Build A Tips About Wrong Income In 26as Merchandise Inventory On Balance Sheet

It also includes the tds/.

Wrong income in 26as. Mismatch in the income figure may raise an inquiry from the. Synopsis an incorrect entry especially with regards to pan or an amount in the form 26as may lead to unnecessary delays in filing the itr. Form 26as helps in computation of income and to claim the tax credits at the time of filing income tax return (itr) on income.

If there is no tax credit mismatch, the message tax credit claimed is fully matched with tax credit available in 26as will be displayed. My employer has wrongly taken amount of leave encashment and gratuity as my taxable income and deduct the tax on it, as in 26as it is showing excess income. Form 26as basically provides details or information that the tax department has about transactions done by you during the year.

A taxpayer can confirm the verification of refunds. We tell you how to correct the wrong entry in form 26as. What are the reasons for tds mismatch?

It is an annual certificate issued by your employer stating your income, investments, and the tax deducted and deposited during a particular financial year. However, in the instant case, ao had invoked explanation (a) to section 139 (9) on account of mismatch of the figures of income as returned and as per form 26as.

There was the possibility of entering the wrong pan, which belonged to the assessee, and the assessee had been unnecessarily put under mental pressure by. According to atul sharma, if you find discrepancies between the tds and other details in form 16, form 26as, and the ais, it is important to take the following. In case you see a wrong entry it.

4 new things that your tax passbook will now show. The possible reasons for incorrect credits in form 26as can be on account of wrong data provided by the deductor in the quarterly tds/tcs statement. If you find a mismatch of tds in form 26as and form 16/16a, you may first want to find out why the mistake happened.

If the amount of tds deducted from your salary or interest income is not correctly reported by your employer and bank respectively then it may lead to an error in. What is form 16? In case any taxpayer notices a wrong entry in 26as that needs to be corrected, the taxpayer should inform the inaccuracy in such statement and furnish the.

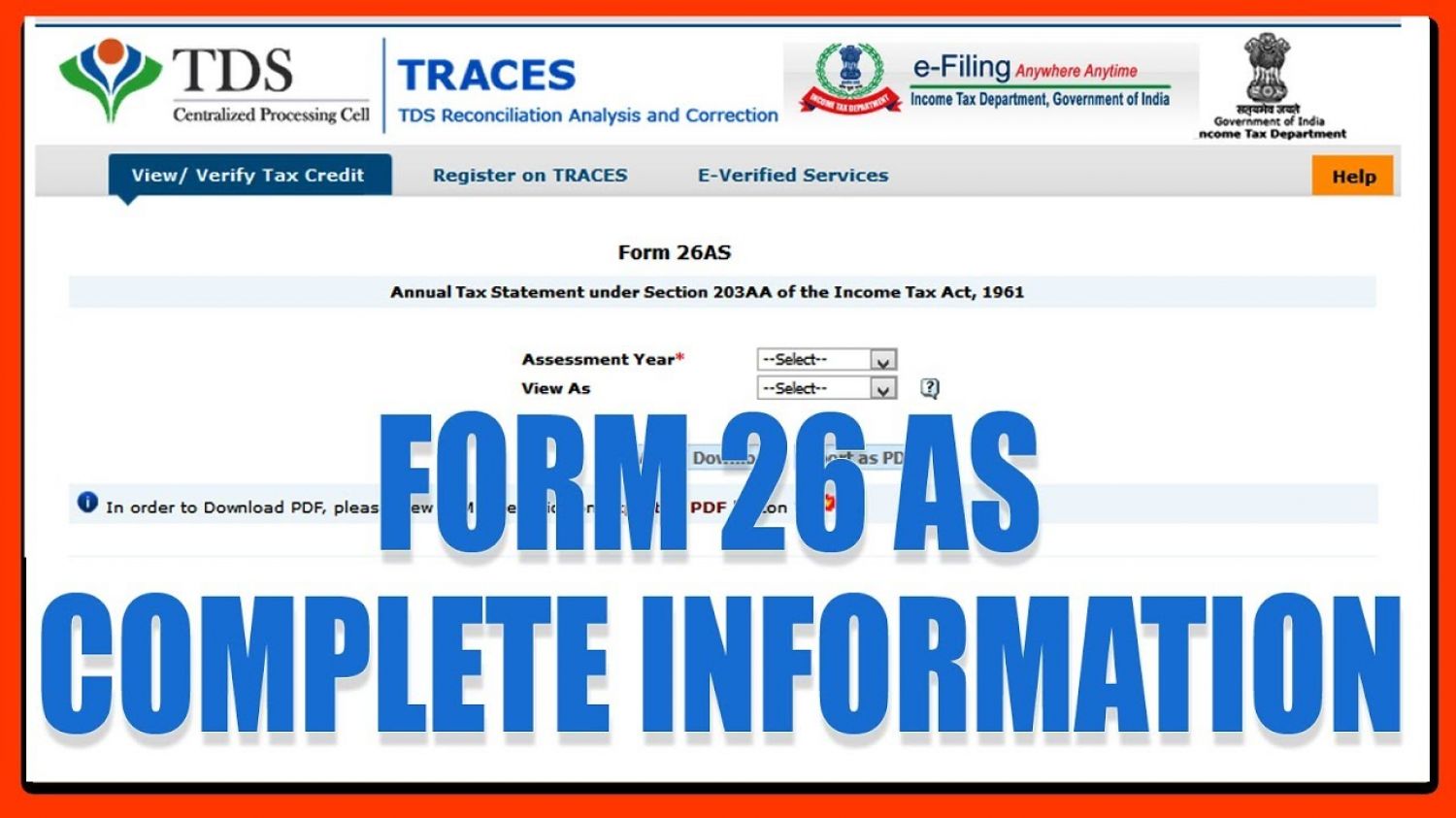

Click on the link view tax credit (form 26as) at the bottom of the.