Outrageous Tips About Balance Sheet Items Explanation Liabilities And Equity

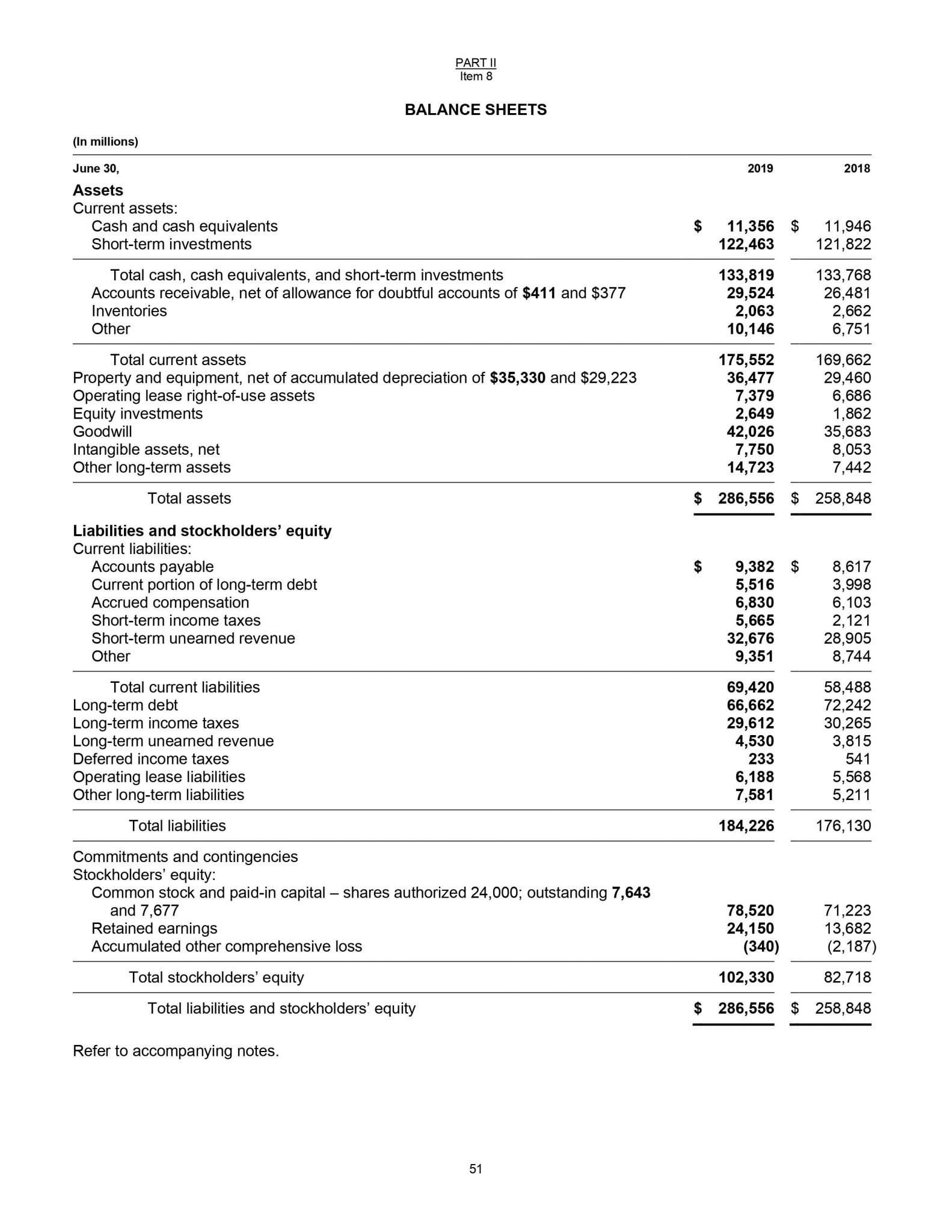

A balance sheet explanation is a financial statement that summarizes a company’s assets, liabilities, and equity at a specific moment.

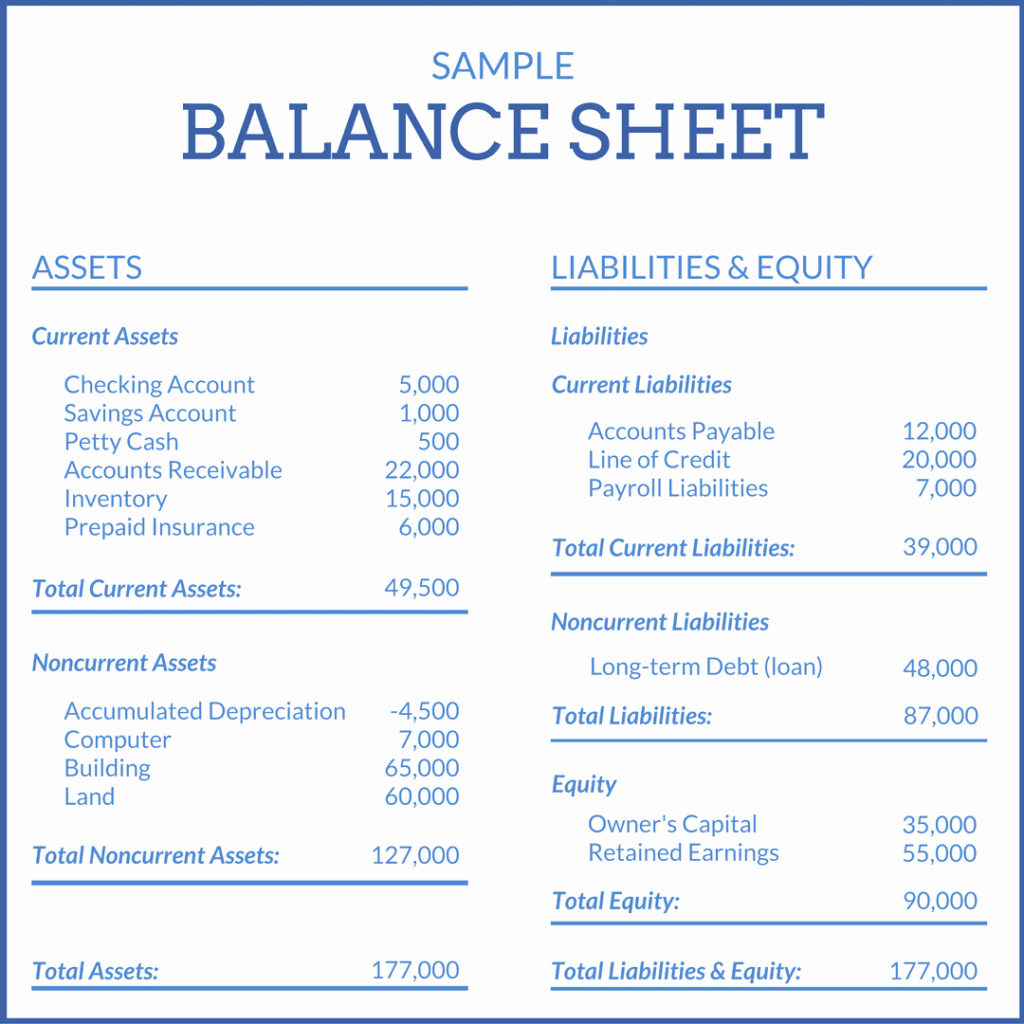

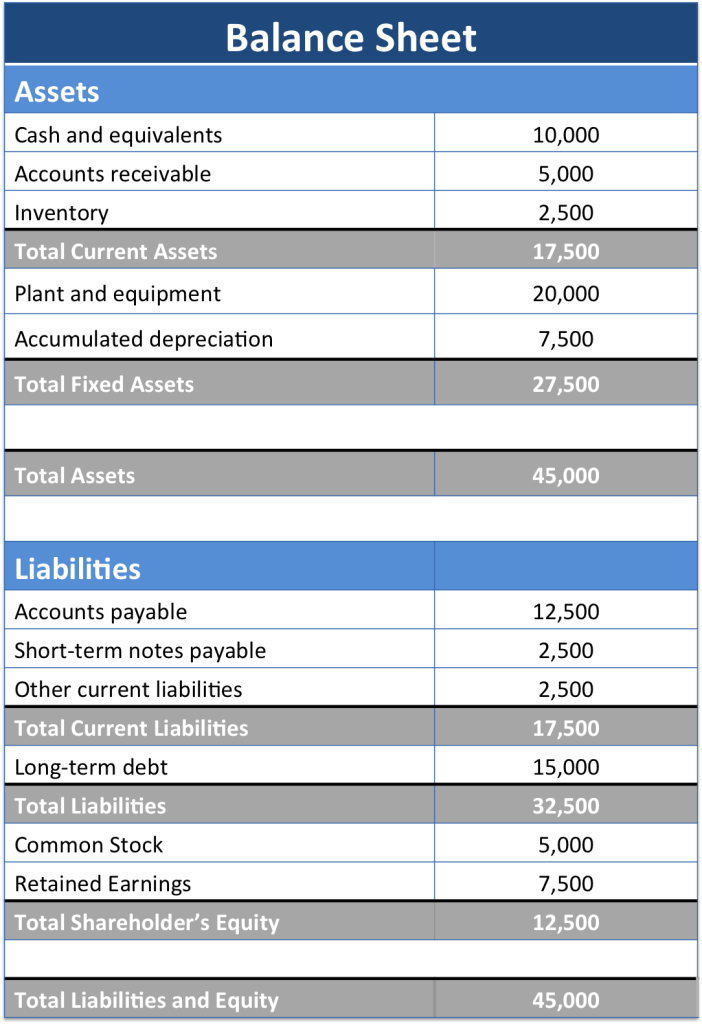

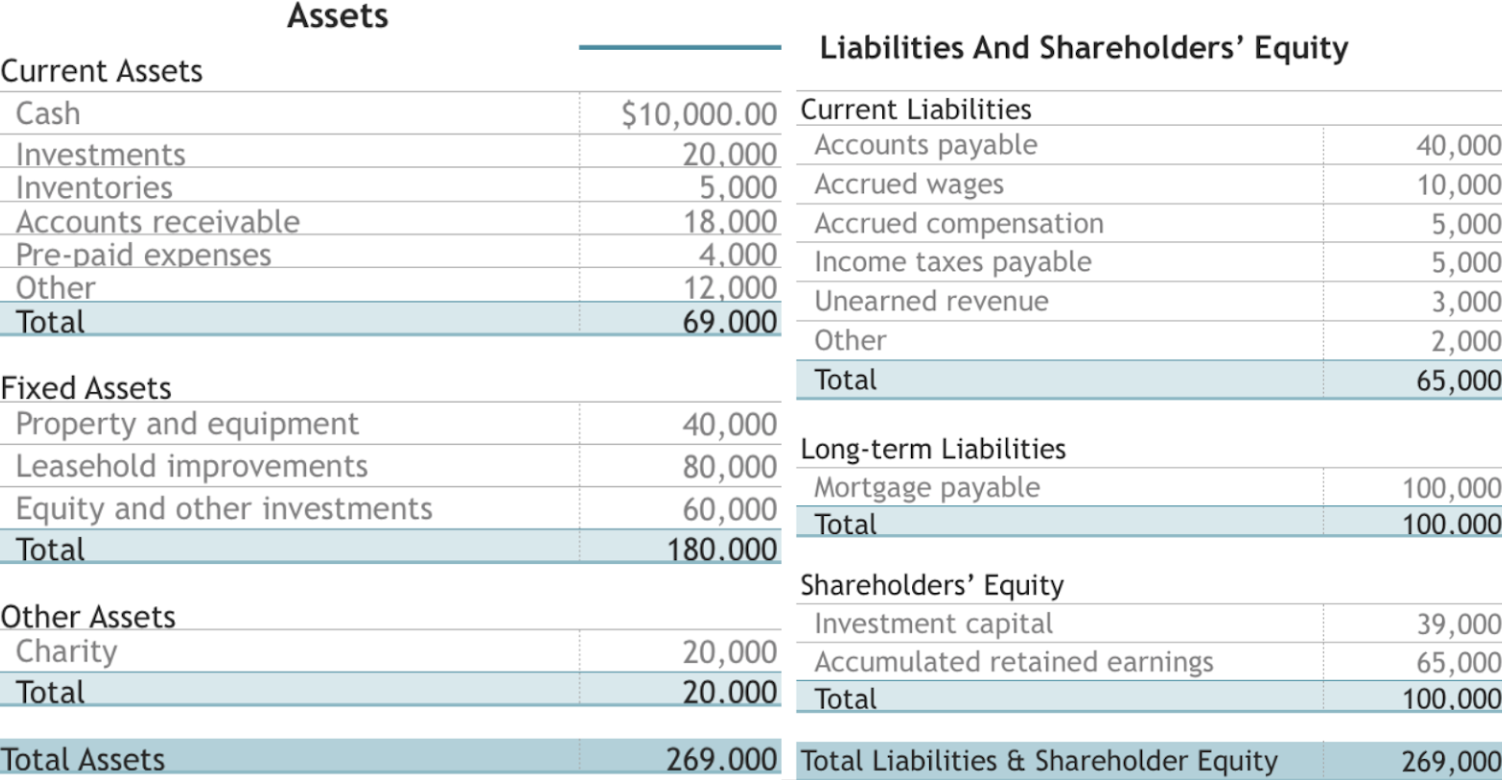

Balance sheet items explanation. What are the three financial statements? The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Assets like cash, inventory, accounts receivable, investments, prepaid expenses, and fixed assets.

The balance sheet is a key financial statement that provides a snapshot of a company's finances. The balance sheet is based on the fundamental equation: A balance sheet is often described as a snapshot of a company's financial condition.

What is the balance sheet? A balance sheet lists all assets and liabilities of a company. A balance sheet is typically compiled at the end of each accounting period, which is also the beginning of the next accounting period.

The balance sheet is one of the three main financial statements, along with the income statement and cash flow statement. To get a complete understanding of the corporation's financial position, one must study all five of the financial statements including the notes to the financial statements. A balance sheet is a financial document that shows a company's current assets, liabilities, and stockholders' equity.

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. It is important to note that the balance sheet is one of the three fundamental financial statements (the other two being the income statement and cash flow statement ). A quick glance at the balance sheet of a small business or large corporation can give investors clues about the company's financial health and net worth at a specific point in time.

The items which are generally present in all the balance sheet includes: It reports a company’s assets, liabilities, and equity at a single moment in time. The balance sheet, one of the core financial statements, provides a snapshot of a company’s assets, liabilities and shareholders’ equity at a specific point in time.

The balance sheet is split into two columns, with each column balancing out the other to net to. While income statements and cash flow statements show your business’s activity over a period of time, a balance sheet gives a snapshot of your financials at a particular moment. Assets represent things of value that a company owns and has in its possession, or something that will be received.

Its purpose is to verify that the. The balance sheet is one in a set of five financial statements distributed by a u.s. The three financial statements are the balance sheet, the profit and loss statement, and the cash flow statement.

A balance sheet summarizes the assets, liabilities, and capital of a company. Core financial accounting leading with finance email print a balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health. A balance sheet is a financial statement that contains details of a company’s assets or liabilities at a specific point in time.

It is one of the three core financial statements ( income statement and cash flow statement being the other two) used for evaluating the performance of a business. Hence, the balance sheet is often used interchangeably with the term “statement of financial position”. Nomic flows of all previous periods.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)