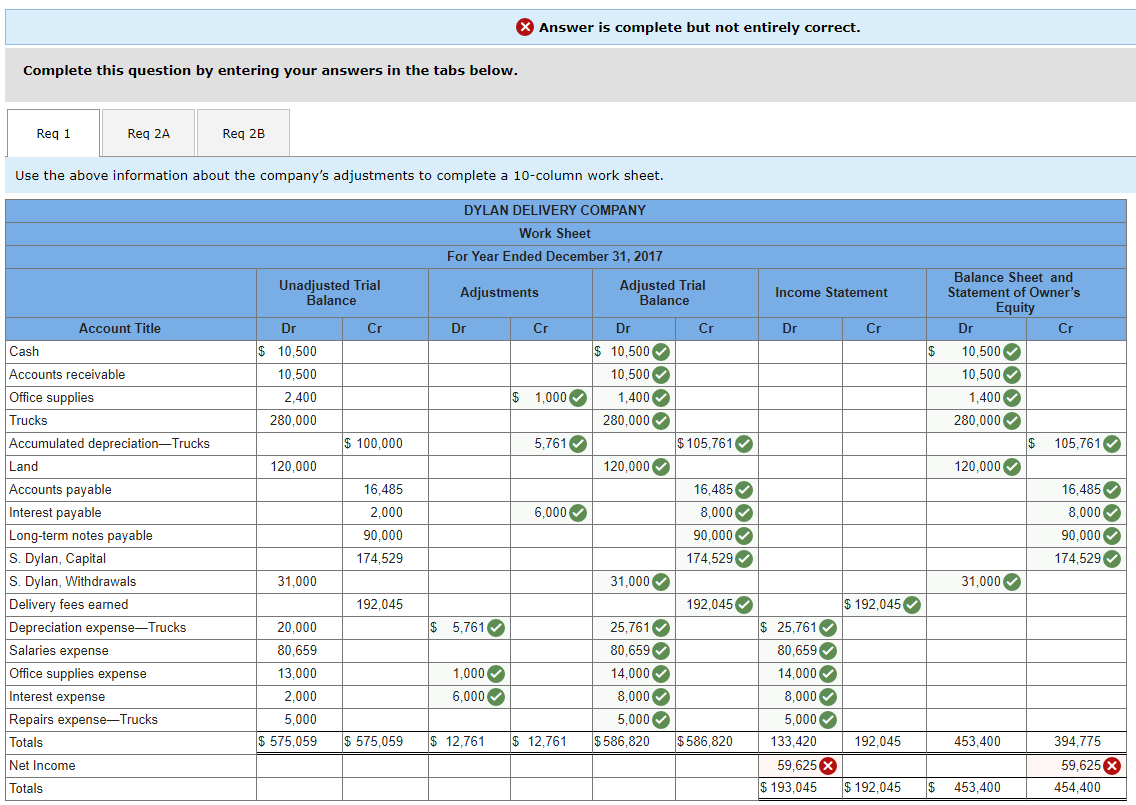

Simple Tips About Unused Office Supplies In Balance Sheet Accounting For Dividends Declared But Not Paid Ifrs

What is office equipment in balance sheet?

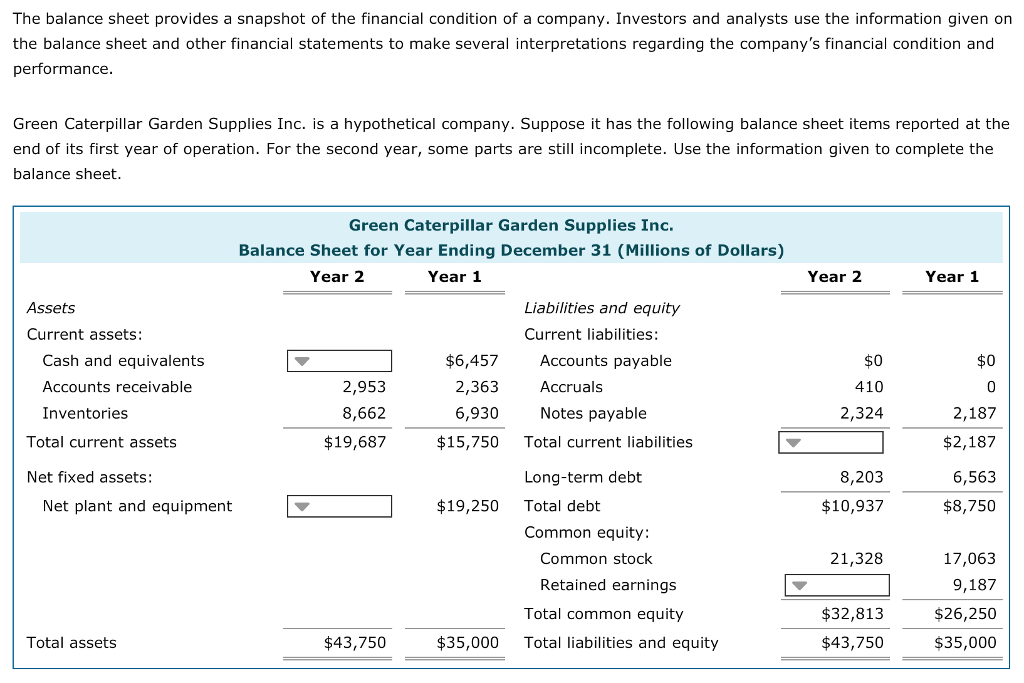

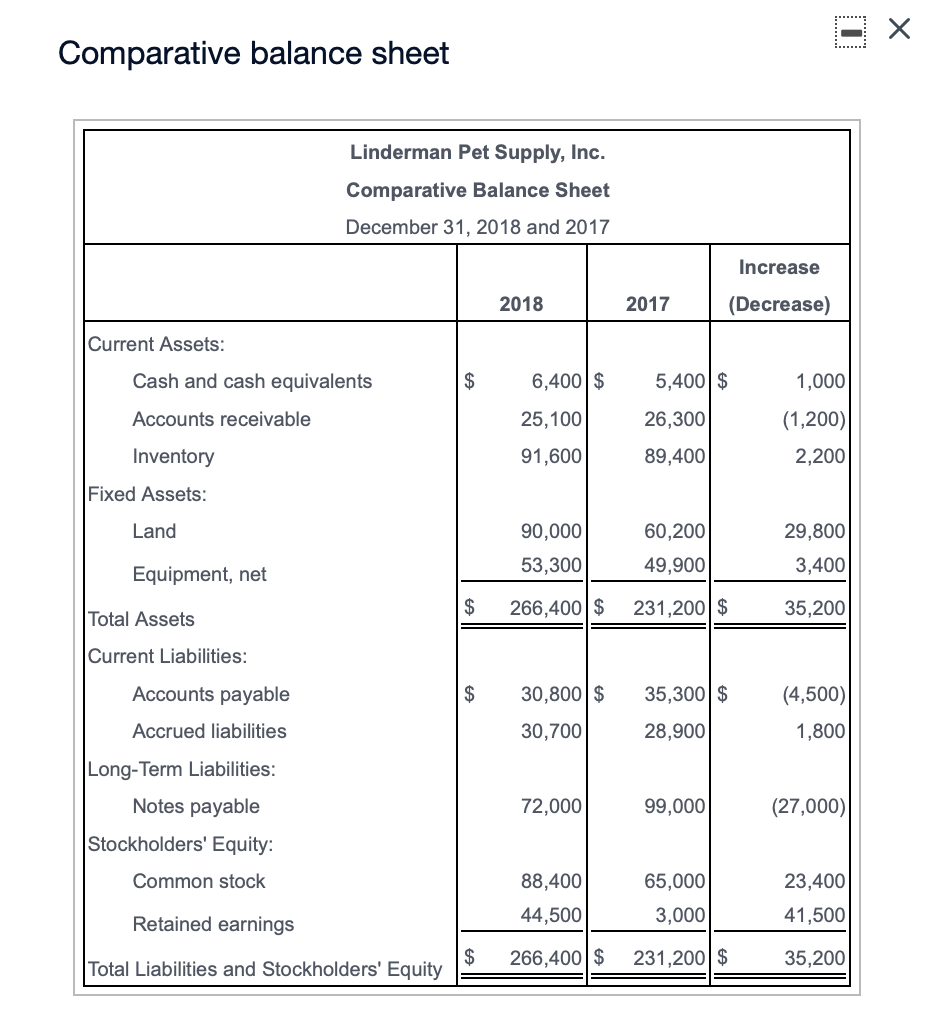

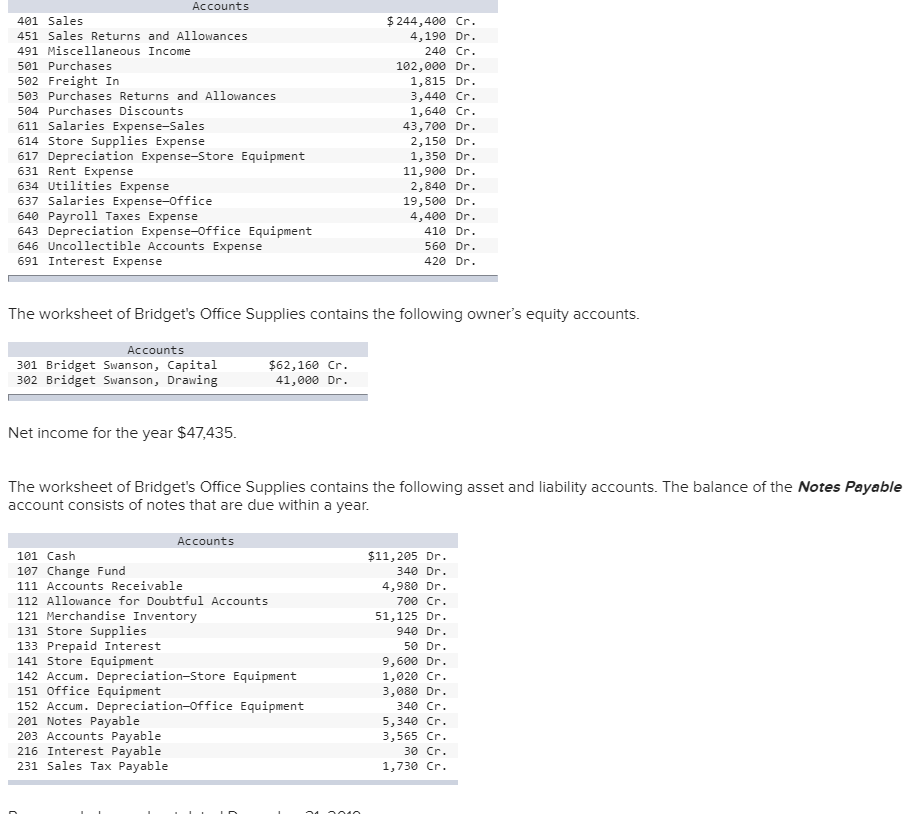

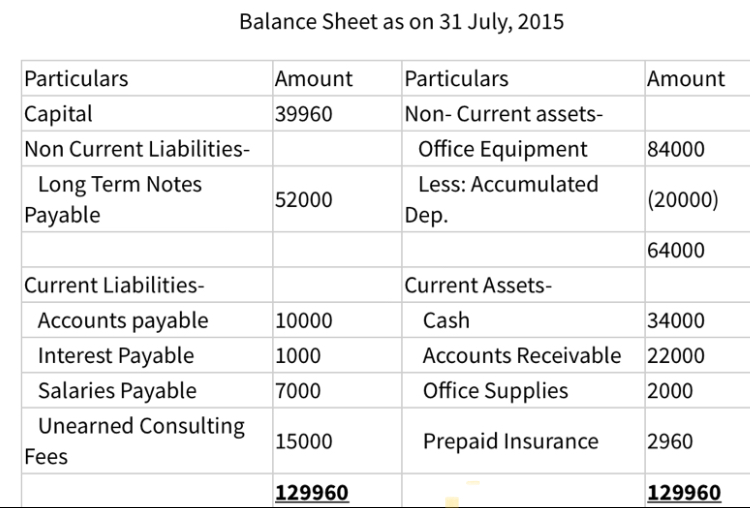

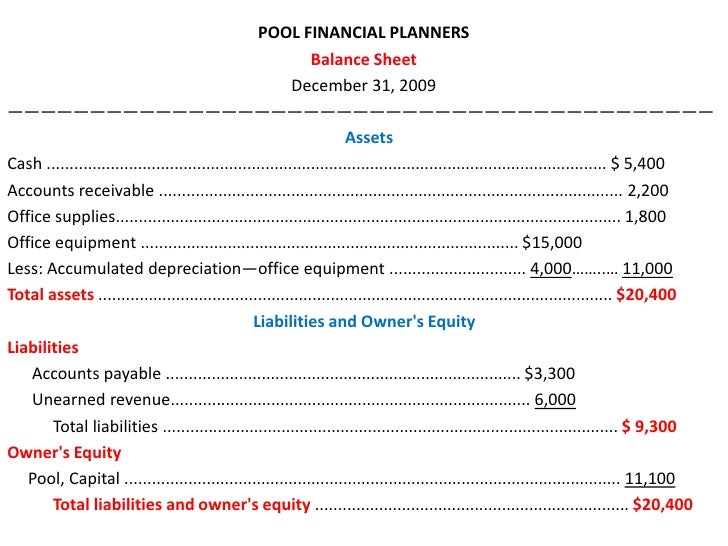

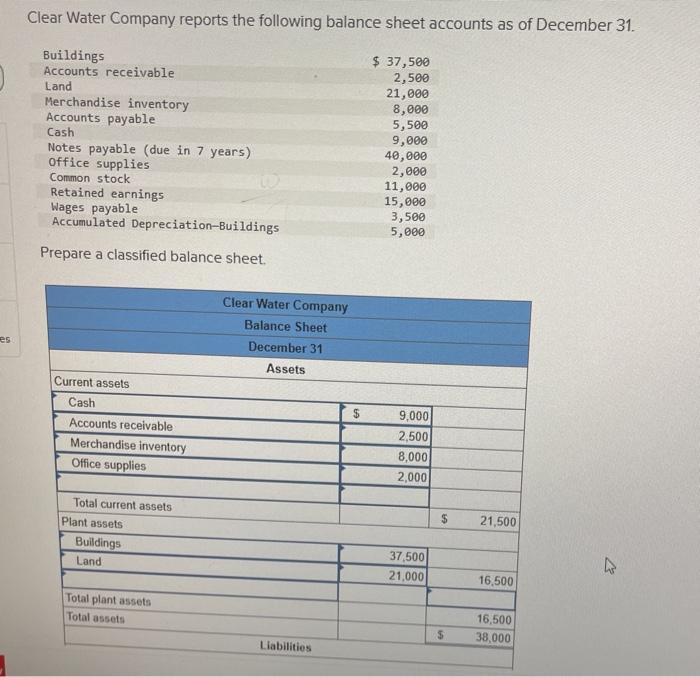

Unused office supplies in balance sheet. Idle, obsolete, missing, and scrap. Prepare a classified balance sheet. When a business purchases office supplies on account it needs to record these as supplies on hand.

The office supplies should be recorded as current assets on the balance sheet when purchased from the supplier. Unused supplies mostly paper products are discarded or recycled at the local level. It is not an inventory account item.

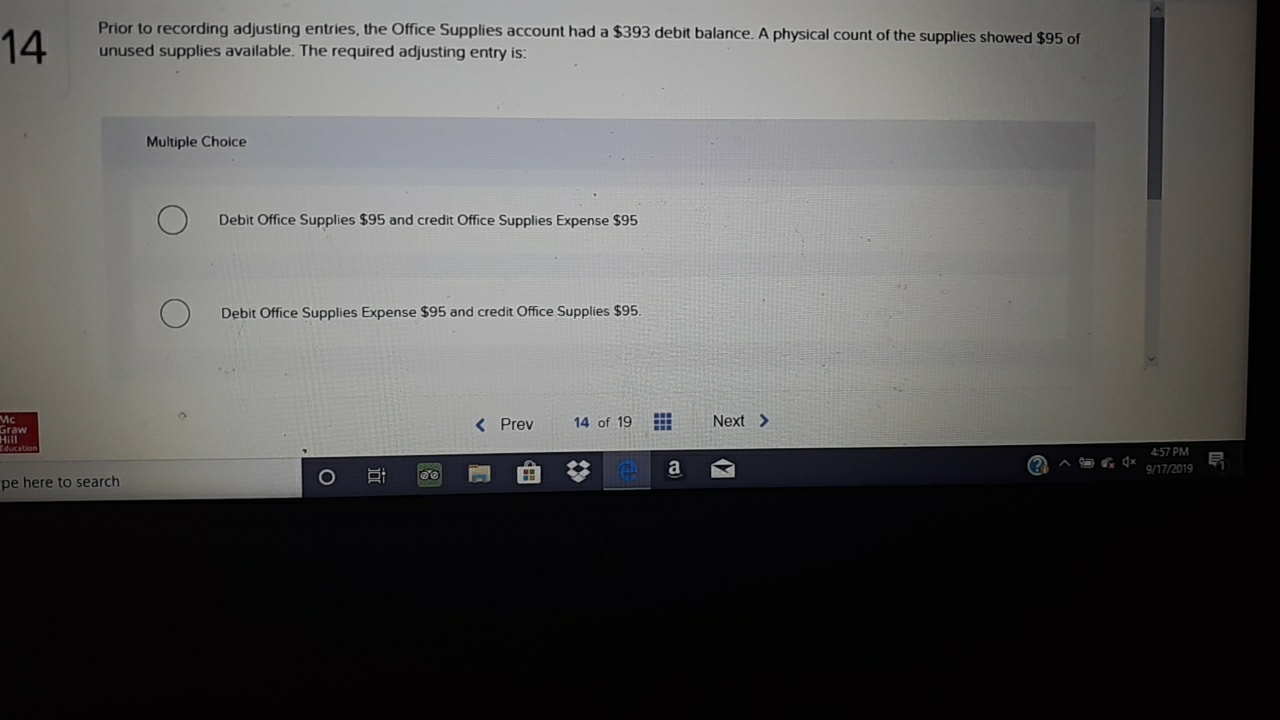

Supplies are incidental items that are expected to be consumed in the near future. The value of the supplies account will be overstated on the balance sheet if you do not make an. As the supplies on hand are normally consumable within one year they are recorded as a current asset in the balance sheet of the business.

Unused office supplies are represented as a current asset in a balance sheet. Overview in accounting, the company usually records the office supplies bought in as the asset as they are not being used yet. The business would then record the supplies used during the accounting period on the income statement as supplies expense.

Office supplies are assets until they are used or consumed. The items included in pp&e are land, computers, furniture, equipment, building, machinery, vehicles, etc. All supplies for office are current assets when they are purchased i.e.

Likewise, the office supplies used journal entry is usually made at the period end adjusting entry. While they are an asset because they hold value, they are not recorded as an asset but are recorded as an expense. What happens if a company has unused supplies at the end of an accounting period?

If the cost is significant small businesses can record the amount of unused supplies on their balance sheet in the asset account under supplies. The office supplies will increase on the balance sheet. You can record how much money the company's employees spend on supplies in your supply account by debiting supplies and crediting cash.

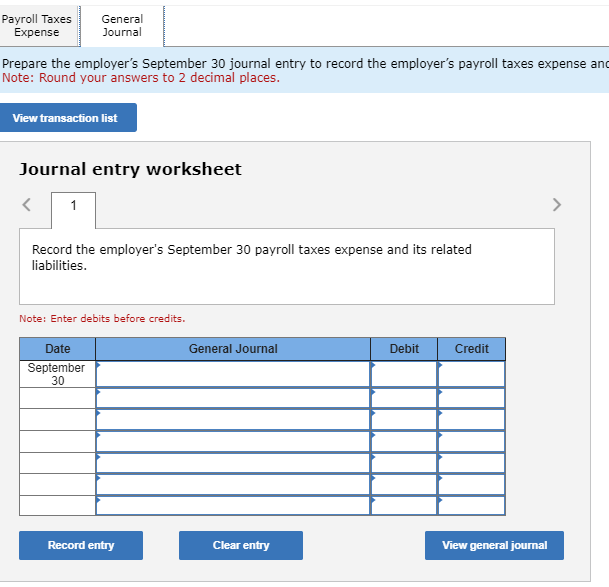

The journal entry is debiting office supplies and credit cash. The normal accounting for supplies is to charge them to expense when they are. When supplies are classified as assets, they are usually included in a separate inventory supplies account, which is then considered part of the cluster of inventory accounts.

Any unused supplies should remain on the balance sheet until they are consumed or expire; This article will go through office equipment and its classification, recognition, measurement, and taxation. Only later, did the company record them as expenses when they are used.

All of these items are 100% consumable, meaning that. If so, supplies then appear within the “inventory” line item in the balance sheet. At which point their value will become zero and they will no longer be recognized as an asset.

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

![[Solved] The worksheet of Bridget's Office Supplie SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2021/07/60ec1874cfd57_1626085491227.jpg)