Can’t-Miss Takeaways Of Info About Balance Sheet Accounts Are Not Affected By Adjustments Bad Debts In Cash Flow

Are not affected by adjustments.b.

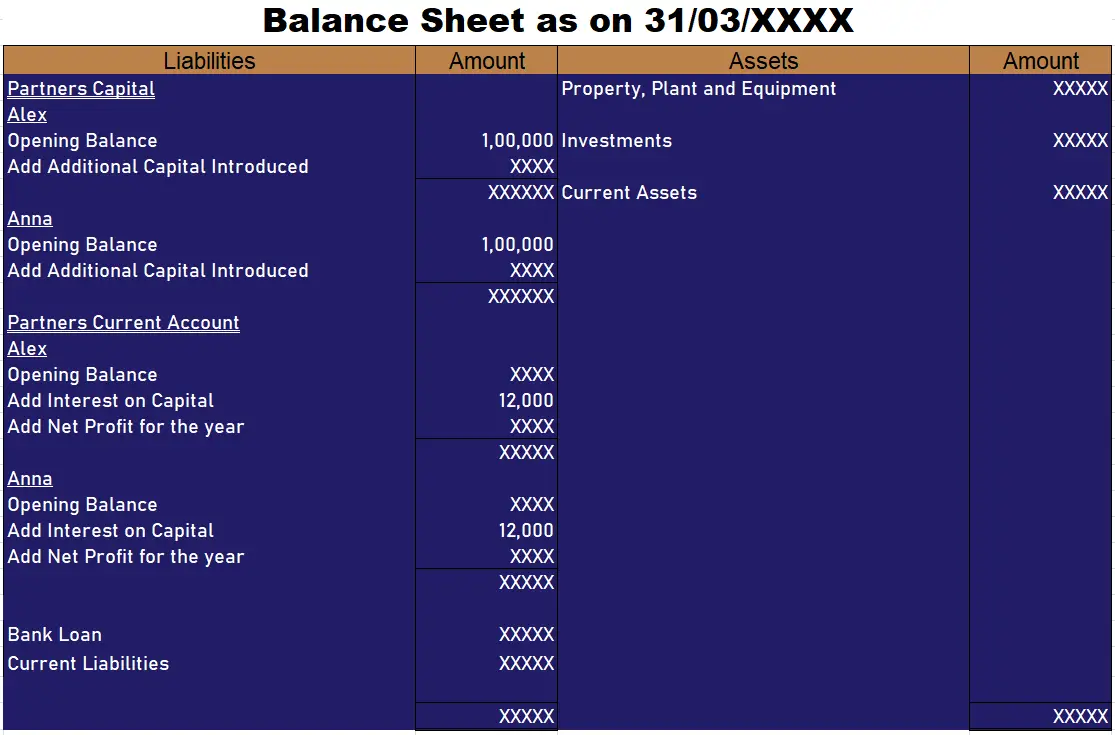

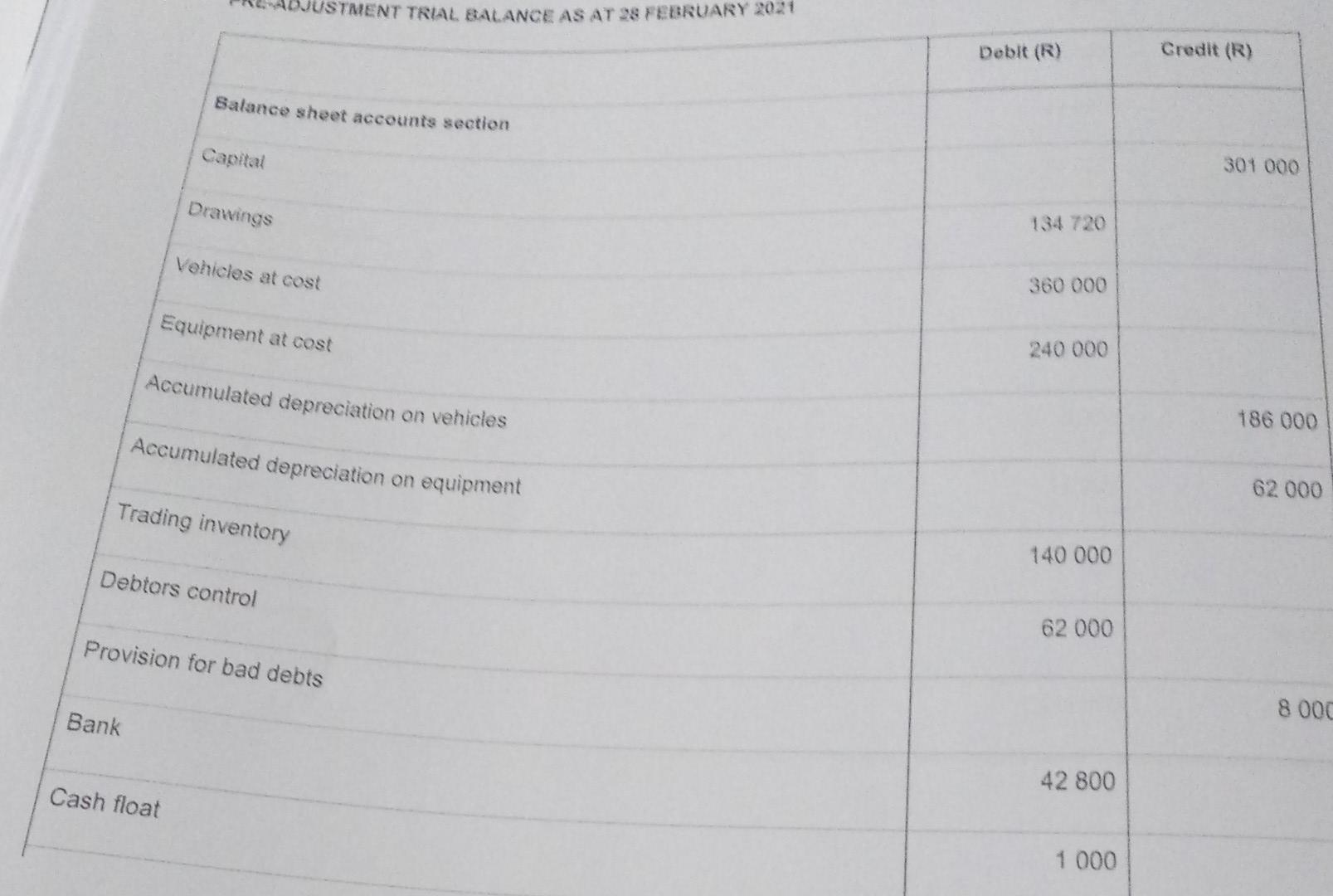

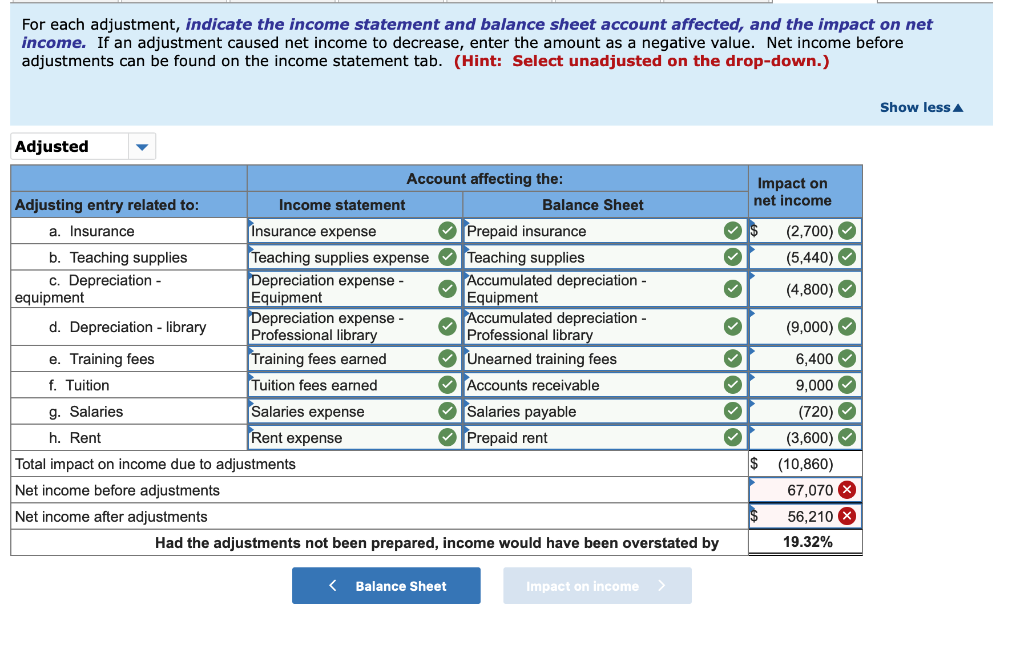

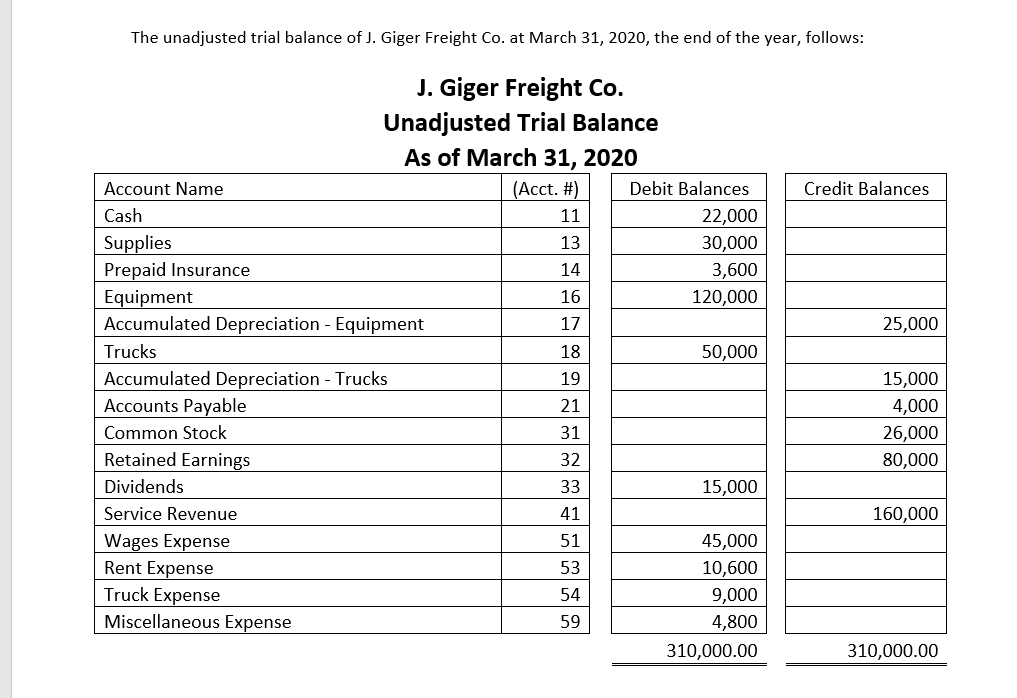

Balance sheet accounts are not affected by adjustments. Lo 4.4 prepare an adjusted trial balance from the following account information, and also considering the adjustment data provided (assume accounts have normal balances). Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable,. Each adjusting entry usually affects one income statement account (a revenue or expense account) and one balance sheet account (an asset or liability account).

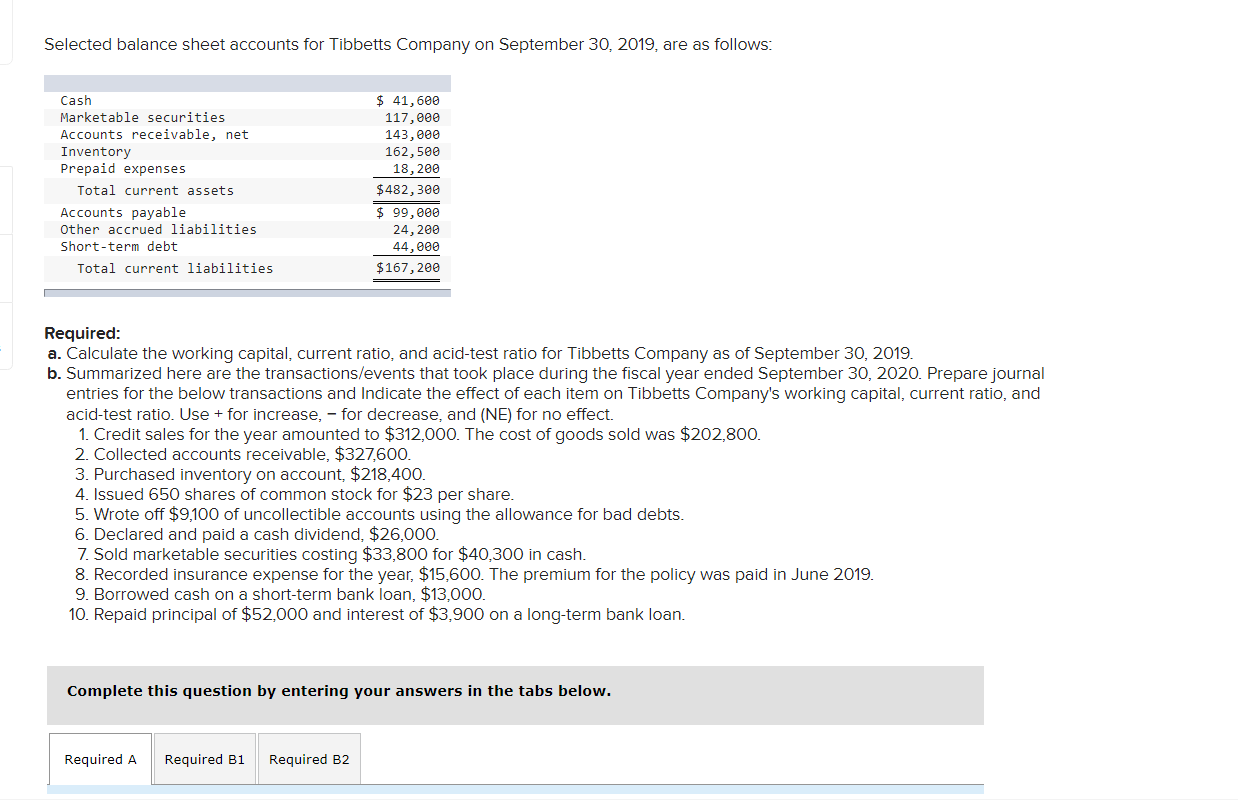

The balance in repairs & maintenance expense at the end of the accounting year will be closed and the next accounting year will begin with $0. Adjusting entries usually involve one or more balance sheet accounts and one or more accounts from your profit and loss statement. Determine the effects on the income statement and balance sheet by identifying whether assets, liabilities, equity, revenue,.

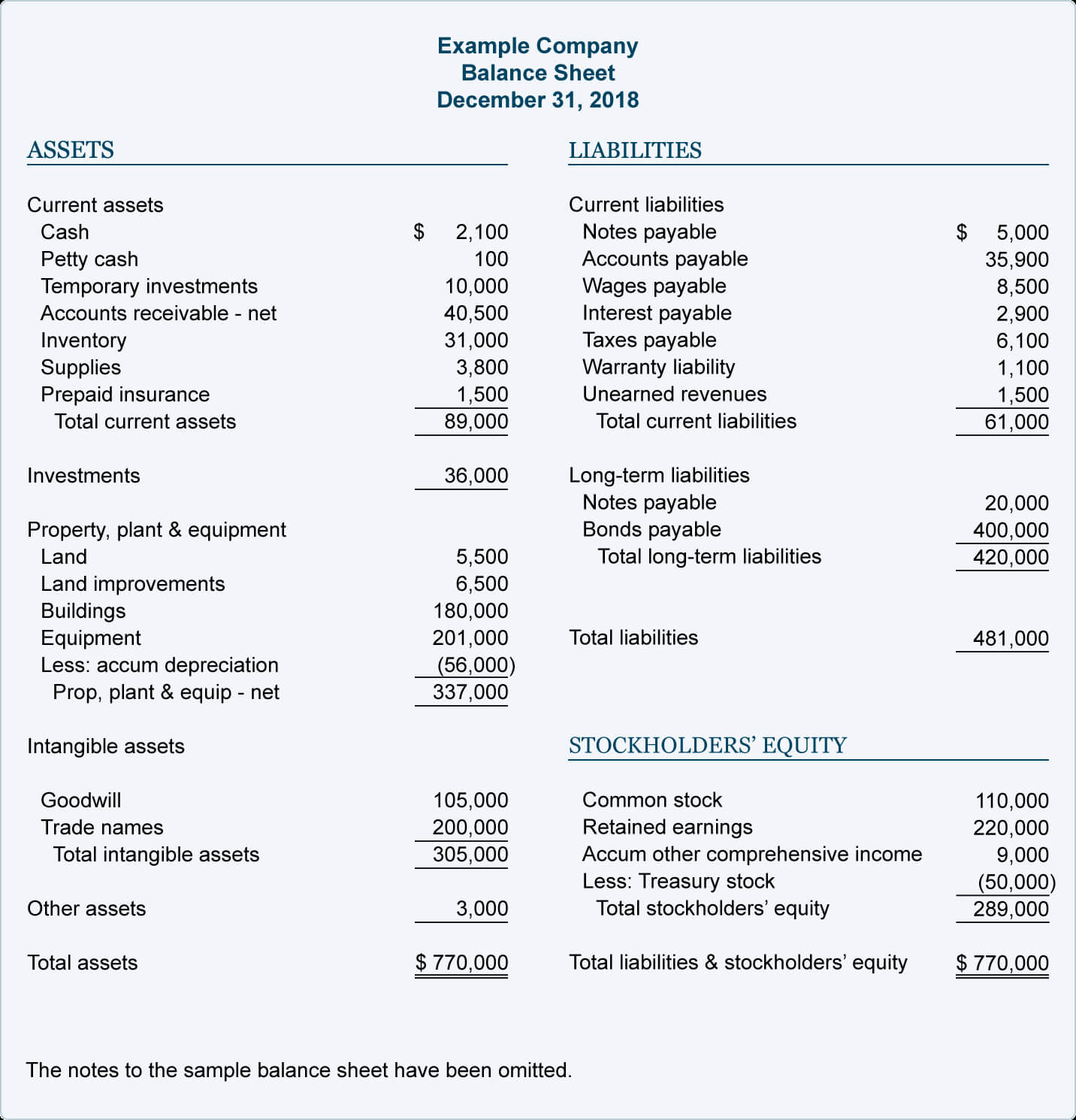

The second rule tells us that cash can never be in an. An adjusting journal entry is typically made. The balance sheet is a snapshot of a company’s financial position at a particular point.

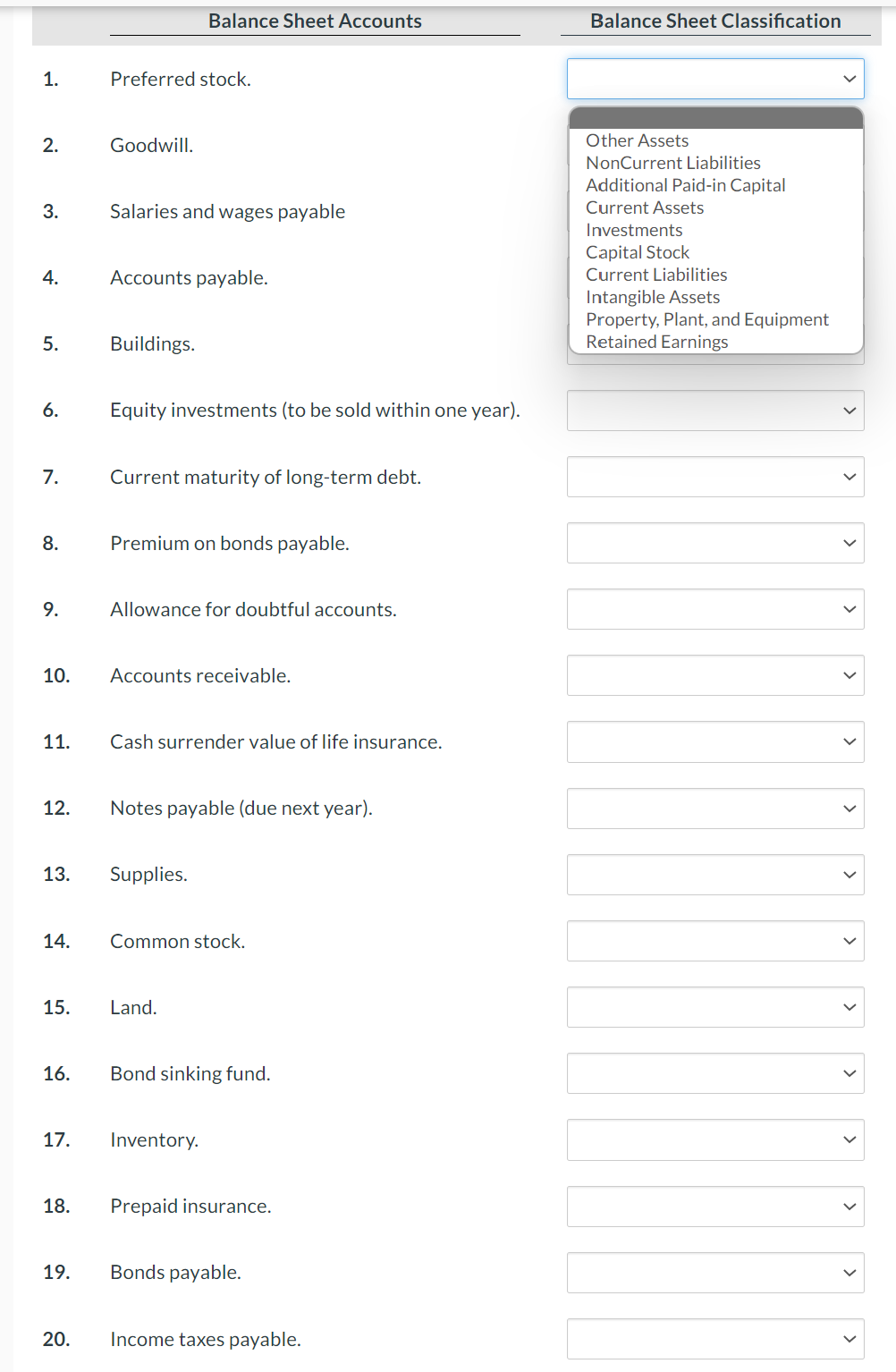

What two accounts are affected by. The following report shows an adjusted trial balance, where the initial, unadjusted balance for all accounts is located in the second column from the left,. Balance sheet accounts are assets, liabilities, and stockholders’ equity accounts, since they appear on a balance sheet.

Adjusting entries are accounting journal entries that convert a company's accounting records to the accrual basis of accounting. These two accounts have been adjusted so that they reflect expenses incurred during july (which will be depicted in the income statement) and unexpired assets on 31 july (which. Each entry has one income statement account and one balance sheet account, and cash does not appear in either of the adjusting entries.

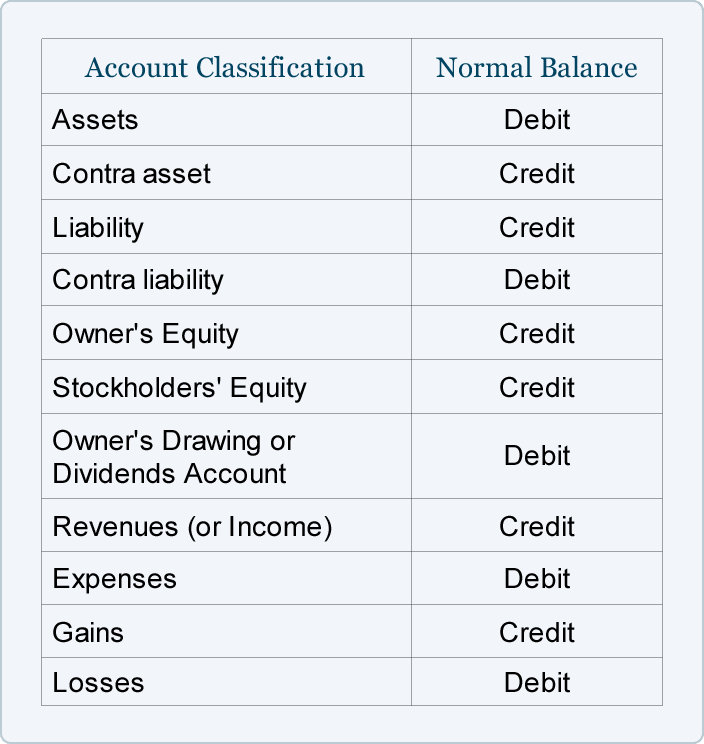

Matching principle as accounting coach explains, the matching principle dictates accrued revenue should be entered when it is earned and expenses should be entered when they are incurred. 4 pts question 6 balance sheet accounts represent amounts accumulated during a specific period of time are called real accounts have zero balances after the. Balance sheet accounts a.are called real accounts b.have zero balances after the closing entries have been posted c.represent amounts accumulated during a specific period of.

The balance is left in the individual customer’s account so that collection procedures continue, but the receivables in the statement of financial position are valued as if the. Correcting timing differences on the income statement will also correct.

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://i.pinimg.com/originals/f7/0d/ec/f70dec3a63cbcc1511efabd76241ea3c.jpg)