Outstanding Tips About Cash Flow Budget Example Google Sheet Balance

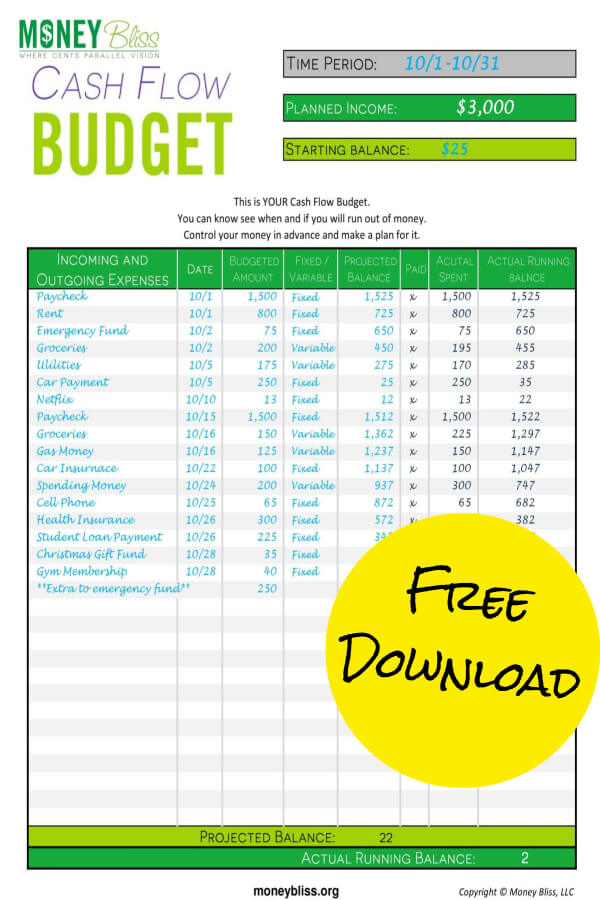

Cash flow budget examples & templates 1.

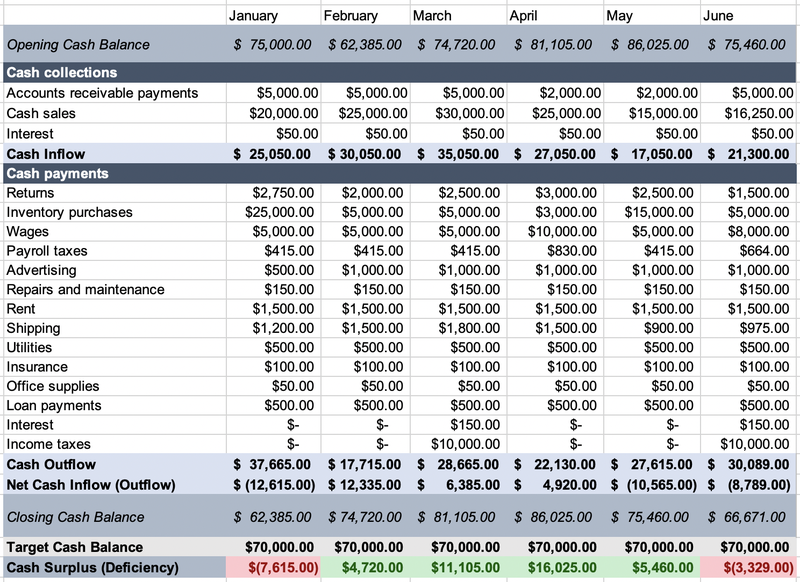

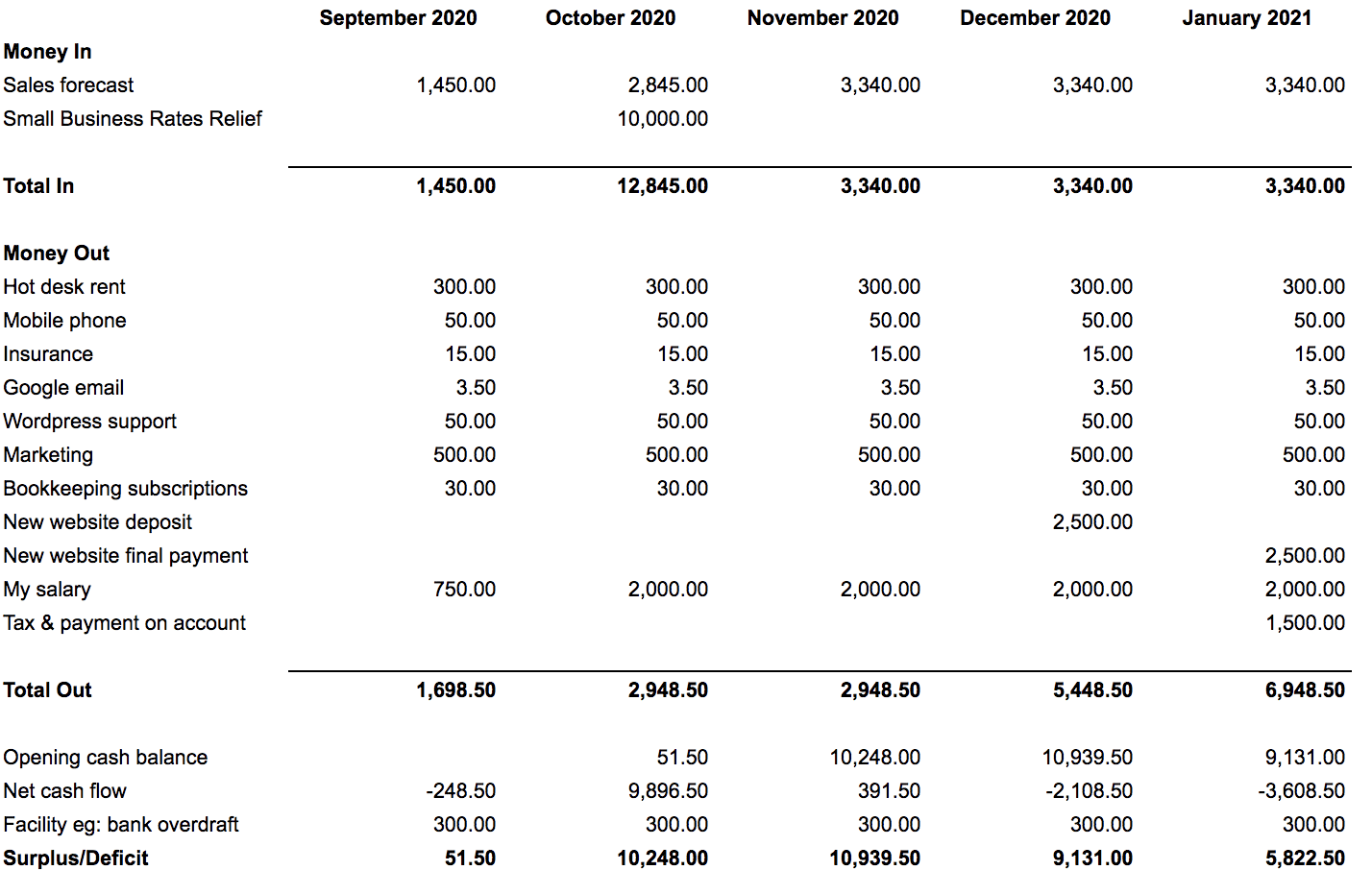

Cash flow budget example. It describes the levied taxes, loan interest, and other expenses clearly. How a cash flow budget can work. Black dollar amounts increase cash.

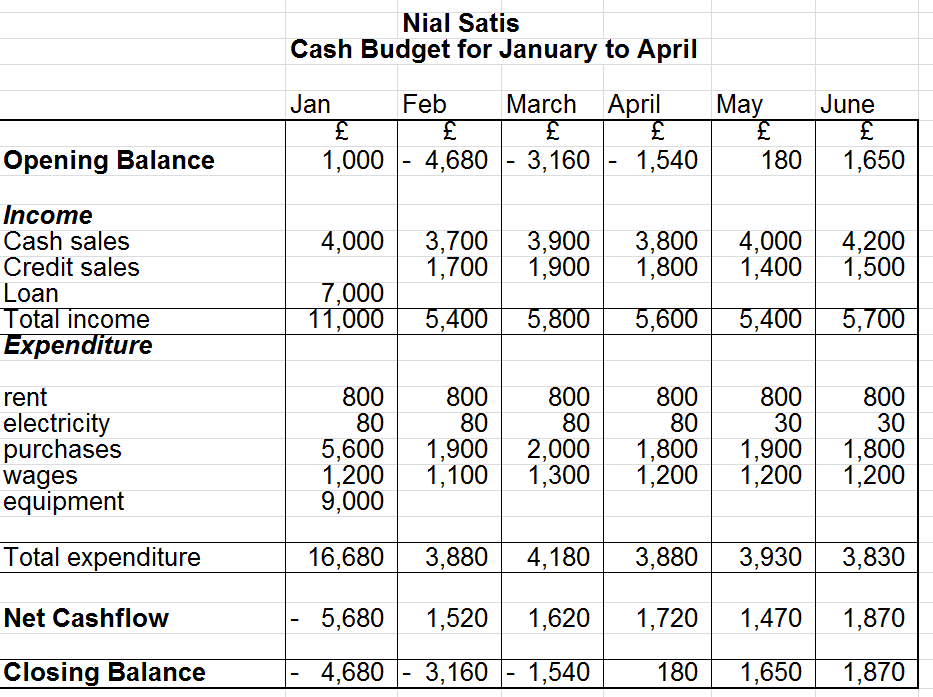

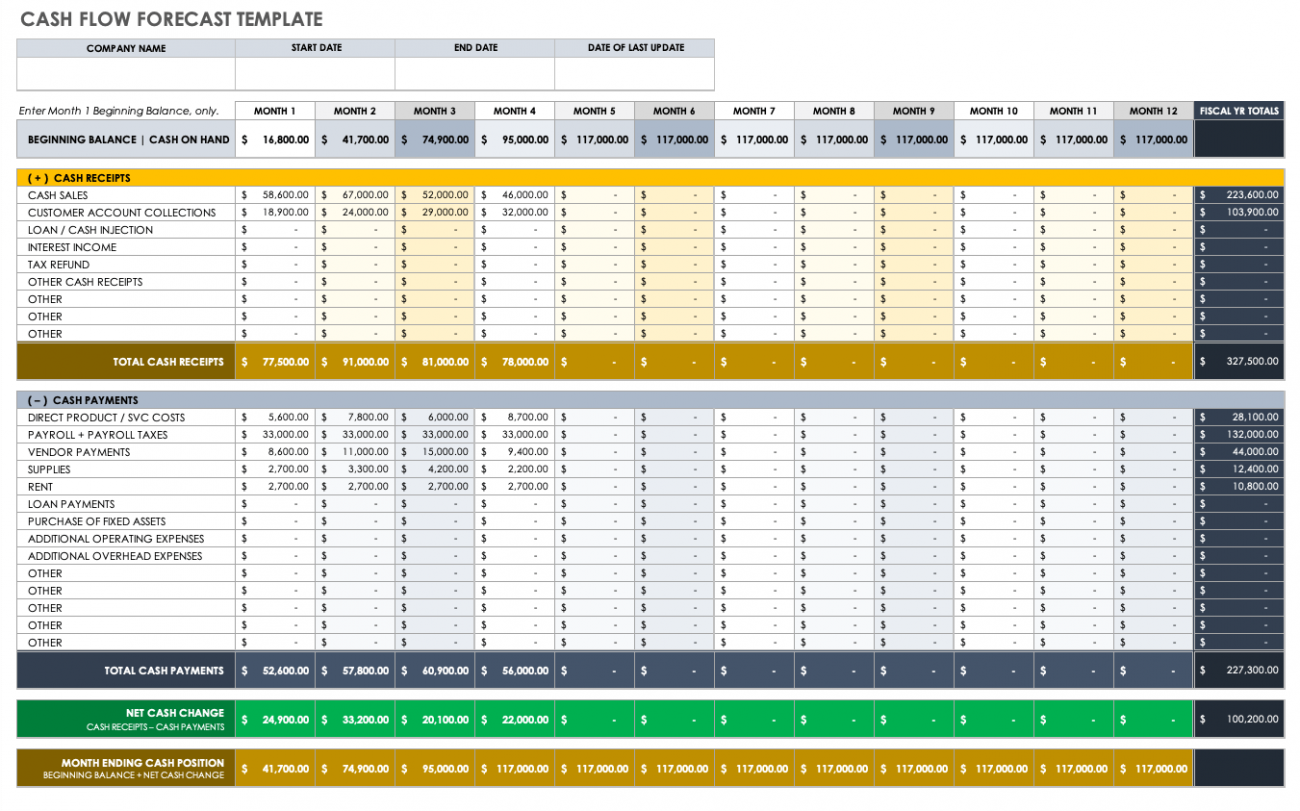

Below is an example of a generic monthly cash budget template in excel that you can download and use for your own purposes. Imagine that company abc is a toy manufacturer that wishes to project its seasonal sales for the final quarter of the year. To get started, it would use last year’s sales figures from.

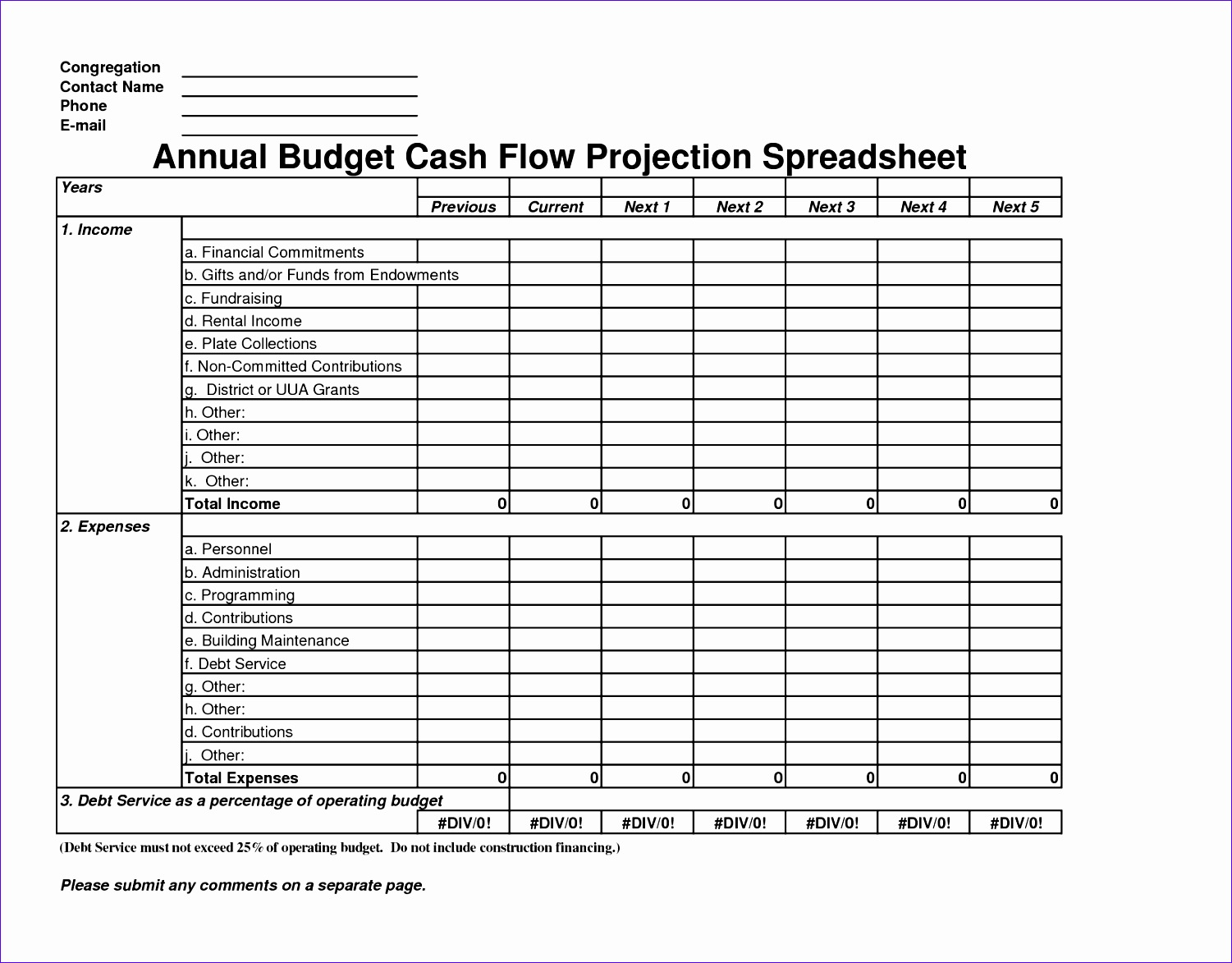

This has meant that the gfecra balance has. Cash flow is the heartbeat of your business. A cash budget is an estimate of cash flows for a period that is used to manage cash and avoid liquidity problems.

The cash inflows forecasted over the month are sales amounting to us$10000, accounts receivables collections to the tune of us$75000, and. Its meaning, format, cash flow budget, importance, steps, advantages and methods with example. Let us look at an example of a cash budget for a period of one month for abc manufacturing pvt.ltd.

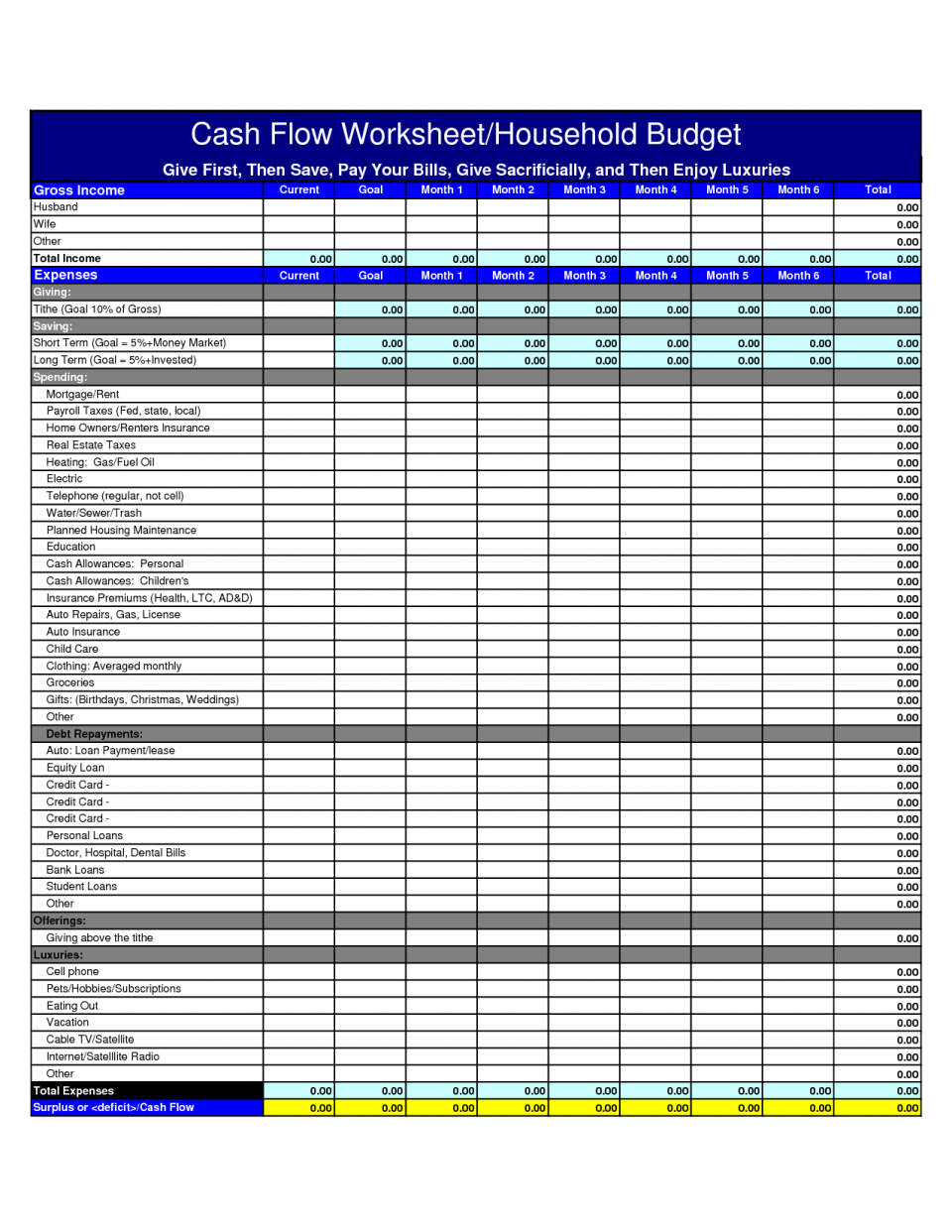

New borrowing of cash coming from external lenders to finance operations or expansion. Cash in from the sale of goods/services cash out for expenses cash in/out for investing cash in/out from financing total change in cash in each period additional resources Your cash flow budget can be simple and easy.

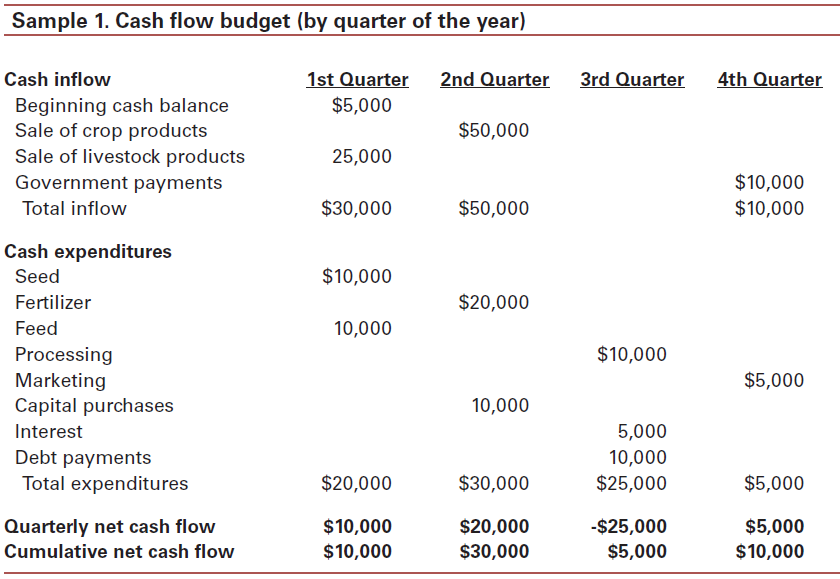

This involves estimates of revenue, costs and financing activities as they occur at points in time. The gfecra captures valuation gains on south africa’s foreign exchange reserves as the rand has moved from r10/us$1 in 2014 to r19/us$1 currently. For instance, when we see ($30,000) next to “increase in inventory,” it means.

You can use the cash flow statement template to create a cash flow forecast by entering your estimated figures for. Our cash budget example is a carefully created excel tool that can help you carefully plan and control your cash flow. Benefits cash flow budgeting provides a valuable tool that may assist companies of all sizes in making plans and managing their cash flow.

Its cash balance at the beginning of the budget period is us$ 20000. Operating expenses are divided between fixed costs and variable costs. Project all cash outflows for the period step 4:

Example of a cash flow statement red dollar amounts decrease cash. Key takeaways a cash budget is a company's estimation of cash inflows and outflows over a specific period of time, which can be weekly, monthly, quarterly, or annually. Examples format importance recommended articles cash budget explained a cash budget is the written financial plan made by the business related to their cash receipts and payments in a given period.

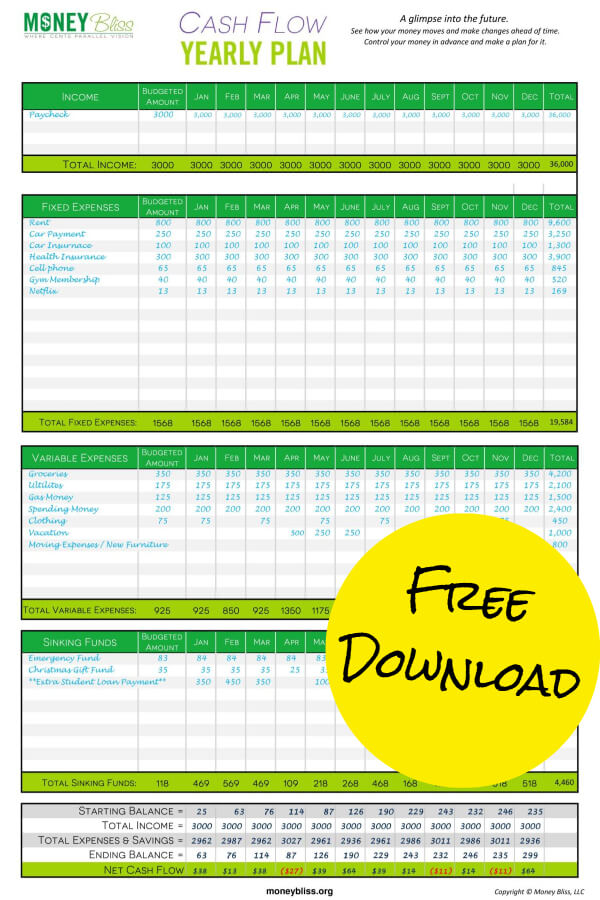

The template includes several sections: Capital budgeting cash flow analysis It is a useful tool to help you understand if you will have enough income to cover your expenses.