Nice Tips About Income Tax 26as Form View Canadian Bank Stock Performance

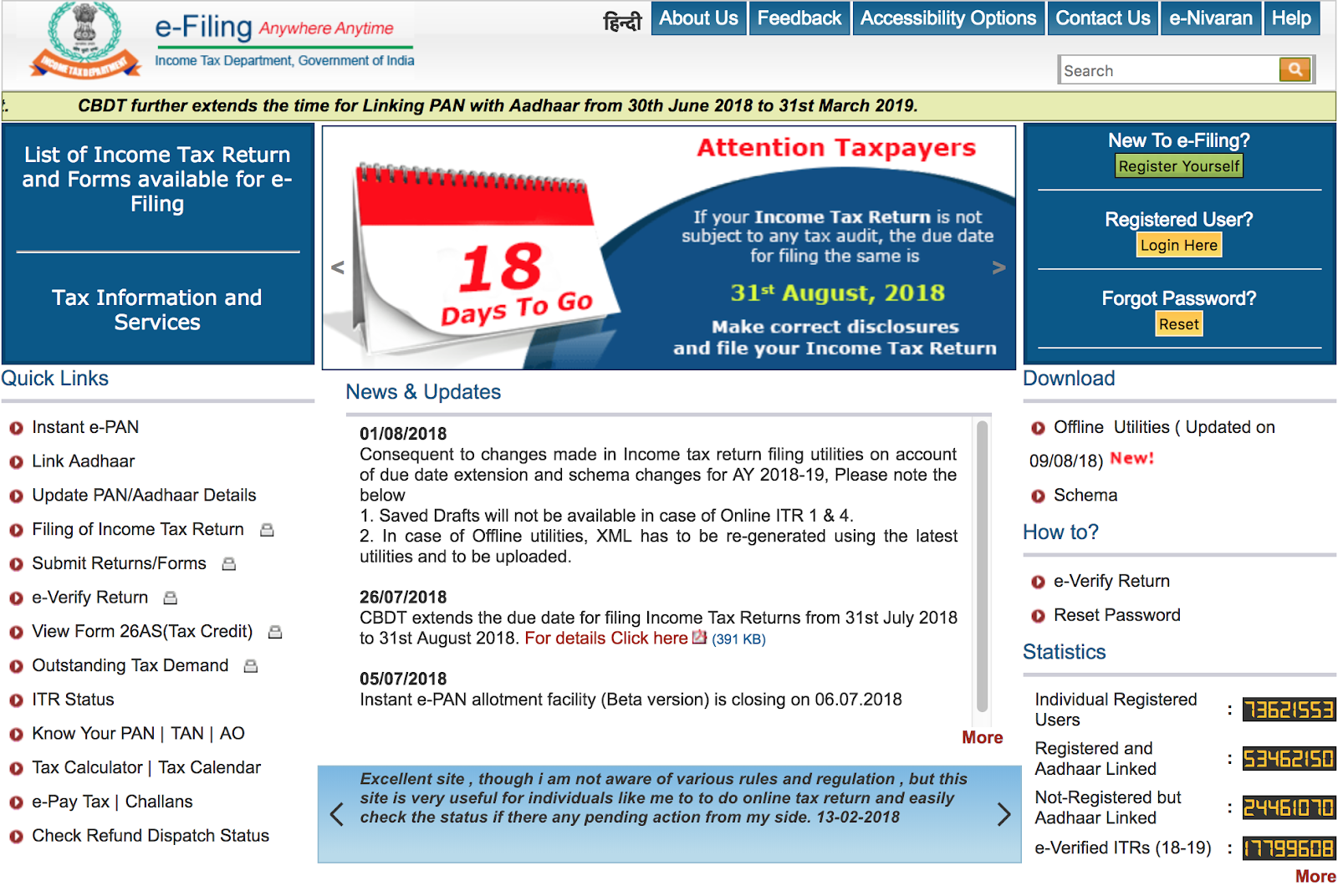

On the tds reconciliation analysis and correction enabling system (traces) portal.

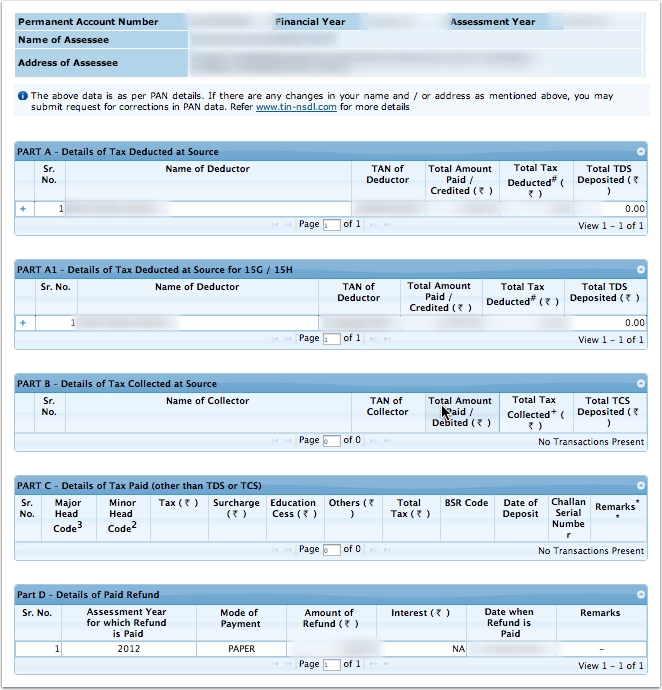

Income tax 26as form view. The income tax department’s website provides an option to view form 26as by logging in using one’s pan (permanent account number). You will need to file a return for the 2024 tax. How to view form 26as?

If you are not registered with traces, please refer to our e. There are a lot of tax documents: One way to understand whether your benefits are taxable is to consider gross income, which is your total earnings before taxes.

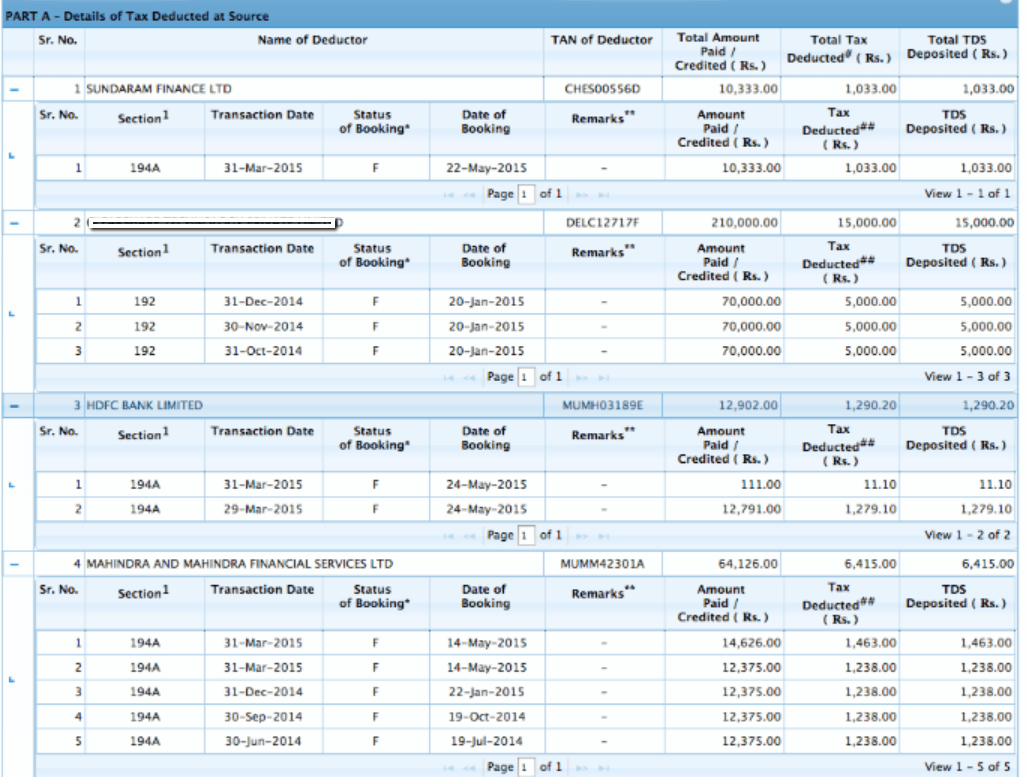

You can visit the traces website to download form. Select 'view tax credit', choose 'assessment year', 'view type' as. Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly contains the taxes that are paid on your.

Details regarding yearly turnover details regarding received income tax refund. Form 26as is a consolidated statement from the income tax department that contains details of tax deductions and tax exemptions. However, not all banks provide the facility.

You may view form 26as by pan no. Meet srishti, an indian citizen currently residing and working in the usa.recently, she checked her form 26as online and discovered a tds entry of inr. How to view form 26as?

1) visit page www.incometaxindiaefiling.gov.in of income tax and locate the form 26as which is. Here are some steps to easily download form 26as on the new income tax portal. The website provides access to the pan holders to view the details of tax credits in form 26as.

This article explores the evolving role of form 26as as a comprehensive tax credit statement. How do i get form 26as or the tax credit statement? Password for the income tax portal.

Log in with your account information to view or download form 26as. The article details its expanded scope, covering diverse financial. Read the disclaimer, click 'confirm' and the user.