Impressive Info About Income And Expenditure Statement Examples Of Extraordinary Items In Cash Flow

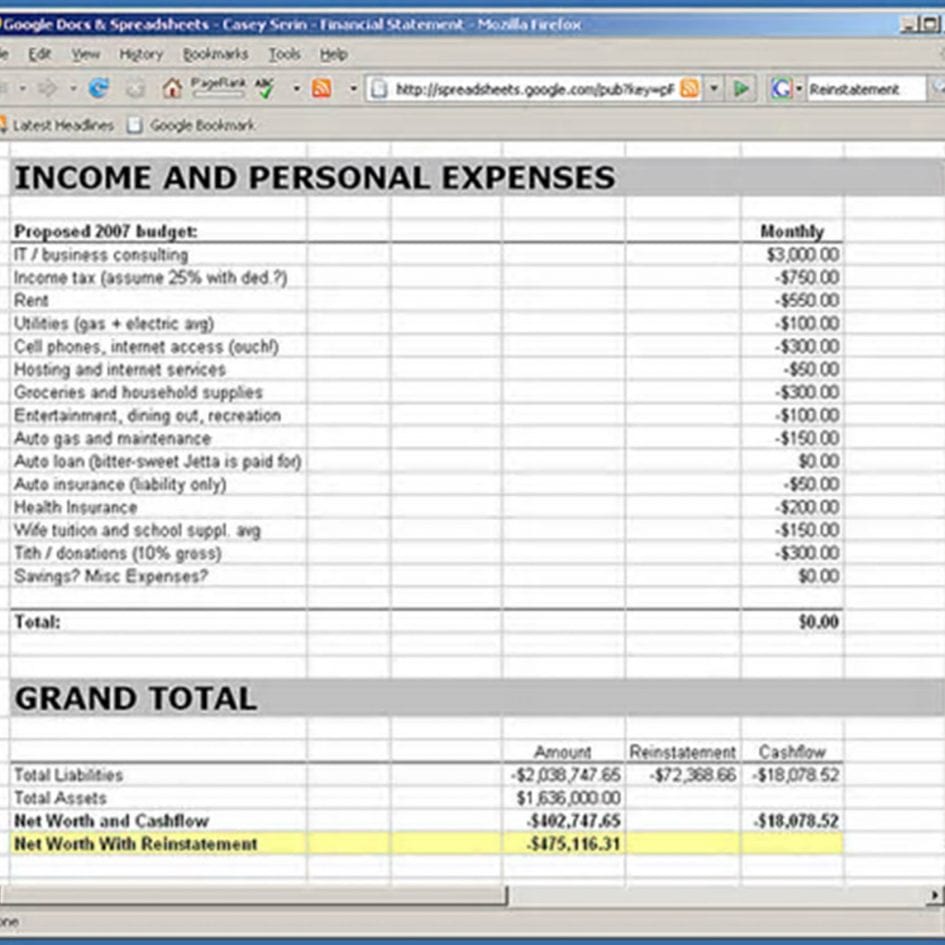

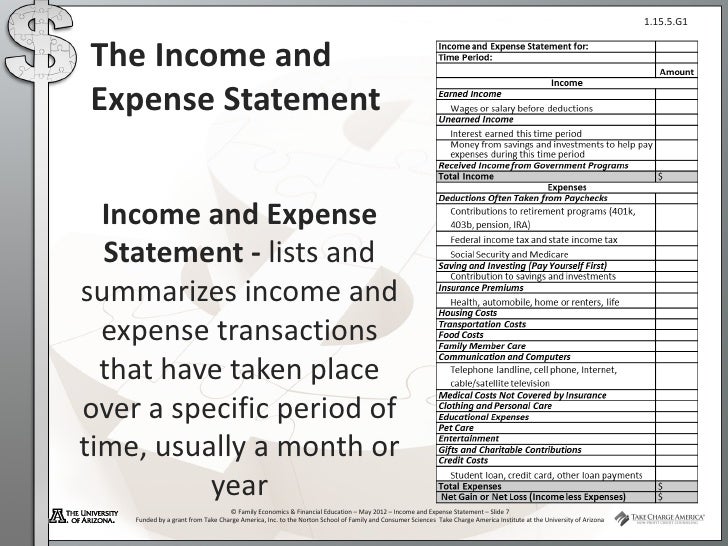

Income statements or profit and loss accounts are financial statements used to calculate the financial health of the company.

Income and expenditure statement. Track your costs in the customizable expenses column, and enter your revenue and expenses to determine your net income. The price per earnings ratio can help. Vat relief in respect of basic food items based on 2010/11 income and expenditure survey data, and two food items and sanitary towels (pads) added from 1.

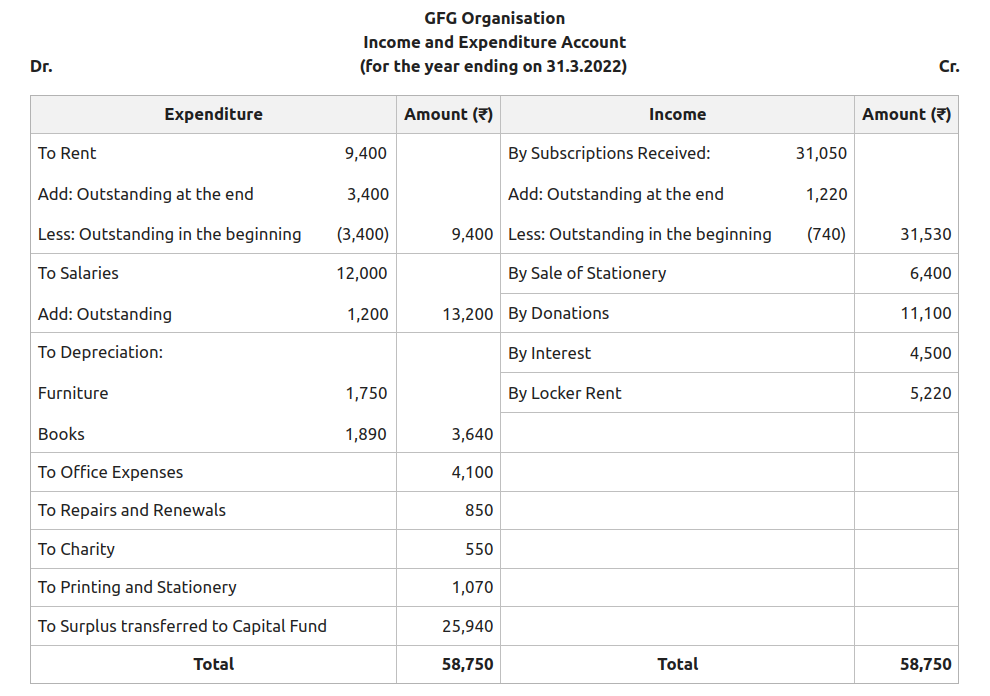

The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. This is the latest release. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss.

What is an income statement? The income statement, also known as the profit and loss (p&l) statement, is the financial statement that depicts the revenues, expenses and net income generated by an organization over a. Opening statement by governor gabriel makhlouf at the joint oireachtas committee on finance, public expenditure and reform, and taoiseach.

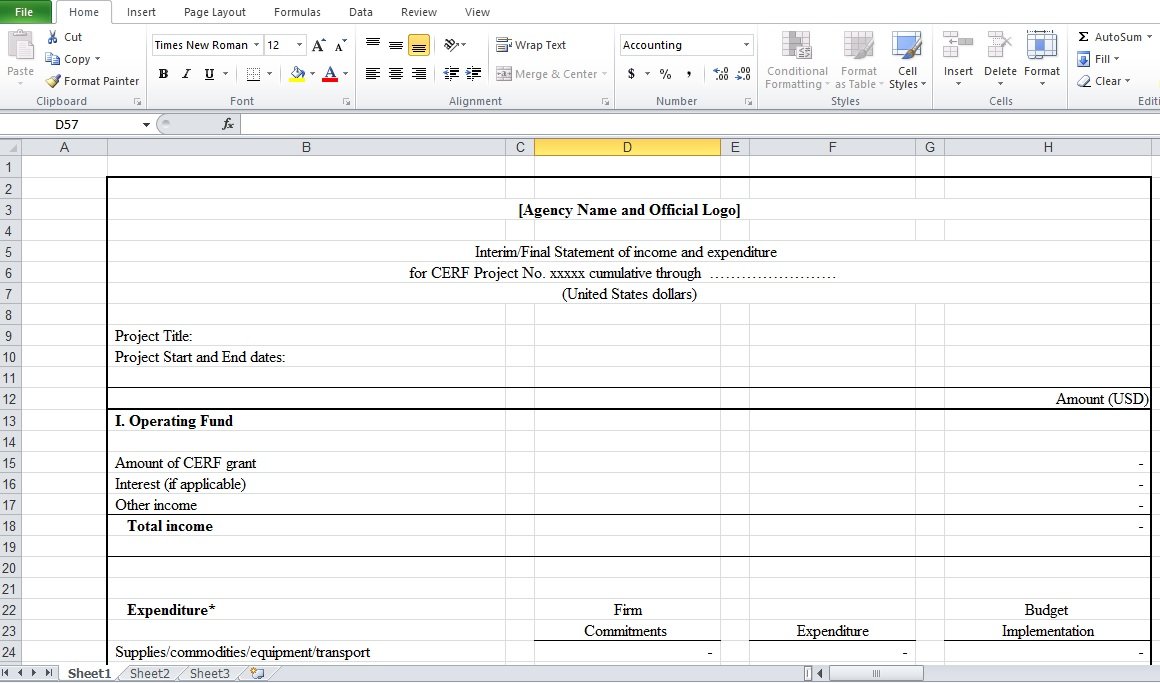

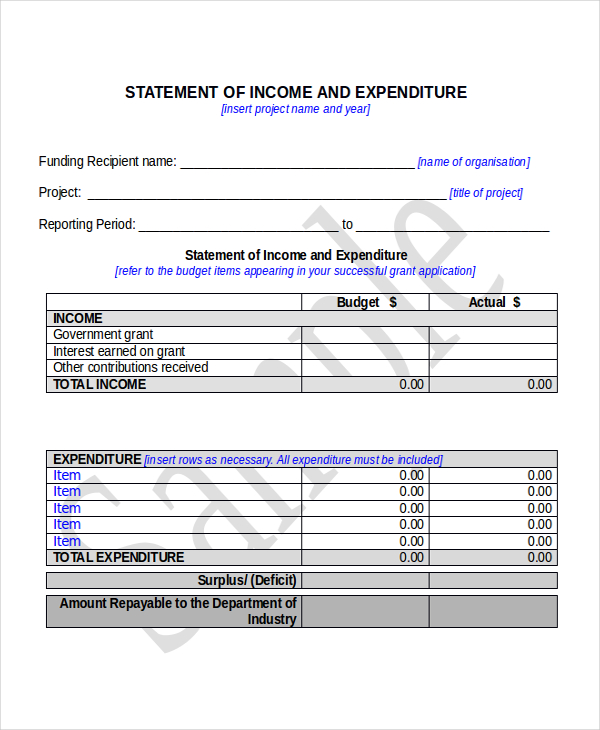

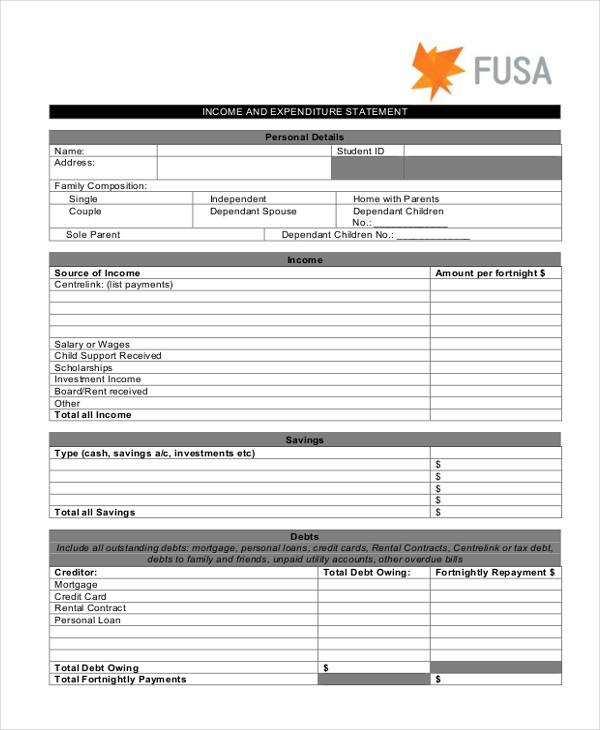

Released 23 january 2024 resents the balance sheet, statement of operations and statement of other economic flows for the public sector, compliant with the government finance statistics. Income and expenditure form and financial statement. Important information relating to taxes, duties and levies for.

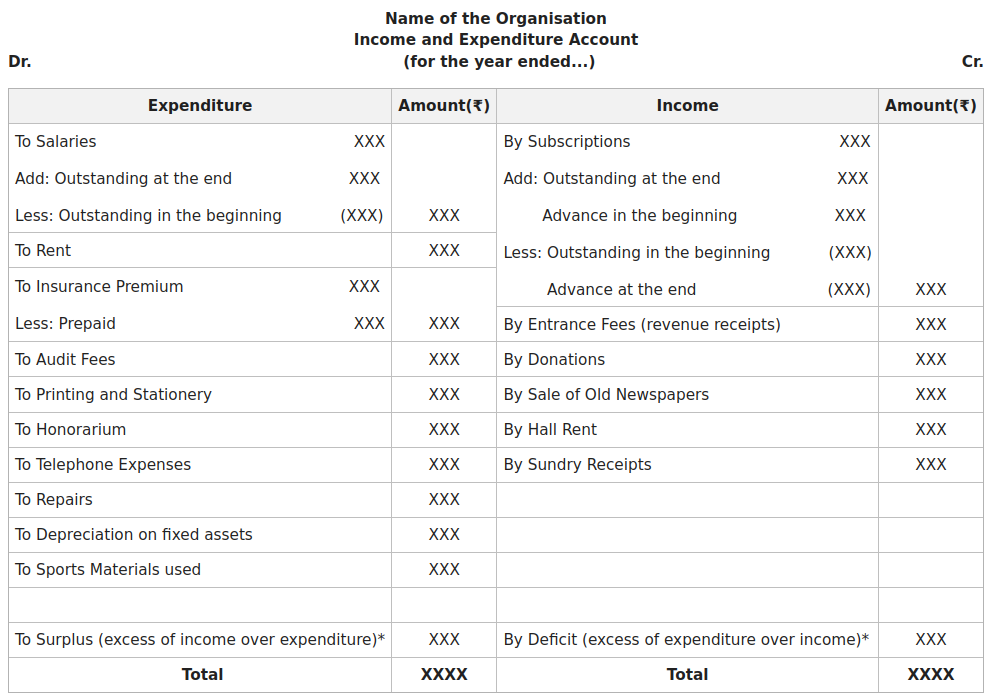

An income and expenditure statement is a financial report summarizing earnings and spending over a period, offering a clear picture of an entity's operational efficiency. Overview of the three financial statements 1. You try to make a payment plan with a creditor.

These ratios are derived from income statements. It is categorised into different line items such as revenue by type, or costs. An income statement is a financial statement that shows you how profitable your business was over a given reporting period.

It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually. An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter. It shows the company’s revenues and expenses during a particular period, which can be selected according to the company’s needs.

Capital gains tax on shares sales not included 4. Budgets are often estimates, because you cannot easily include unexpected expenses in a budget. Revenue, expenses, gains, and losses.

This calculation shows investors and creditors the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues. 'financial statements' or 'income and expenditure' (i&e) forms help creditors understand your situation. Tax rates from 1 march 2024 to 28 february 2025:

Prepared on an accrual basis, this account records every income and expense in a particular year, irrespective of whether they are clear or not. The statement then deducts the cost of goods sold to find gross profit.from there,. The 2024 budget speech by finance minister enoch godongwana put this speculation to rest when he announced that there would be no major changes to income tax, and no inflation adjustment to.