Inspirating Tips About Cash Flow Statement Steps Beyond Meat Balance Sheet

December 13, 2023 what is a statement of cash flows?

Cash flow statement steps. How to create a cash flow statement 1. Assess investing cash flow step 3: It is one of the three key reports (in addition to the income statement and the balance sheet).

Calculate net cash flow role of cash flow statements in the big picture navigating the financial health of a business involves more than just tracking profits and losses. Whether it’s a rapidly growing startup or a mature and profitable company. We will use these names interchangeably throughout our explanation, practice quiz, and other materials.

Some companies prepare cash flow statements annually—covering their full fiscal year—while others prepare them quarterly or even monthly. Write the opening balance of cash and bank for the year. It is an essential document for evaluating the sources and uses of cash for an organization.

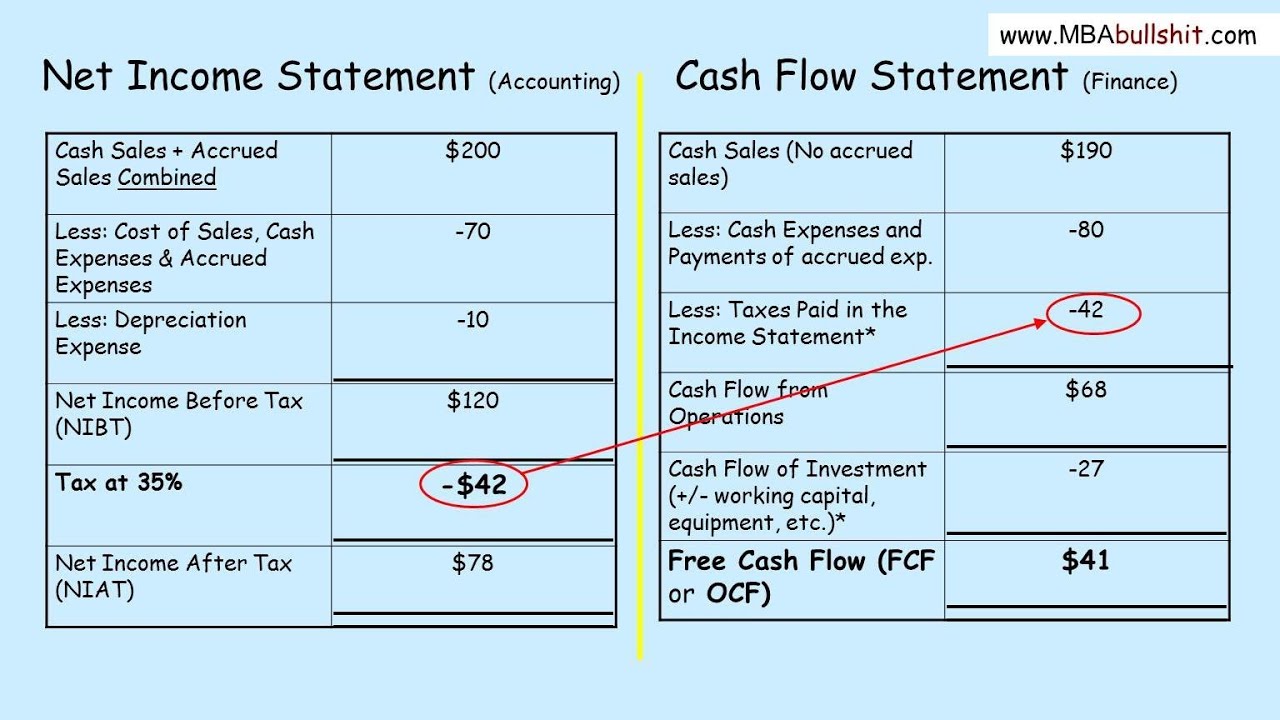

Using this information, an investor might decide that a company with uneven cash flow is too risky to. Determine net cash flows from operating activities. The direct method uses actual cash inflows and outflows from the company’s operations, and the indirect method uses the p&l and balance sheet as a starting point.

Add back noncash expenses, such as depreciation, amortization, and depletion. The cash flow statement is required for a complete set of financial statements. Users of financial statements need them to measure the financial health of a business.

1 determine the ending cash balance from the prior year. The statement of cash flows is one of the main financial statements produced by a business, alongside the the income statement and balance sheet. The four steps required to prepare the statement of cash flows are as follows:

Deduct all outbound cash flows via operating, investing, and financing activities. The statement of cash flows is prepared by following these steps:. Determine operating cash flow step 2:

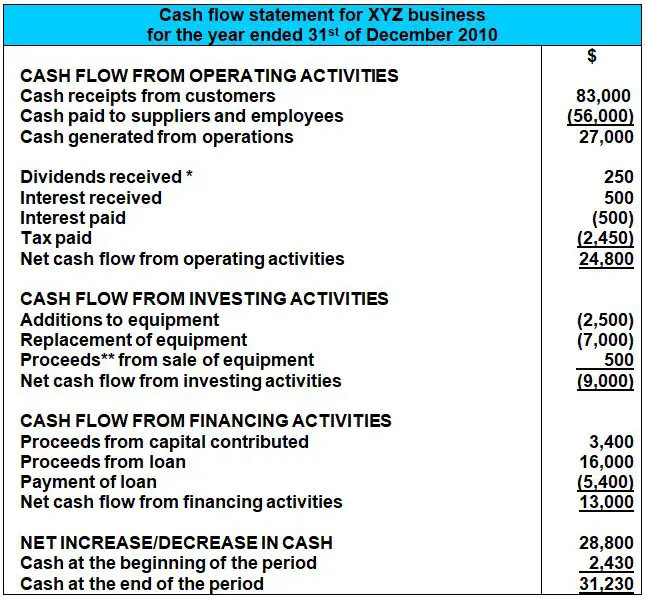

Following are the basic steps to proceed with a cash flow statement: The cfs measures how well a. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

In the above example, the business has net cash of $50,049 from its operating activities and $11,821 from its investing activities. Begin with net income from the income statement. It provides an overview of how much cash the business generates and where it’s being spent.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. Add all the annual cash inflow from operating, investing, and financing activities. For example, cash flow statements can reveal what phase a business is in:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)