Cool Tips About The Variable Costing Income Statement Separates How Do You Make An

Fixed costs are expenses that don't change even when the activity base does.

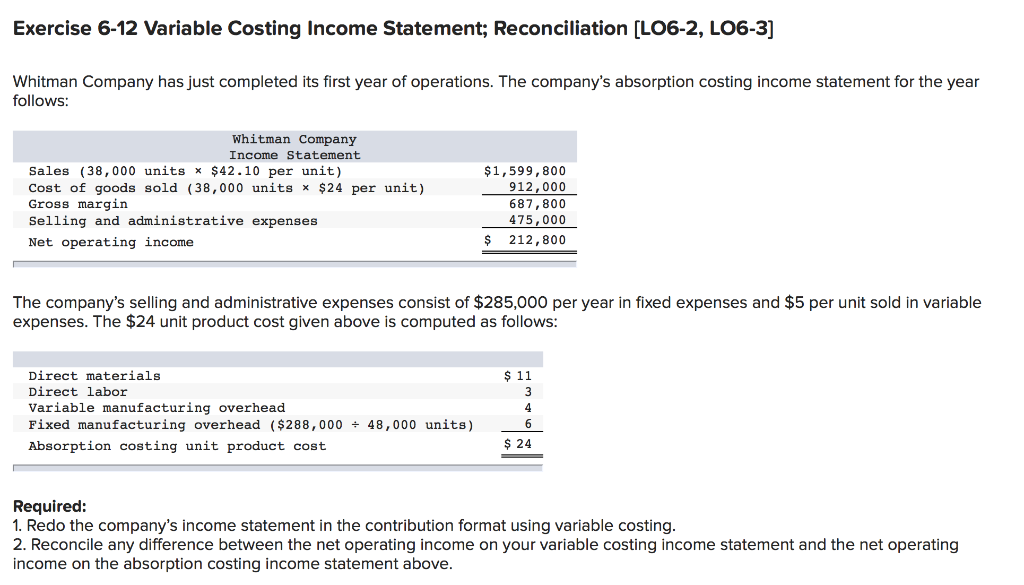

The variable costing income statement separates. You should remember, the contribution margin income statement separates variable costs. Variable costing (also called marginal costing) is a costing method in which fixed manufacturing overheads are not allocated to units produced but are charged. A variable costing income statement ______.

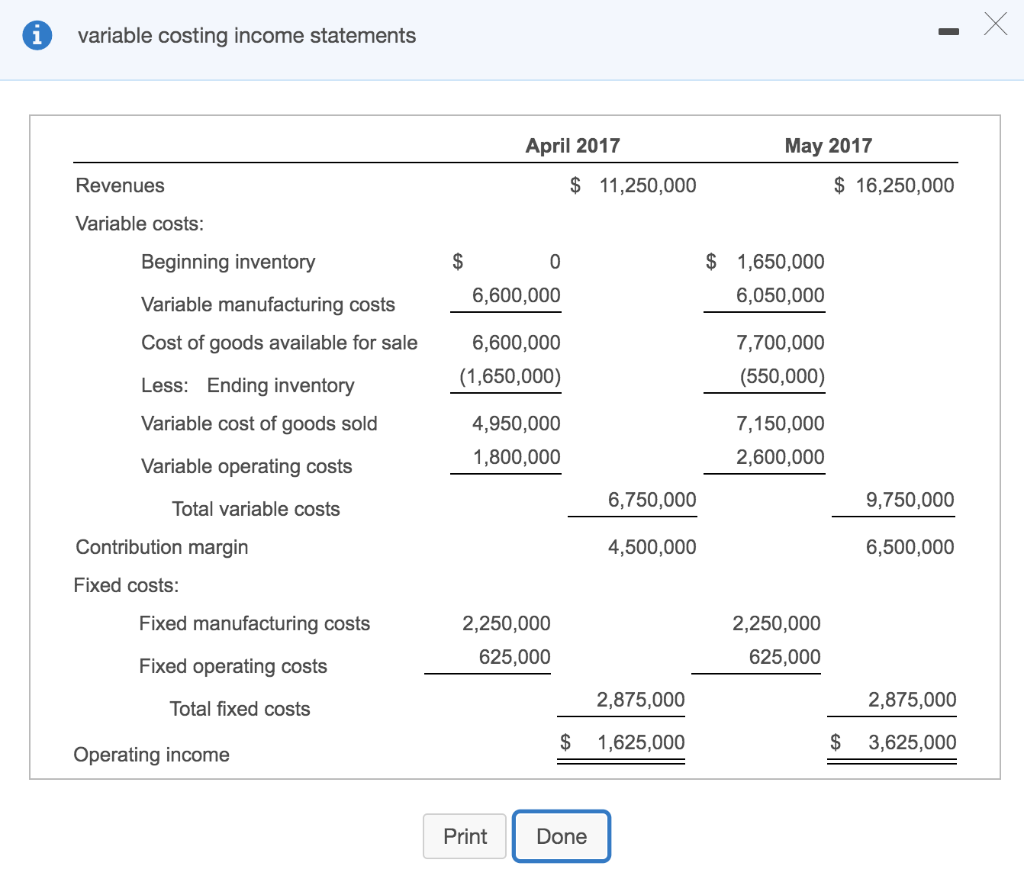

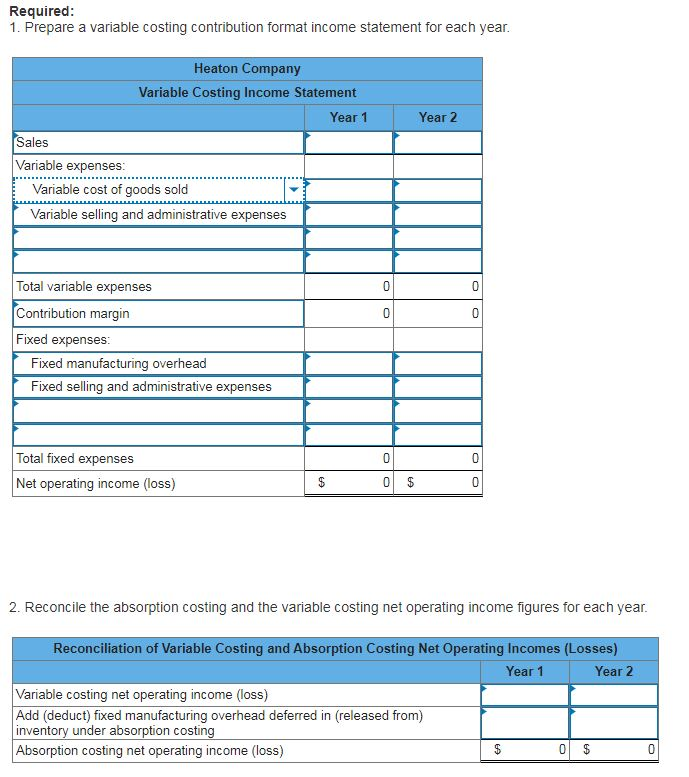

Select all that apply. Under variable costing, the income statement. Income statement (variable) for month ended may:

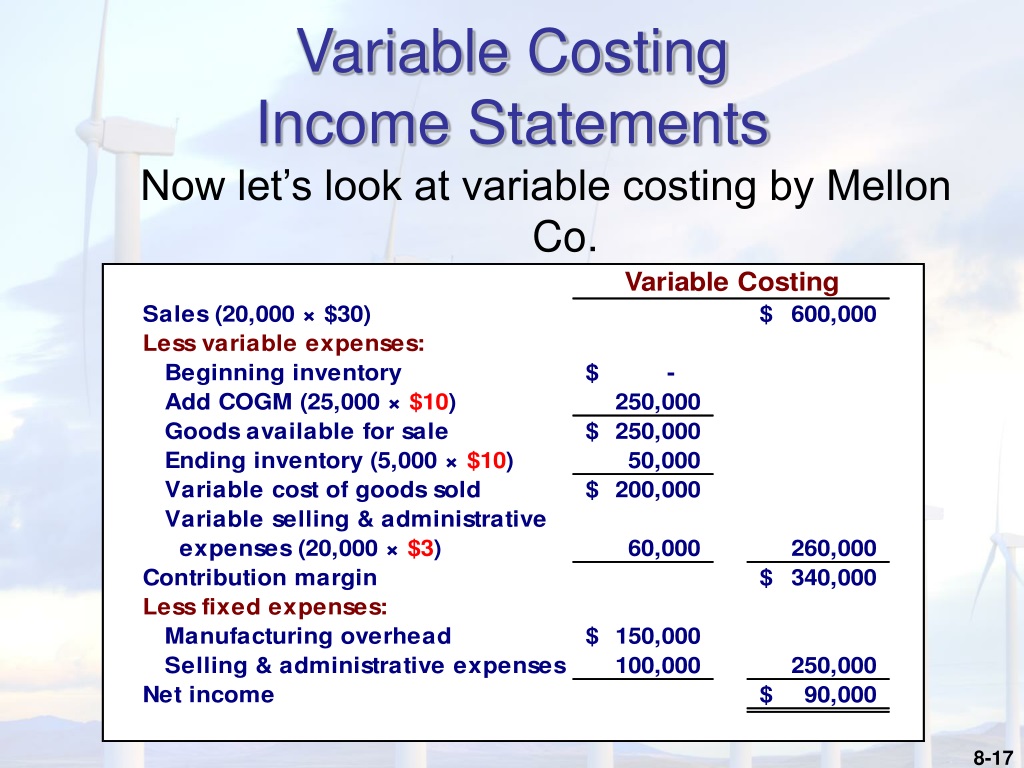

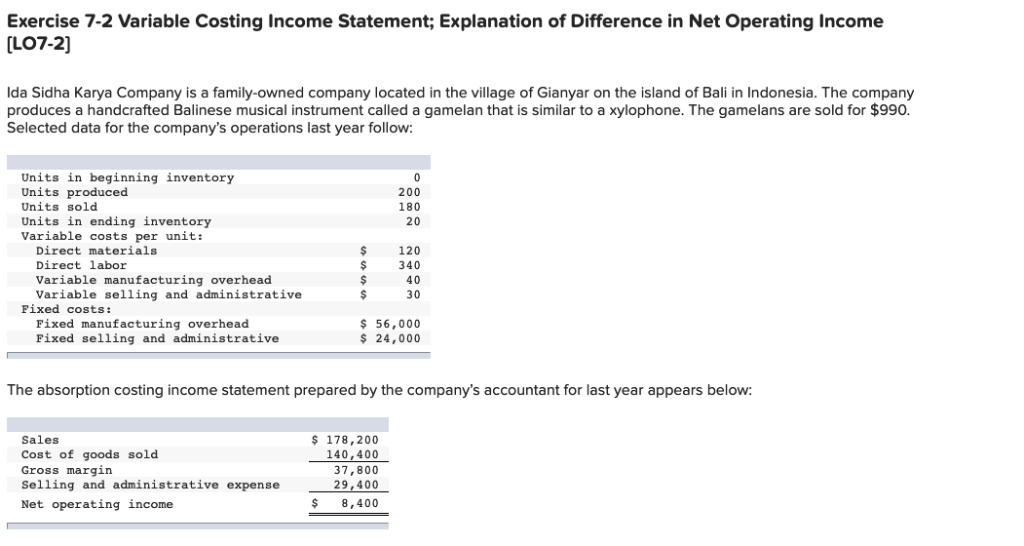

The variable costing income statement separates the variable expenses and fixed expenses. Sales (9,000 x $8 per unit) $ 72,000: The choice of costing method, such as variable costing or absorption costing, can impact the preparation of income statements.

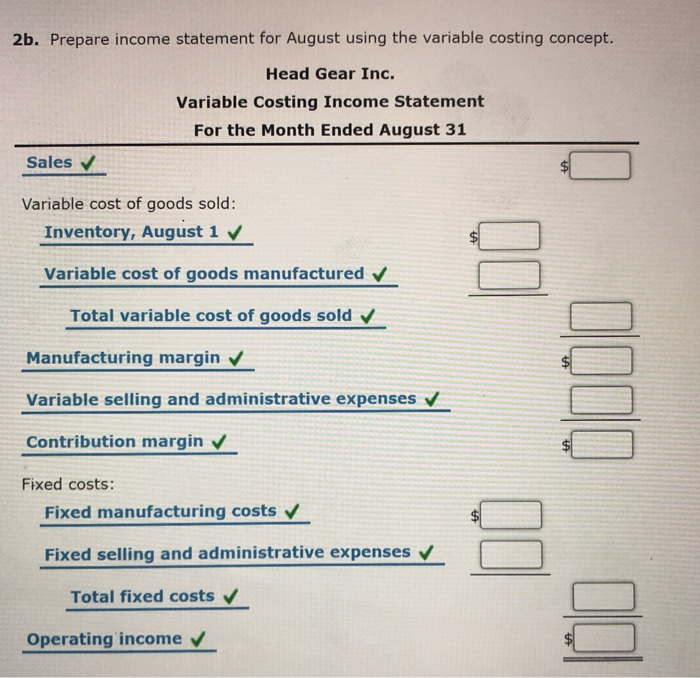

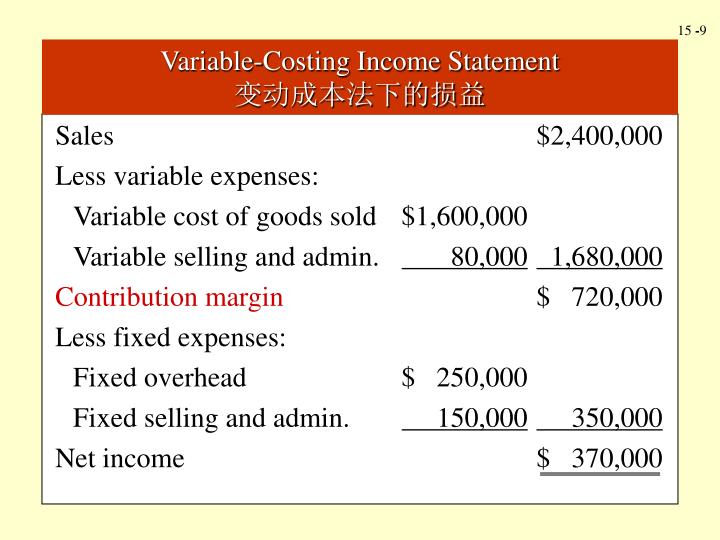

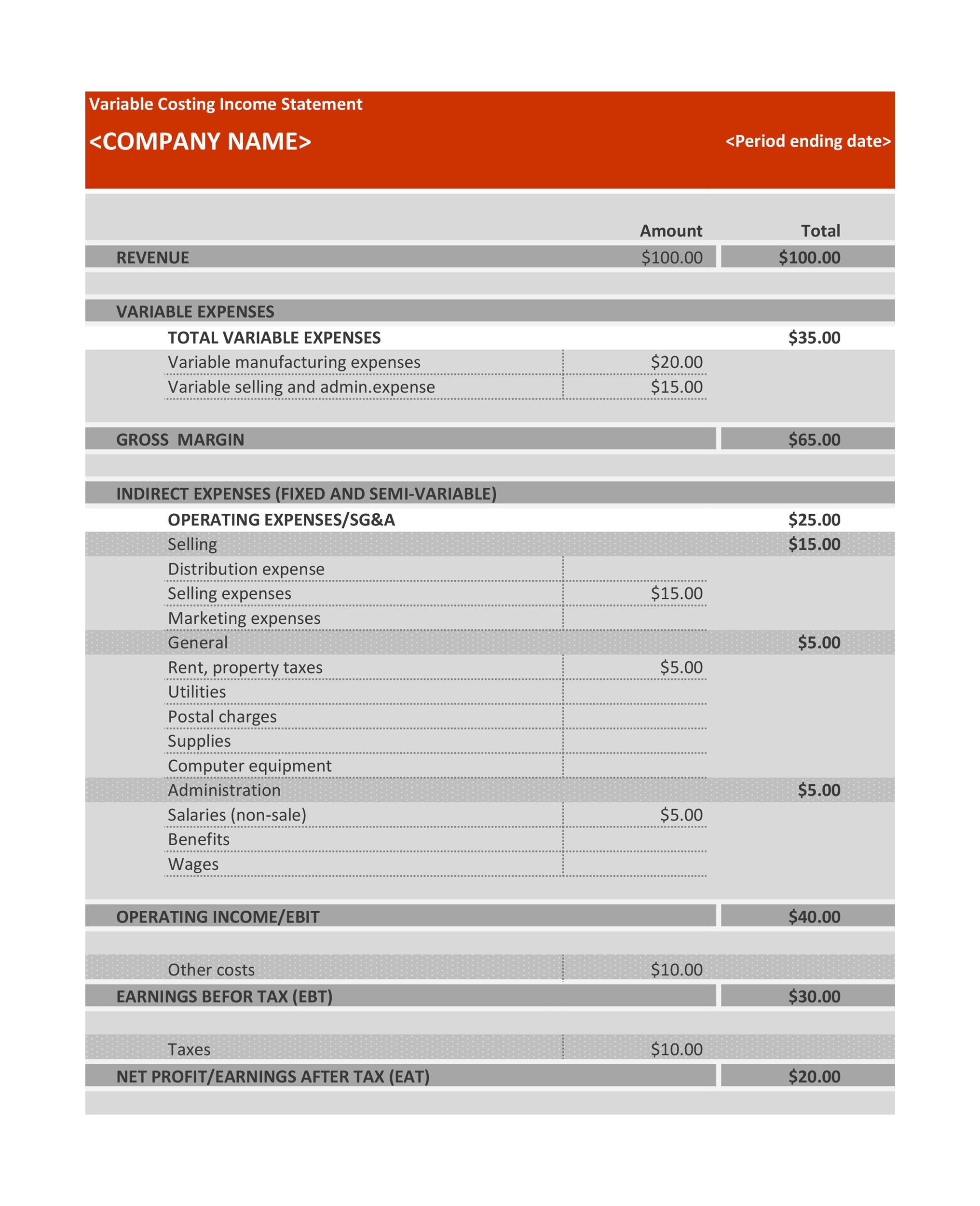

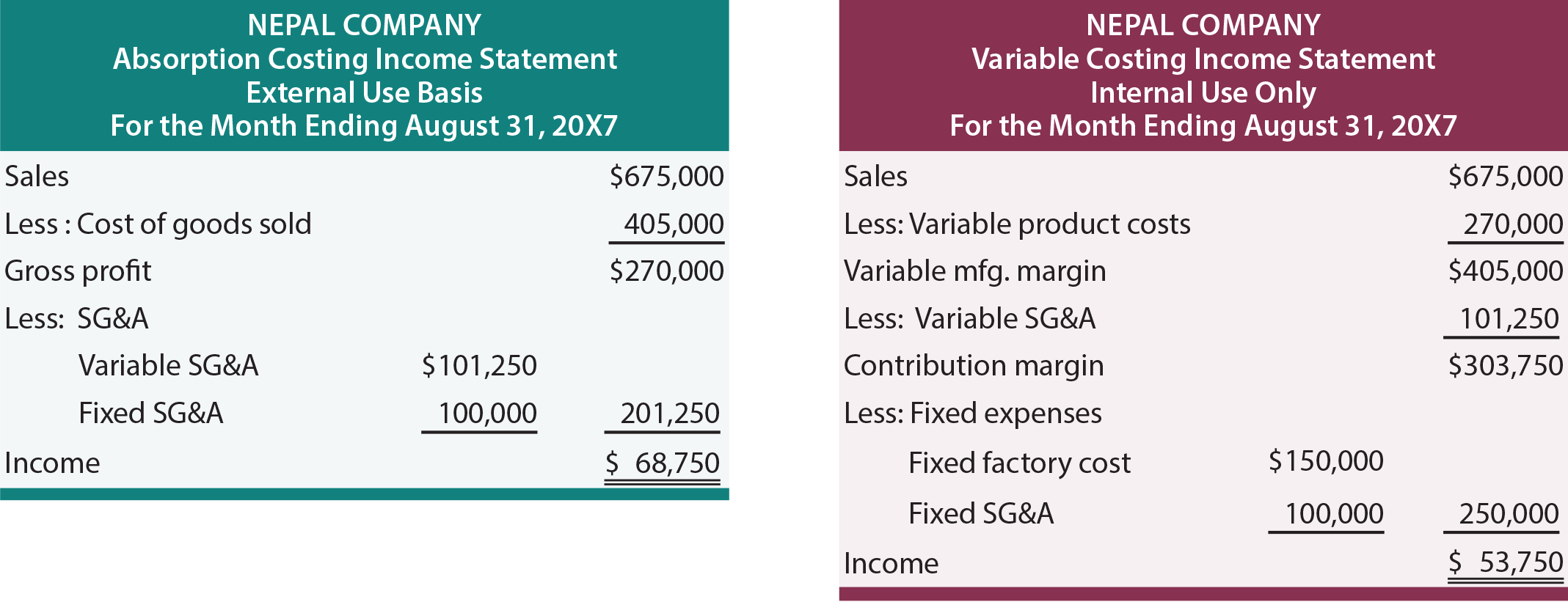

Calculates contribution margin while the absorption costing income statement calculates gross. A variable costing income statement is a type of income statement in which you subtract variable expenses from total sales revenue to arrive at a separate. A variable costing income statement is one in which all variable expenses are deducted from revenue to arrive.

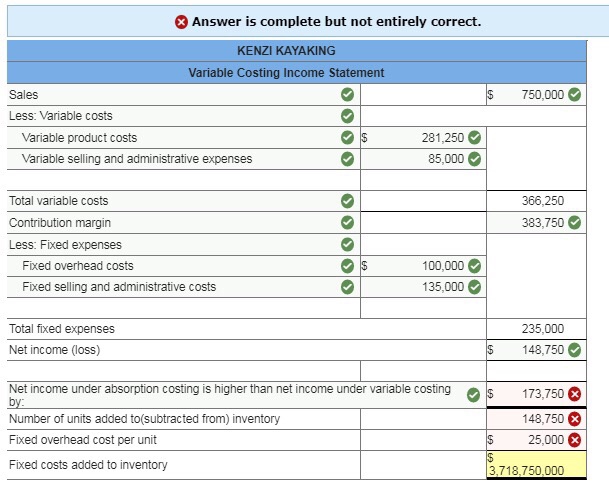

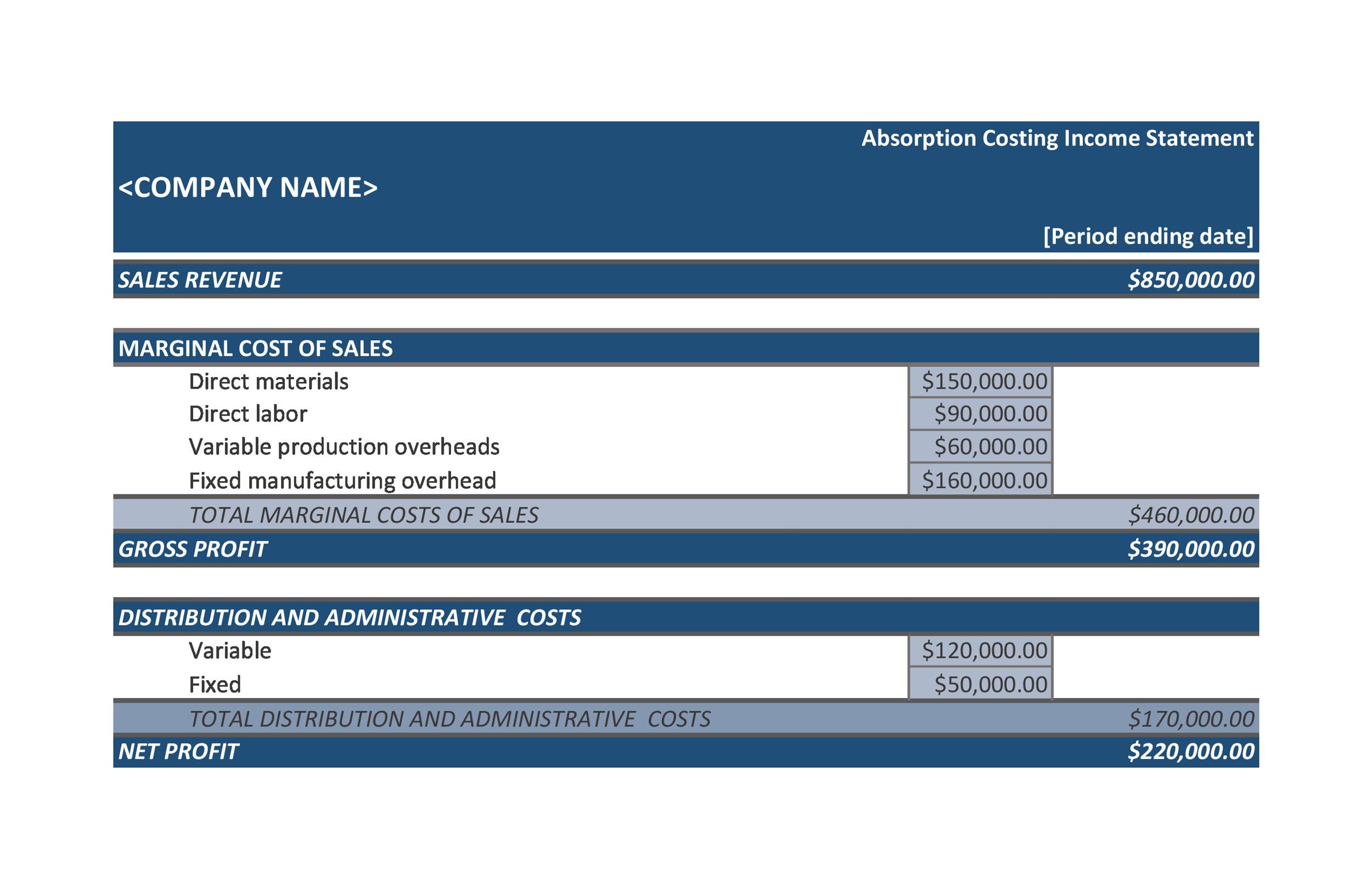

A variable costing income statement is a financial report in which you subtract the variable expenses from revenue, resulting in a contribution margin. The absorption costing income statement follows a more traditional format of computing gross profit first and then subtracting operating expenses. This problem has been solved!

In the variable costing income statement, the line that separates the variable and fixed costs is d. A variable costing income statement ______. Finance acct 2020 unit 1 smartbook blissful breeze manufactures and sells ceiling fans.

Cost of goods sold (9,000 x $3.30 per unit) 29,700: Once it arrives at that contribution, the variable costing. To make an income statement is necessary to use the calculation methods since they are.

Variable costing will only be a factor for companies that expense costs of goods sold (cogs) on their income statement. Similarly, those profits are known as the contribution to a particular product. In this statement, companies only deduct variable expenses for a specific period.

A traditional income statement uses absorption or full costing, where both variable and fixed manufacturing costs are included when calculating the cost of goods. Calculates contribution margin while the absorption costing income statement calculates gross margin. Expenses are separated into two accounts:

This format is referred to as an absorption costing income statement. What is a variable costing income statement? A variable costing income statement is a report prepared under the variable costing method.