Fine Beautiful Info About Indirect Method Of Cash Flow Example Investing Activities Definition

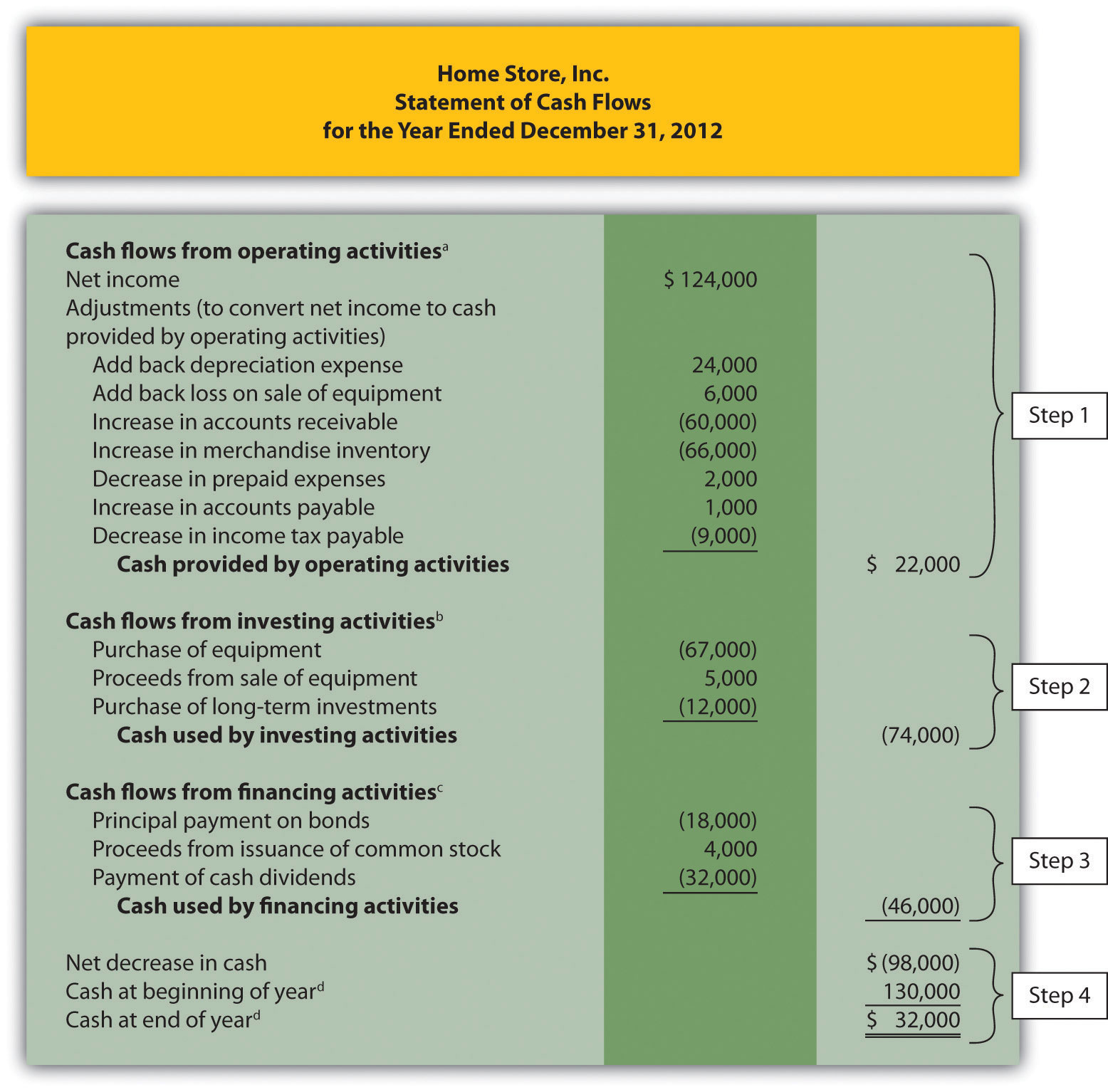

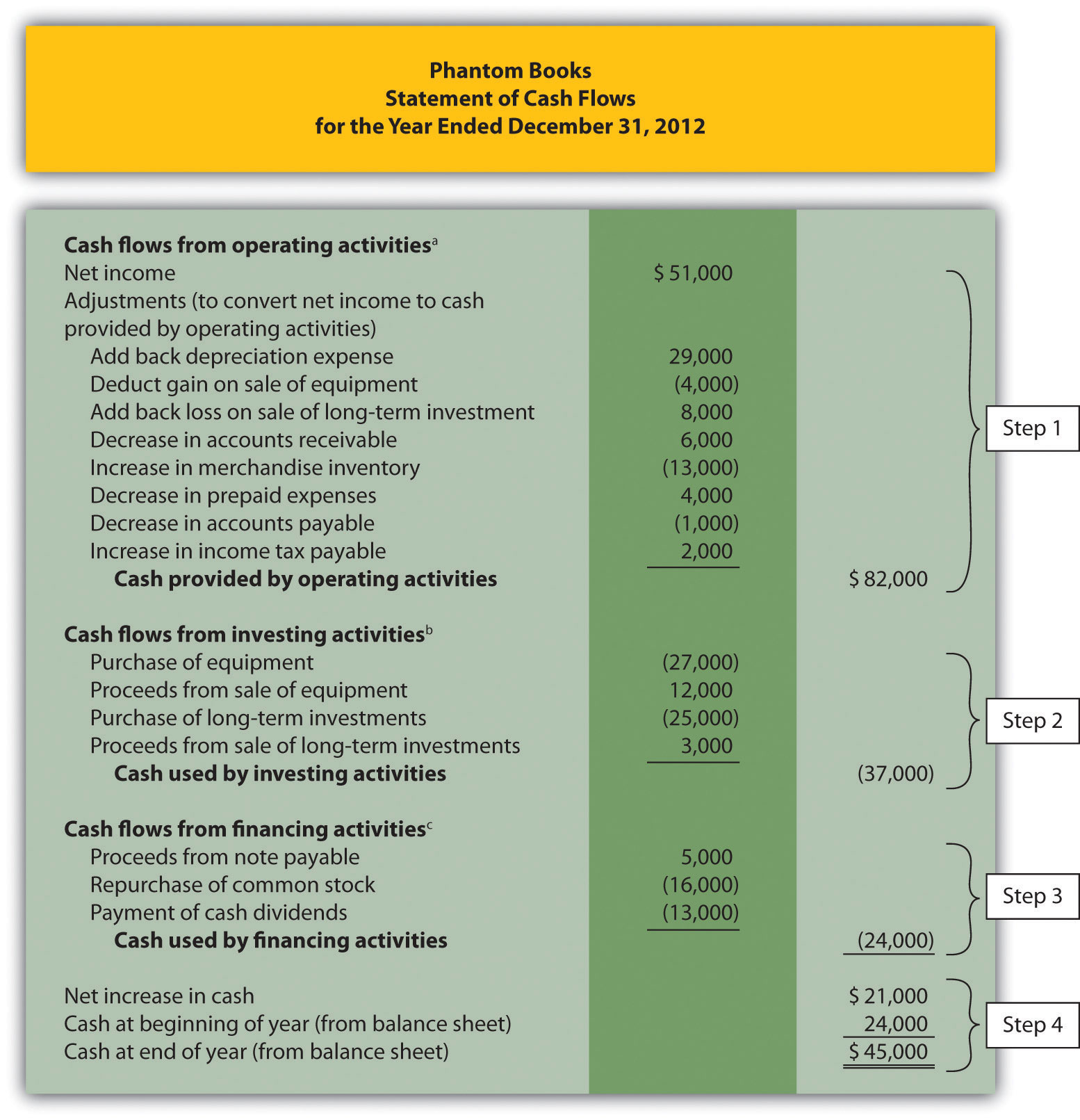

Using the balance sheet changes, the indirect method modifies the operating section of the cash flow statement.

Indirect method of cash flow example. The cash flow indirect method is a way to calculate a company's cash flow from the data on the cash statement. This example shows students the calculations and format of cash flows. The indirect method reports cash flows from operating activities into categories such as:

These adjustments include deducting realized gains and other adding back realized losses to the net income total. Under the accrual method of accounting, revenue is recognized when earned, not necessarily when cash is received. This statement will include information about the company’s operating, investing, and financing activities.

It starts with a business’s net income and then lists cash flows, both received and paid, for various activities (i.e., the three cash flow categories: In other words, changes in asset and liability accounts that affect cash balances throughout the year are added to or subtracted from net income at the end of the period to.

Begin with net income from the income statement. Here we will study the indirect method to calculate cash flows from operating activities. Definitions and examples evans kimatu updated march 10, 2023 businesses monitor various metrics when reporting financial statements and tracking how much money they spend and earn.

Download a free statement of cash flows template download cfi’s free excel template and start practicing today. Profit and loss account net sales 95,000 cost of goods sold (44,000) gross profit 51,000 operating expenses (including deprecation) (28,600) net profit 22,400 dividend declared and paid 20,000 Most use the indirect method.

Cash flow statement: Why is the cash flow statement important? Indirect cash flow method.

Depreciation (10,000) accounts payable (20,000) accounts receivable: Cash flows from investing activities. Add back noncash expenses, such as depreciation, amortization, and depletion.

Indirect method [explained & example] accounting 101 the cash flow statement gives a great insight into a company’s cash management. You will also get to learn the full format of the indirec. In the presentation format, cash flows are divided into the following general classifications:

The company started on 1st january 2003, when it issued 60,000 shares of $1 par value common stock for $60,000 cash. To illustrate indirect method of statement cash flows, we will use the first year of operation for tax consultants inc. The direct method converts each item on the income statement to a cash basis.

The cash flow statement indirect method is used by most corporations, begins with a net income total and adjusts the total to reflect only cash received from operating activities. If a customer buys a $500 widget on credit,. Creating the cash flow statement using the indirect method is considered one of the most challenging exercises in finance since it requires thorough knowledge of accounting methodologies, the company's business model, debt calculations, tax calculations, and the way in which these items fit together.