Nice Tips About Nature Of Expense Method Ifrs Skyworks Solutions Balance Sheet

Reporting expenses by their nature.

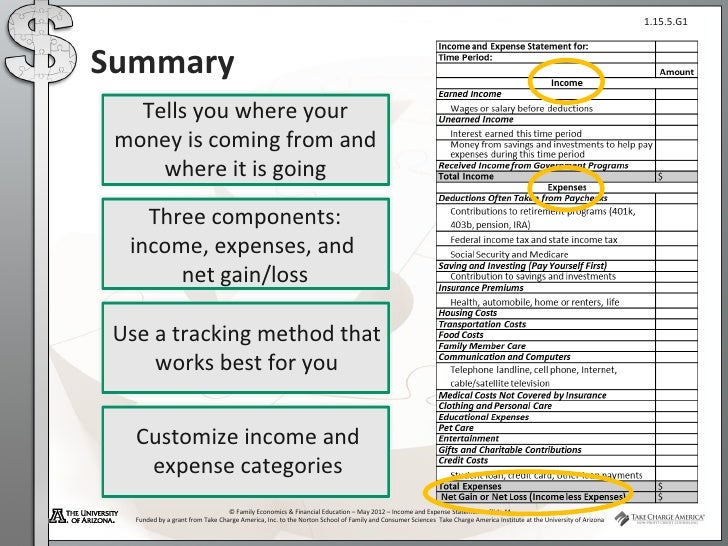

Nature of expense method ifrs. An entity that presents an analysis of operating expenses using the function of expense method in the statement of profit or loss would also be required to disclose in a single. Any income statement by nature is the one. Income statement by nature of expense.

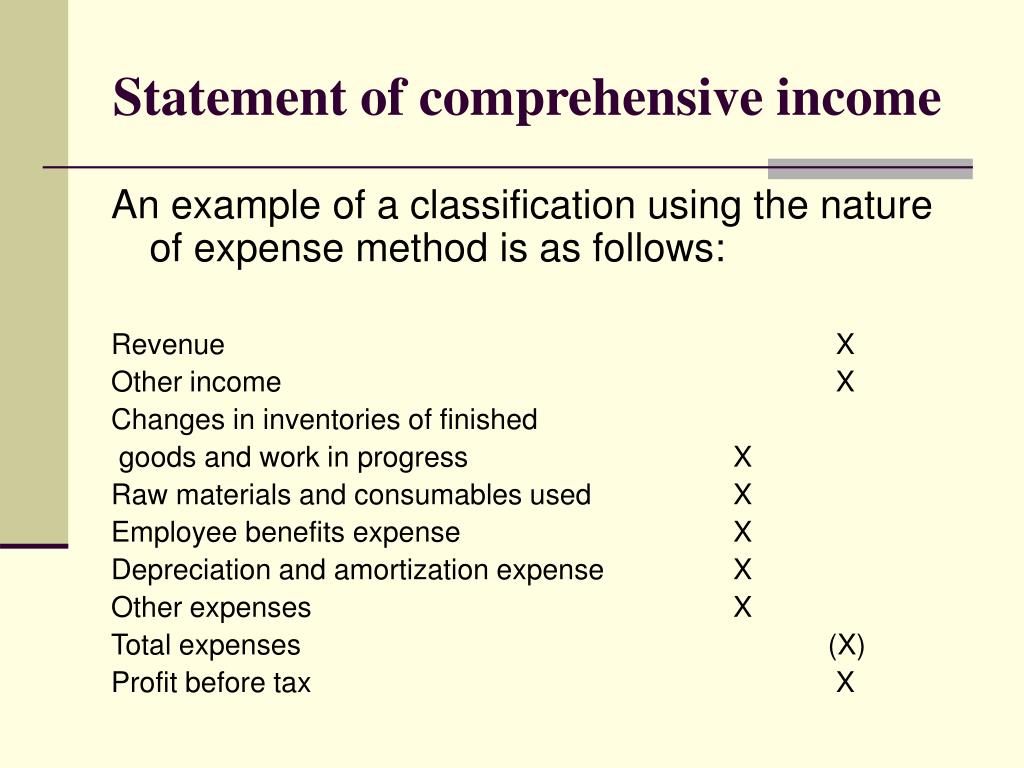

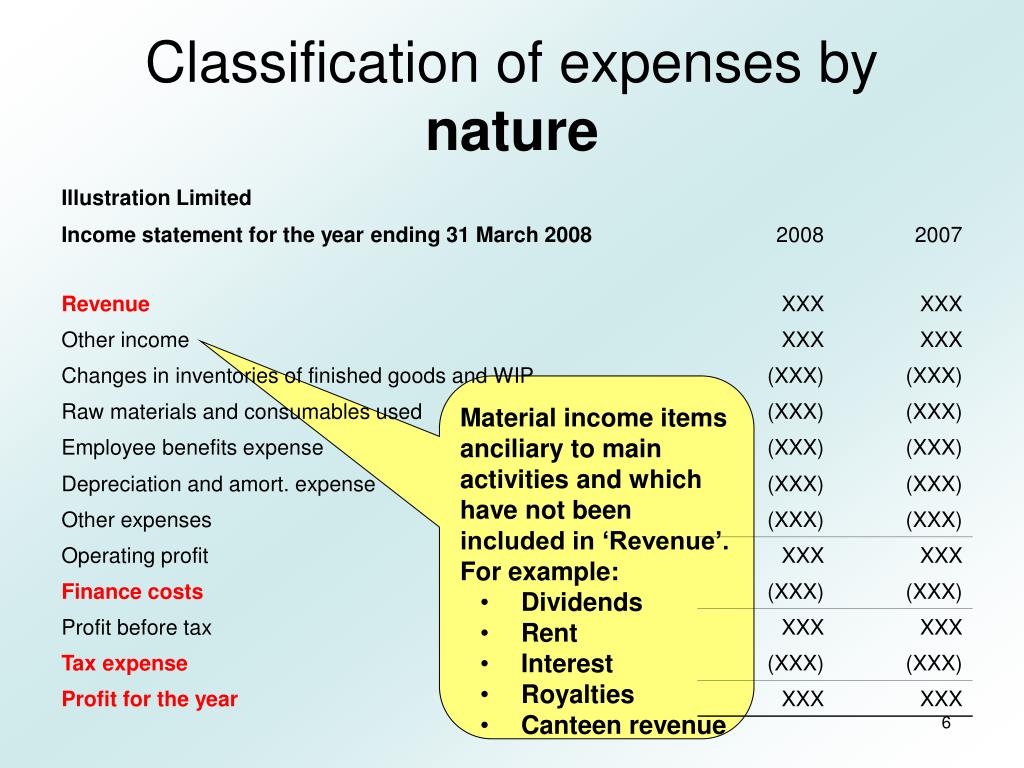

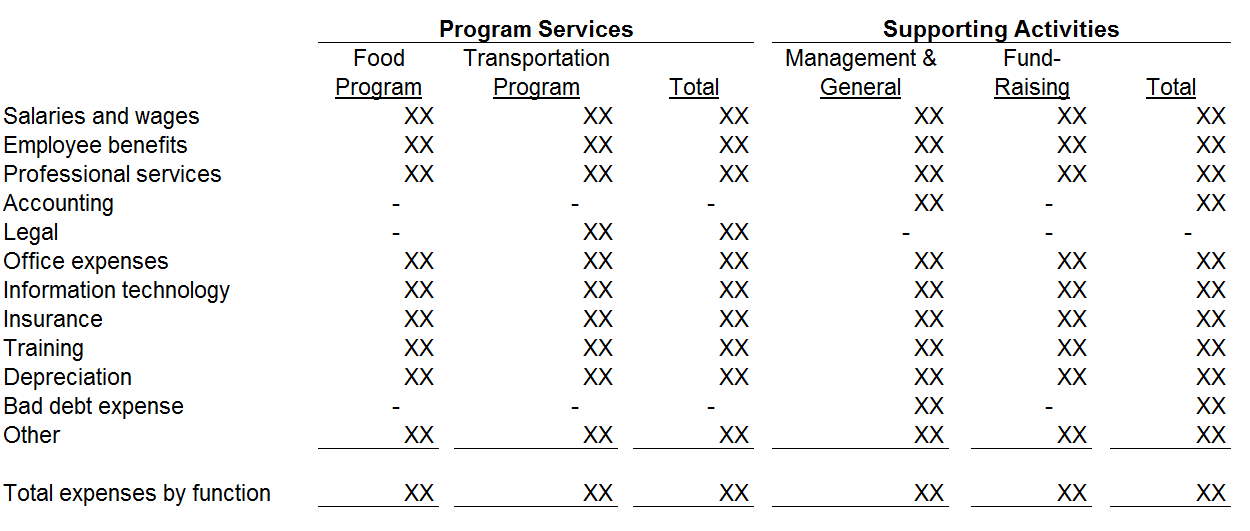

Typically, the function of expense method involves allocating operating expenses of the same nature between different types of activities of the entity. For example, expenses may be disaggregated as purchases of materials, transport costs,. Would exempt entities from disclosing information about operating.

Helps entities to assess whether similar income or expenses will arise in the future, to be developed based on guidance on the assessment of future transactions and other events. More specifically, the staff recommends exploring a partial cost relief that: Help forecast future operating expenses and cash flows (amounts reported by functions can make it difficult for users to forecast future operating expenses because functions.

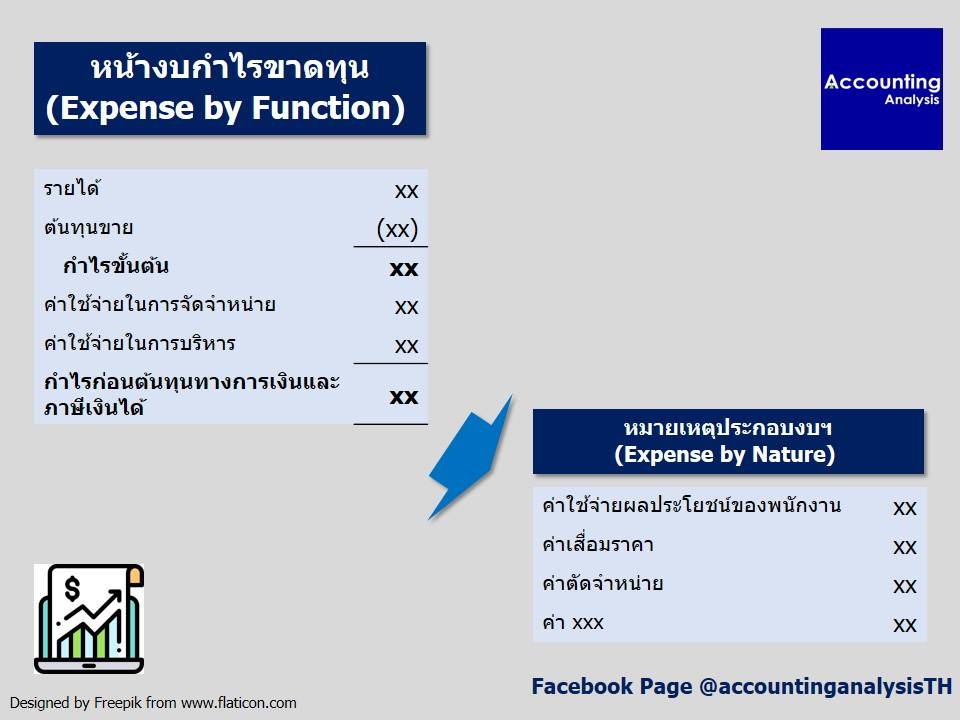

Historically, negative interest rates have been a rare phenomenon. Income statement via nature of expense. The use of function method to disclose expenses still requires us to disclose the individual expenses by nature method under each function either on the face of the.

An income statement by nature method is the one in which expenses are disclosed according to their nature such as depreciation, transports costs, rent expense,. Expenses in an income statement are either classified by their nature or by their function. Others believe that the responsibility to generate profits must be balanced against other competing objectives, such as environmental and social concerns.

The iasb proposed to require an entity that presents an analysis of operating expenses by function in the statement of profit or loss to also disclose, in a single note, an analysis of. Ifrs permit firms to classify expenses on the profit and loss statement according to either their nature or function, depending on which is more useful to the users of that financial. Ifrs 15 revenue from contracts with customers issued.

The presentation of expenses by nature is less complex. The irfs income statement coming certain formatting requirements and options different off states gaap. That information, along with other.

Expenses in an income statement are either classified by their nature or by their function. An income statement by nature is the one.

An alternative format is to report expenses by their nature. Effective for an entity's first annual ifrs financial statements for periods beginning on or. 1 nature of operations 13 2 general information, statement of compliance 13 with ifrs and going concern assumption 3 new or revised standards or interpretations 14 4 significant.