Inspirating Tips About A Statement Of Cash Flows Is Generated To Show Personal Finance Balance Sheet Example Steps Prepare Trial

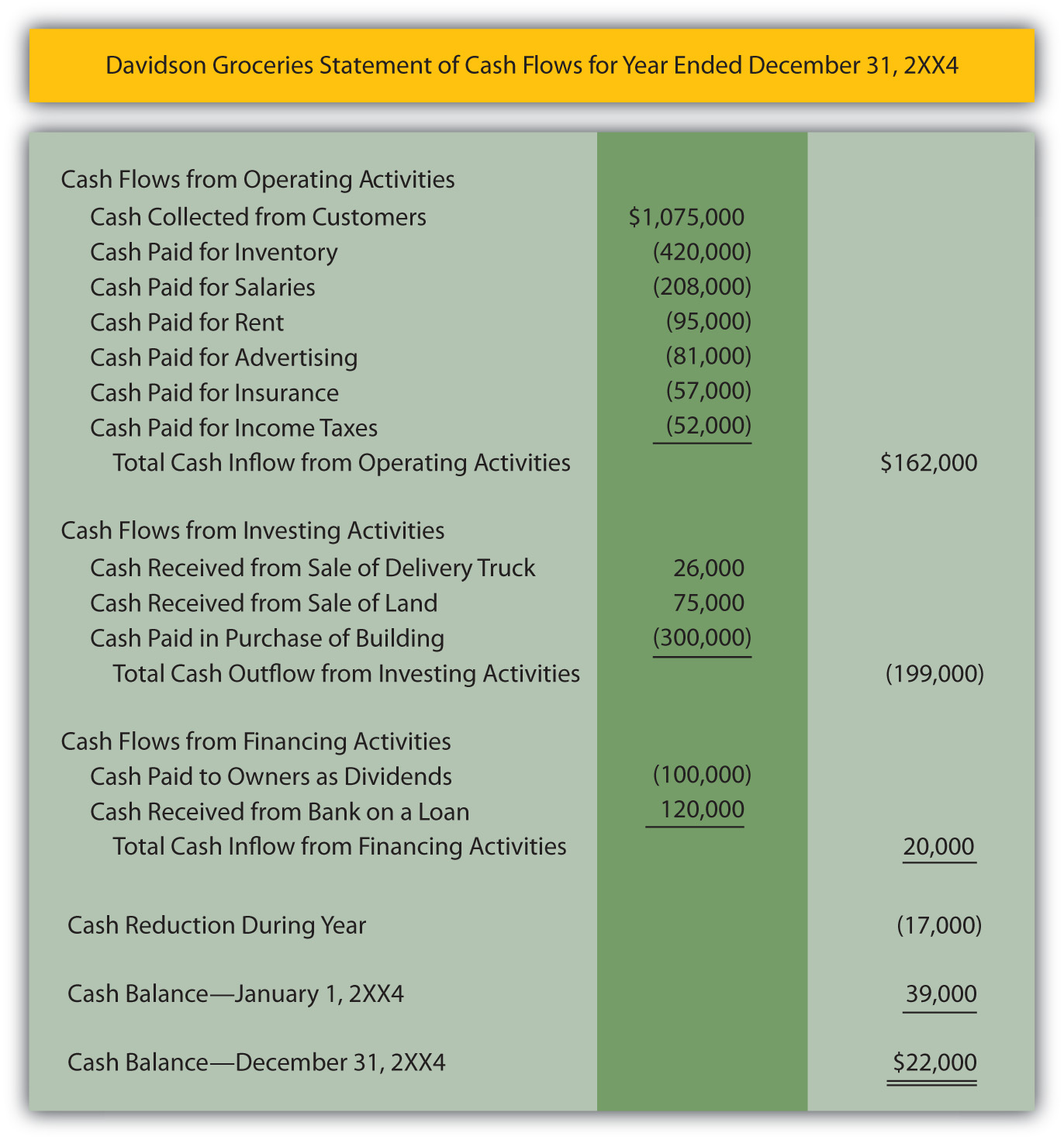

The cash flow statement is one of the three main financial statements that show the state of a company's financial health.

A statement of cash flows is generated to show personal finance balance sheet example. Your personal cash flow statement will include two sections: The amounts on the scf provide the reasons for the change in a company's cash and cash equivalents during the period covered. Question 1 a statement of cash flows is generated to show:

Below is an example from amazon’s 2022 annual report, which breaks down the cash flow generated from operations, investing, and financing activities. When the company raises cash by issuing shares or by getting a loan from the bank, it is shown in the financing cash flow section. The cash flow statement is one of three key financial statement for a company.

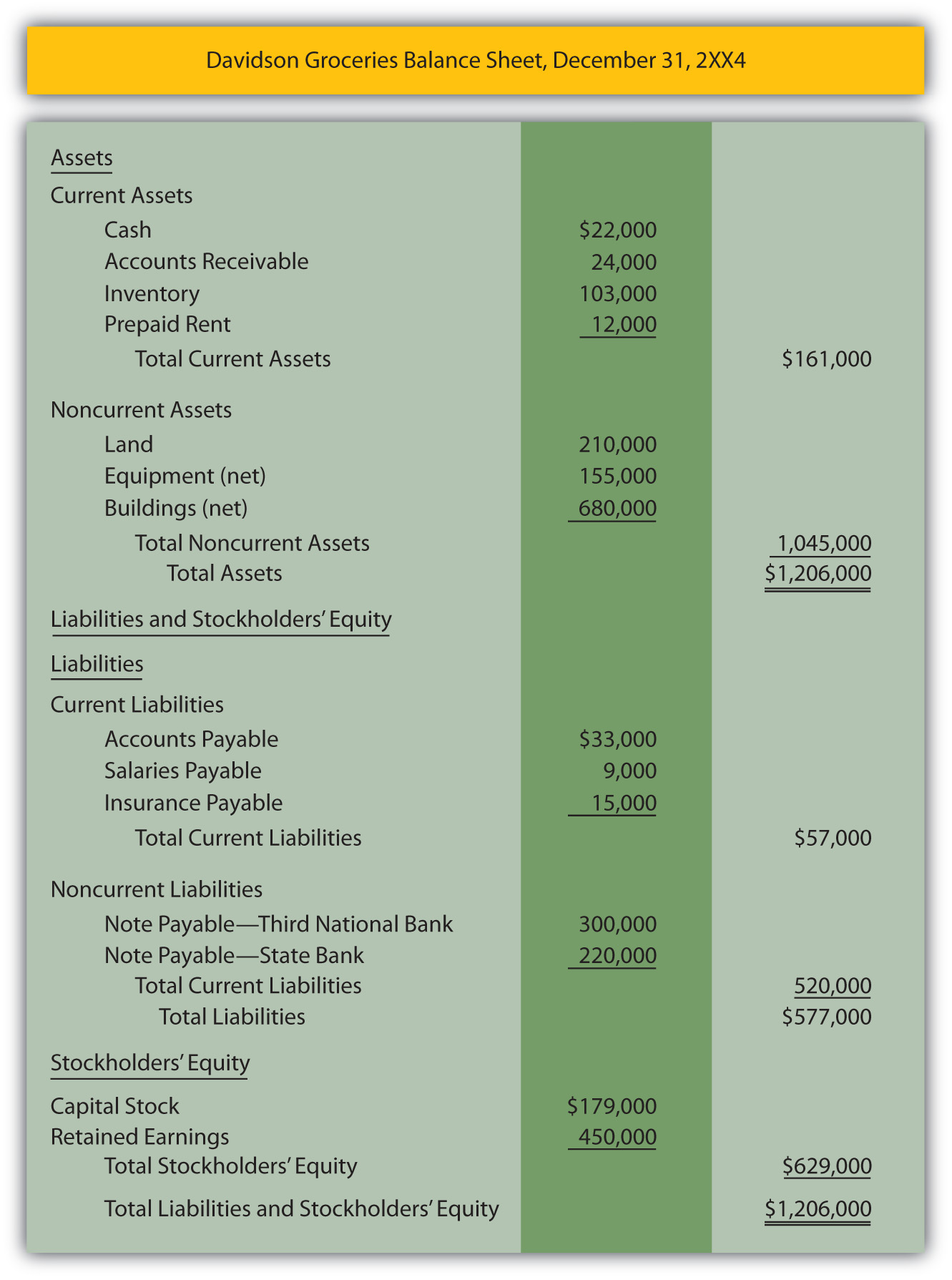

A personal cash flow statement measures your cash inflows and outflows to show you your net cash flow for a specific period. A balance sheet compares what you own (assets) against what you owe (liabilities) to calculate your net worth (assets minus liabilities) for a specific period of time. The revenues the company has earned during the period.

Cash flow from financing. Statement of cash flows example. The changes in cash flow for the period covered by the statement generally come from information found in the income statement and balance sheet.

The cfs measures how well a. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Here are some examples:

Two examples include year ended december 31, 2022 and three months ended september 30, 2022. Cash flow from financing shows the cash flows to and from those who fund the company: Income statement, balance sheet, and p&l.

It is a crucial statement, as it shows the sources of and uses of cash for the firm during the accounting period. This problem has been solved! As a result, you'll glean a clearer picture of your overall financial health.

The other two important statements are the balance. Build financial models with correct interconnectivity between the three primary accounting statements: There is a cpf government forced saving and the remainder is your take home disposable income.

What is the difference between a personal balance sheet and a cash flow statement? Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. Cash flow statement vs.

An example of the cash flow statement using the direct method for a hypothetical company is shown here: Its owners (investors) and creditors (like banks). This cash flow statement shows company a started the year with approximately $10.75 billion in cash and.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)