Sensational Info About Debit And Credit Balance Sheet Personal Income Statement Template Excel

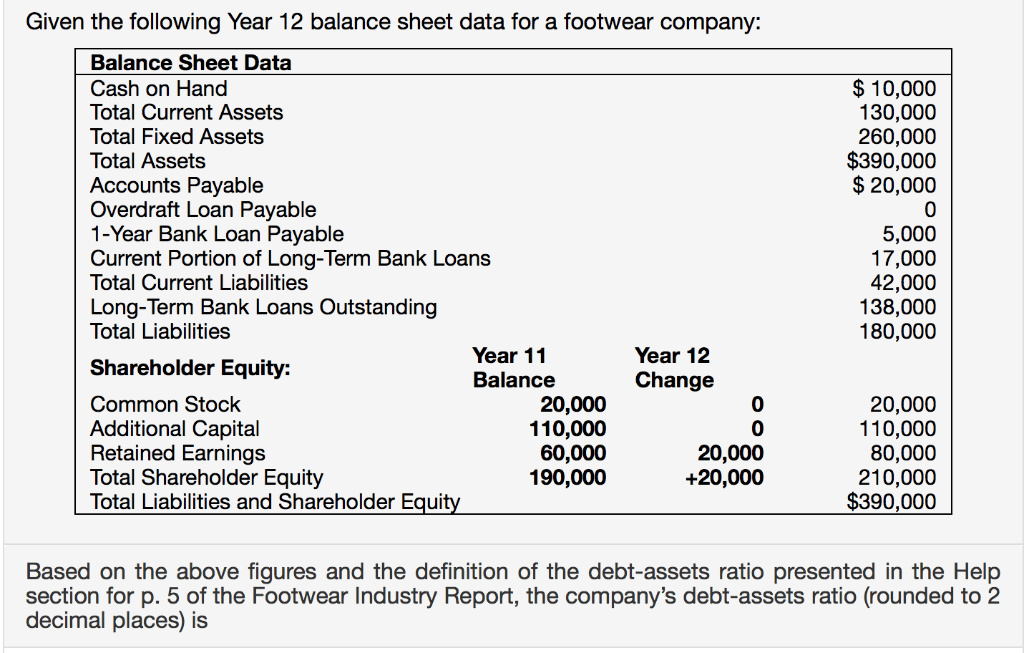

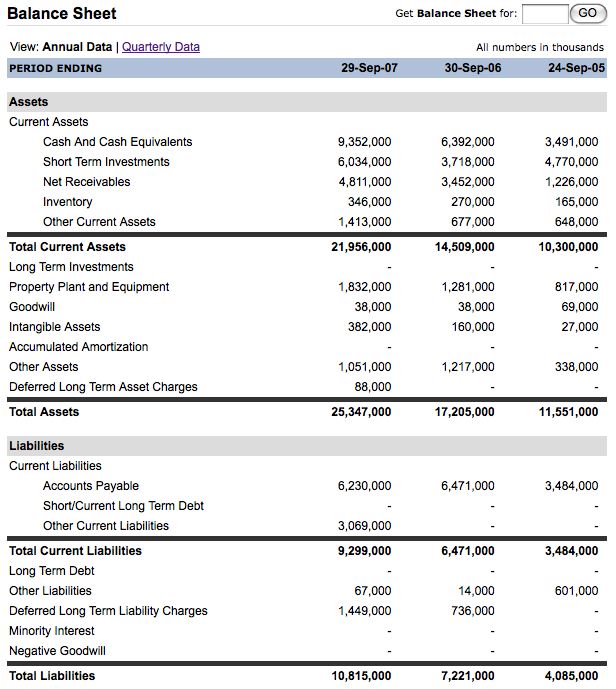

It summarizes a company's assets, liabilities, and owners' equity.

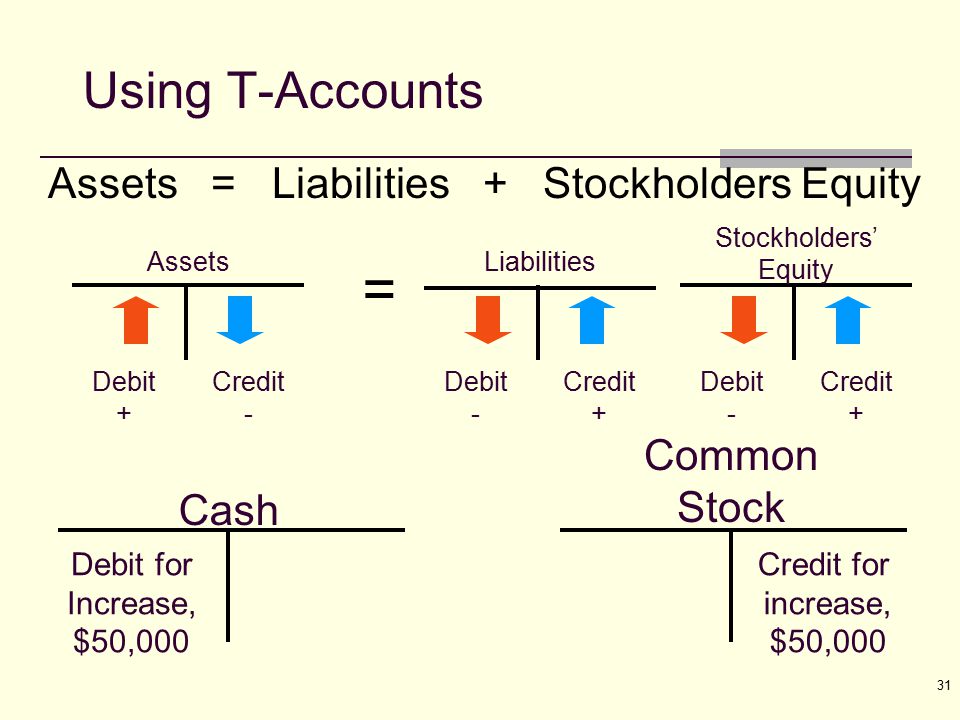

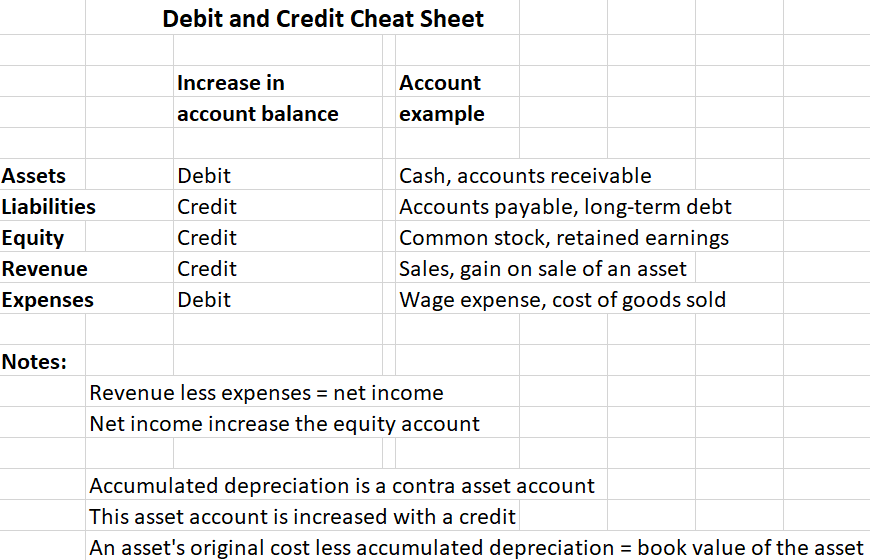

Debit and credit balance sheet. Credit for a particular account. Normal debit and credit balances for the accounts we will now return to the format of the balance sheet and the basic accounting equation: A debit is an accounting entry that results in either an increase in assets or a decrease in liabilities on a company’s balance sheet.

It is positioned to the left in an accounting entry, and is offset by one or more credits. Recording assets, liabilities, and equity Debits and credits are important to balance the books and keep an accurate balance sheet, which offers an overall picture of assets, liabilities, and owner’s or shareholders' equity.

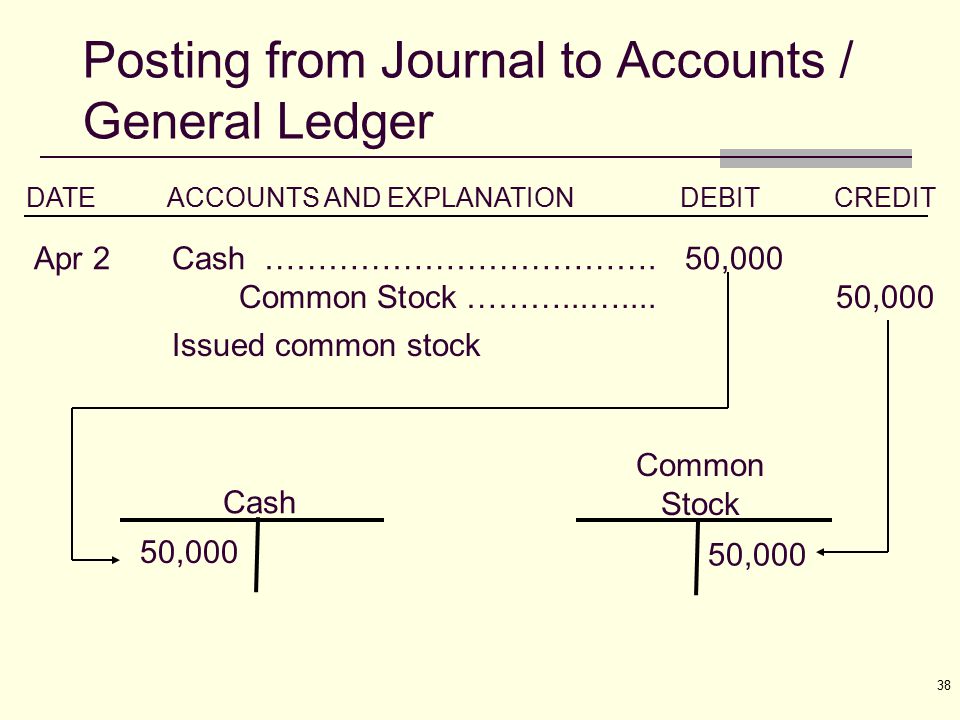

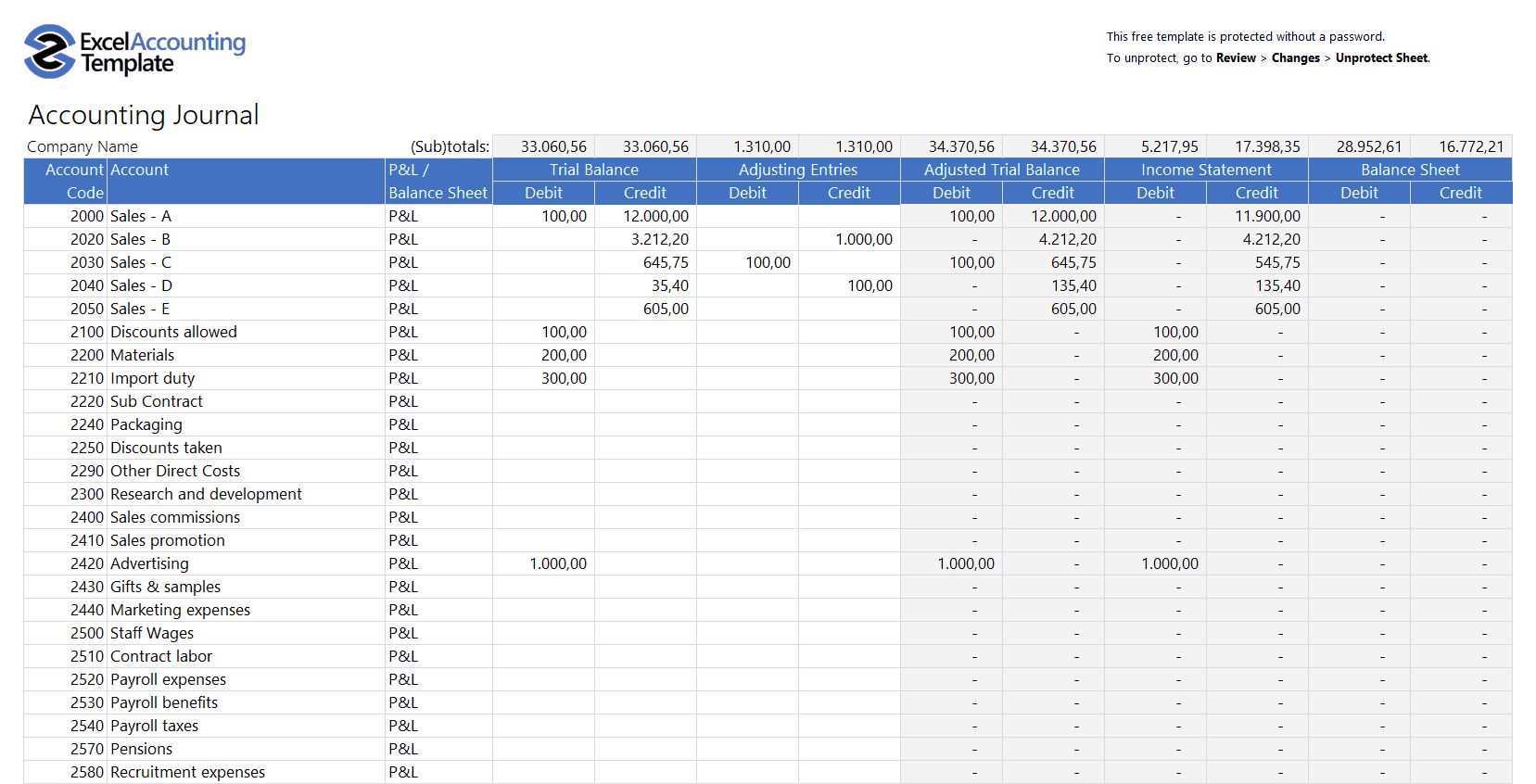

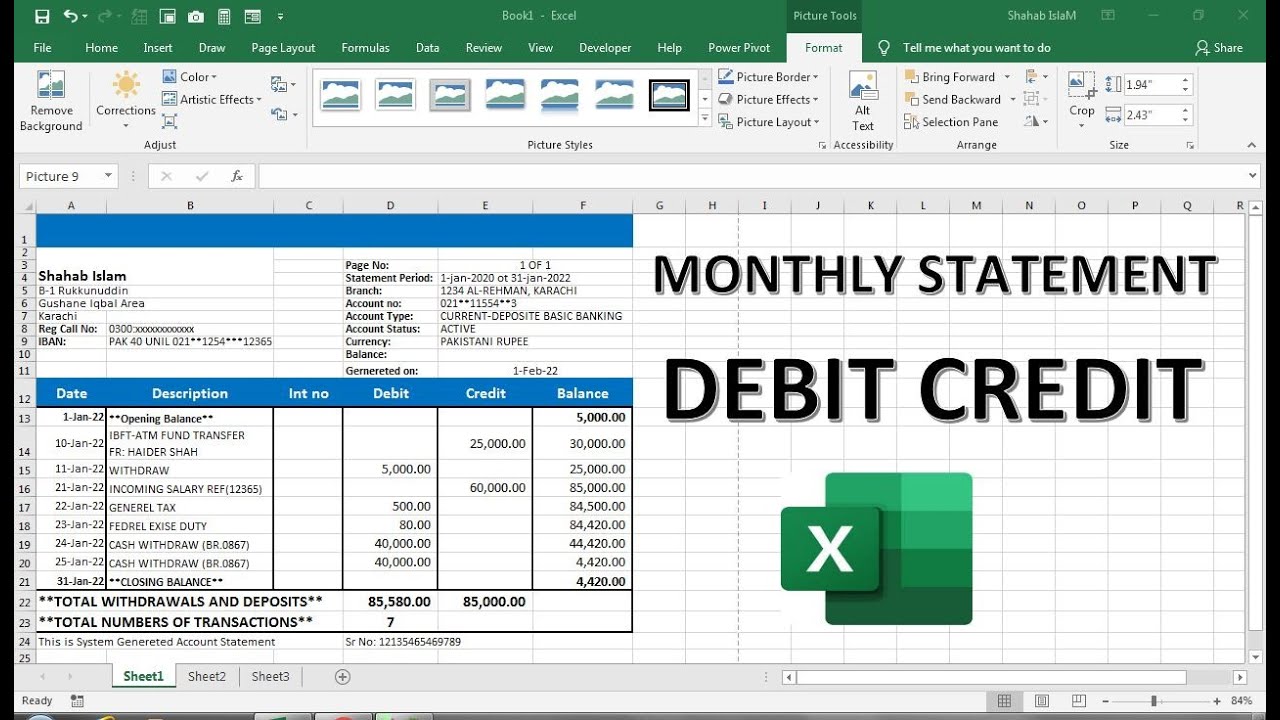

Each financial transaction made by a business firm must have at least one debit and credit recorded to the business's accounting ledger in equal, but opposite, amounts. In this context, debits and credits represent two sides of a transaction. Accounts receivable is an asset —a plus on your company’s balance sheet—symbolizing money owed by customers for products or services already delivered.

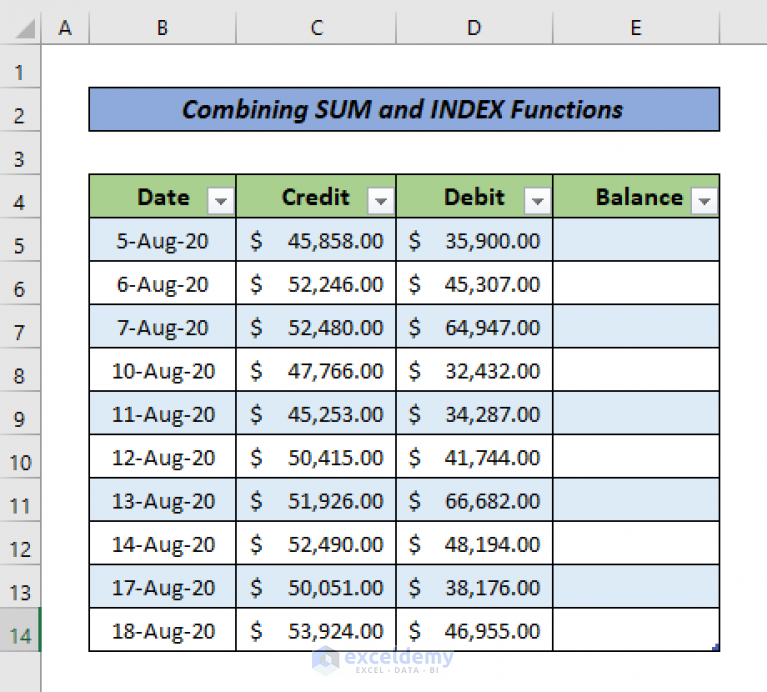

Every accounting transaction must be either a credit or debit. On a balance sheet or in a ledger, assets equal liabilities plus shareholders' equity. Cash has 600 debits minus 100 for credits.

If a transaction increases the value of one account, it must. An increase in the value of assets is a debit to the account, and a decrease is a credit. When money flows into a bucket, we record that as a debit (sometimes accountants will abbreviate this to just “dr.”) for example, if you deposited $300 in cash into your business bank account:

For every transaction, there must be at least. The balance sheet is one of the three basic financial statements that every owner analyses to make financial decisions. These accounts include assets, liabilities, equity, expenses, and revenue.

On the left side of the accounting equation: 2023 — these faqs update question 9 to provide that a united states military service member who is a wrongfully incarcerated individual and who receives back pay following the reversal of a court martial conviction may not exclude the payments under section 139f if the. For example, debit increases the balance of the asset side of the balance sheet.

That’s where debits and credits come in. Here is a summary of the accounts in general: Apply a formula with sum function to create debit credit balance sheet.

Its business checking account has a relatively small $100 minimum deposit requirement to open the account. The balance sheet report for small businesses includes both debits and credits. £20 credit to the vat creditor on the balance sheet.

It needs to add up the debits and credits on each side of the t. In fundamental accounting, debits are balanced by. What are debits and credits on the balance sheet?