The Secret Of Info About Balance Income Statement Auditor General Report 2016

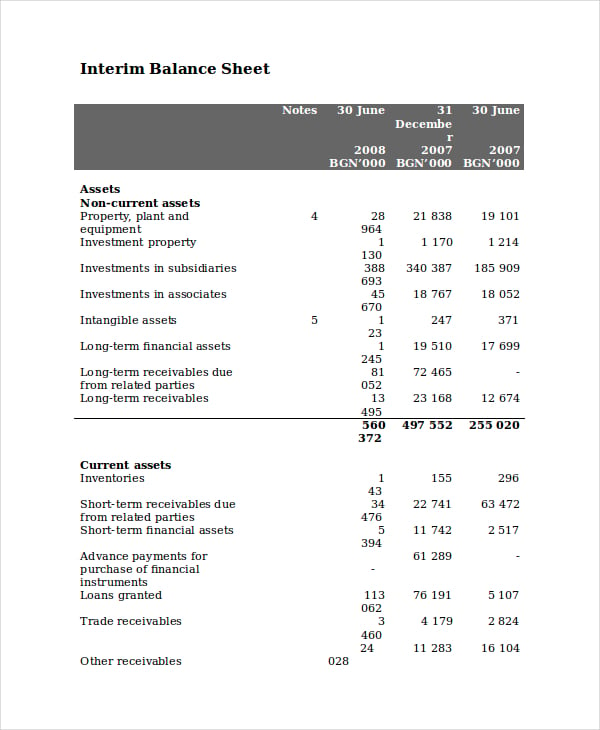

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

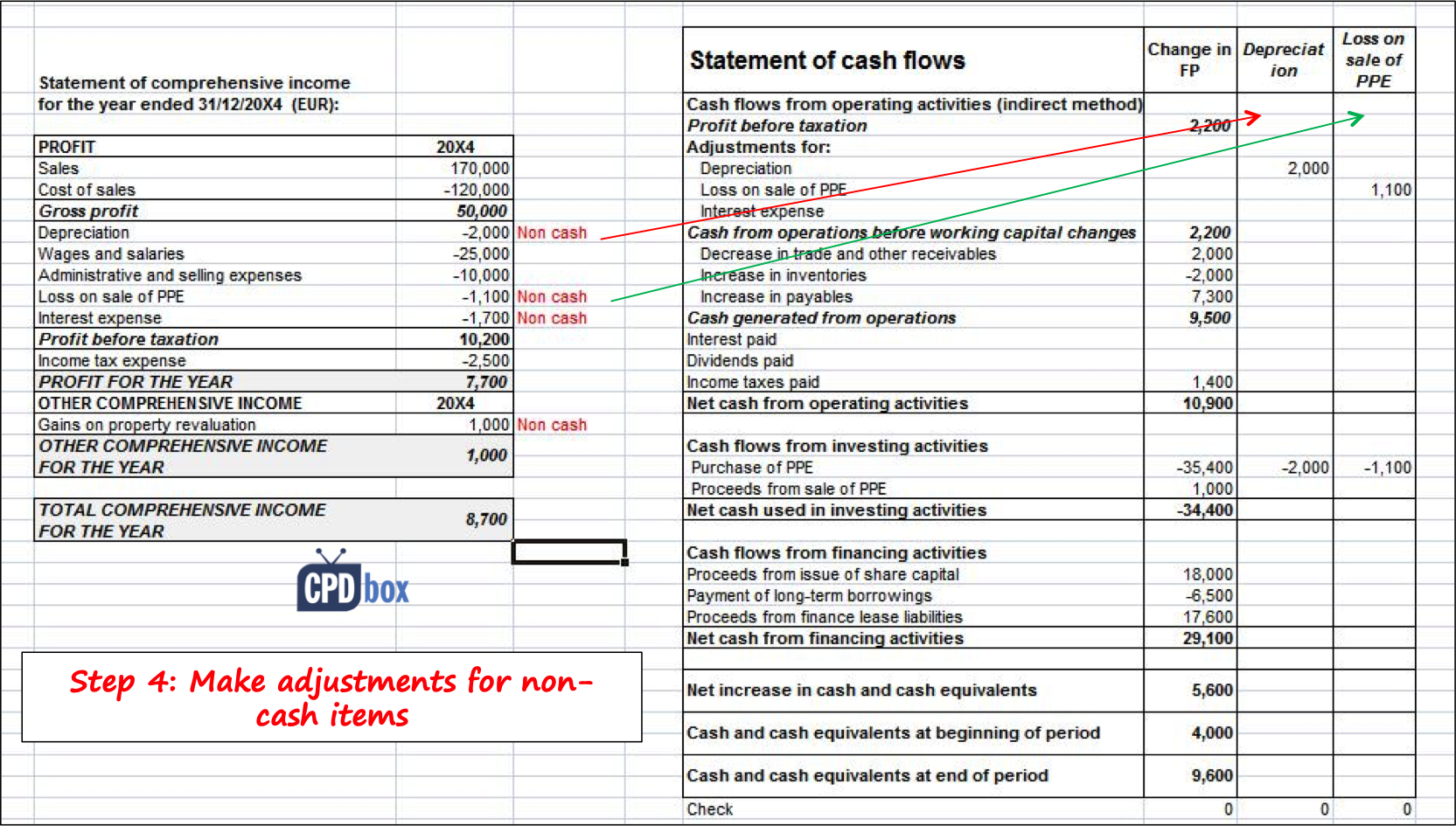

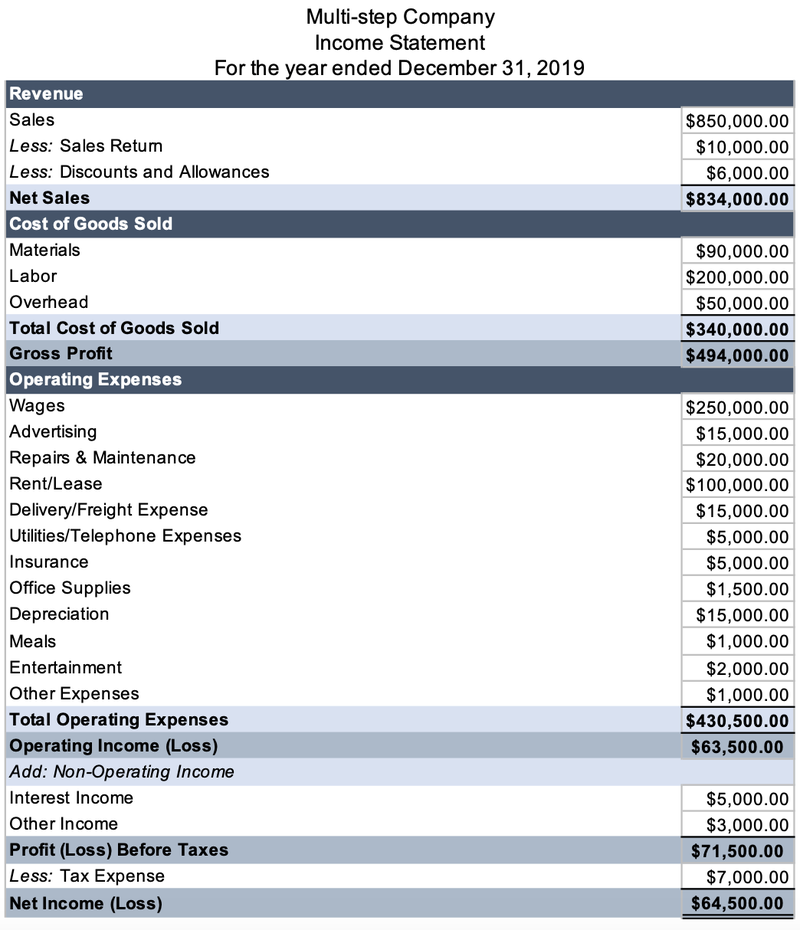

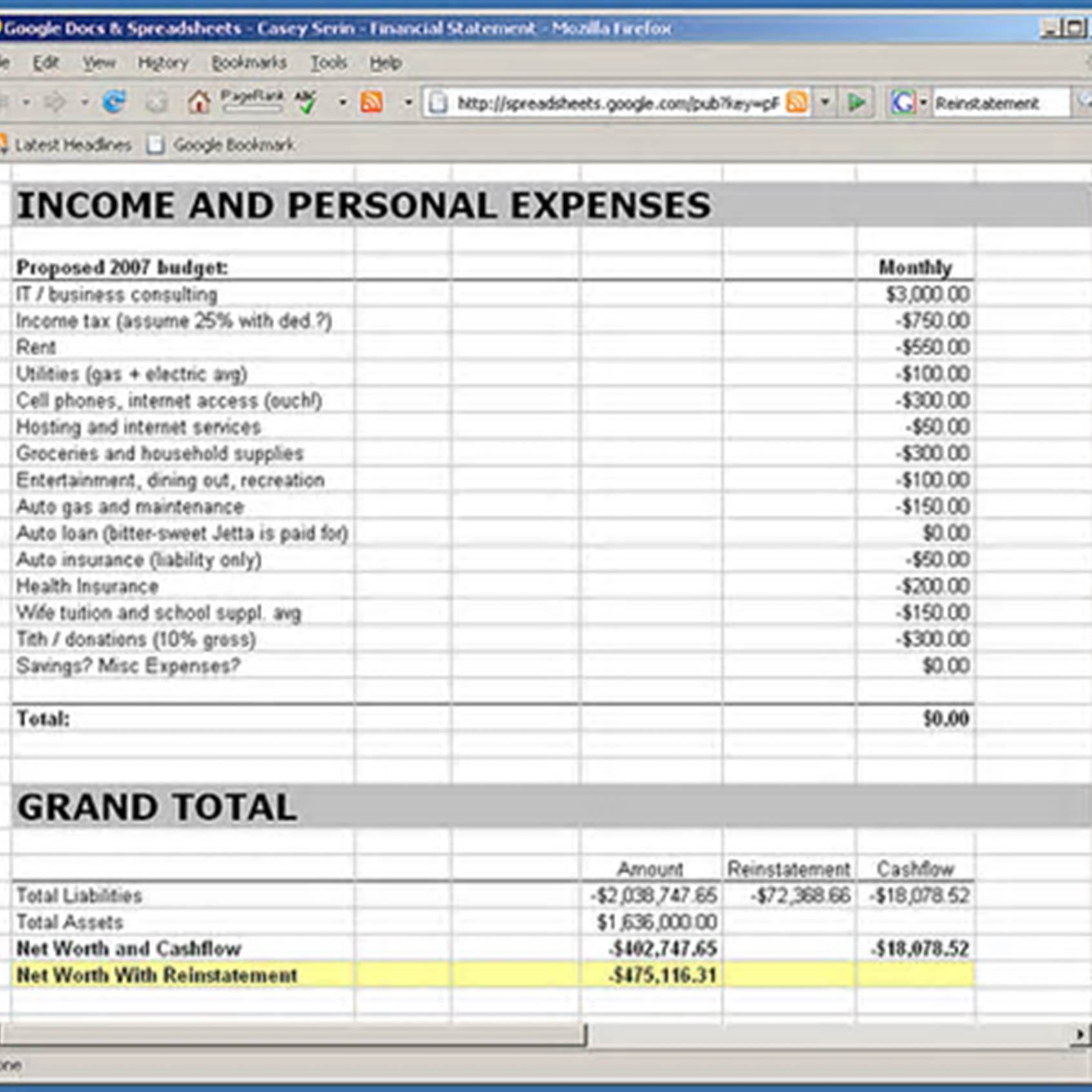

Balance income statement. To do this, you’ll need to add liabilities and shareholders’ equity together. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it. An income statement shows a company’s revenue, expenses, gains and losses over a.

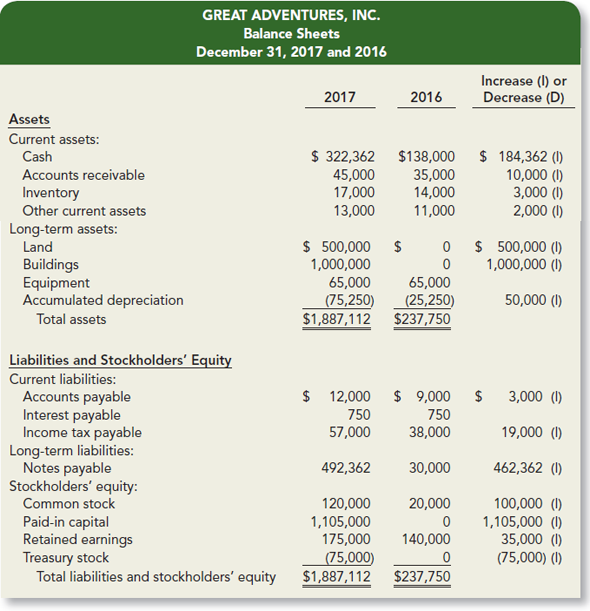

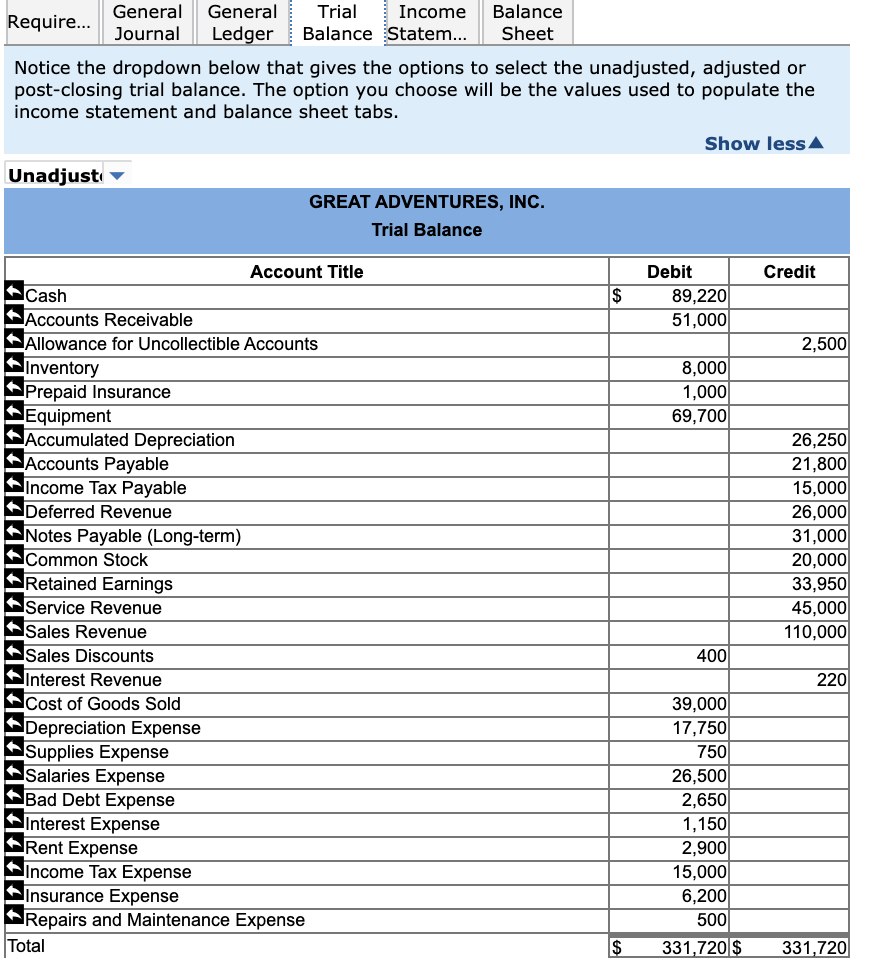

While the definition of an income statement may remind you of a balance sheet, the two documents are designed for different uses. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity. A balance sheet and an income statement are financial tools used to manage a business’s financial performance.

The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. Analyzing these three financial statements is one of the key steps when creating a financial model. Must be a resident of new brunswick at the time of application.

The statement balance is the total amount you owed on your credit card at the end of the last credit card billing cycle. The difference between a balance sheet and an income statement is the information they show and the period of time they cover. The balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time, highlighting its financial position.

An income statement is a financial report detailing a company’s income and expenses over a reporting period. Statements and releases today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable. As fixed assets age, they begin to lose their value.

Balance sheet and income statement relationship (video) | khan academy course: In financial accounting, the balance sheet and income statement are the two most important types of financial statements (others being cash flow statement, and the statement of retained earnings). A balance sheet highlights its assets, liabilities, equity, and other financial investments at a given time.

A balance sheet, on the other hand, records assets, liabilities, and equity. Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business activities and profitability for. Partnership income tax returns will need.

On the other hand, the income statement offers a. These three financial statements are intricately linked to one another. The balance sheet and the income statement provide distinct yet interconnected perspectives on a company’s financial standing.

Had $3,000 or more in family working income for that taxation year. Add total liabilities to total shareholders’ equity and compare to assets. The three core financial statements are 1) the income statement, 2) the balance sheet, and 3) the cash flow statement.

The income statement details your total revenues and expenses over a longer period to show you how the company is performing overall. Together, they tell a more complete story. Written by cfi team what is the balance sheet?