Best Tips About Treatment Of Income Tax Paid In Cash Flow Statement Vertical Analysis Profit And Loss

Taxes appear in some form in all three of the major financial statements:

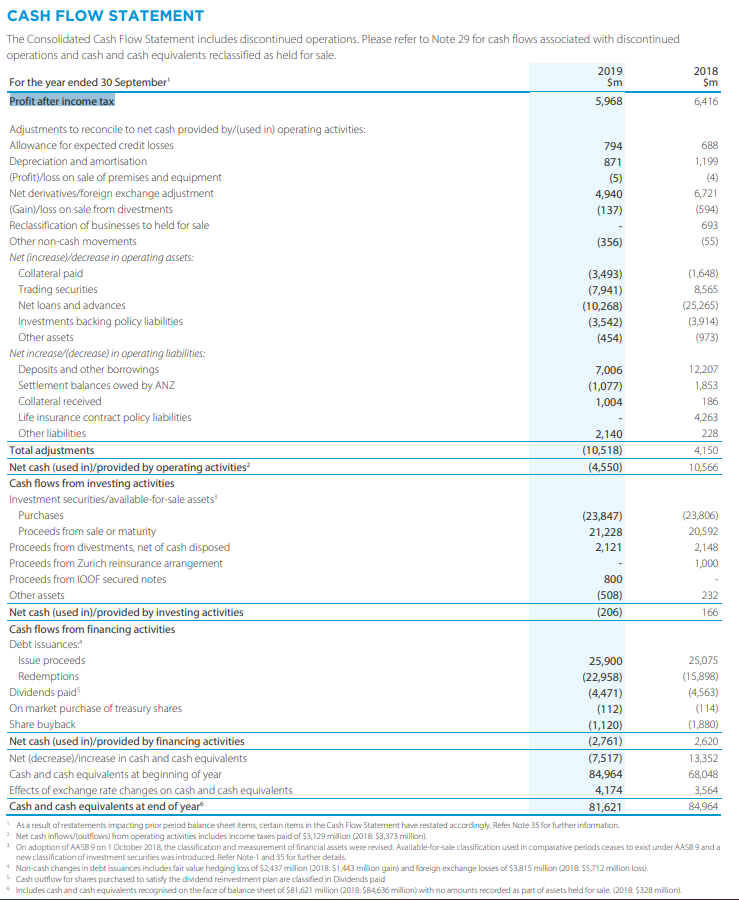

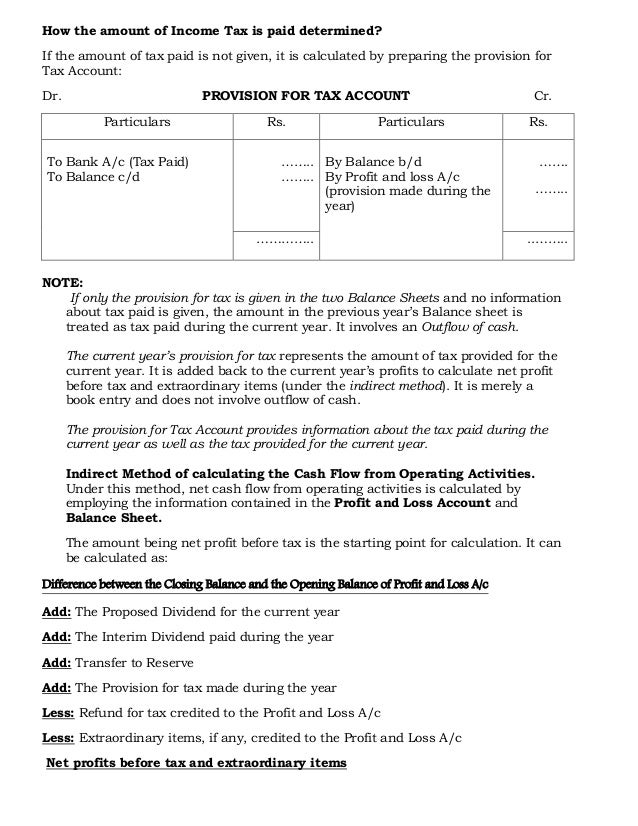

Treatment of income tax paid in cash flow statement. Sfas 95, statement of cash flows, classifies income tax payments as operating outflows in the cash flow statement, even though some income tax payments relate to gains. This video will help yo. Income tax payable goes on the balance sheet while you find tax paid in the cash flow statement.

An enterprise should prepare a cash flow statement and should present it for each period for which financial statements are presented. The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of. It is an expense on reported profits for the period based on the matching principle.

The given amount of tax paid is added as a provision for taxation in the current year to calculate net profit before tax and extraordinary items. This shall be adjusted in the operating activities section of the cash flow statement by deducting the credit amount of $1000 from the net profit or loss in order to get one step. The balance sheet, the income statement, and the cash flow statement.

Ias 7 2021 issued ifrs standards (part a) ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements,. Tip you report income tax payable on your current profits as a liability on the. (a) requires entities to classify each type of cash flow (dividends paid, dividends received, interest paid and interest received) in a single section of the statement of cash flows;.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)