One Of The Best Tips About Ias 19 Standard Balance Sheet Template Uk Excel

In particular, by requiring the surplus or deficit.

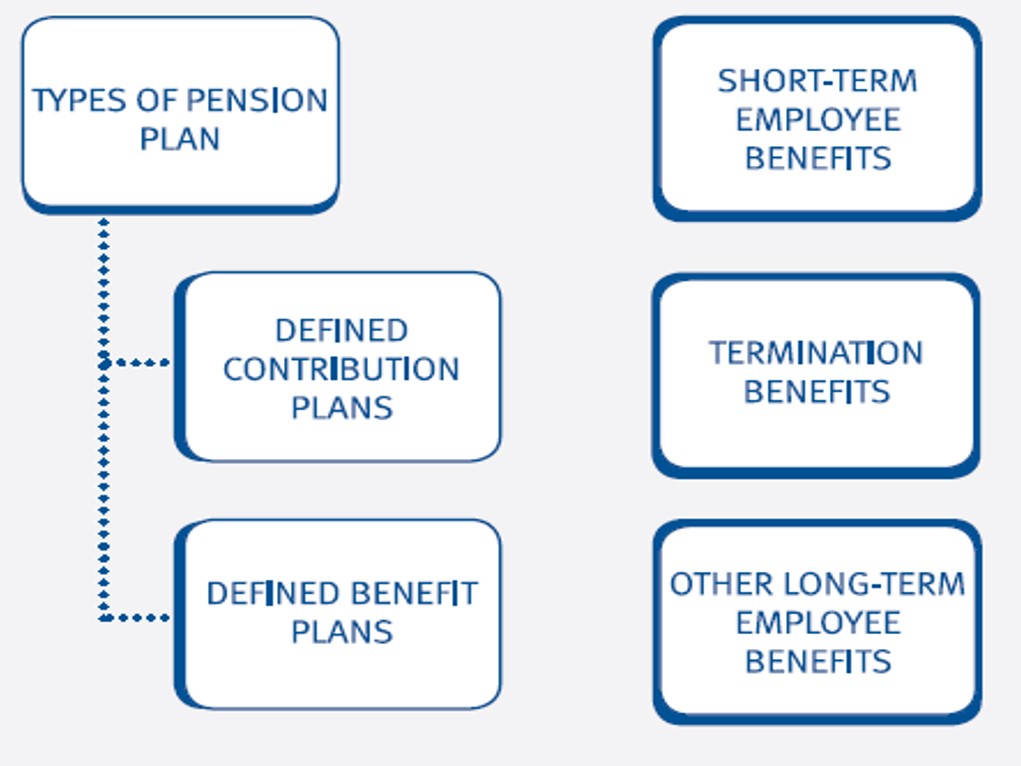

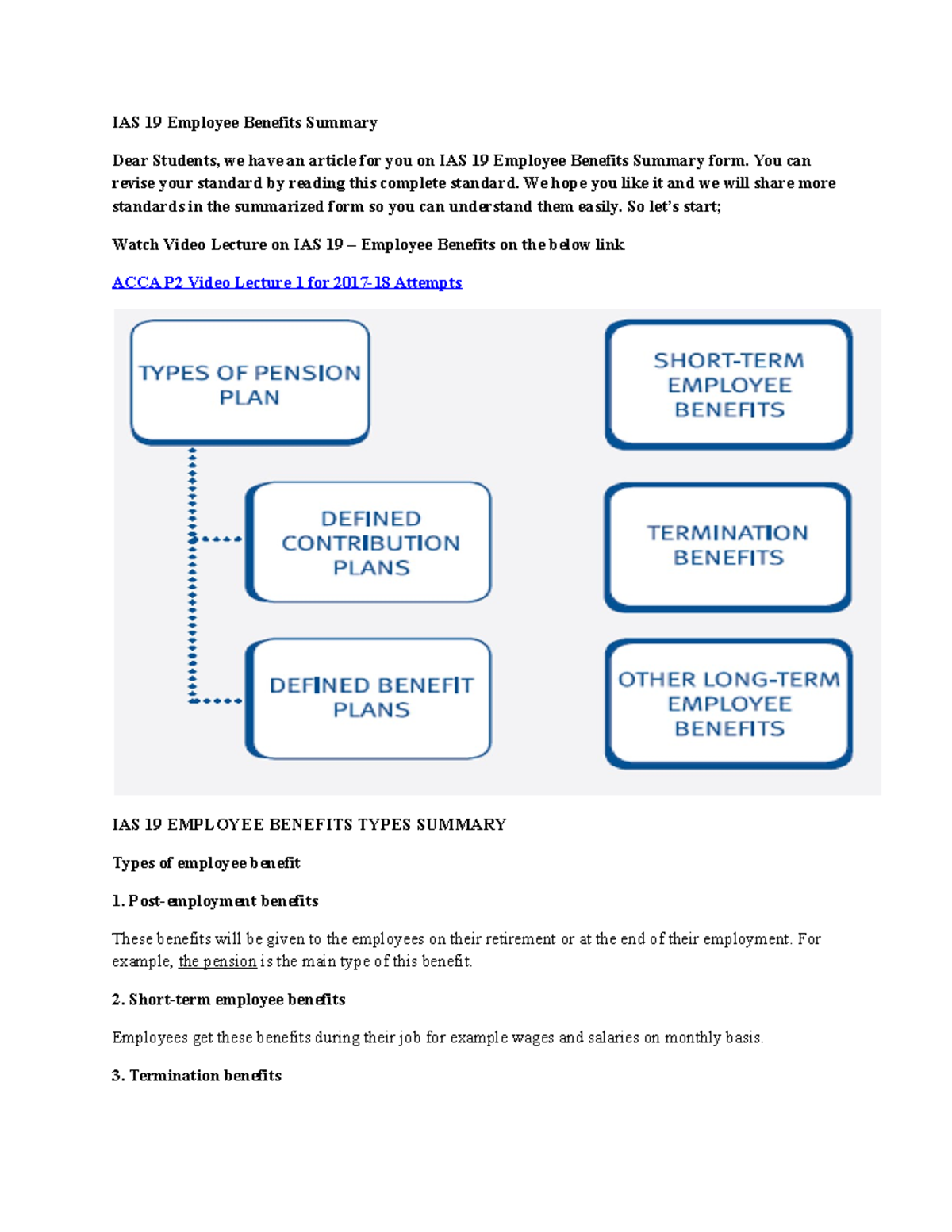

Ias 19 standard. The standard requires an entity to recognise: For the requirements reference must be made to. According to ias 19.5, employee benefits are categorised into four main types:

Ifrs accounting standards are developed by the international accounting standards board (iasb). @dream_ias_officer_ ncert notes 200 rs standard book notes 400 rs ssc cgl notes 200 rs all state. Employee benefits are all forms.

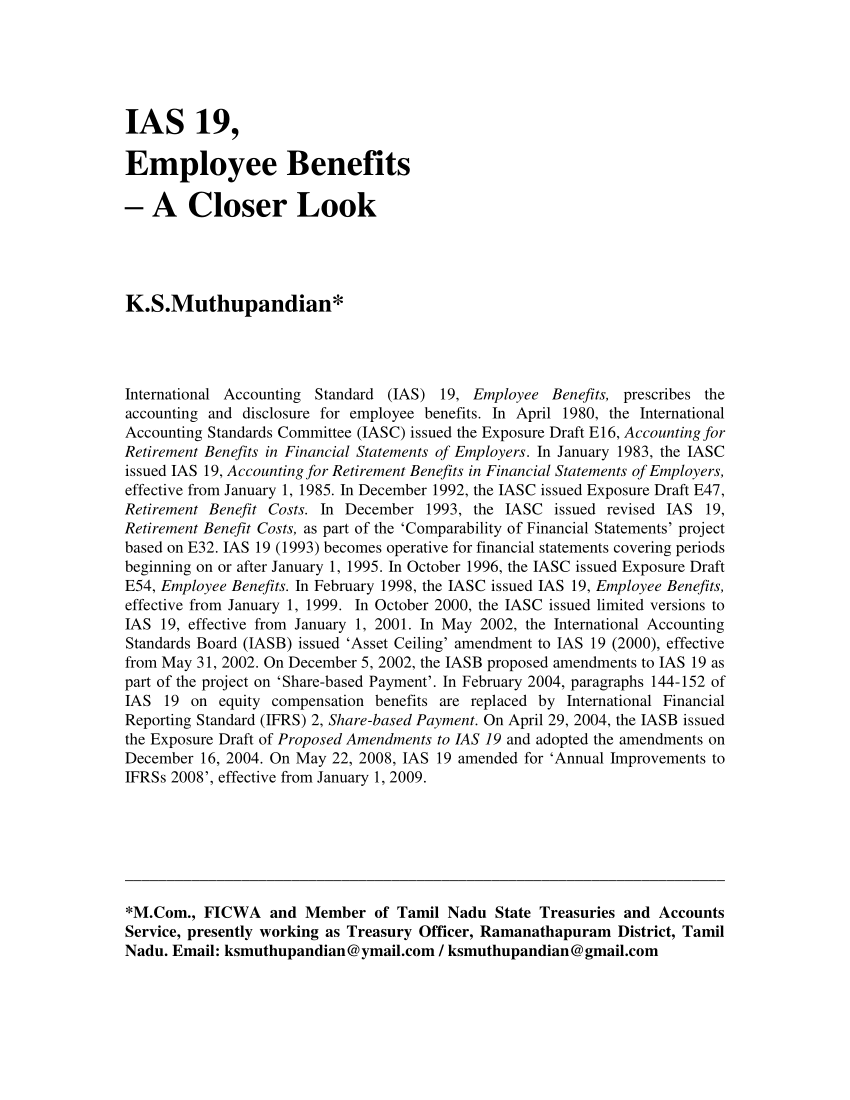

Ias 19 or international accounting standard nineteen rule concerning employee benefits under the ifrs rules set by the international accounting standards board. Ias 19 technical summary this extract has been prepared by iasc foundation staff and has not been approved by the iasb. Ias 19 employee benefits.

The staff asked if the committee agrees with the analysis and the recommendation not to add a. As international accounting standards are continually being updated with amendments and consequential amendments, we maintain one version of all of the international. International accounting standard 19 (ias 19) is set out in and.

All the paragraphs have equal authority but retain the iasc format of the standard when it was adopted by the. 45 rows international accounting standards (iass) were issued by the antecedent international accounting standards council (iasc), and endorsed and. Employee benefits—undiscounted vested employee benefits (ias 19) employee long service leave (ias 19 and ias 32) benefit allocation for defined benefit.

The amendments to ias 19 are designed to make users of financial statements aware of the risks associated with those commitments; (a) a liability when an employee has provided service in exchange for employee benefits to be paid in the future;

.jpg)