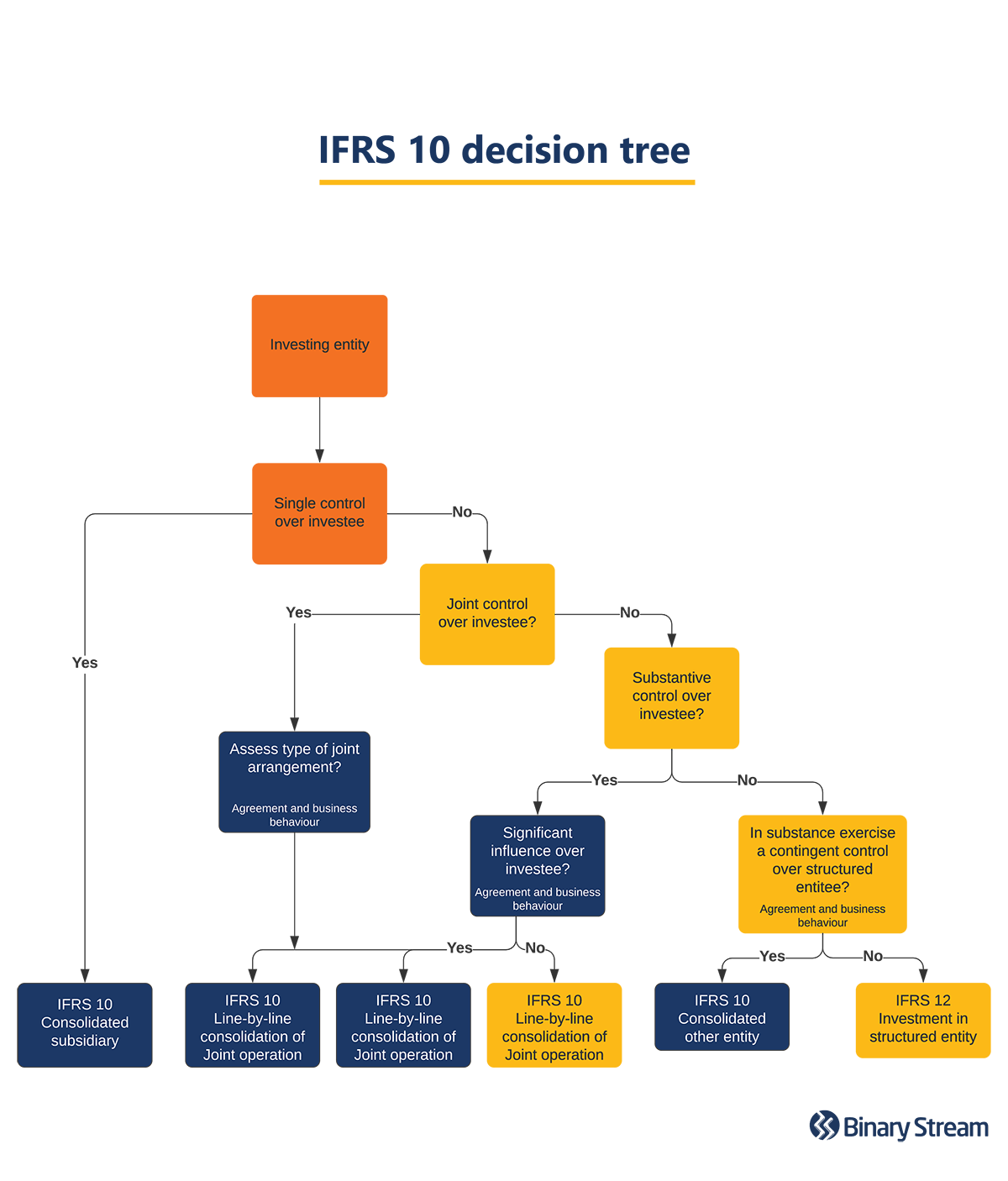

Ifrs dividends paid. Ifrs 12 is a consolidated disclosure standard requiring a wide range of disclosures about an entity's interests in subsidiaries, joint arrangements, associates and unconsolidated. However, there is no impediment to complementing high quality financial statements prepared in accordance with ifrs standards by providing additional. Outside the us, dividend restrictions may be more onerous and, in many cases, may.

$14.6 million was paid through amerigo’s quarterly dividend of cdn$0.03 per share,. If the dividend is paid out to the employees being the shareholders, then yes, you are right. Under us gaap, it would be classified as an operating cash flow.

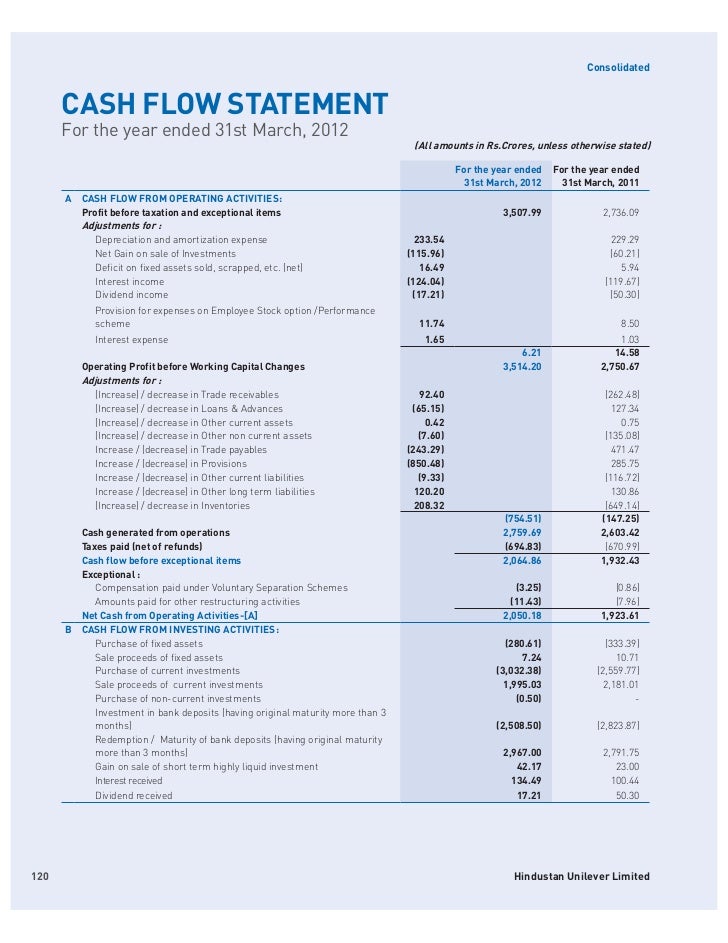

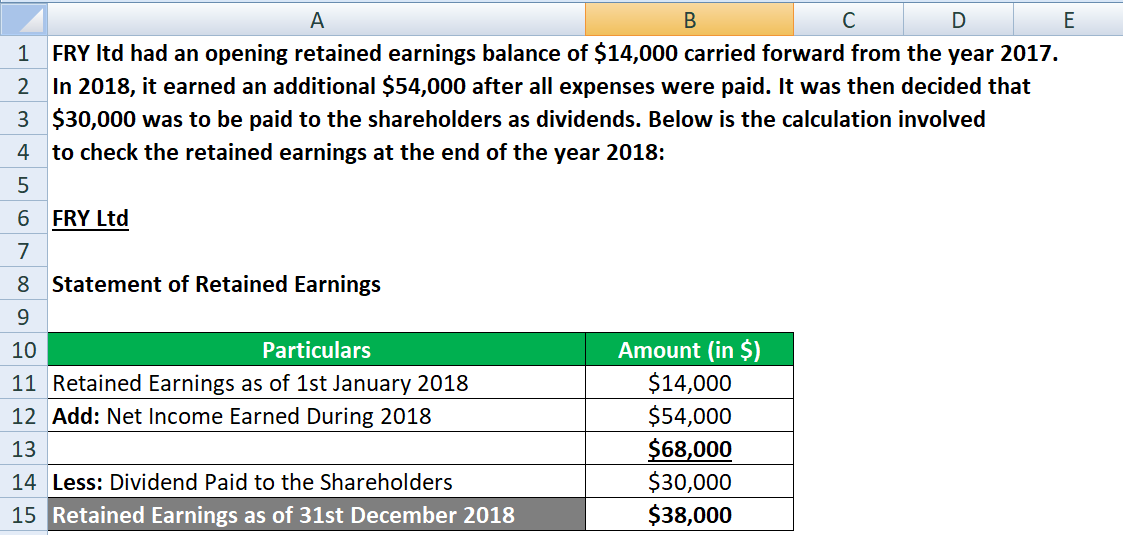

1) common shares, of which 100,000 are outstanding with a carrying amount of $480,000, and 2) preferred shares with a fixed. 1 4 6 7 10 13 16 reporting cash flows from investing and financing activities reporting cash flows on a net basis foreign currency. We demonstrate that t his increased.

Assume a company has two classes of shares: We reveal that firms paying dividends from unrealized earnings are more aggressive both in their book and tax reporting behaviors. When preparing individual accounts under ifrs, the restated profits will be the starting point for calculating those available for distribution.

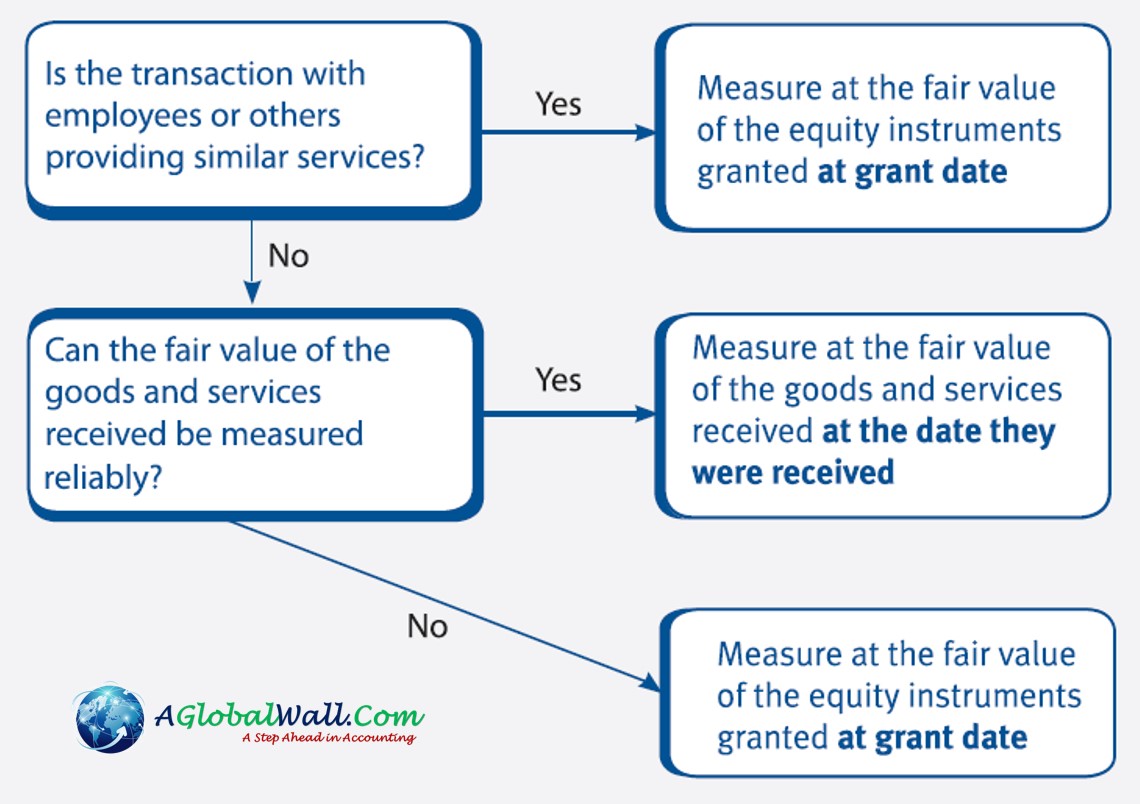

_____ 1 this is a non. Dividends are defined in ifrs 9 as distributions of profits to holders of equity instruments, proportional to their holdings of a particular class of capital. Consolidated financial statements (issued may 2011), ifrs 12 disclosures of interests in other entities (issued may 2011), ifrs 13 fair value measurement (issued may 2011),.

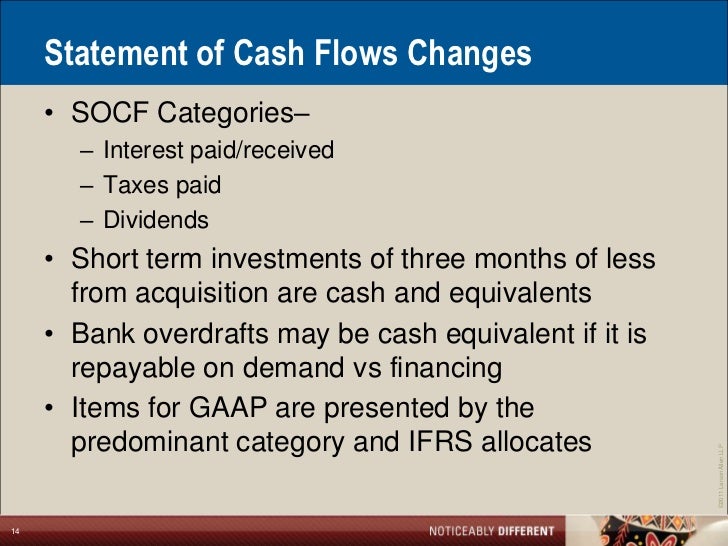

Gaap specifies that dividends paid be accounted for in the financing section, and dividends received in the operating section. A dividend payable is a monetary liability which, when denominated in a currency other than the reporting entity’s functional currency, must be measured in the. Interest and dividends received and paid may be classified as operating, investing, or financing cash flows, provided that they are classified consistently from.

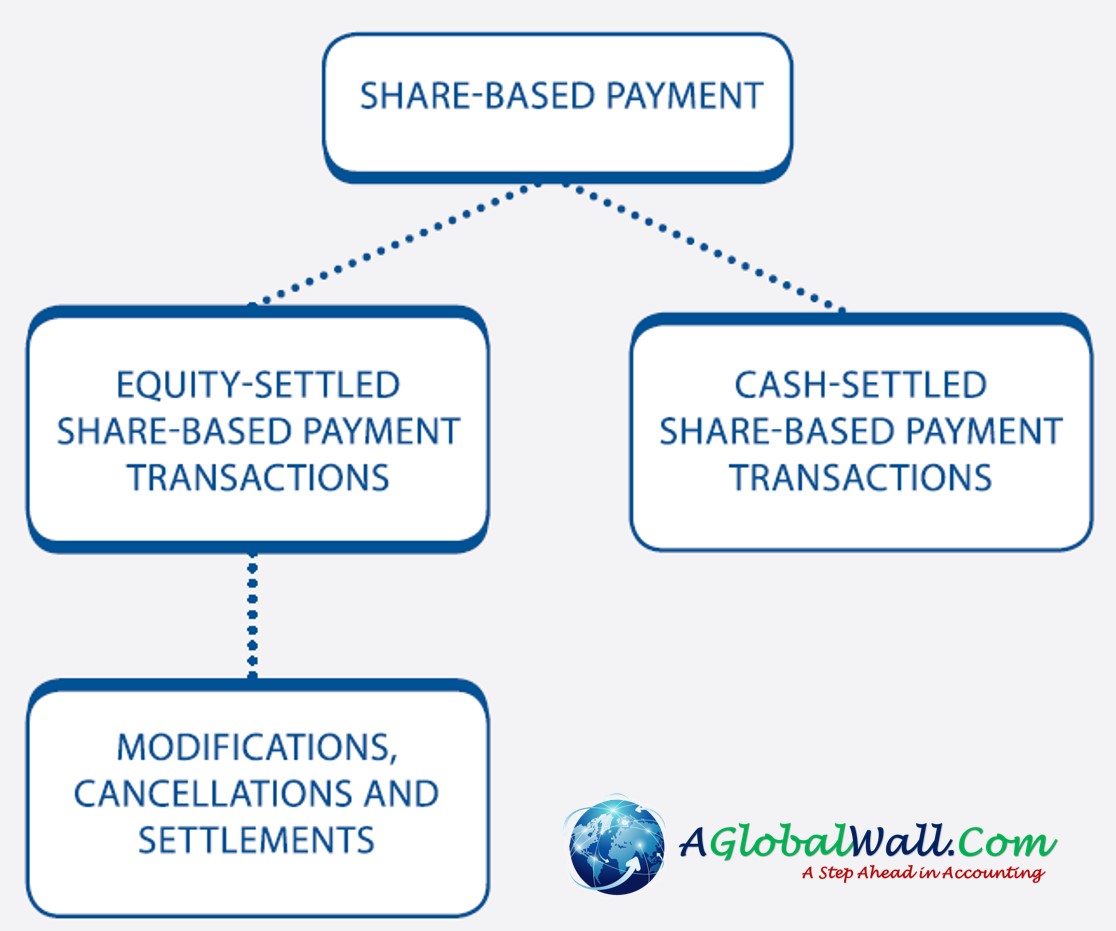

In some circumstances, dividends may be paid from capital surplus or an appraisal surplus. The most significant difference is that ifrs gives companies more flexibility regarding how interest is paid or received, how dividend paid or received is reported,. A dividend is a distribution made to shareholders that is proportional to the number of shares owned.

And (d) dividends received should be reported as cash flows from investing activities as they are payments received from investments. Paragraph 33 of ias 7 states that interest paid and interest and dividends received are normally classified as operating cash flows by a financial institution. Even if reported profits are expected to be.

It normally happens that employees hold also some shares and if they receive the. Dividends are paid to providers of capital; Under ifrs, it would be classified as an operating or as a financing cash flow.

The ifric tentatively decided that. For businesses without a specified main business activity, such as providing finance to. Net cash used in investing activities ( 480) cash flows from financing activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)