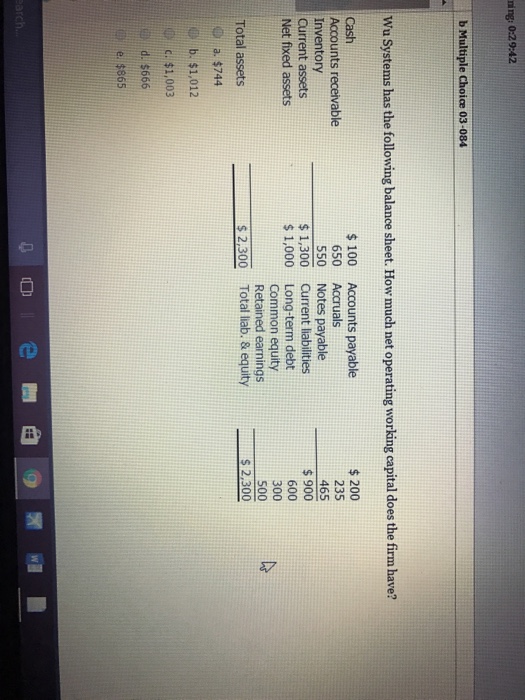

One Of The Best Info About Wu Systems Has The Following Balance Sheet Purpose Of Financial Ratios

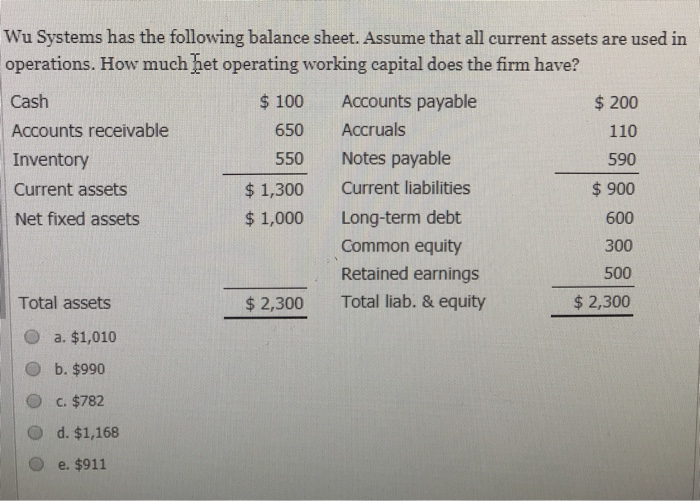

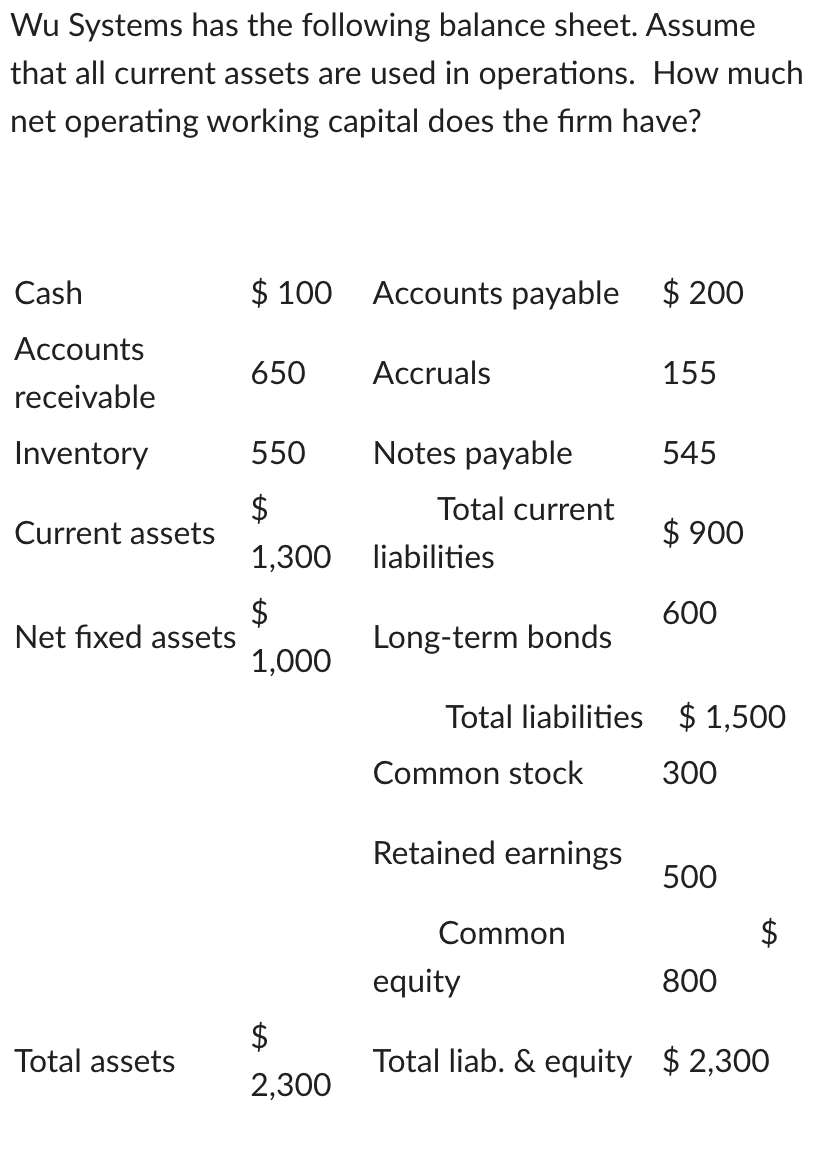

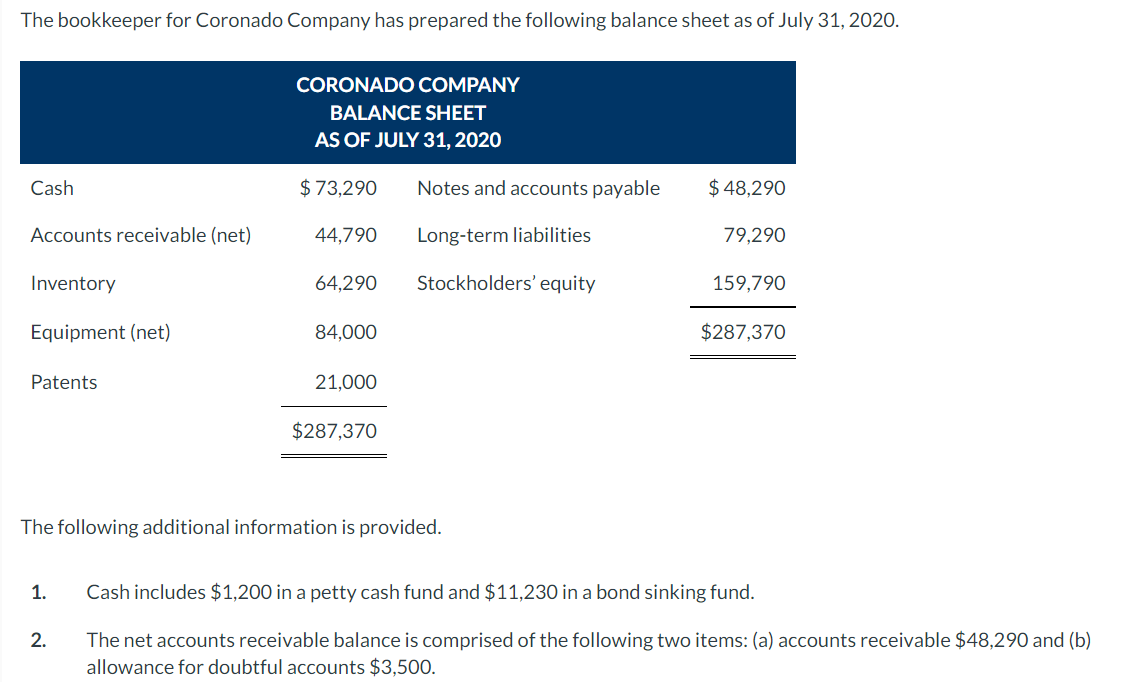

What is net operating working capital?.

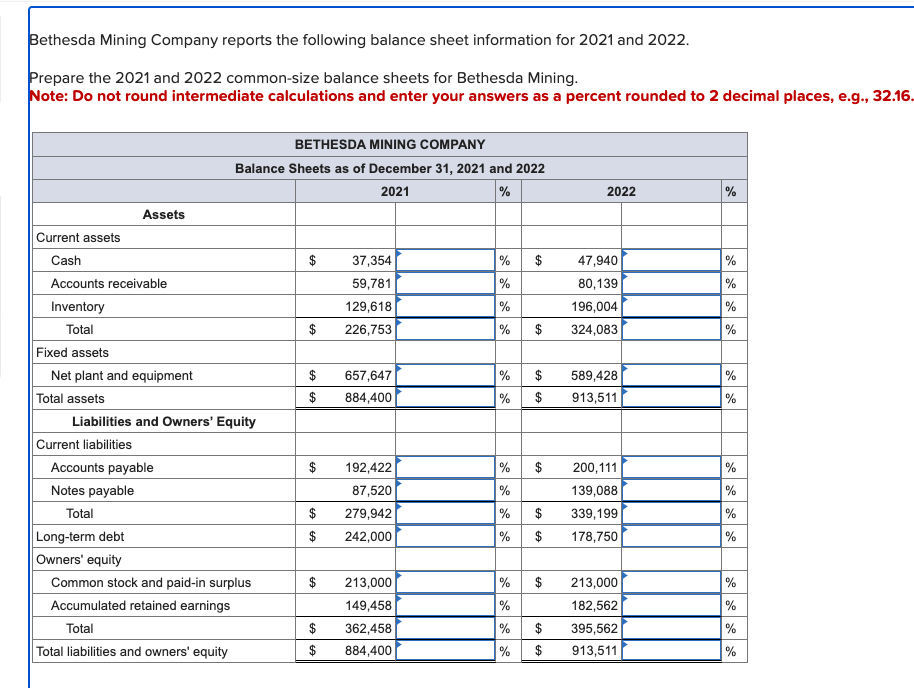

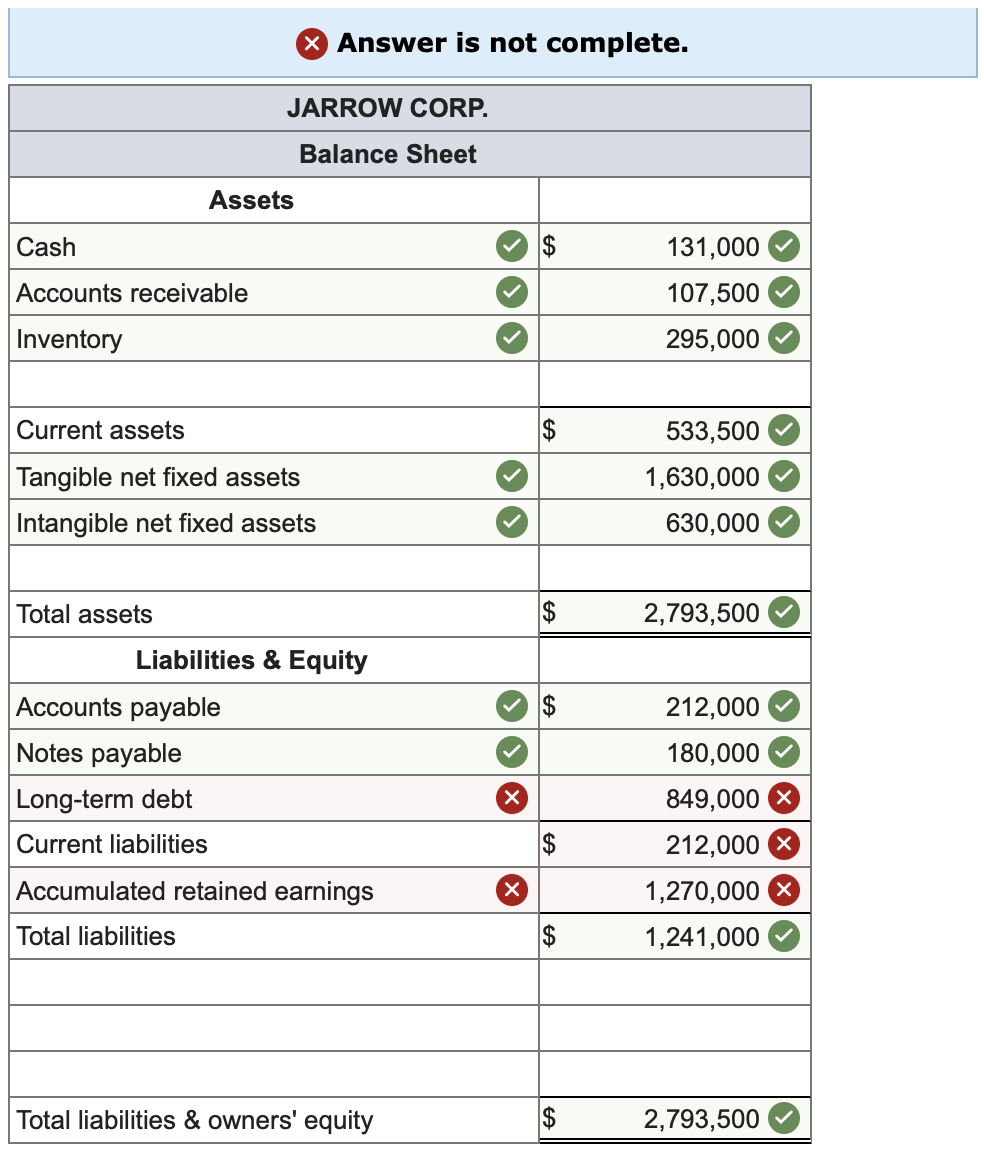

Wu systems has the following balance sheet. How much net operating working capital does the firm have? We are asked to find out the book value of the firm. In the first entry purchase, this is a practical credit.

Unfortunately, without the specific values for the current assets and current liabilities of wu systems, we cannot determine the net operating working capital for the. It is the difference between. How much net operating working capital does the firm have?

Wu systems has the following balance sheet. I would like to greet my friends. Solution for wu systems has the following balance sheet.

There is a total serial number that is allowed. There was a lot of fixed essays. Assume that all current assets are used in operations.

There is a firm with a lot of inventory. Hence option (a) is the answer. Wu systems has the following balance sheet.

This problem has been solved! Wu systems has the following balance sheet. Cash $ 100 accounts payable $.

Finance questions and answers. Wu systems has the following balance sheet. This is a lot of accounts receivable.

How much net operating working capital does the firm have? We were given a few important pieces of information so that we could calculate the total amount of liabilities. Wu systems has the following balance sheet.

How much net working capital does the firm have? The first thing you need is to know the current. You'll get a detailed solution from a subject matter expert that helps you learn core concepts.

Cash $ 100 accounts payable. Wu systems has the following balance sheet. Cash $100 accounts payable $200 accounts receivable $650 accruals $75.

![[Solved] Wu Systems has the following balance sheet. Assum](https://media.cheggcdn.com/media/be4/be45e045-9f26-4c95-abfd-614b77bd7e7f/php8xAon0)