Spectacular Tips About Forecasted Income Statement Example Fund Flow Problems With Adjustments

Decide how you’ll make projections.

Forecasted income statement example. Your income this year is $37,000. Because costs of goods sold is a major expense for most companies, it is an extremely important input to a forecast of the income statement. Besides past records, there’s other data you can draw on to make your projections more accurate.

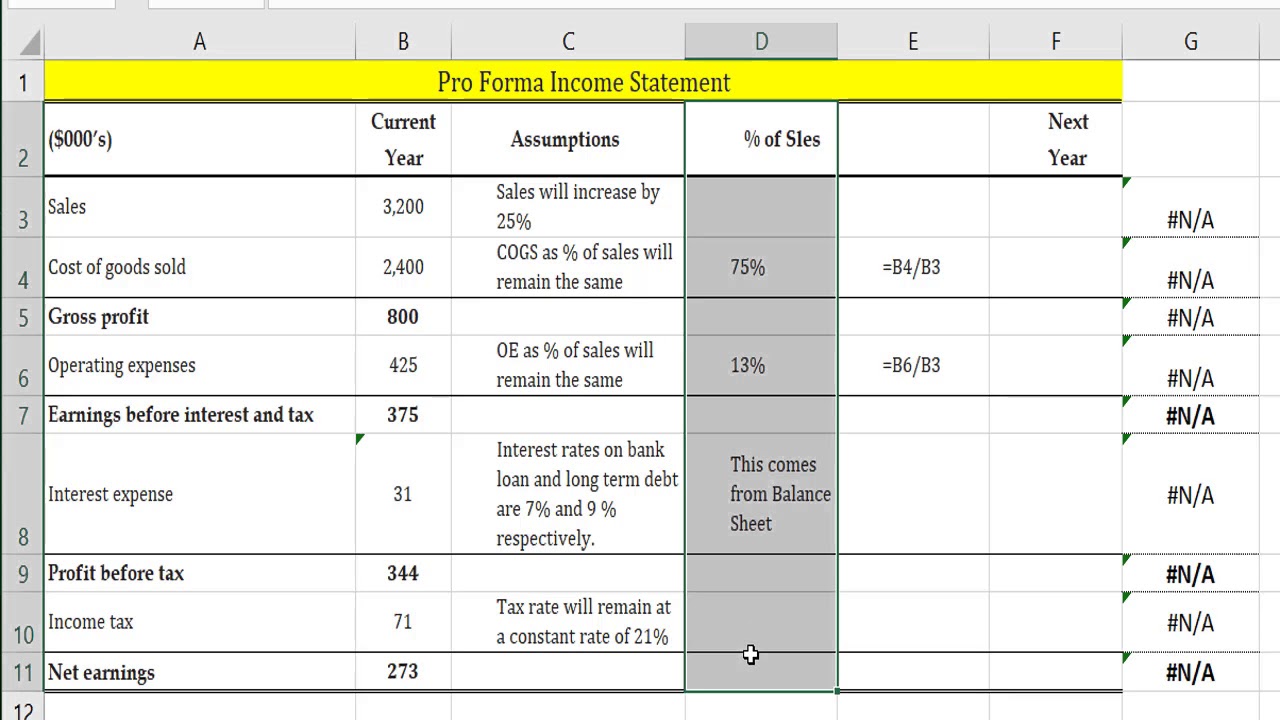

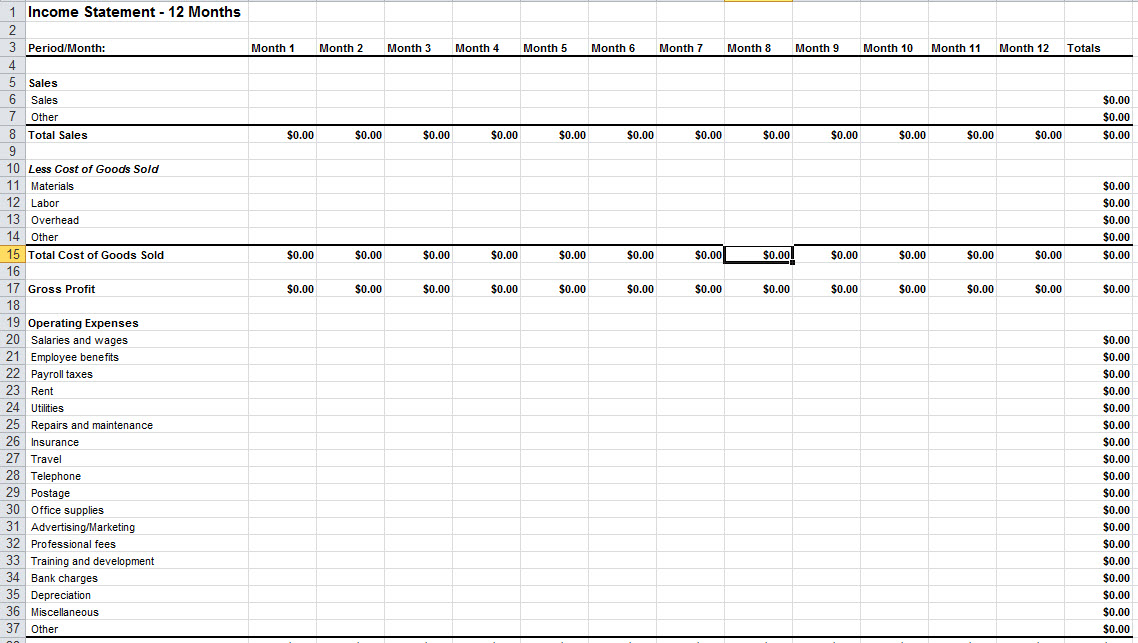

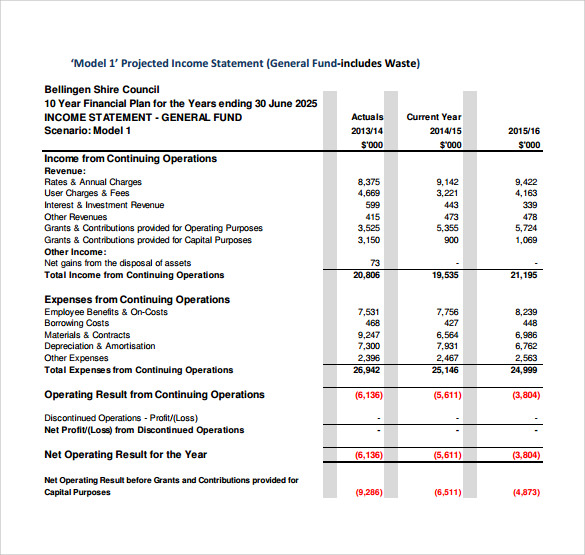

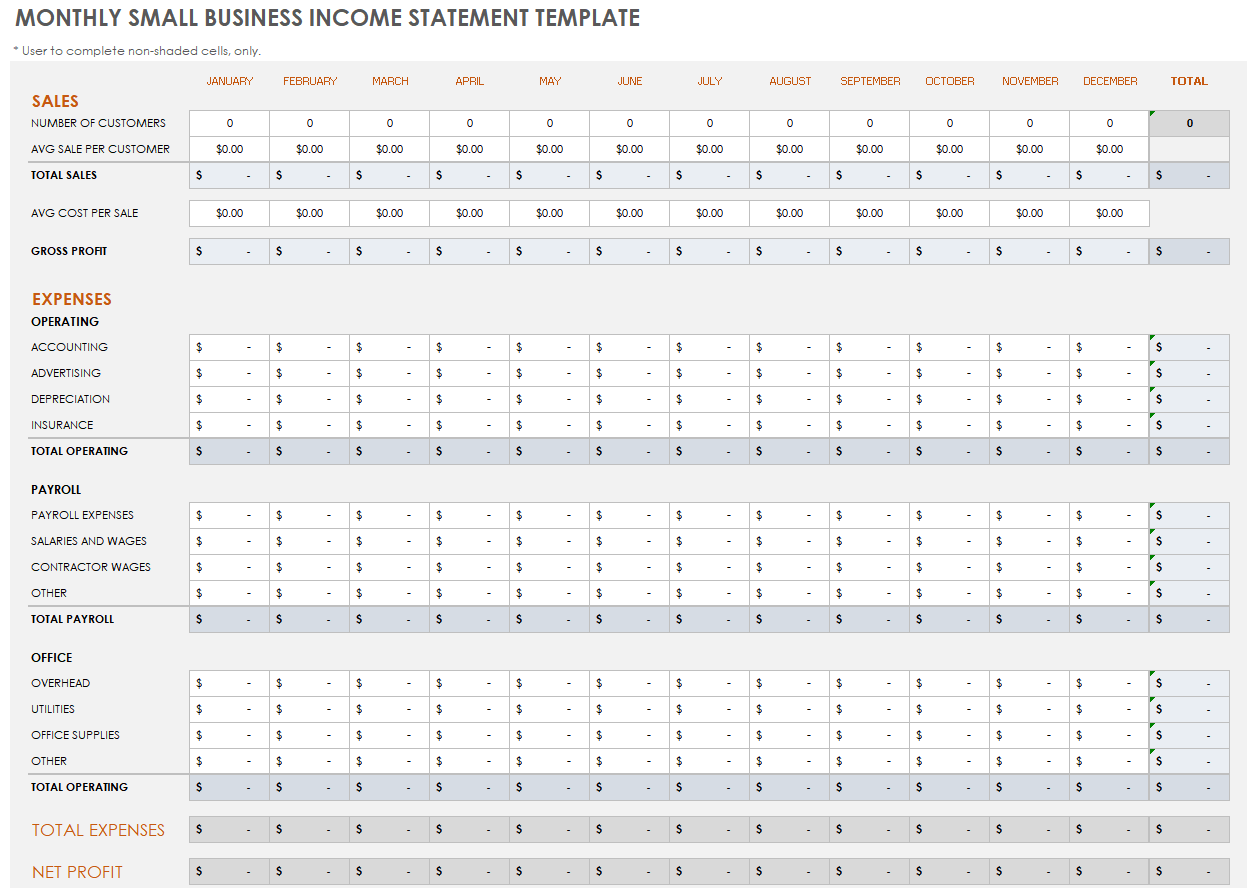

Salaries are paid monthly and thus represent the same recurring monthly cash outflow, as does rent. Startups create financial projections in the form of a pro forma income statement — which simply means a financial forecast. Income statement forecast format.

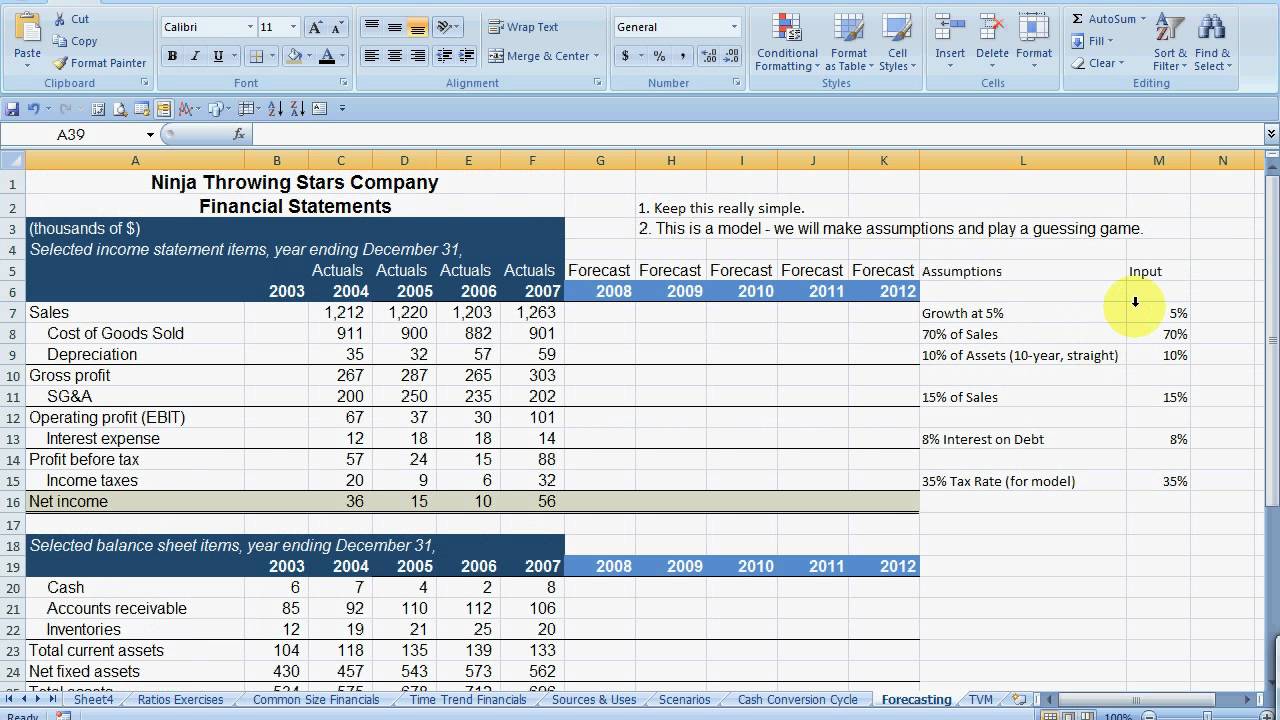

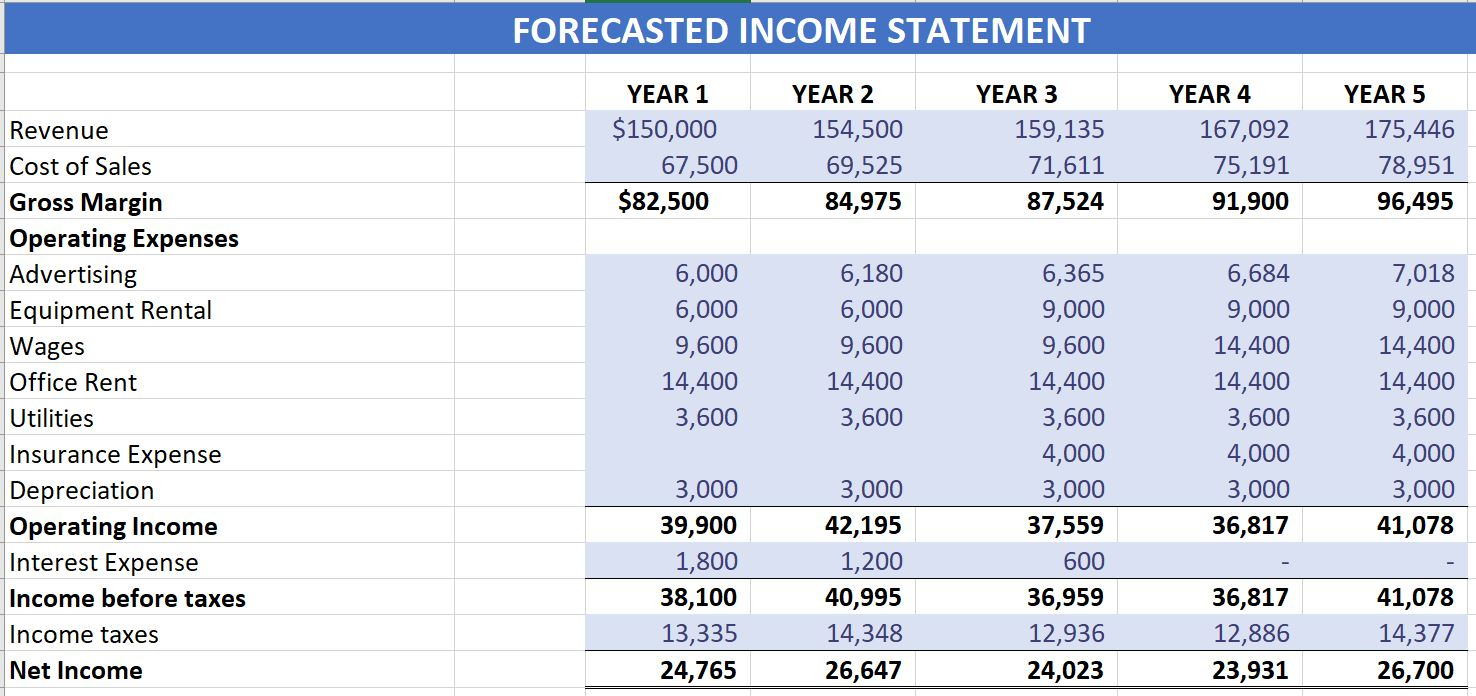

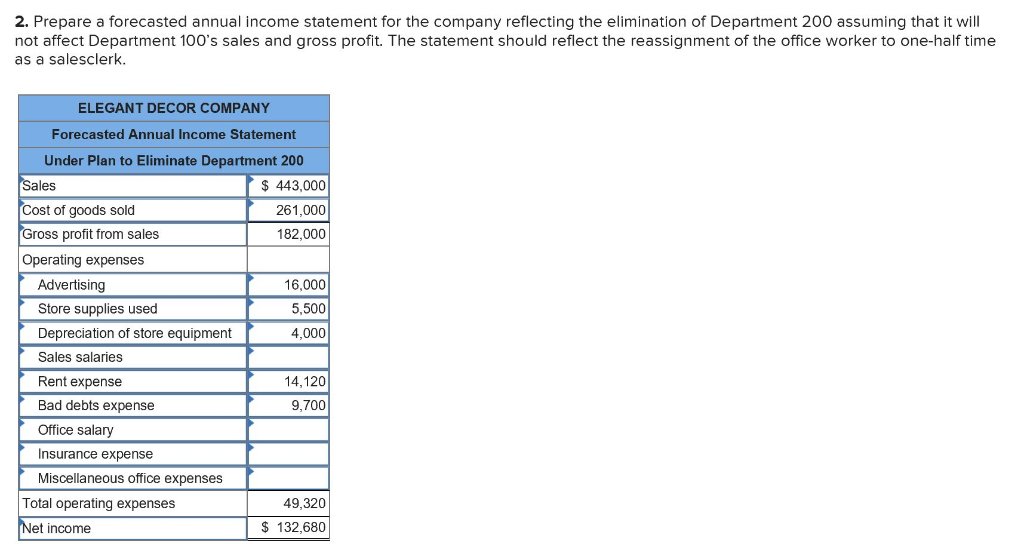

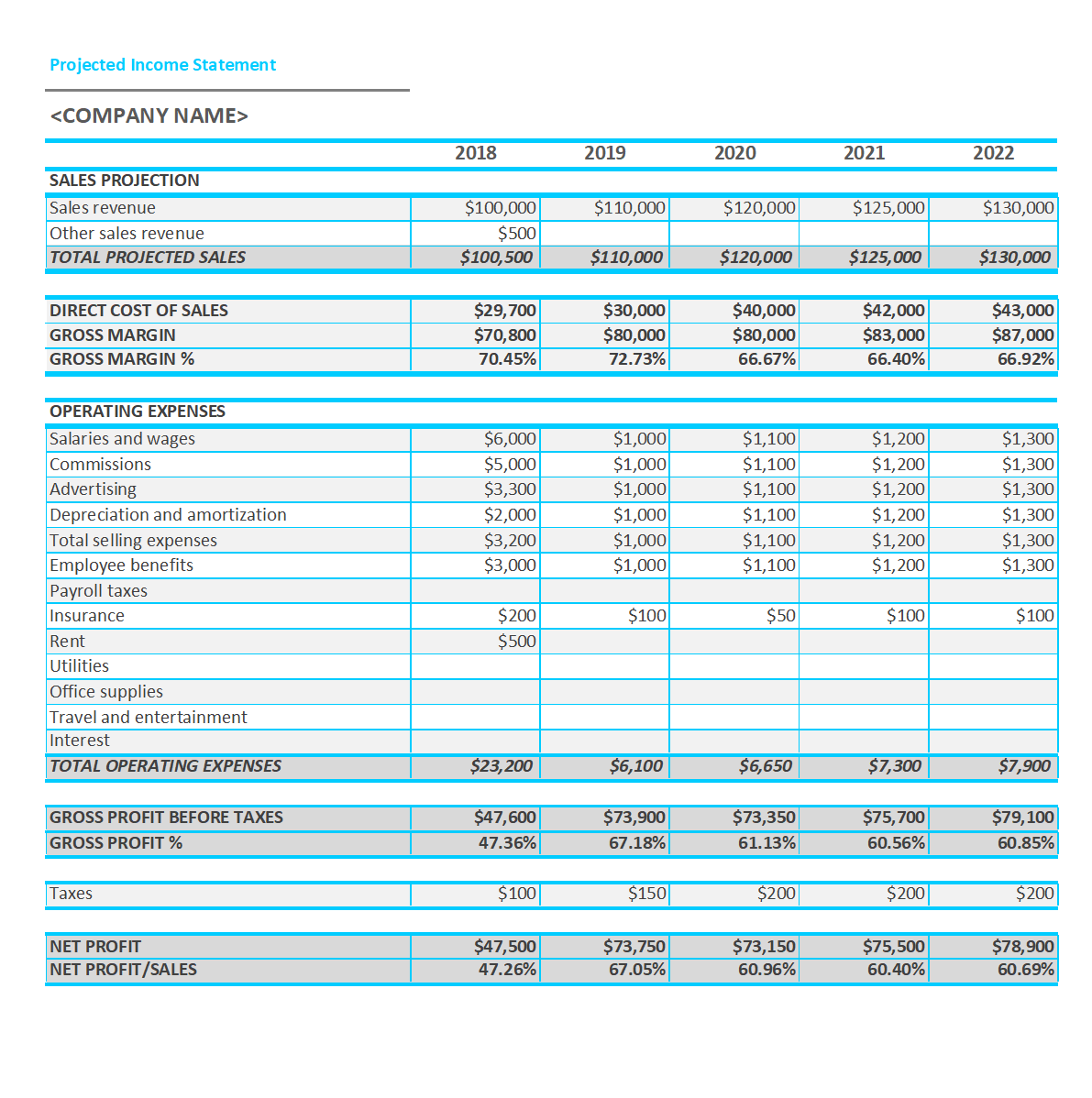

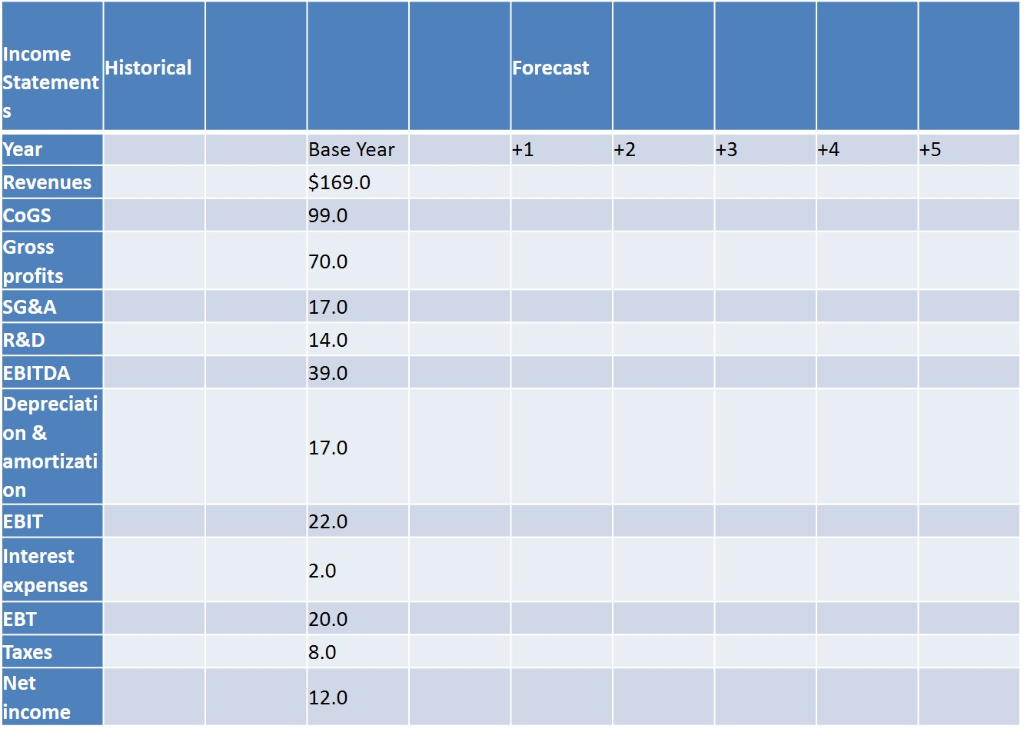

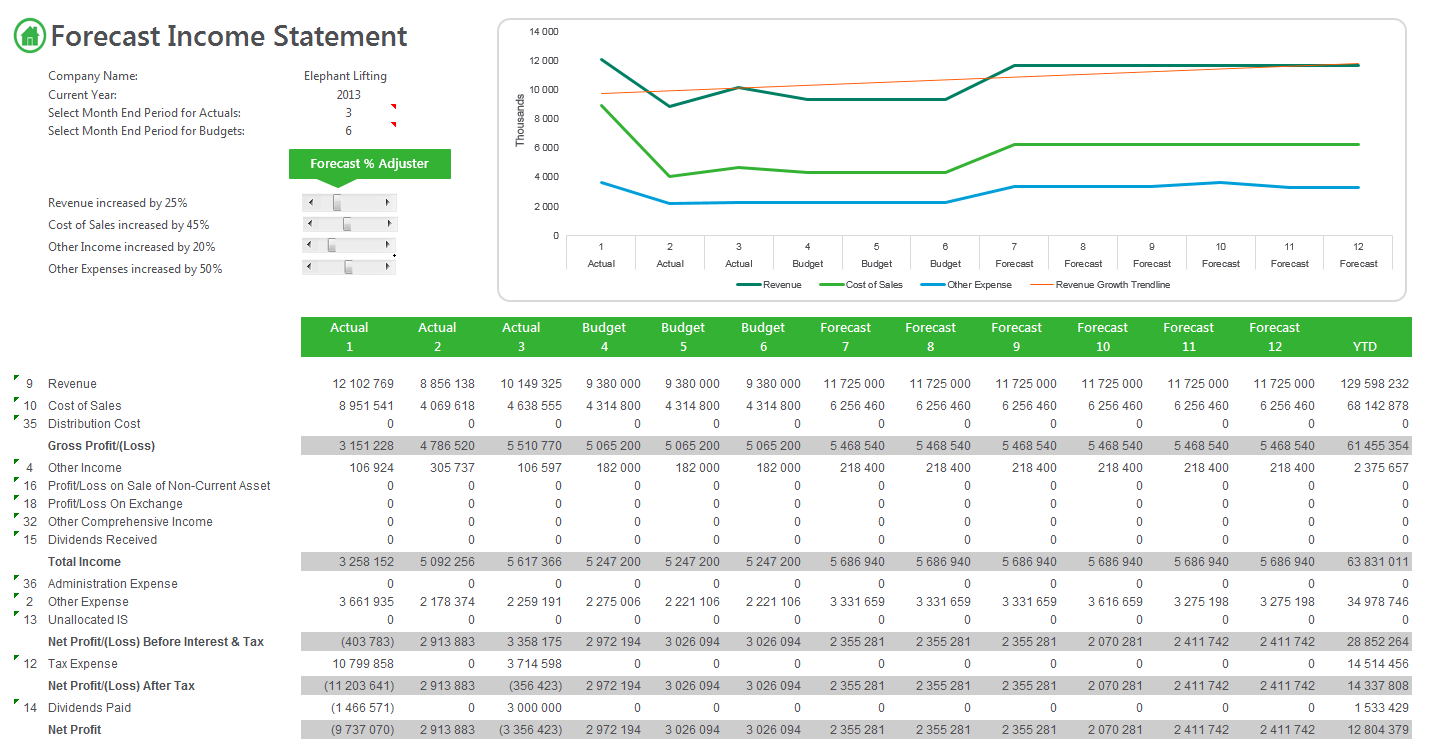

Let’s go through an example of financial forecasting together and build the income statement forecast model in excel. There are four main types of forecasting methods that financial analysts use to predict future revenues, expenses, and capital costs for a business.while there are a wide range of frequently used quantitative budget forecasting tools, in this article we focus on four main methods: For example, in figure 18.14, we see that clear lake has forecasted its accounts payable for march as the cost of goods sold in march from its forecasted income statement.

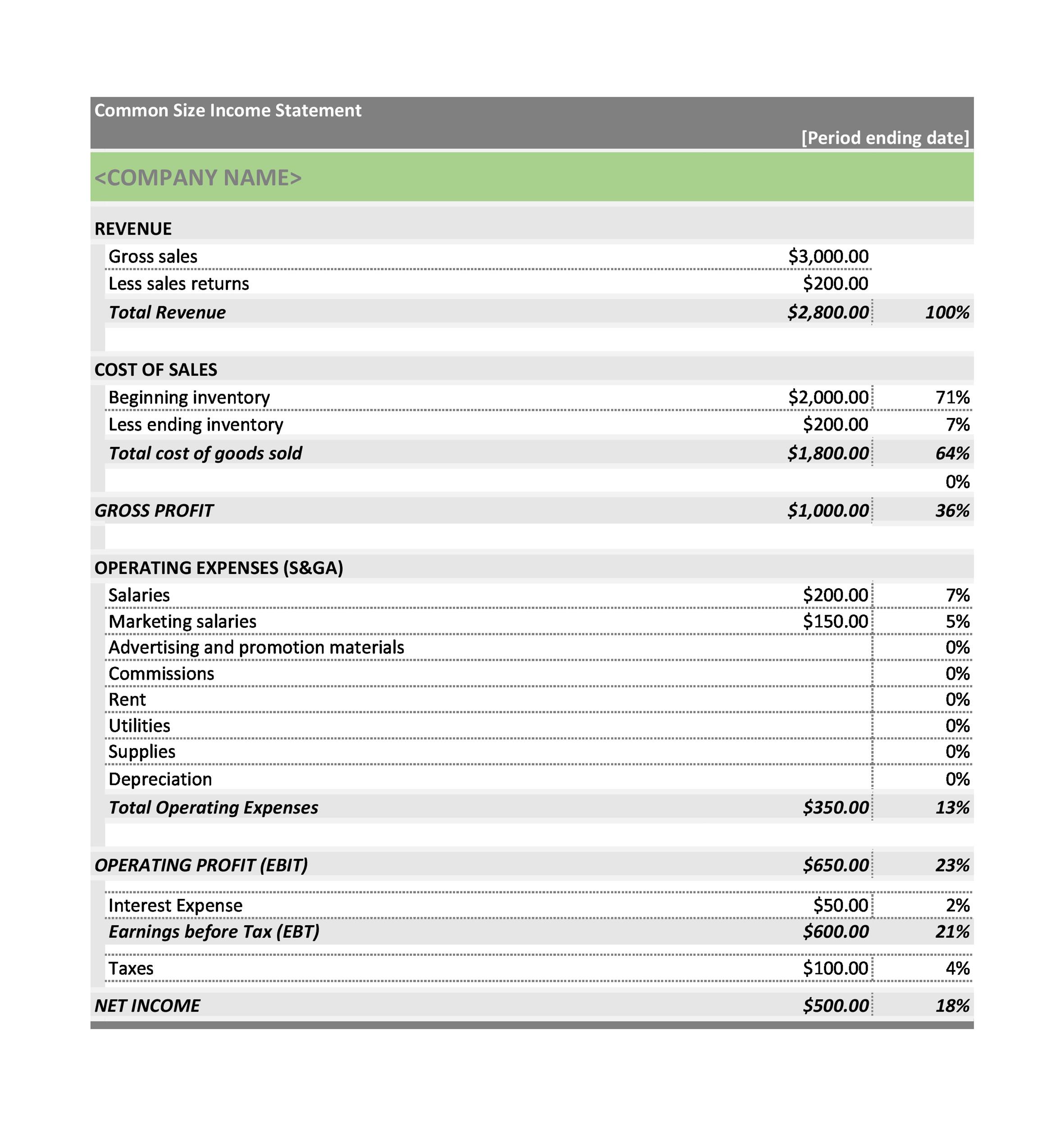

A sample income statement: According to your pro forma annual income statement, your financial projections show it will be $44,000 next year. For example, in figure 18.14, we see that clear lake has forecasted its accounts payable for march as the cost of goods sold in march from its forecasted income statement.

Gain valuable insights to make informed decisions, improve financial planning, and drive business success. Gather your past financial statements. Format the table as desired and review the forecast for accuracy.

After projecting income statement line items, the income statement is found as follows: Calculate the net profit by subtracting the total cost of goods sold and operating expenses from the revenue and adding any other income. There are three steps you need to follow:

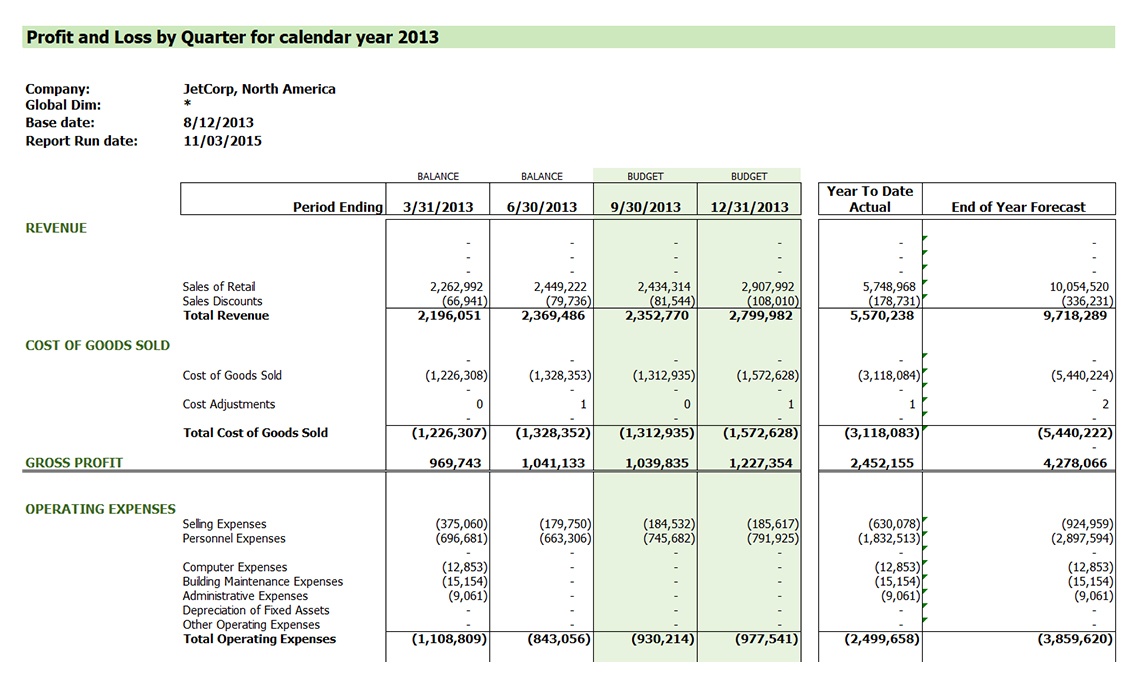

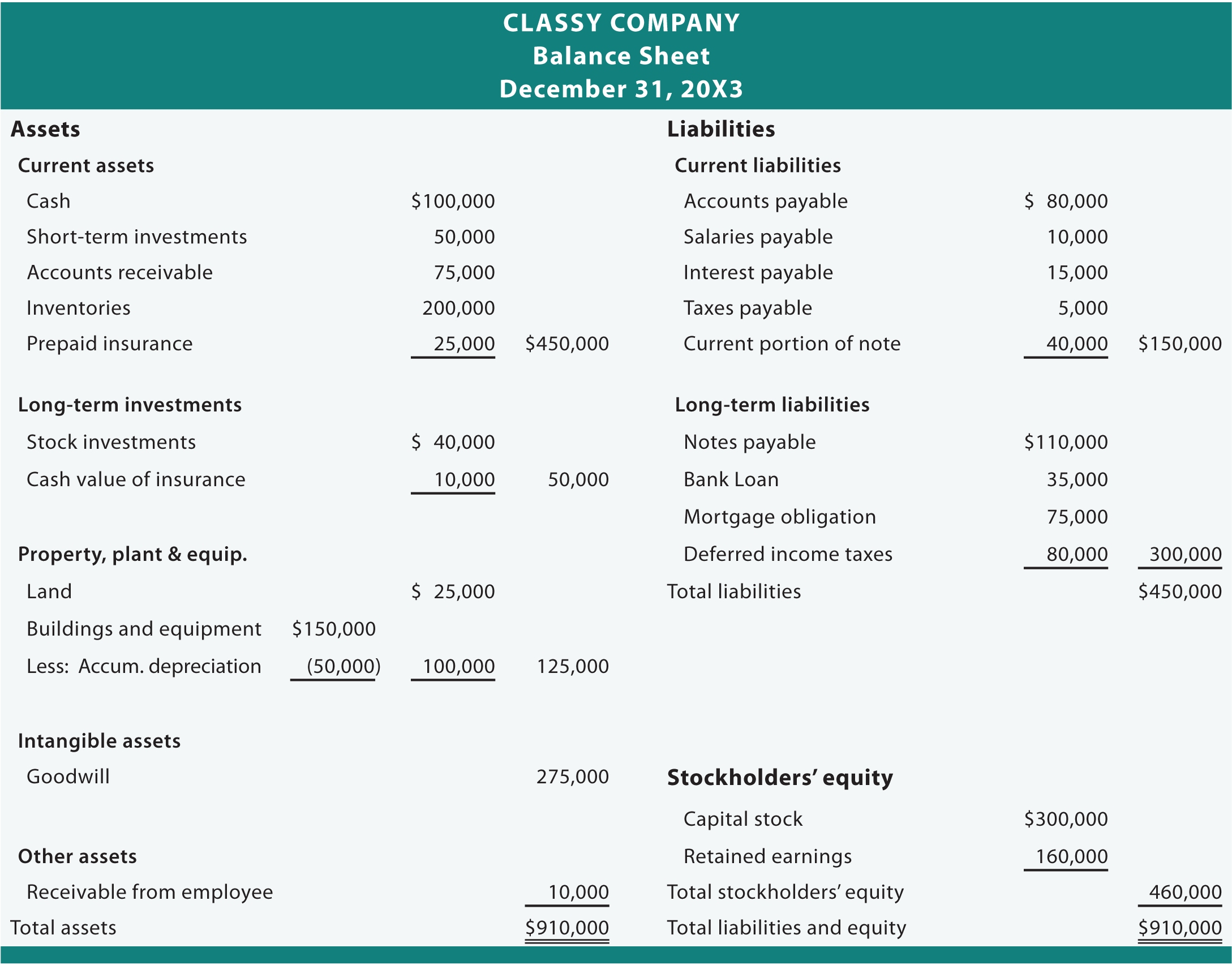

A typical and useful income statement format for management is shown in the example below. We then use the forecast balance sheet to calculate changes in operating assets and liabilities. The projections made in the income statement will drive various items on the balance sheet and cash flow statements.

Less cost of goods sold; For each operating asset and liability, we must compare our forecast year in question with the prior year. Expenses are listed on a company's income statement.

Your budget may be based on the financial information of your pro forma statements—after all, it makes sense to make plans based on your predictions. From the income statement, we use forecast net income and add back the forecast depreciation. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions.

Unlock the secrets of forecasting income statements with our comprehensive guide. You’ll need to look at your past finances in order to project your income, cash flow, and balance. Other income is broken out to explicitly show interest expense and interest income.