Nice Tips About Sole Proprietorship Income Statement Get Form 26as

Thus it is not included in the income statement.

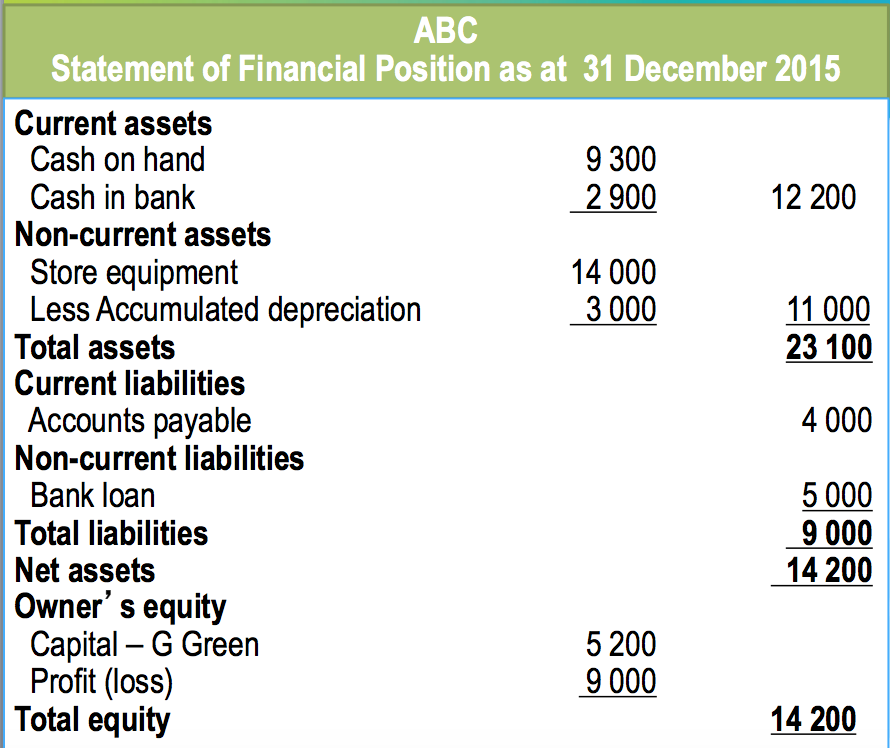

Sole proprietorship income statement. A sole proprietorship (also known as individual entrepreneurship, sole trader, or proprietorship) is a type of unincorporated entity that is owned only. The statement of owner’s equity, which is the second financial statement created by accountants, is a statement that shows how the equity (or value) of the organization has. You’ll complete a separate form for your sole proprietorship taxes, schedule c, which you file with your personal income tax form, form 1040.

When you file your income tax and benefit return, you must include financial statements or one or more of the following forms, as applicable: Alexandra twin updated december 19, 2023 reviewed by khadija khartit fact checked by jared ecker investopedia / theresa chiechi what is a sole. A sole proprietorship is an unincorporated business with one owner.

If you are liable for: In describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate, we discussed the function of and. Here is a sample income statement of a service type sole proprietorship business.

Templates include calculations for revenue, expenses, and overall profit and loss, and they are used to document, analyze, and project business finances. This blank profit and loss statement allows you to record quarterly financial data over one year. Forms for sole proprietorship.

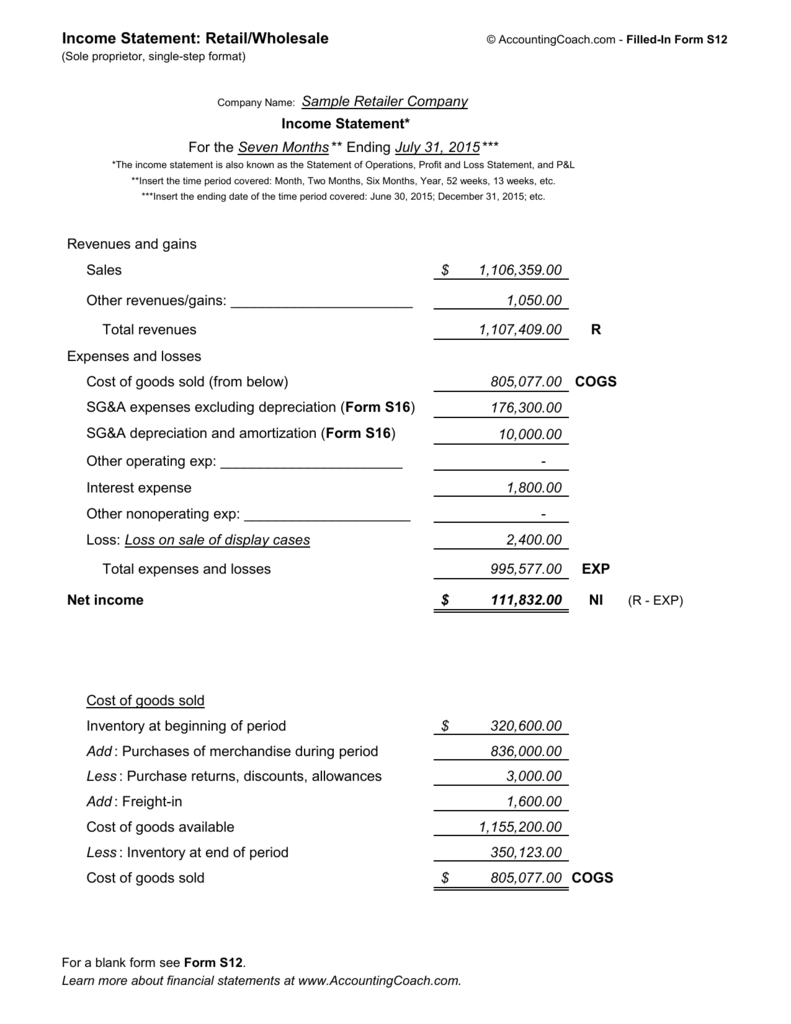

The statement of financial performance, also known as the income statement or trading account, reports the results of earnings activities for a specific time. A small business income statement template is a financial statement used to report performance. Also, if your combined income exceeds $200,000 for 2022, you’ll pay an additional medicare tax rate of 0.09%.

The template layout is simple and intuitive, including sections for. Prepare your sole proprietorship's income statement to reflect that the profit or loss from your business is the same as your personal business income for the. This form is designed for a sole proprietorship involved in retail or wholesale operations.

As soon as you embark on a solo side gig, freelance job, or a new business venture, you’re. We've named the company carter printing services. Form t2125, statement of business.