Casual Tips About Total Liabilities And Equity Financial Condition Analysis

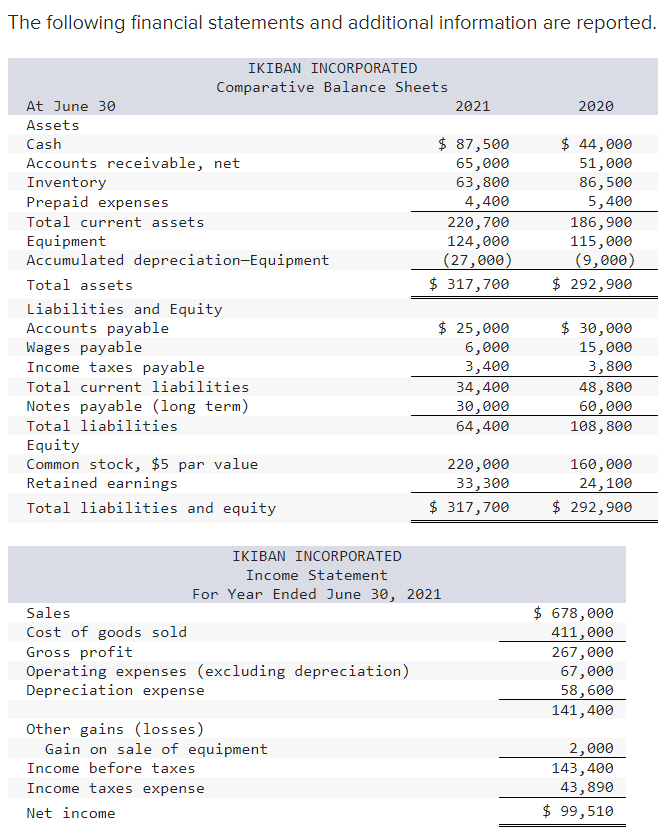

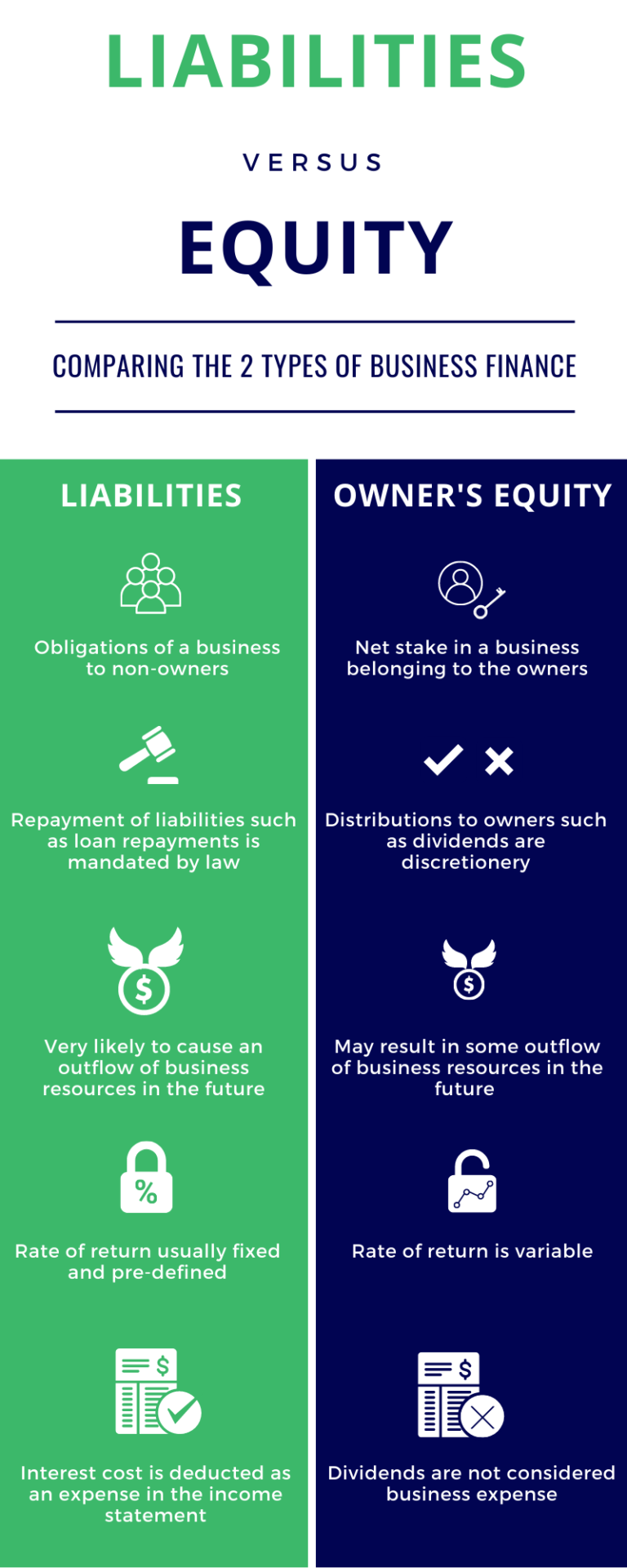

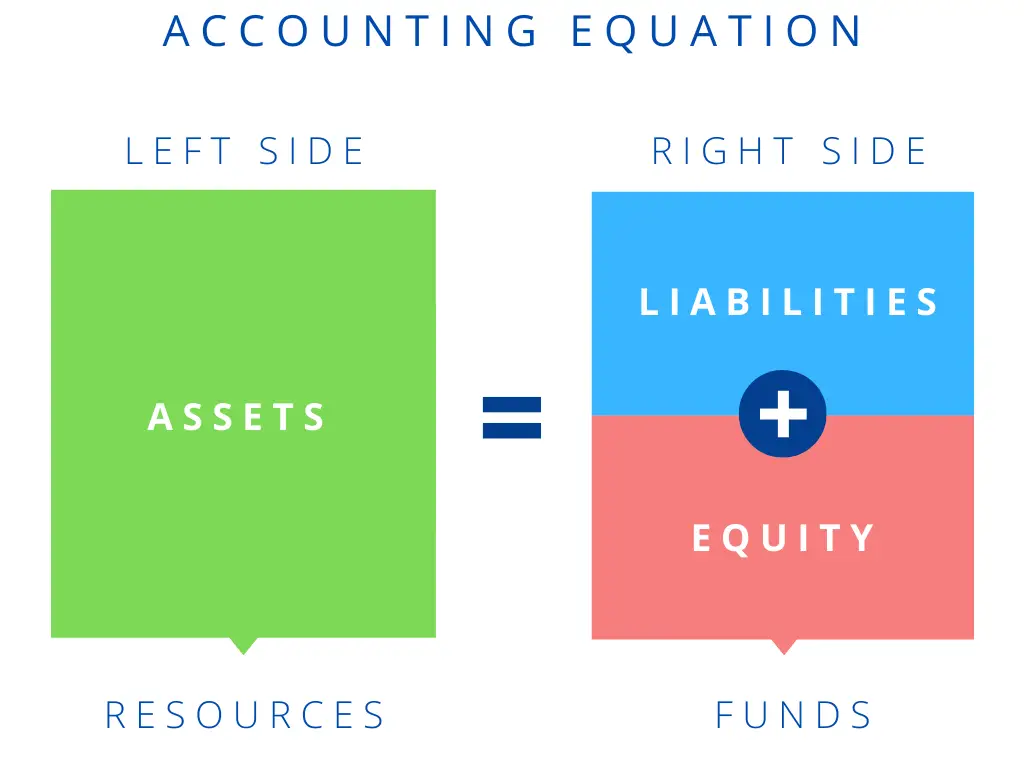

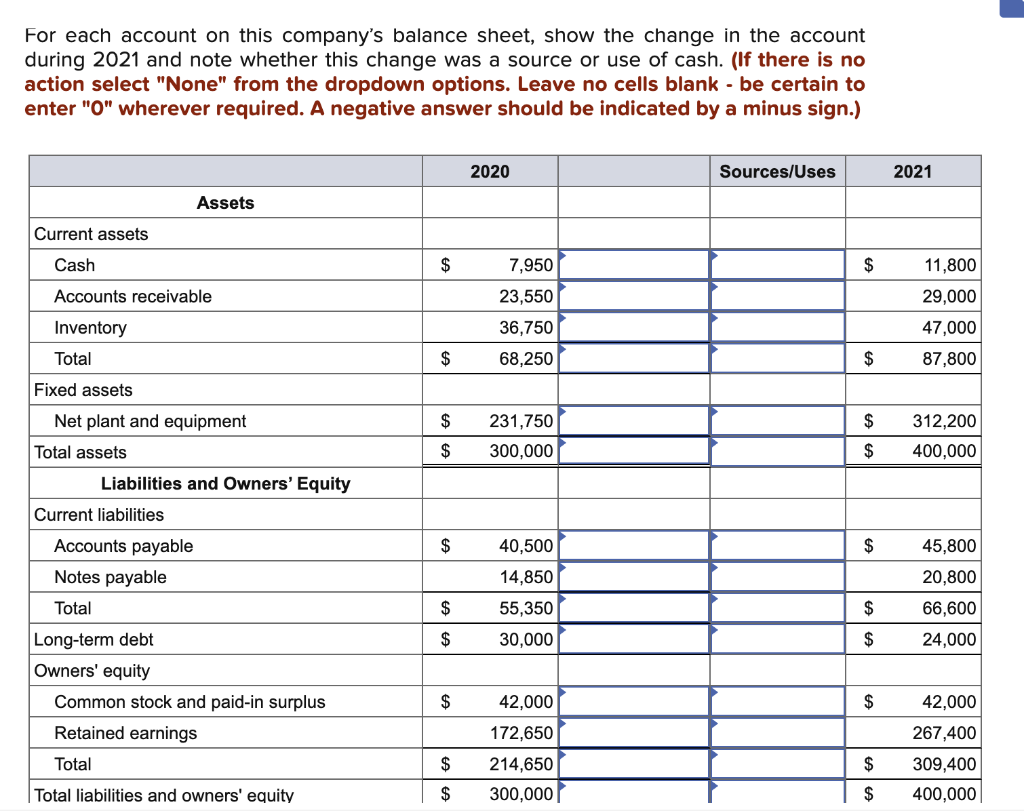

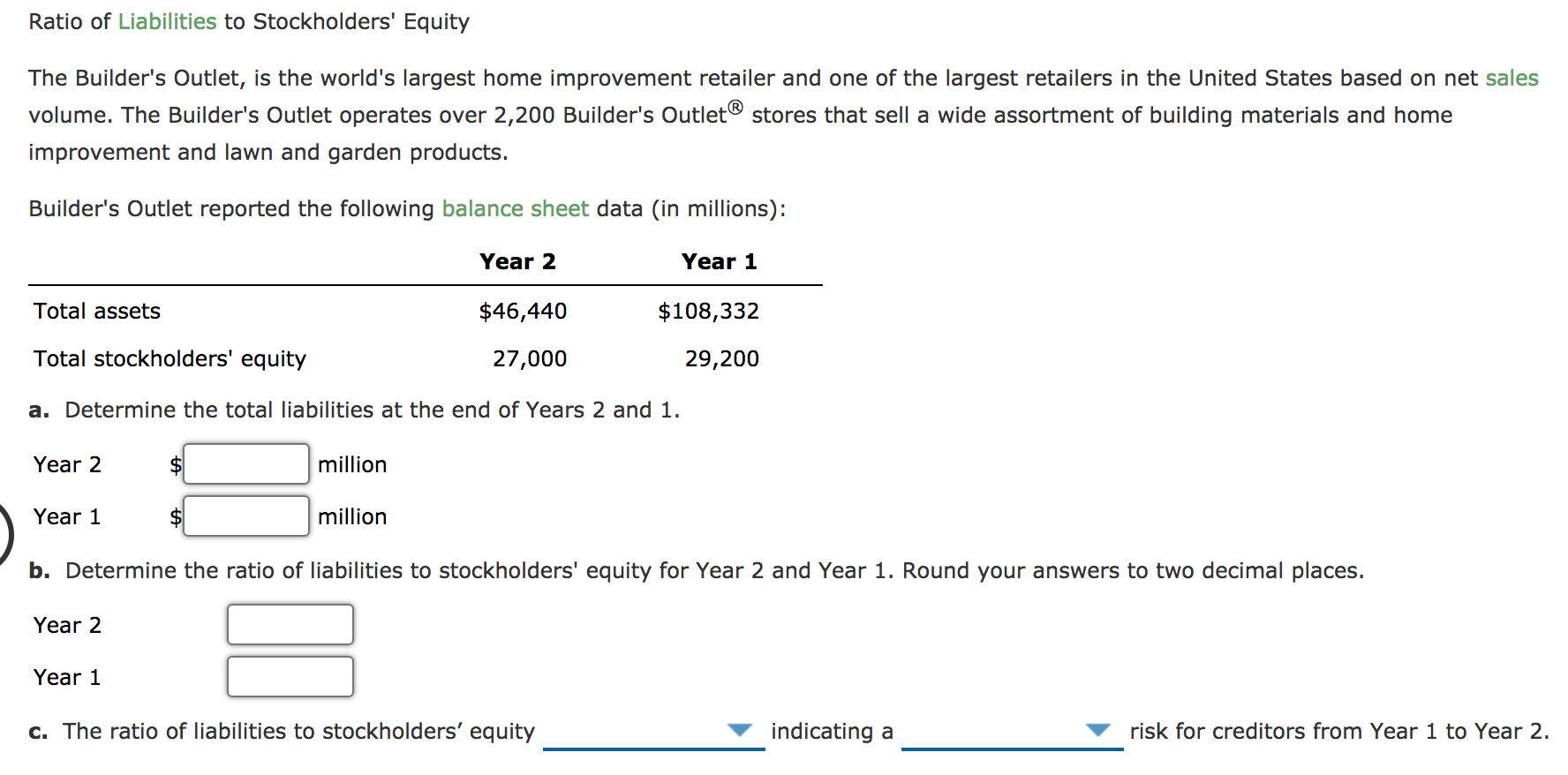

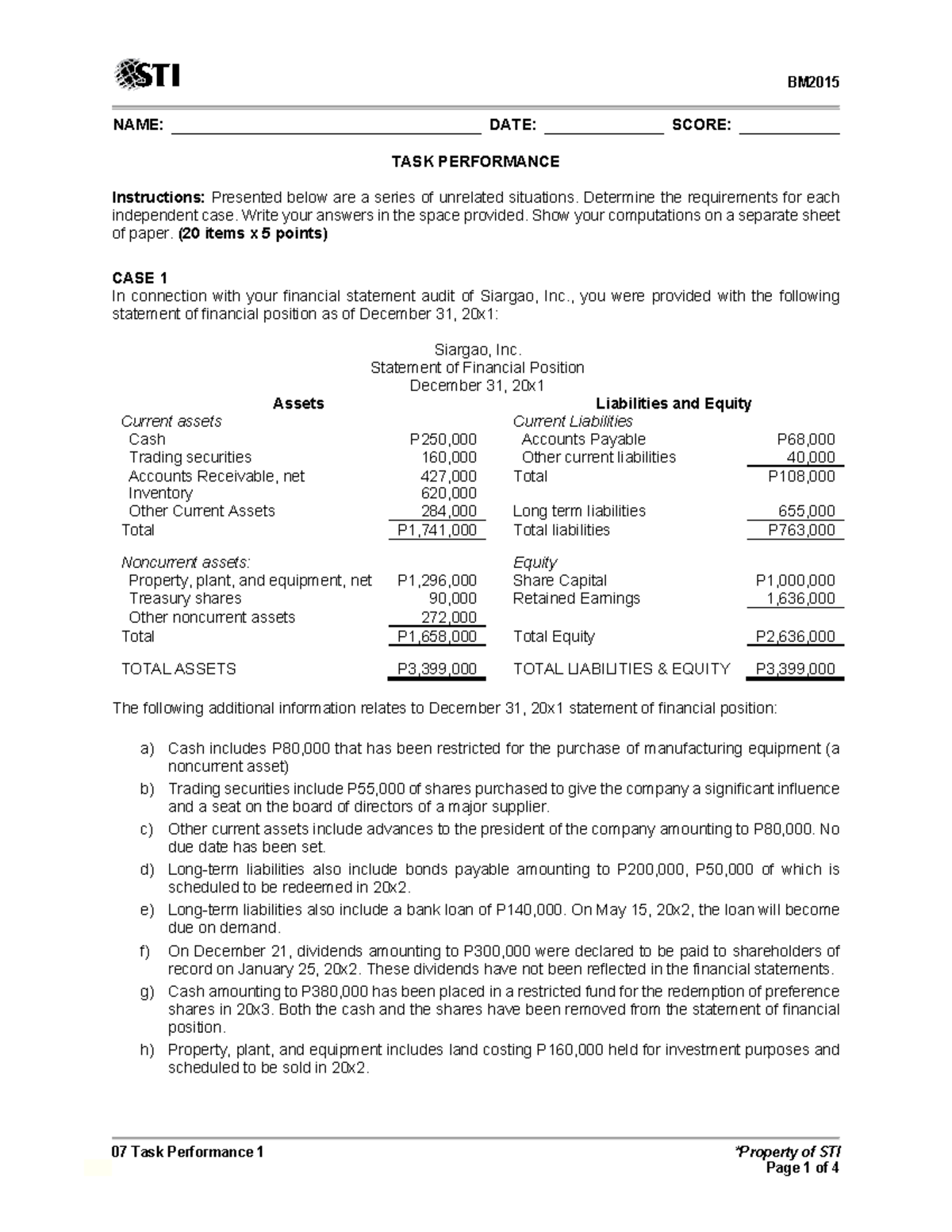

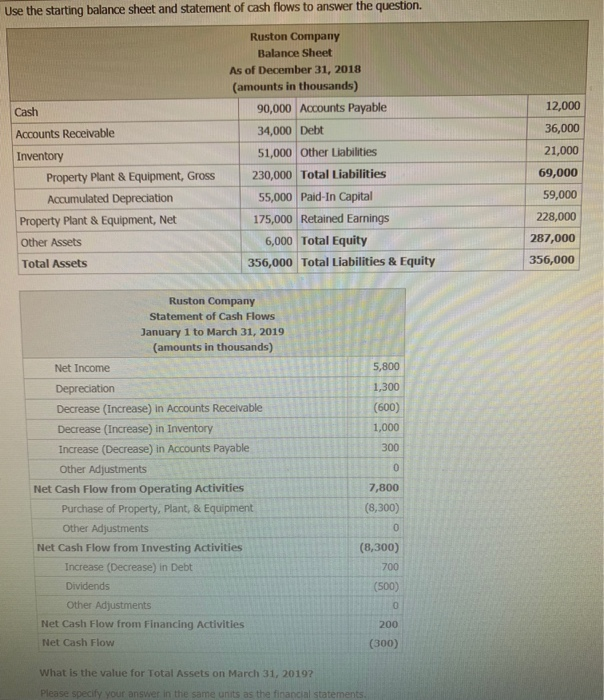

Total liabilities are reported on a balance sheet and are part of the general accounting formula:

Total liabilities and equity. Assets = liabilities + equity. Assets are anything valuable that your company owns, such as cash, equipment, or inventory. A company's total liabilities are the combined debts and obligations owed to other parties.

Assets = liabilities + equity. This is a list of what the company owes. Common liquidity ratios include the following:

This is probably where you come in as an investor. It can also be referred to as a statement of net worth or a statement of financial position. Total liabilities can be an important financial metric for company.

You can calculate this total and. Liabilities are any debts your company owes, such as accounts payable or. The accounting equation is balanced, as shown on the balance sheet, because total assets equal $29,965 as do the total liabilities and stockholders’ equity.

The balance sheet is based on the fundamental equation: Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. One side lists the company's assets, the other lists its liabilities and its owners' equity.

You can determine shareholders' equity by calculating the total assets and liabilities using the following formula: Total liabilities are any debts and obligations that a company or individual owes to another party. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

A company's balance sheet has two sides:

:max_bytes(150000):strip_icc()/latex_ee299ef83f267e92b7d1a82e14f82c14-5c73ffaf46e0fb0001f87d26.jpg)