Looking Good Tips About Balance Sheet Reconciliation Policy Types Of Ratio Analysis

Yet, the process is often reactive and highly manual, resulting in wasted time, errors, and limited capacity for analysis.

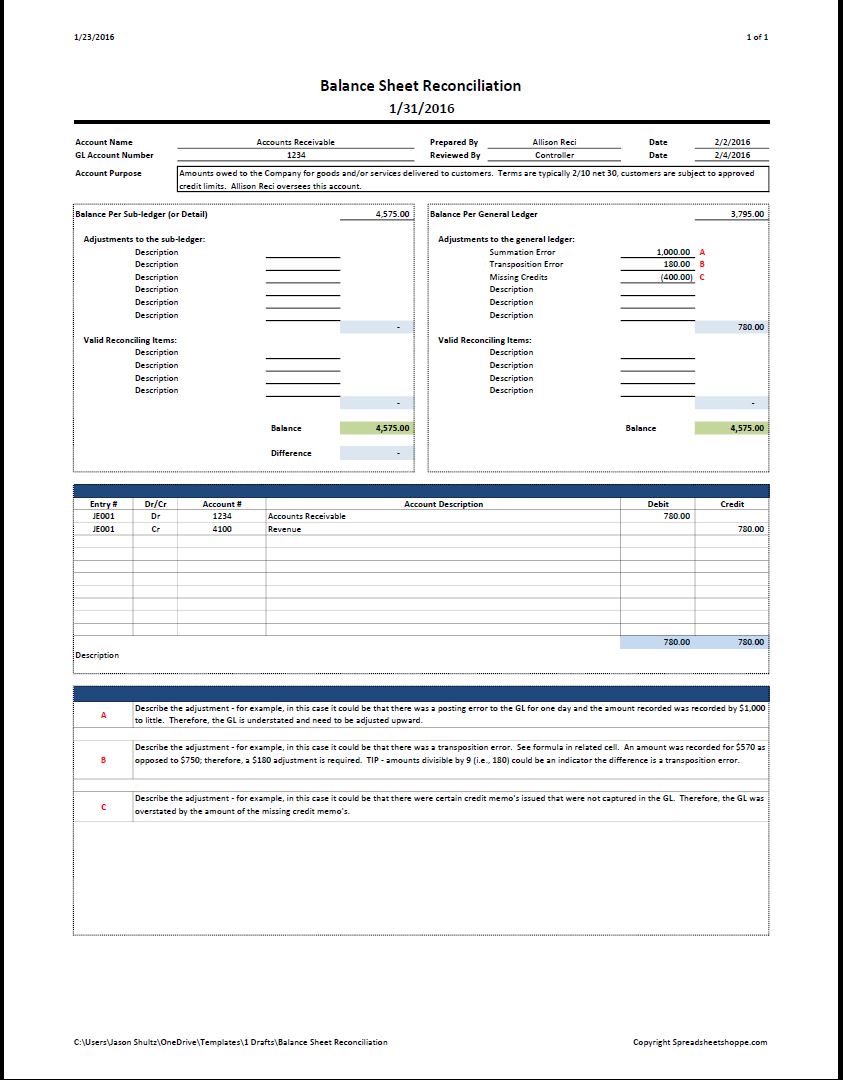

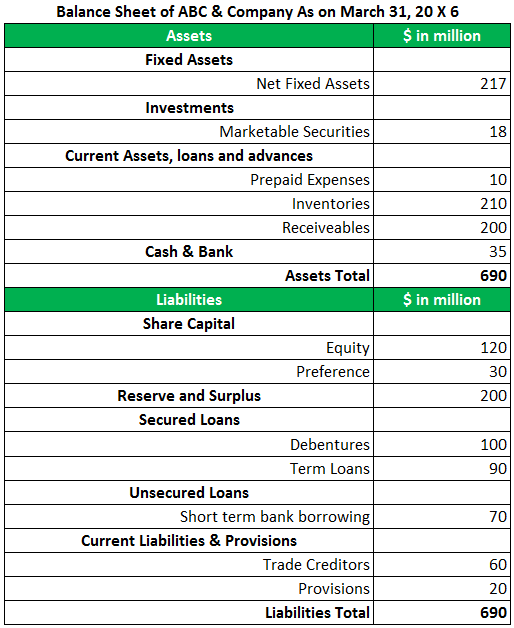

Balance sheet reconciliation policy. Account reconciliation is a critical step and key control for finance and accounting. Balance sheet reconciliations can highlight and assist with issues by: By completing reconciliations for all balance sheet accounts on a regular basis assurance is obtained that college financial information is reliable and informative.

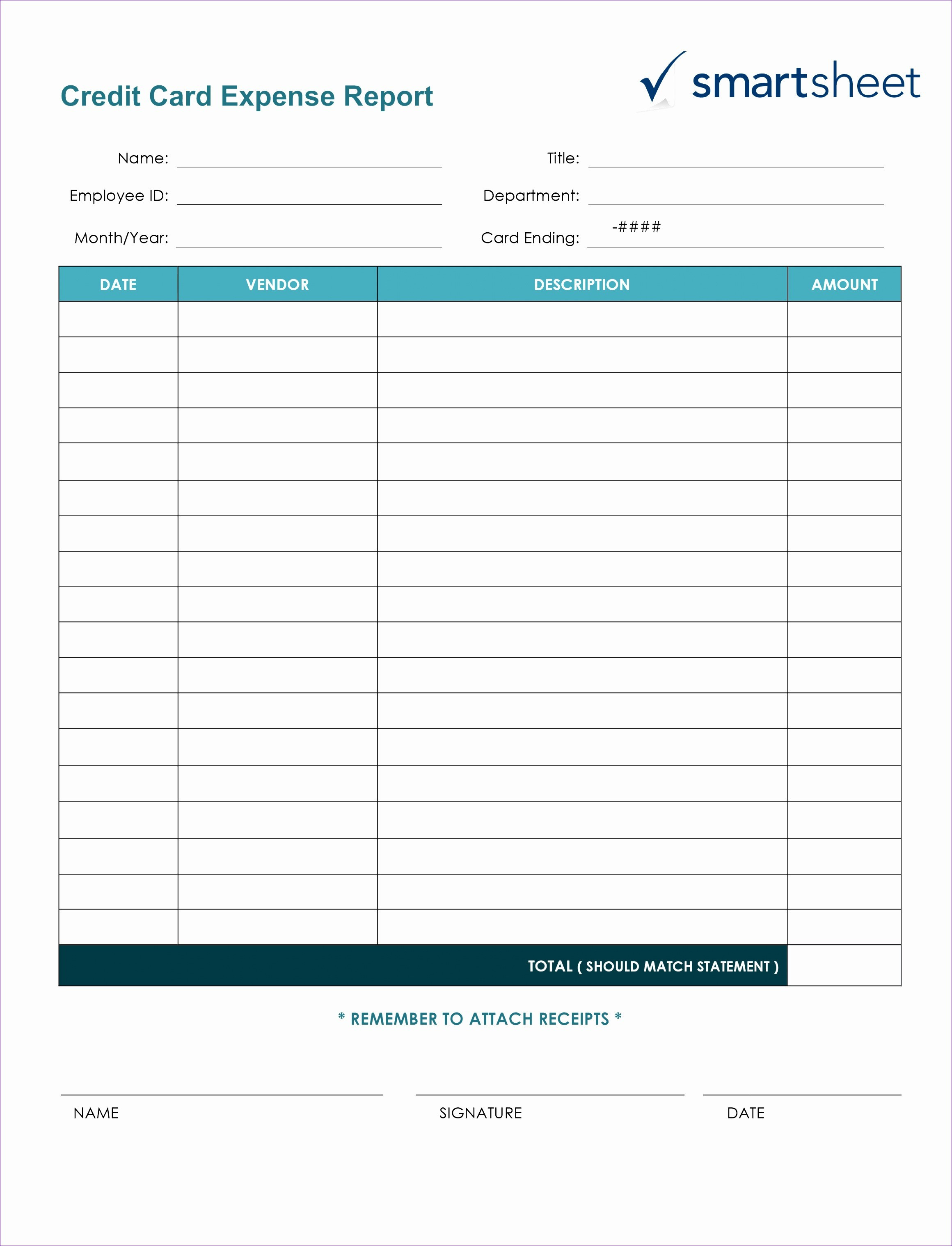

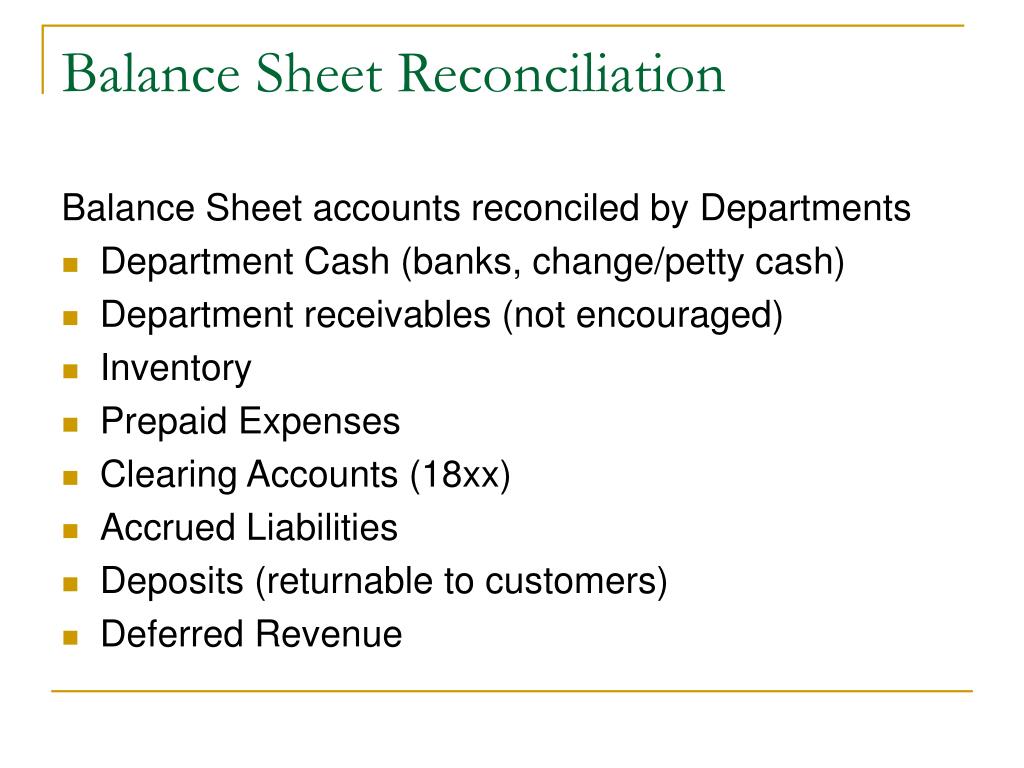

Define your reconciliations an account reconciliation policy can act as a training document for employees, in addition to clarifying requirements and procedures. Account reconciliation relies on large organisation and the upkeep of invoices, account balances, balance sheet reconciliation and more. Balance sheet reconciliations are a fundamental control point for accounting.

Balance sheet reconciliation policy is a crucial part of financial control and reporting, helping organizations maintain the integrity of their financial data. Guidelines and criteria are more likely to be adopted when individuals fully understand the importance and relevance of a process — reducing the likelihood of resistance to change. Authorized in accordance with university policies, state and federal laws and regulations, and specific sponsor or donor requirements or restrictions, and

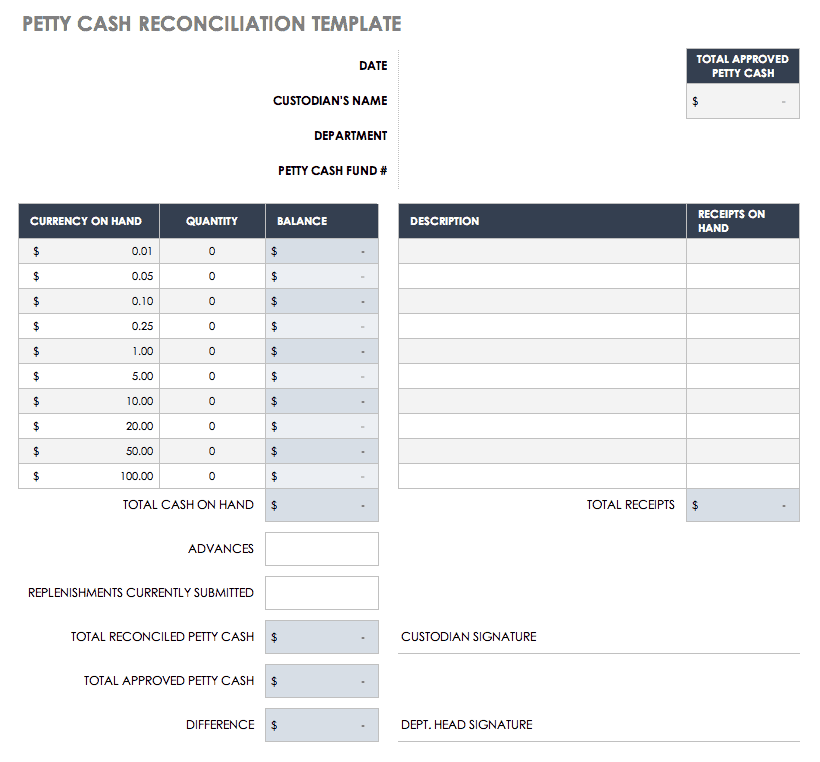

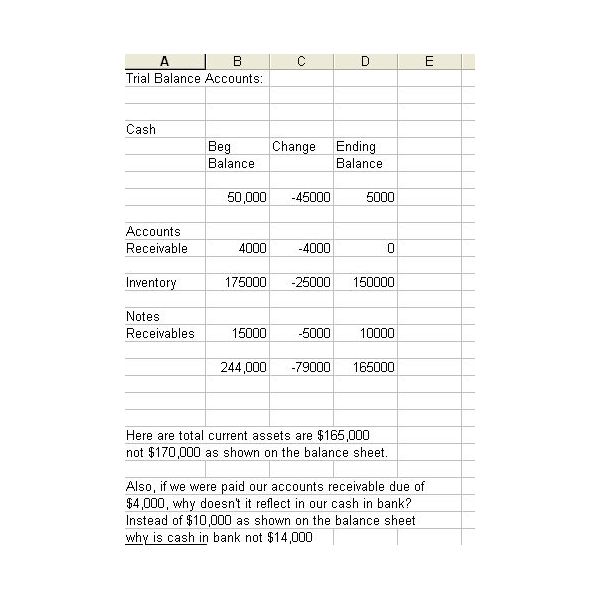

Essentially, reconciliation is done to verify that accounting for a certain period has been accurately portrayed on a company’s books. What is a balance sheet reconciliation? This secondary documentation can include anything from a bank statement to a spreadsheet and invoices.

Balance sheet reconciliations are performed monthly to ensure transactions are timely and accurately reported. Account reconciliation is the process of matching internal accounting records to ensure they line up with a company’s bank statements. The purpose of an account reconciliation reconciliation is to confirm that the account balance is accurate, valid, and complete.

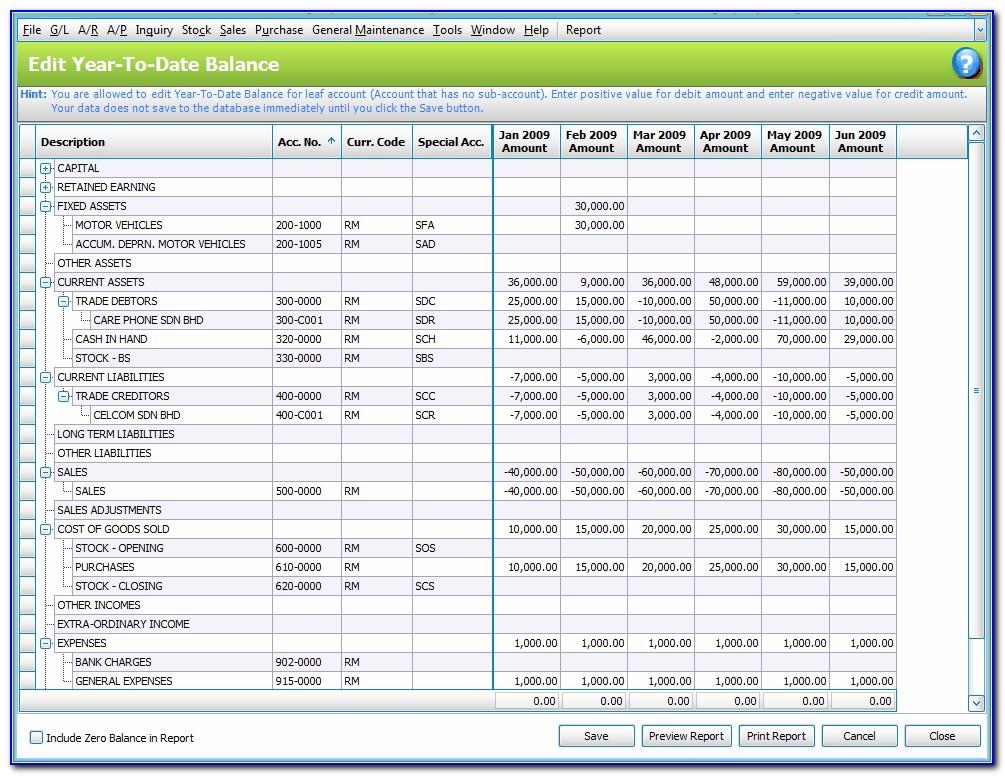

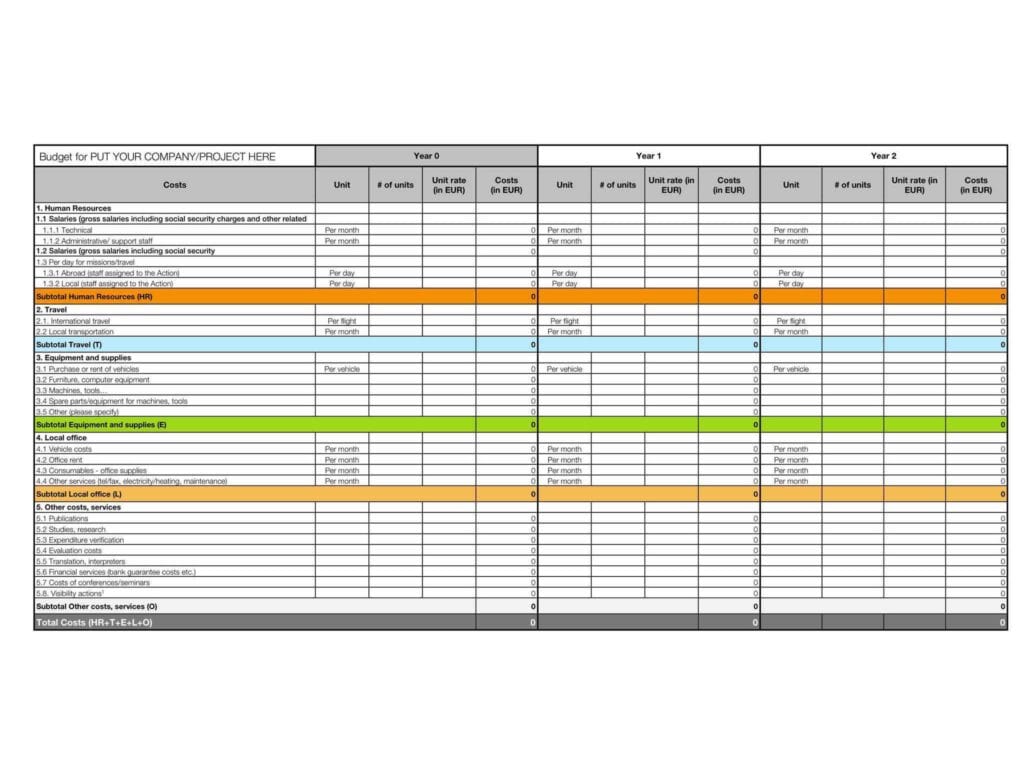

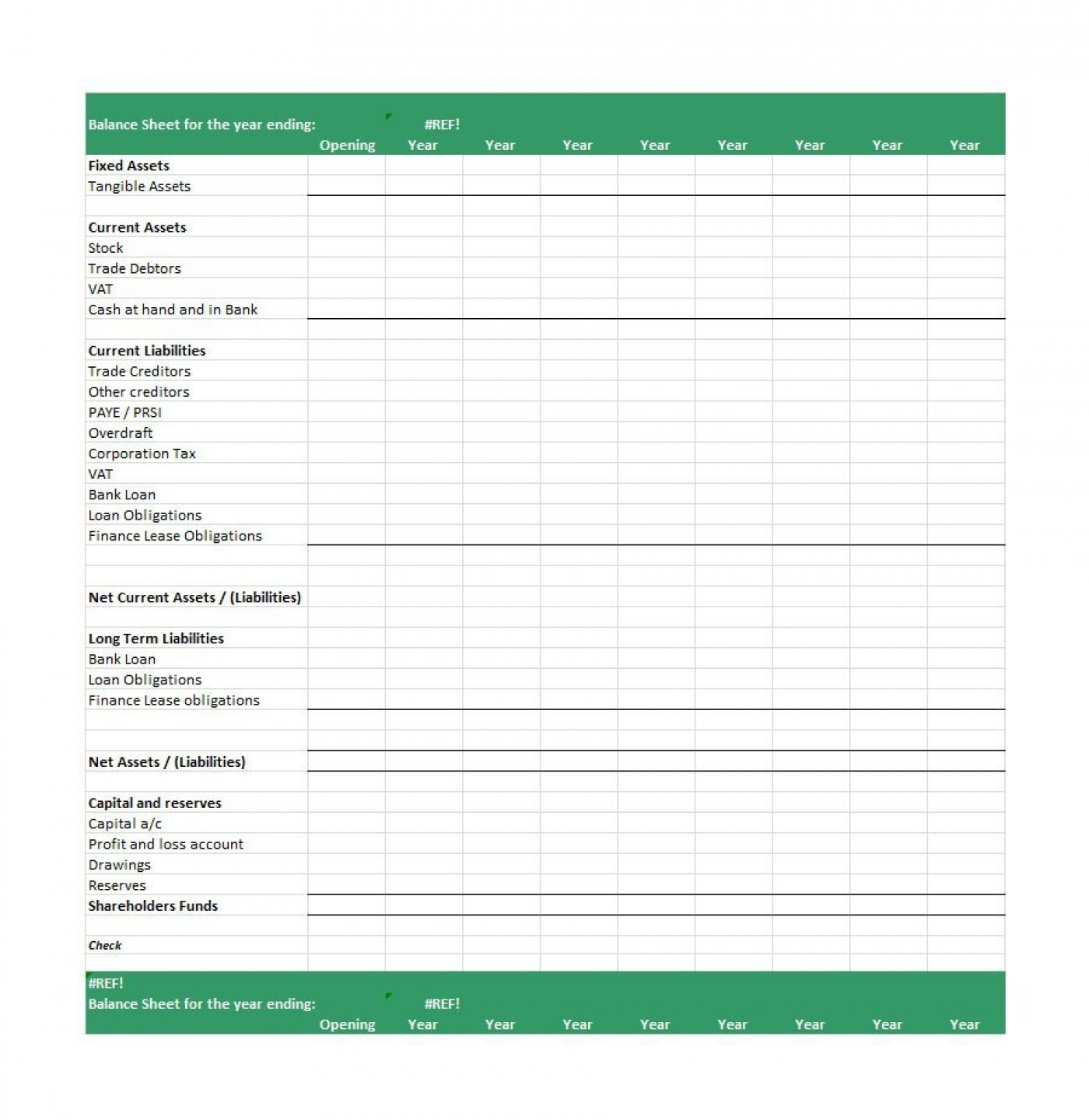

Monitoring the organization’s activities (e.g., consumption of raw materials, sales, or purchases). The first step requires the preparation of a separate work paper for each balance sheet account. Reconciliation is the process of comparing the transactions on a balance sheet to secondary documentation.

Check the different types of balance sheet reconciliation with examples 5 balance sheet reconciliation best practices to overcome challenges effectively 1. Reconciling items must not be allowed to remain in a balance sheet account indefinitely.

The substantiation of a balance sheet account at a point in time, involving providing evidence that the composition of a balance or a group of related account balances are accurate and complete, and identifying any unreconciled items that require remediation. In a qa review, a sample of reconciliations are reviewed to gauge their quality against customizable goals — for example, policy compliance, proper utilization of technology and timely certification. The purpose of a balance sheet ledger account reconciliation is to verify the accuracy, completeness, and validity of ledger.

Leverage technology to facilitate collaboration:. Balance sheet account reconciliation: Detecting missing, duplicated, or untimely transactions.

Step 1 set up the reconciliation spreadsheet step 2 gather documentation to support the balance sheet account balance step 3 reconcile supporting documentation with the balance sheet account balance step 4 resolve current and prior period reconciling items step 5 resolve current and prior period reconciling items. The person who is responsible for preparing the balance sheet account reconciliation. Balance sheet reconciliation is a process of verifying the accuracy of information presented in the balance sheet.