Inspirating Info About Loss In Balance Sheet Bjs Financial Statements

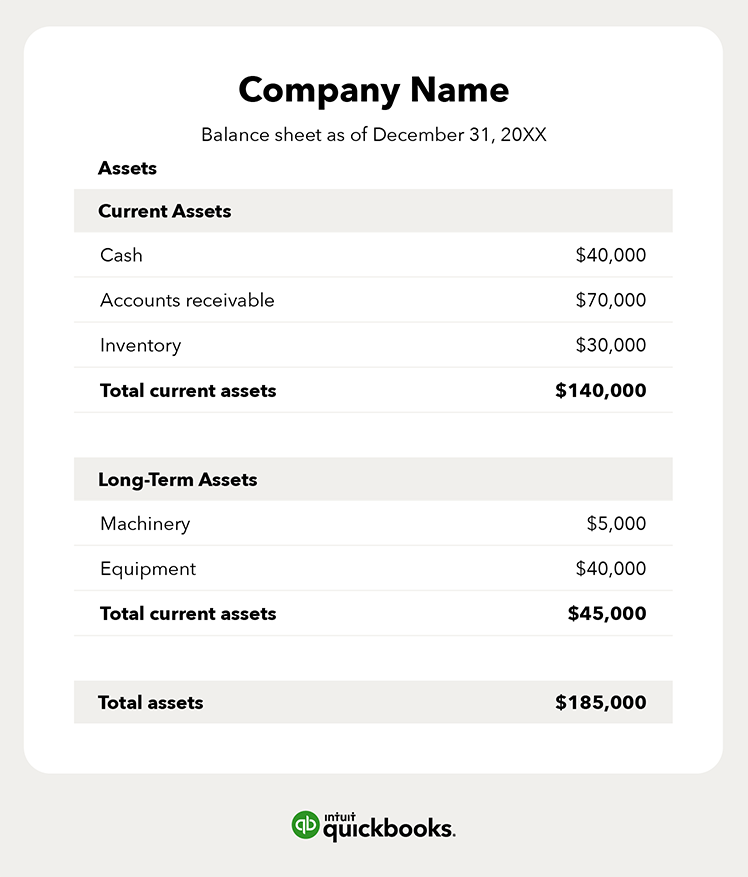

In any typical balance sheet, the company’s total assets should be equal to the company’s total liabilities.

Loss in balance sheet. A balance sheet should always balance. June 11, 2021 you may have heard your accountant or bank manager talk about your “balance sheet” and “profit and loss account”. A balance sheet is prepared on the last day of a financial year while the profit and loss account is maintained for the whole accounting period.

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. A judge has ordered former president donald trump and his companies to pay nearly $355 million in a ruling in the new york civil fraud case. Balance sheets provide the basis for.

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Liabilities are amounts of money that a company owes to others. · have debt no more than 10% of the company’s net worth.

It lists all the ownership, i.e. What do these terms mean, and what information can these documents provide you about your company? The iiss will publish its assessment of russian equipment losses on 13 february with the release of the military balance 2024.

What is the balance sheet? The equation above is called the balance sheet equation or the accounting equation. A balance sheet provides a snapshot of a company’s financial performance at a given point in time.

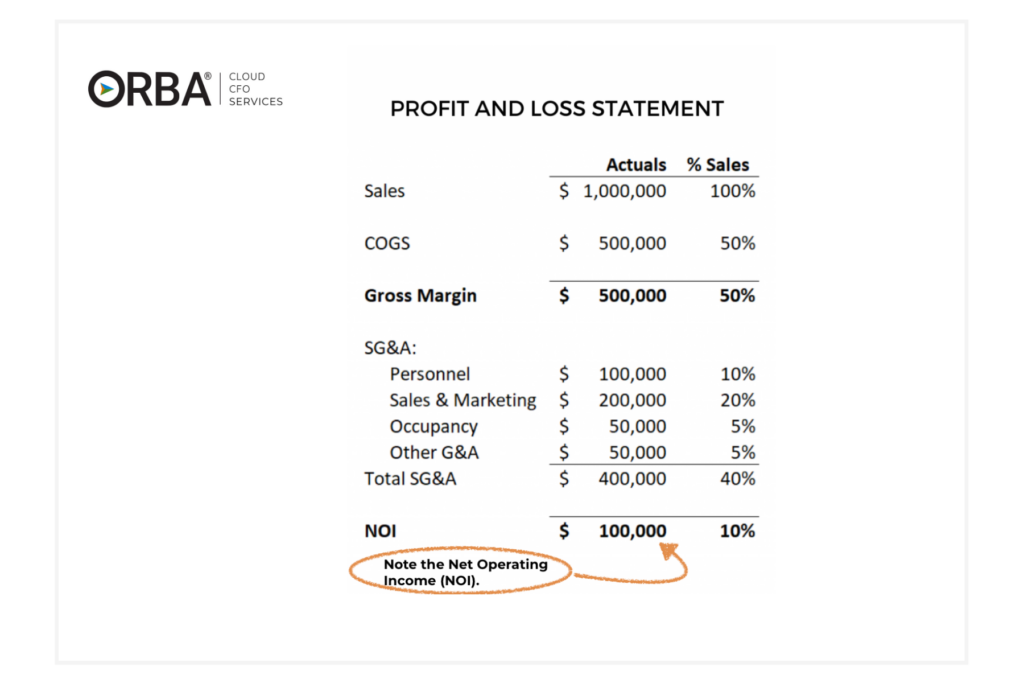

The principle for which expenses and revenues must be recorded in the same period is called the matching principle. Your balance sheet and profit and loss account explained by: Here are other equations you may encounter:

Balance sheets are typically prepared and distributed monthly or quarterly depending on the. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it at $8,000 per year. In other words, a company incurs a net loss when the expenses for a specific period are higher than the revenues for the same period.

Small business owners have two reporting options when preparing an income statement: To make my balance sheet powerhouses list, a company must: The losses are estimated to include more than 3,000 armoured fighting vehicles in the past year alone and close to 8,800 since february 2022.

Such statements provide an ongoing record of a company's. The balance sheet is one of the three financial statements businesses use to measure their financial performance. Assets must always equal liabilities plus owners’ equity.

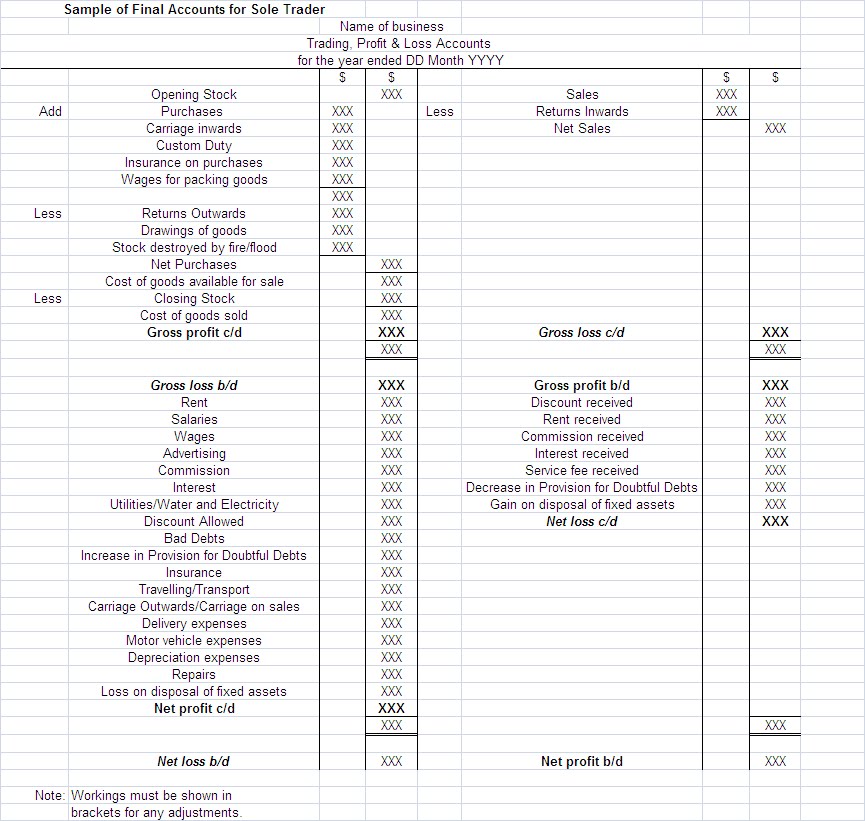

The p&l statement is one of the three most important financial statements for business owners, along with the balance sheet and the cash flow statement (or statement of cash flows). The other two are the profit and loss statement and cash flow statement. Key difference between a balance sheet and a profit and loss account (p&l) provides a snapshot of the company's financial position at a specific point in time.