Unbelievable Info About Debit Balance Of Profit And Loss Account In Sheet Reclassification Note Financial Statements

At the end of a financial year, the net loss is transferred to the balance sheet and shown as a deduction from capital.

Debit balance of profit and loss account in balance sheet. A profit and loss account, on the other hand, is an account that shows the revenue earned and expenses sustained by the company, during the course of business, in a. This indicates that the company has not made enough money to cover its costs. What is the profit and loss statement (p&l)?

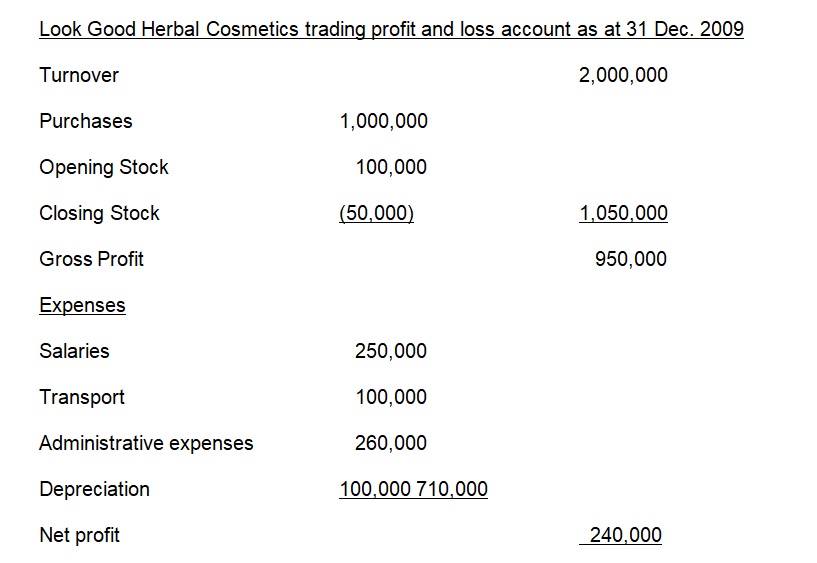

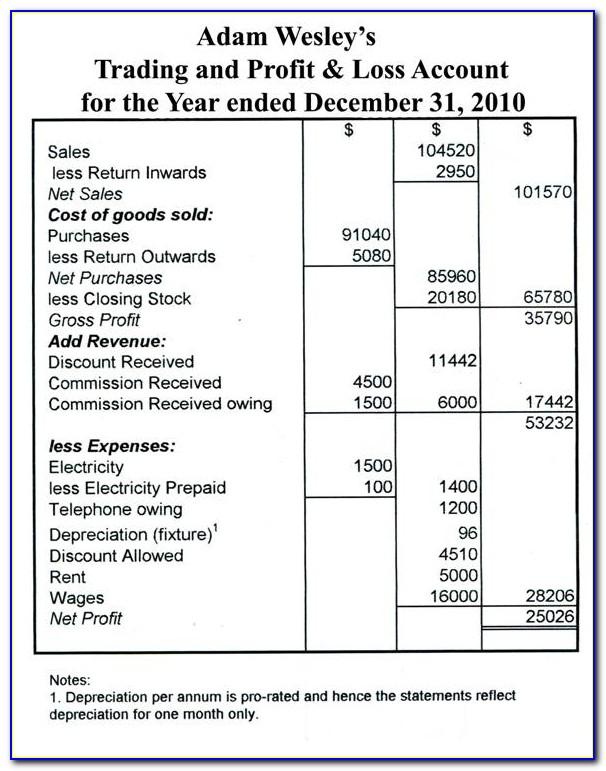

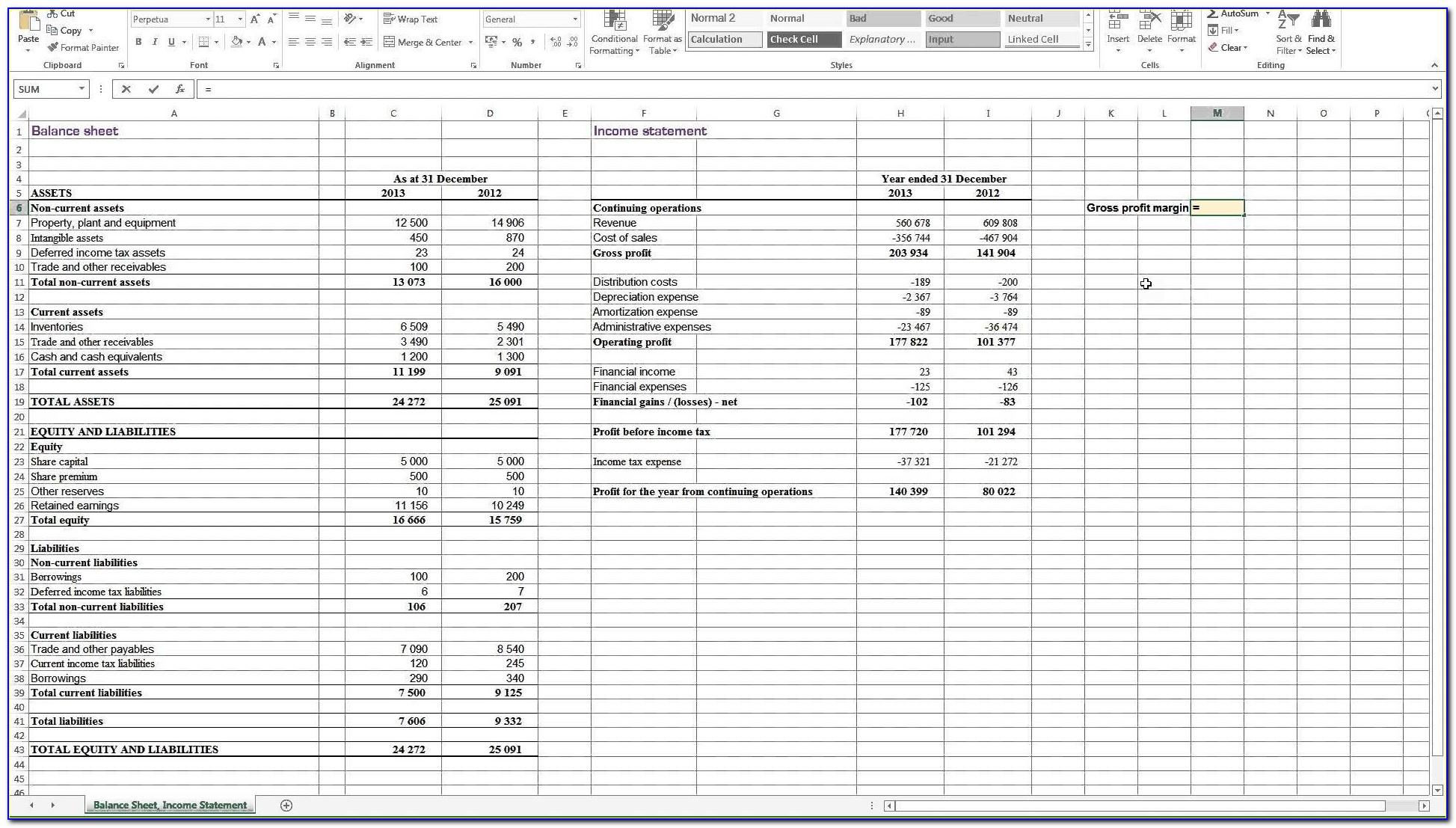

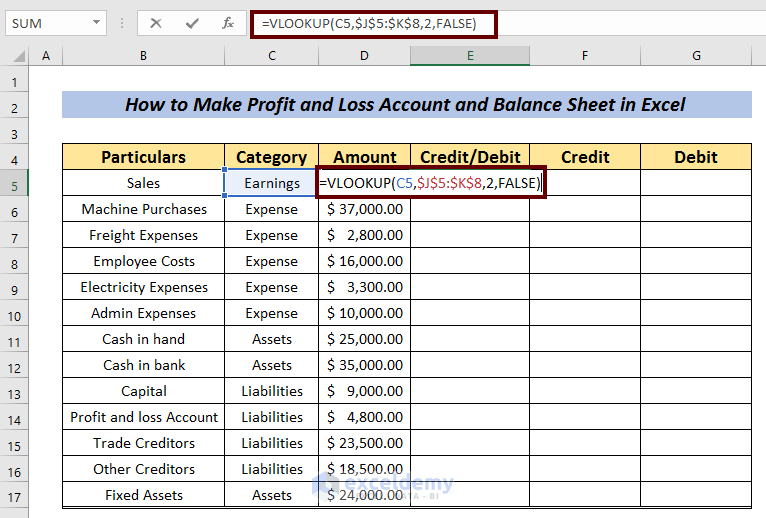

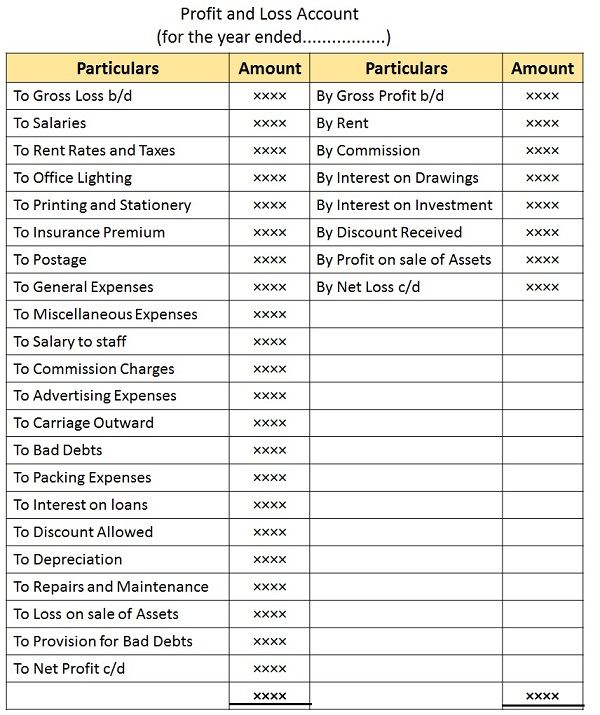

The trading and profit and loss account is divided into three sections: A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. The trading account, the profit and loss account and the appropriation account.

The debit balance of the profit and loss account profit and loss account the profit & loss account, also known as the income statement, is a financial statement that. It helps in determining the. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable, unearned.

A p&l statement provides information. However it is also said that as credit balance of p&l. 3 months, 1 year, etc.

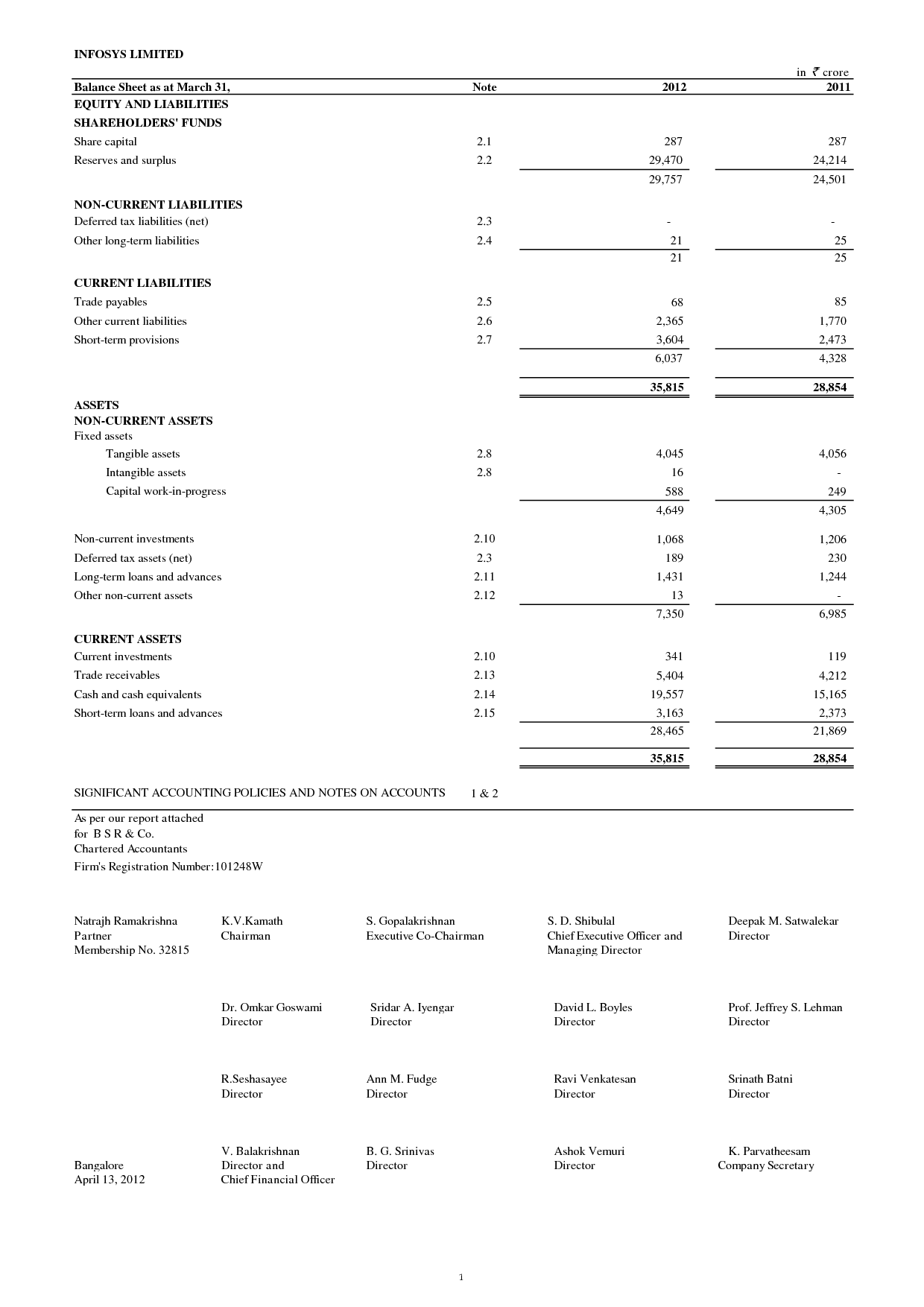

All the items of revenue and expenses. Balance sheet vs profit and loss account the basics of a balance sheet and p&l explained by chris andreou updated february 7, 2024 contents balance. The profit and loss statement, abbreviated as p&l, is a financial statement that summarises revenues, expenditures, and expenses incurred during a specific time.

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. This reduction in equity signifies that. The three main types of financial statements are the income statement (also known as the profit and loss statement), the balance sheet, and the cash flow.

Profit and loss account is made to ascertain annual profit or loss of business. Solution verified by toppr the debit balance of a profit and loss account denoted loss. Only indirect expenses are shown in this account.

Debit balance of the profit and loss account shows that the expenses were more than. (refer to the image below) debit side (indirect expenses) <. The profit and loss account shows the profit or loss of a business over a given period of time e.g.

A profit and loss (p&l) statement is a financial statement that records a summary of all expenses and incomes of a business during a period of time. It is reflected as a negative amount, indicating the company has suffered losses. If a company prepares its.

In contrast, the balance sheet is like a photograph taken. Profit's effect on the balance sheet the profit or net income belongs to the owner of a sole proprietorship or to the stockholders of a corporation. The accounts reflected on a trial balance are related.