Have A Info About Purpose Of Retained Earnings Statement Llp Balance Sheet Format 2018 In Excel

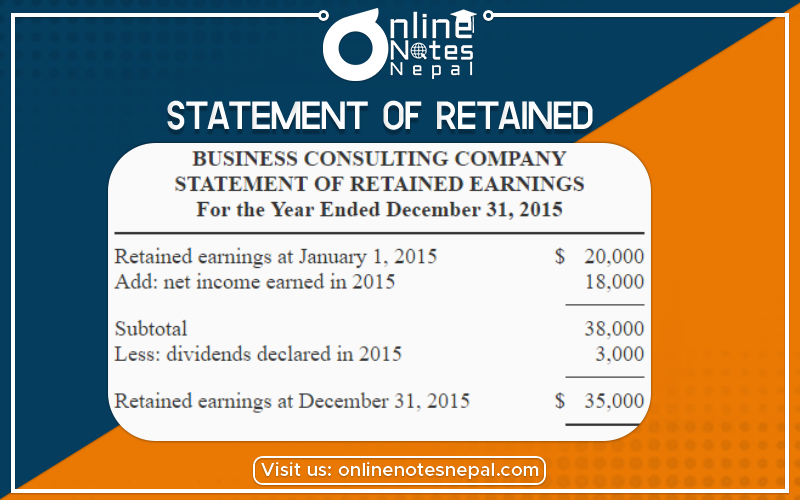

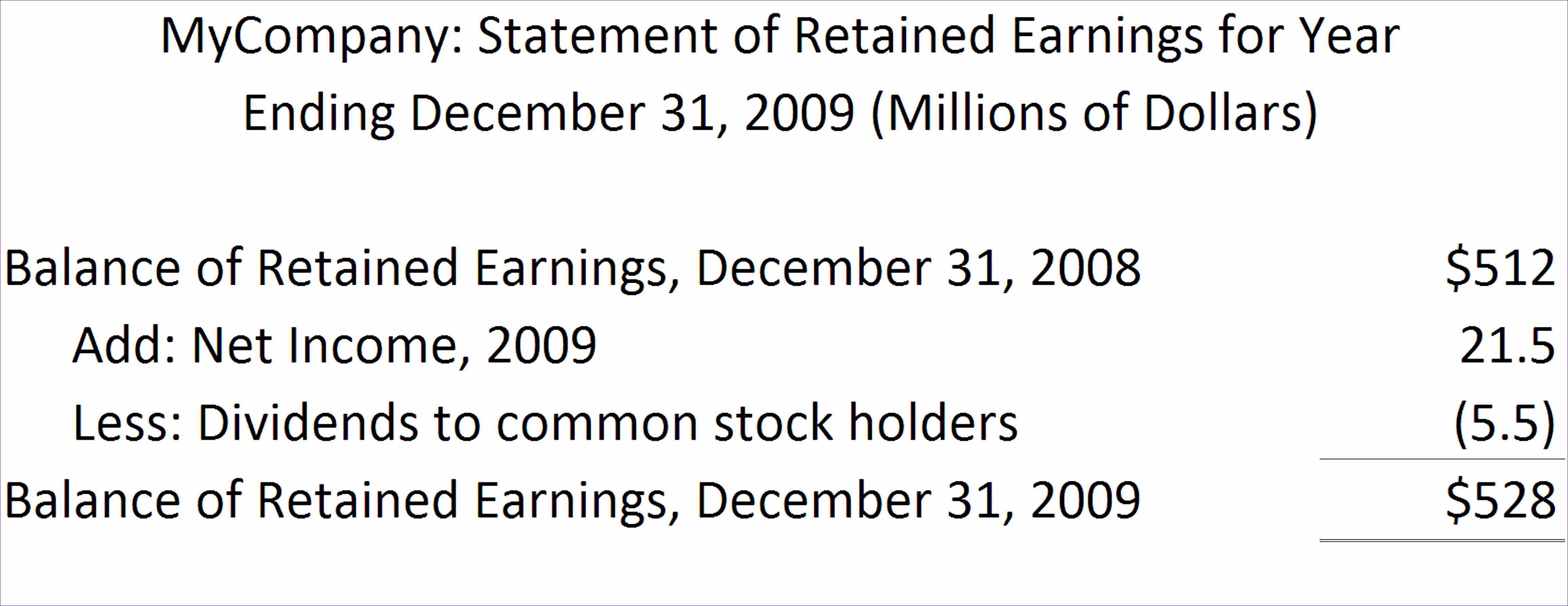

Let's break down the retained earnings calculation for abc ltd:

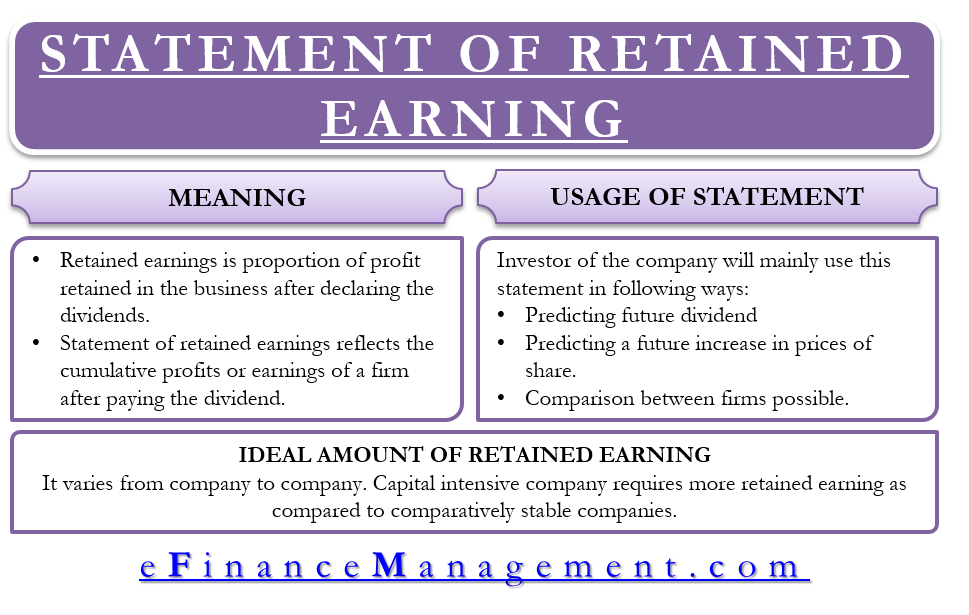

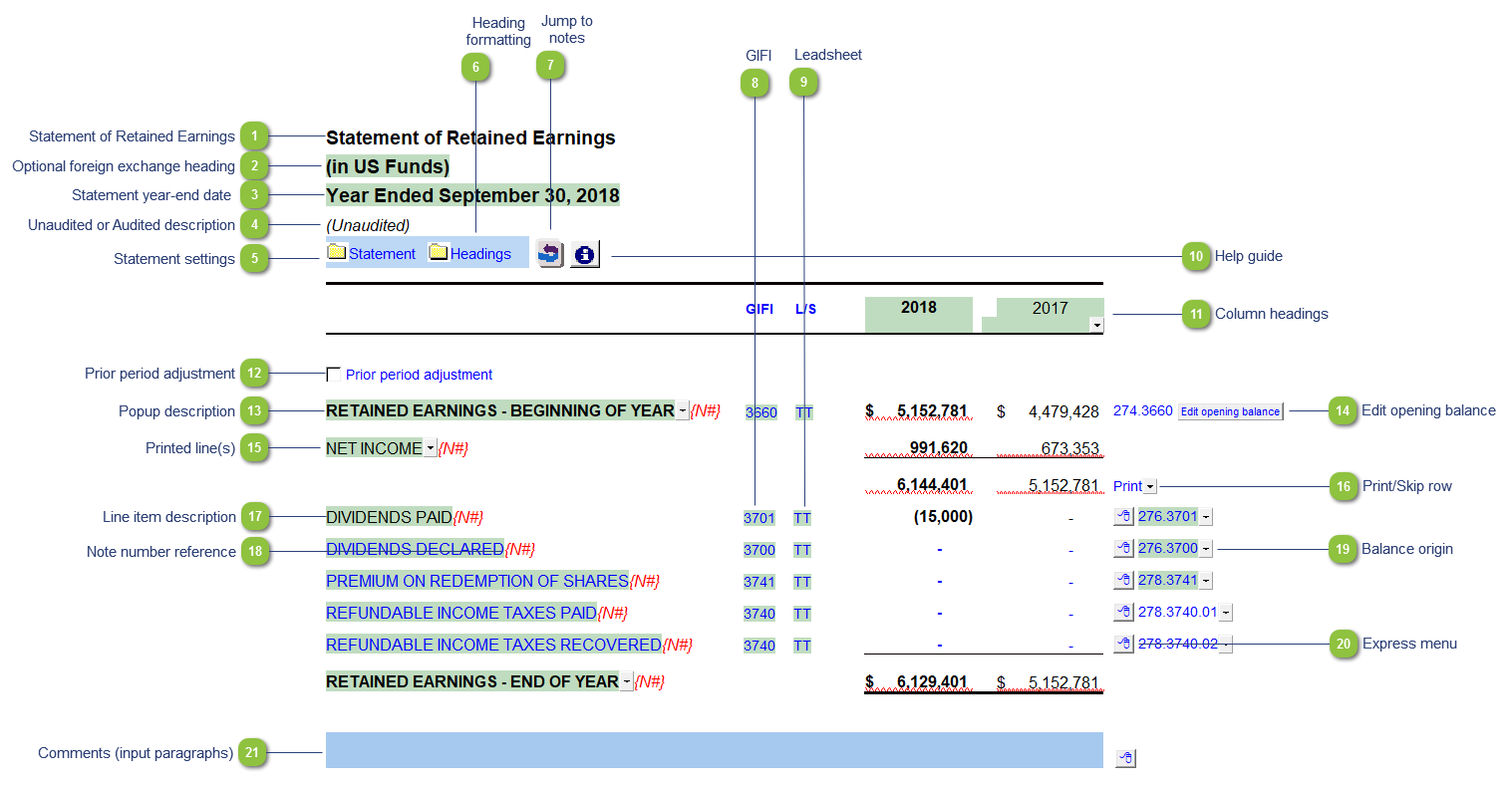

Purpose of retained earnings statement. The retention ratio is the amount of profit. The statement of retained earnings reconciles changes in the retained earnings account during a reporting period. Retained earnings are the profits or net income that a company chooses to keep rather than distribute it to the shareholders.

What is the purpose of retained earnings? The primary purpose of a statement of retained earnings is to disclose changes in a company’s retained earnings over a specific time frame, usually a fiscal year. The decision to retain the earnings or distribute them.

By comparing retained earnings balances over time, investors can better predict future dividend payments and improvements to share price. Retained earnings essentially reflect the portion of a company’s past earnings that it has chosen to keep rather than distribute as dividends. It is a financial statement that summarizes the changes in a company’s retained earnings over a period of time.

A statement of retained earnings shows changes in retained earnings over time, typically one year. The statement of retained earnings can help investors analyze how much money the company’s shareholders take out of the business for themselves, versus how much they’re leaving in the company to be reinvested. The statement of retained earnings (retained earnings statement) is defined as a financial statement that outlines the changes in retained earnings for a specified period.

The statement of retained earnings is a useful linkage between the income statement and the balance sheet as it records the net income transfer after dividends from the income statement to the shareholders’ equity in the balance sheet. By examining the proportion of earnings retained, investors can gain insights into management’s capital allocation strategy. The statement of retained earnings is a financial statement that reports the business's net income or profit after dividends are paid out to shareholders.

The purpose of retaining these earnings can be varied and includes buying new equipment and machines, spending on research and development, or other activities that. The purpose of retained earnings can be diverse and may include buying new property & machinery, paying off debt, investing in research and development, and other activities that could increase the growth of the company and result in potential profits. Retained earnings represent a useful link between the income statement and the balance sheet, as they are recorded under shareholders’ equity, which connects the two statements.

During the year, the company earned a net income of $200,000 and distributed $50,000 in dividends. The numbers provide insight into a company’s financial position and the owner’s attitude toward reinvesting in and growing their business. Financial analysis cont… today’s session is emphasizing on ‘statement of change in equity & statement of cash flows’.

The company's annual net income was $200,000. This statement is primarily for the use of outside parties such as investors in the firm or the firm's creditors. Also, the purpose of the retained earnings statement is to outline what a company does with its profits to show the trend of how the company invests in growth and development.

The statement of retained earnings is also called the statement of changes in equity (soce); Most financial statements have an entire section for calculating retained earnings. The statement of retained earnings (retained earnings statement) is a financial statement that outlines the changes in retained earnings for a company over a specified period.

Retained earnings serve as a link between the balance sheet and the income statement. Who uses the statement of retained earnings. It merely divides retained earnings into two parts—appropriated retained earnings and unappropriated retained earnings.

:max_bytes(150000):strip_icc()/statement-of-retained-earnings-final-8500839aff40433dba054ce0af9f9f42.png)