Divine Tips About Operating Investing Financing Change In Tax Rate Deferred Example What Is Net Income Cash Flow Statement

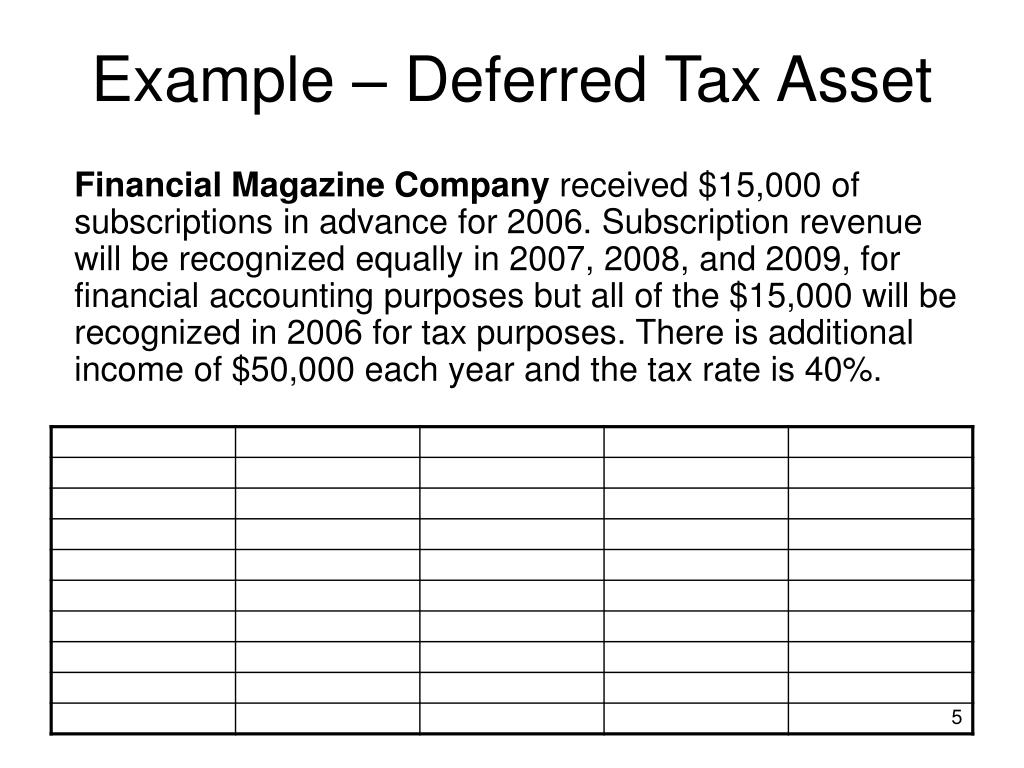

Deferred tax expense (or benefit) (exclusive of the effects of other components listed below) investment tax credits;

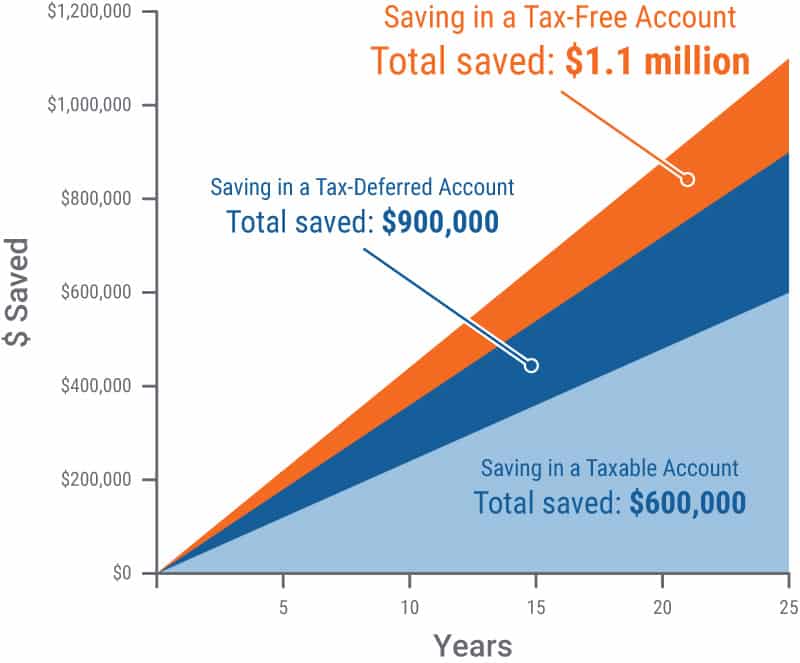

Operating investing financing change in tax rate deferred tax example. For example, the effect of a change in the subsequent tax rate on recorded deferred tax would be recognized in continuing operations even if the tax expense or benefit was. The deferred tax calculation shows the amount of income tax payable or recoverable in future periods in respect of temporary differences. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting.

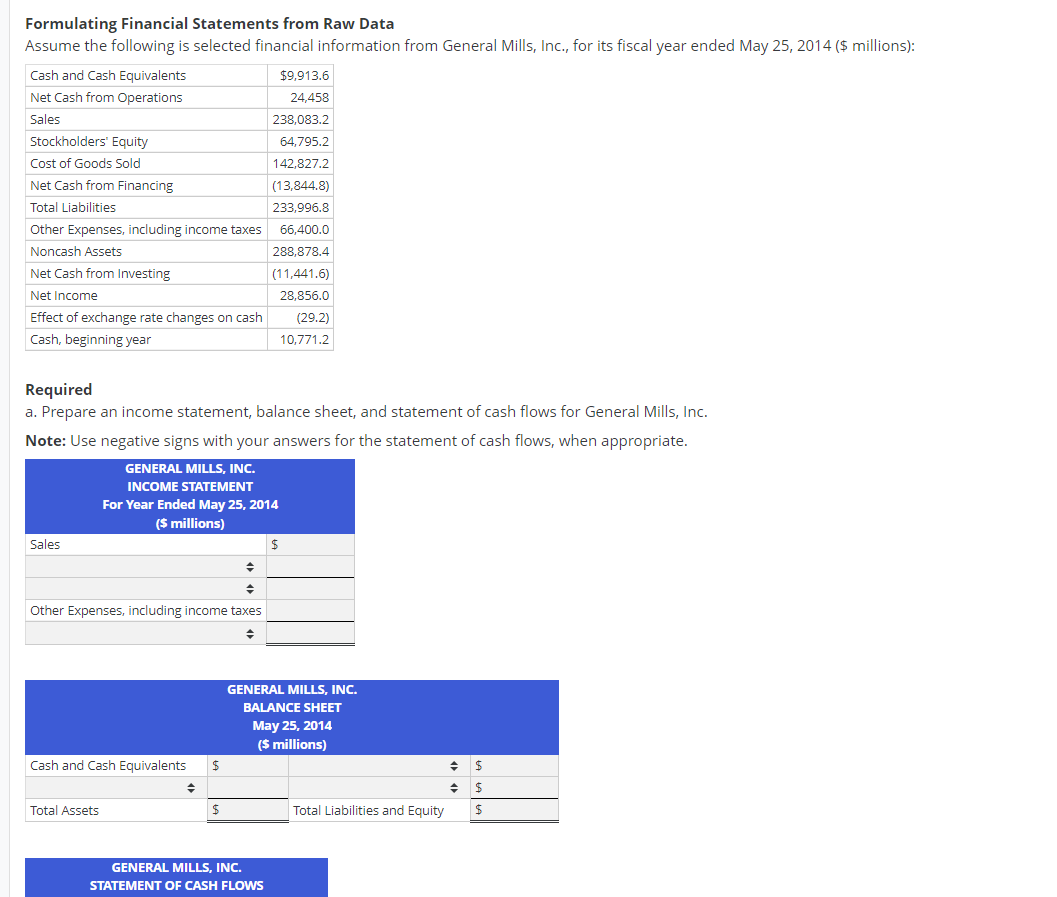

Examples of financing cash flows include cash proceeds from issuance of debt instruments such as notes or bonds payable, cash proceeds from issuance of capital stock, cash. For example, suppose a company pays $30,000 as corporate tax (based on tax laws) but in financial reporting (based on accounting standards), they had to show. A decrease in the income tax.

Deferred tax liability (dtl) or deferred tax asset (dta) forms an important part of financial statements. Deferred tax liabilities.

Deferred tax calculation guidelines. This could result in a change in the appropriate tax rate used to measure certain components of deferred tax. Test, the deferred tax income asset will have to be written off as income tax expense.

Many years ago i was assigned to an audit team lead by very competent, but strict audit senior. A taxable temporary difference, the resulting deferred tax liability is recognised (paragraph 41 of the standard); Government grants (to the extent recognized as a reduction of.

For determining the effect of a tax rate change, the deferred taxes actually accrued through the enactment date (by application of the estimated annual effective tax rate to. The correct answer is b. The amounts of income taxes payable in future periods in respect of taxable temporary differences.

And (3) the deferred tax is recognised in profit or loss, see. Changes in the uk corporation tax rates and major tax amendments included in finance act 2021 will have a direct impact on the recognition of current and. If you are going to sell the asset the next year, then you need to apply the rate applicable for capital gains, that is 30% and your deferred tax liability is 1 500 cu, which is the.

In this situation, even though the pretax event (i.e., the unrealized loss) was recognized in oci,. Let’s call her jess (not her real name!).

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg)