Recommendation Info About Balance Sheet Not Balancing Capital Account Format In Excel Example

And while there are different ways to do it, using.

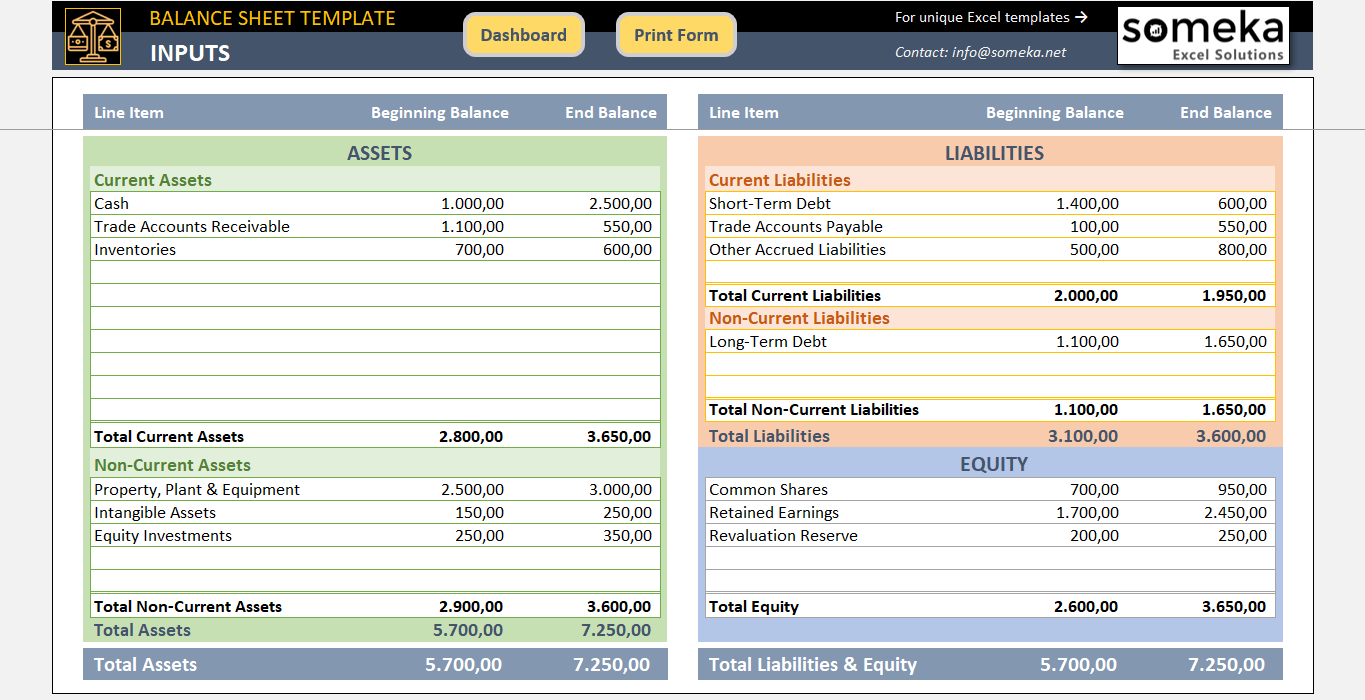

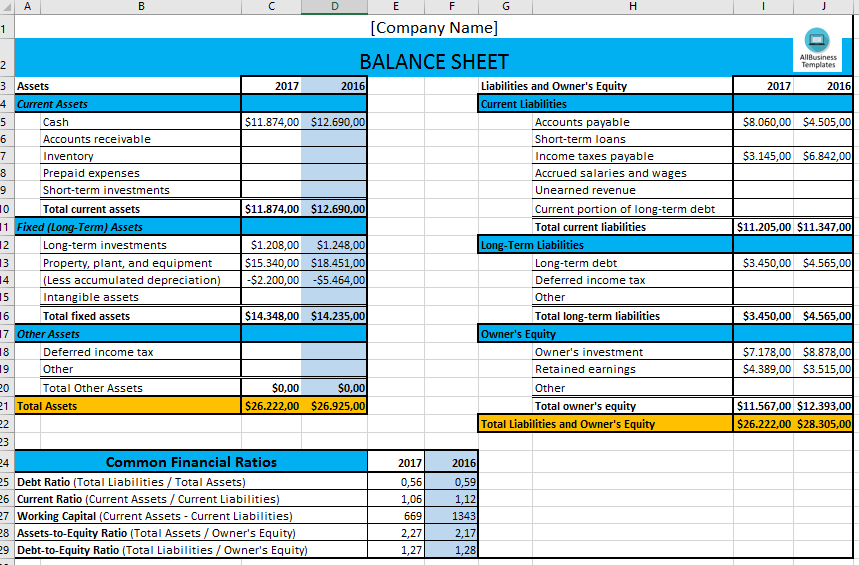

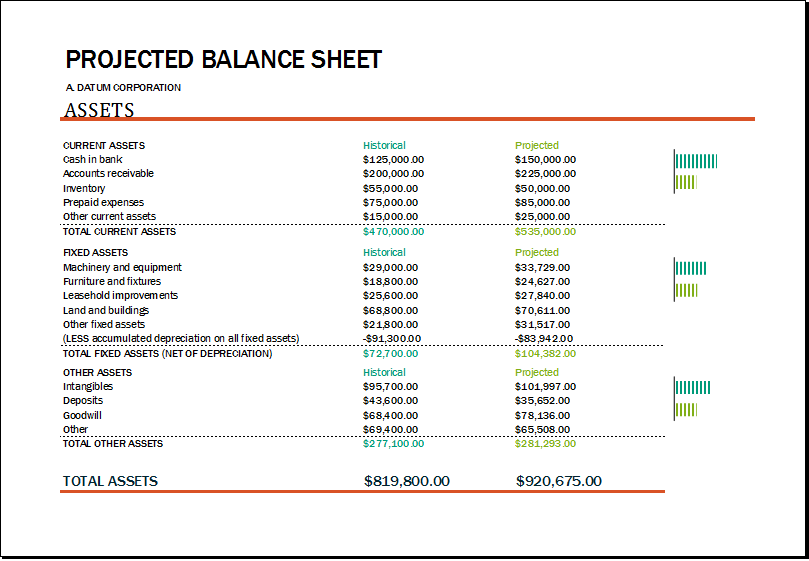

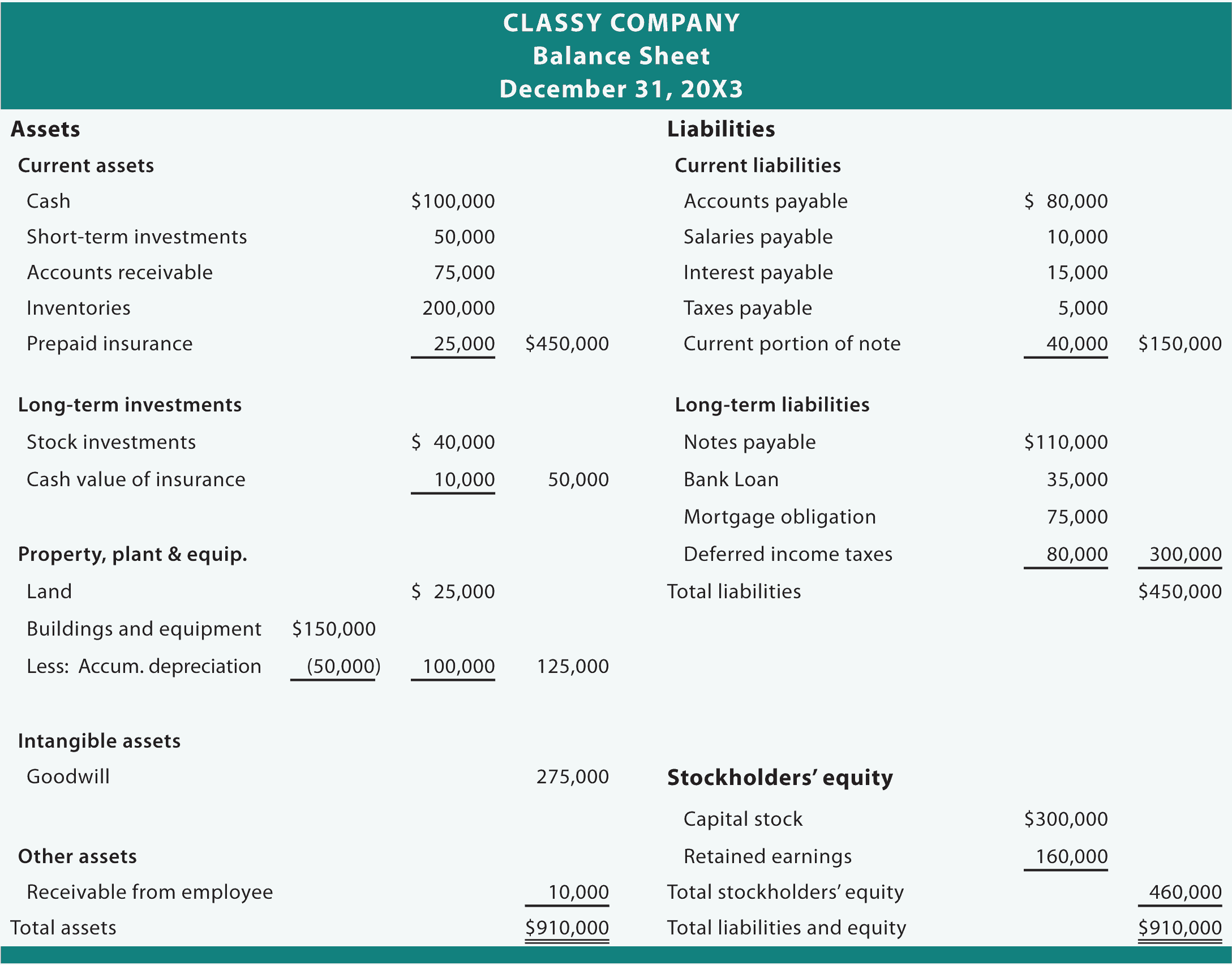

Balance sheet not balancing capital account format in excel. Balance sheet format is categorized in two types. June 21, 2023 if you’re a business owner or financial analyst, understanding how to conduct a balance sheet analysis is essential. Filling out the balance sheet template.

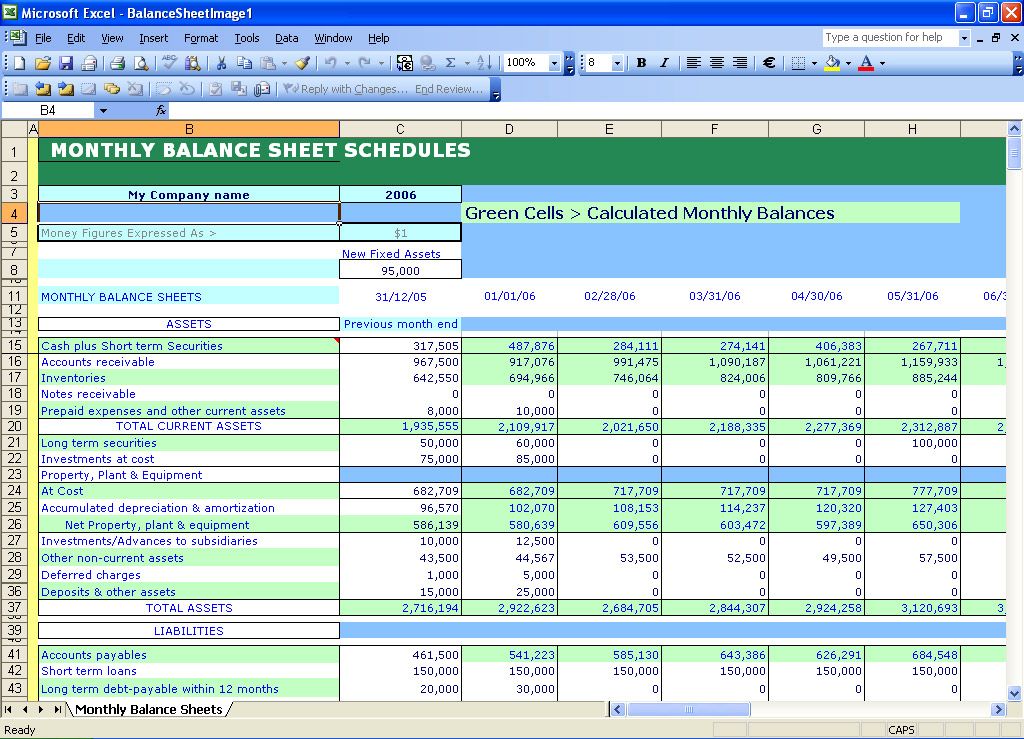

Open up a new file on microsoft. We provide a comprehensive range of cash flow forecast templates with formulas which automatically calculate the entire balance sheet. So now i just wanted to give you 4 things to look for if your balance sheet is not balancing.

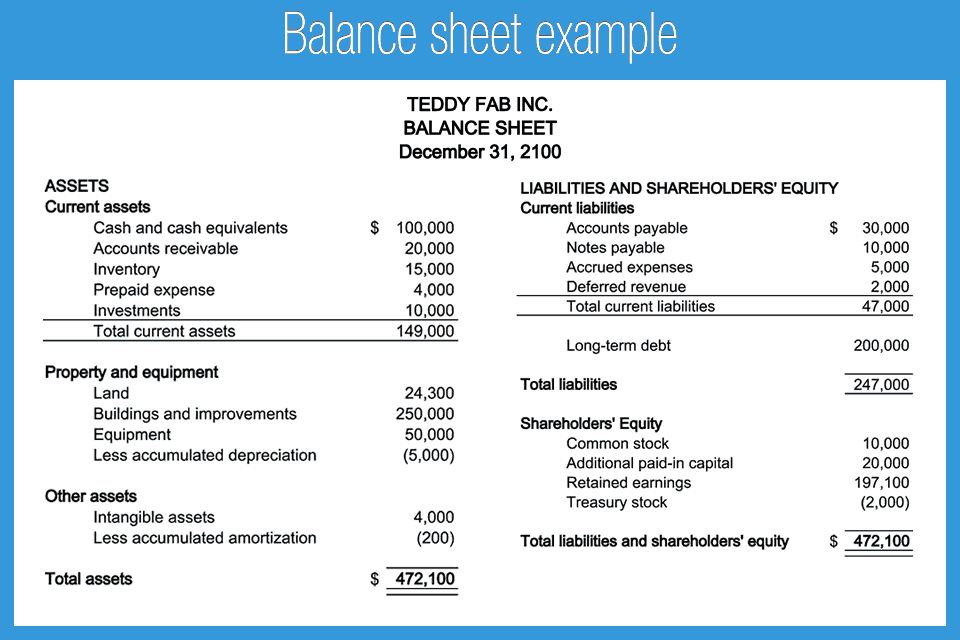

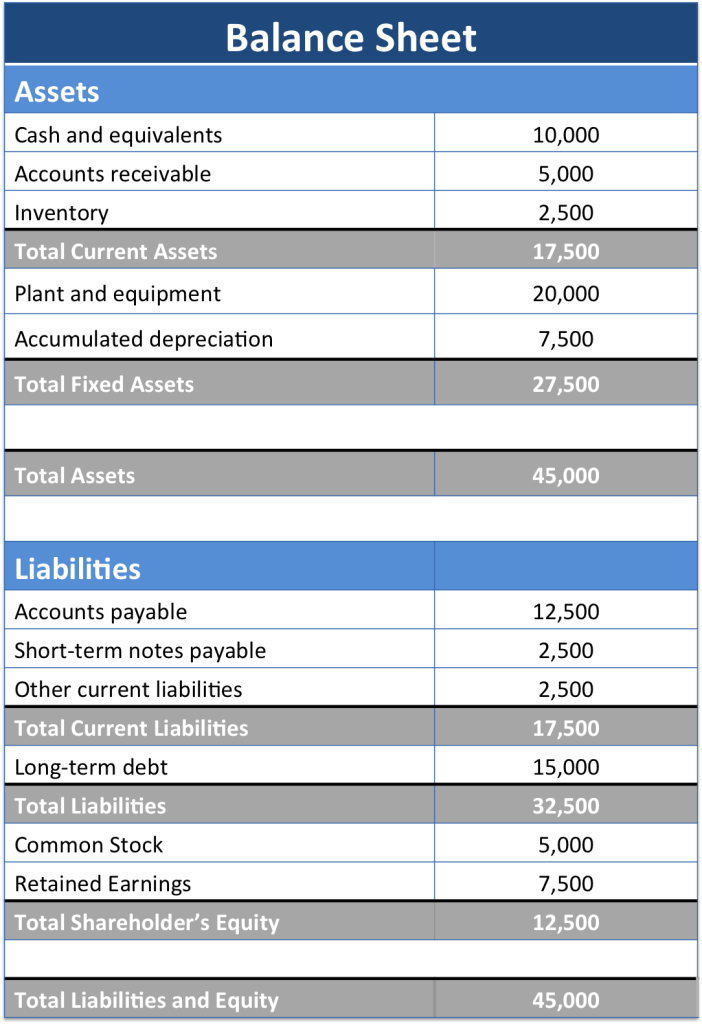

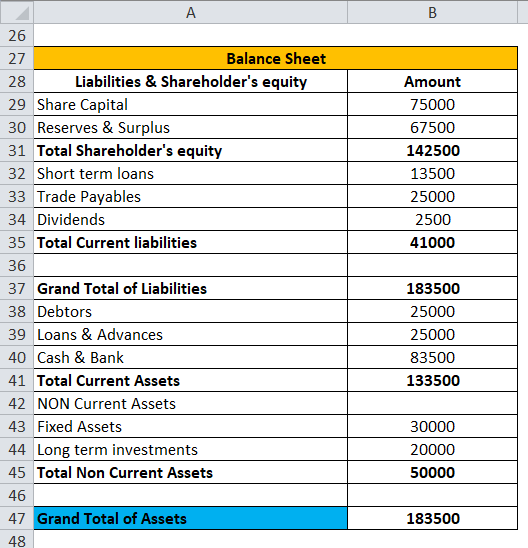

Assets (what the company own) 2. Balance sheet format in excel, pdf, word. (iv) the balance sheet of this account depicts its type as surplus or deficit balance.

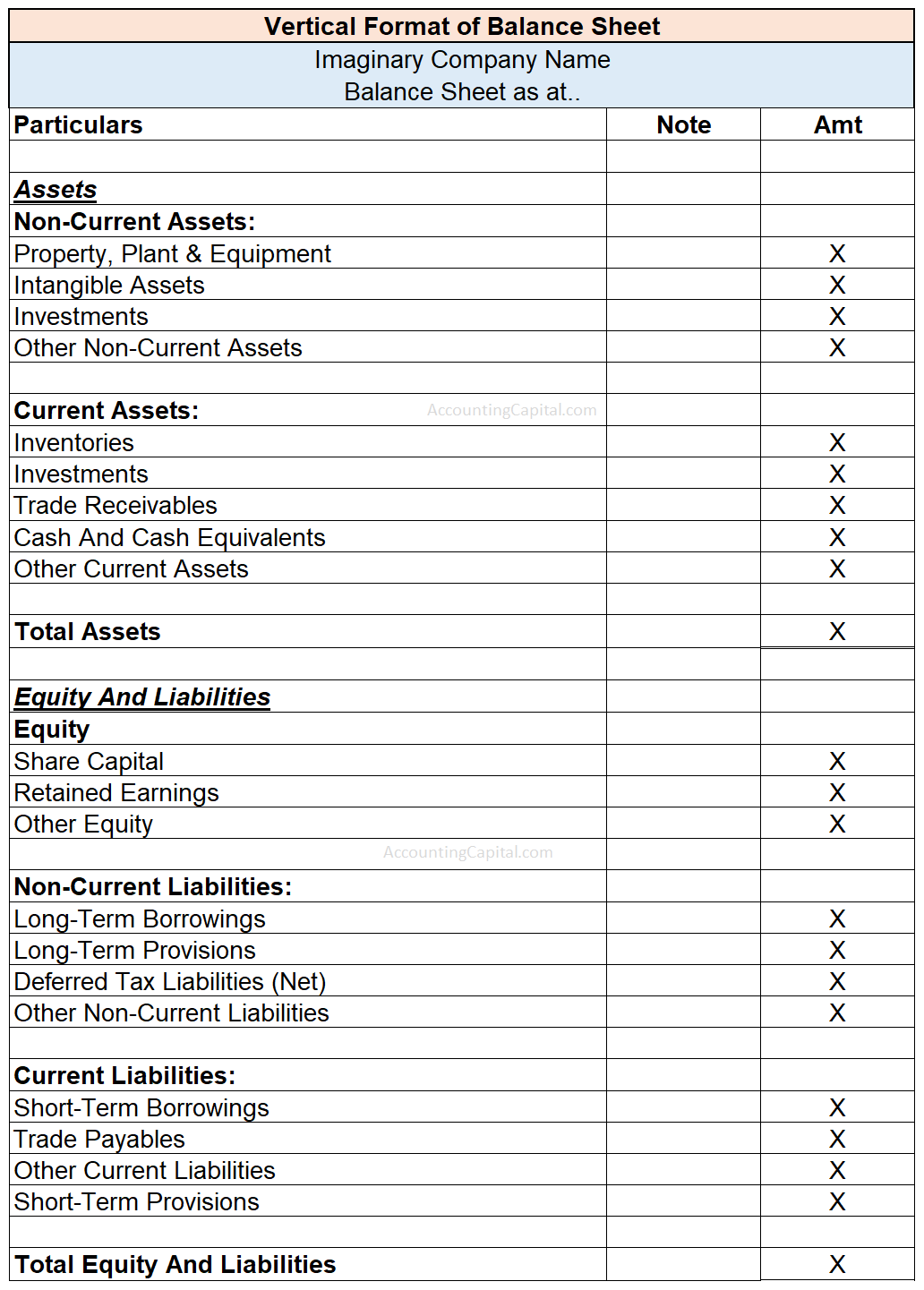

First, you have to prepare the heading for your balance. Liabilities (what the company owe) assets = liabilities + equity the above two heads must be an equal ratio for a balance. The five major sections under the vertical format of the balance sheet are;

(v) normally, the surplus or deficit balance from the income and expenditure. The first one is account form in which two columns are present which are assigned for liabilities and equities respectively. This balance sheet template includes tallies of your net assets — or net worth — and your working capital.

Your balance sheet won’t balance. Download the sample template for additional. Simple format of individual profit & loss account, balance sheet, capital account & income tax computation #xlsx.

Steps to make a balance sheet format of a company in excel 📌 step 1: A balance sheet is a crucial report that summarises the financial balances of a business. Download 13+ free accounting templates in excel to manage billing statements, balance sheets, expense reports, and more.

Once you know the period you're covering and have the values you need, it's time to create the excel file. Create the excel file. Next, make two columns for assets and liabilities as.