Who Else Wants Tips About The Basics Of Understanding Financial Statements Operating Activities Meaning

Let us dig into the basics of financial statements:

The basics of understanding financial statements. Financial statement = scorecard there are millions of individual investors worldwide, and while a large percentage of these investors have chosen mutual funds as the vehicle of choice for. Learn how to read financial statements by understanding the balance sheet, the income statement, and the cash flow statement mariusz skonieczny 4.24 148 ratings12 reviews the purpose of this book is to help readers understand the basics of understanding financial statements. Learn how to read these documents, and you will gain insight into your own finances and those of any company you may invest in.

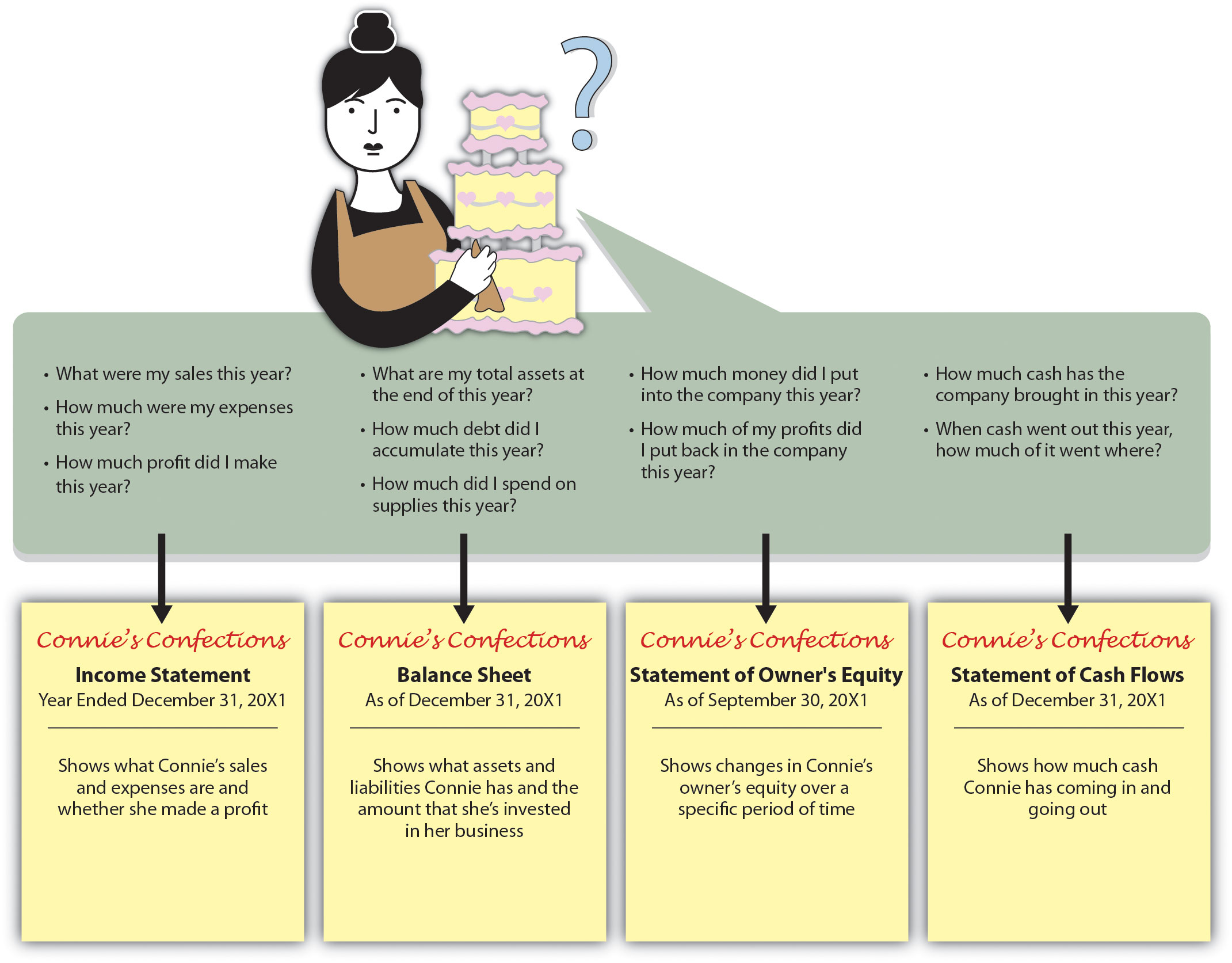

Financial statements are written records that convey the financial activities of a company. Investors do not need to become professional accountants in order to have the skills ne… Understanding financial statements now that you know about the three main types of financial statements, let’s dive a little deeper into understanding them.

Learn how to read financial statements by understanding the balance sheet, the income statement, and the cash flow statement 1 by skonieczny, mariusz (isbn: The basics aren’t difficult and they aren’t rocket science. Understanding financial statements improves the student's ability to translate a financial statement into a meaningful map for business decisions.

The purpose of this book is to help readers understand the basics of understanding financial statements. Free download, borrow, and streaming : Financial statements play an important role in helping you to understand the financial position of your business.

How to read an income statement an income statement, also known as a profit and loss (p&l) statement, summarizes the. The purpose of this book is to help readers understand the basics of understanding financial statements. The basics of understanding financial statements:

Financial statements will tell you how much money the firm has and how much debt it owes. Sometimes, we look at the revenues of a company and conclude the business model is viable. But really, what we should be looking at is the profits trajectory of the company.

It also covers information about how these three statements are. Balance sheet (statement of financial position) profit and loss account (income statement) cash flow statement The balance sheet provides a clear overview of the company and can be divided into three components namely, assets, liabilities, and.

It allows you to see what. The material covered in each chapter helps students approach financial statements with enhanced confidence and understanding of a firm's historical, current, and prospective financial condition and. Financial statements are often audited by government agencies and accountants to ensure.

Simply look at the income statement of a company and you will know if the economics of a business is worth it or not. They provide information on a company's assets, liabilities, revenue, expenses, and cash flow. Learn how into get financial statements by understanding the balance sheet, the income statement, and which cash flow statement operating activities.

However, to understand accounting driven financial statements, it is important to recognize that accounting is less about counting and more about measuring. How to read a cash flow. Learn how to read financial statements by understanding the balance sheet, the income statement, and the cash flow statement :