Fine Beautiful Tips About Discounted Cash Flow Statement Importance Of Financial Analysis

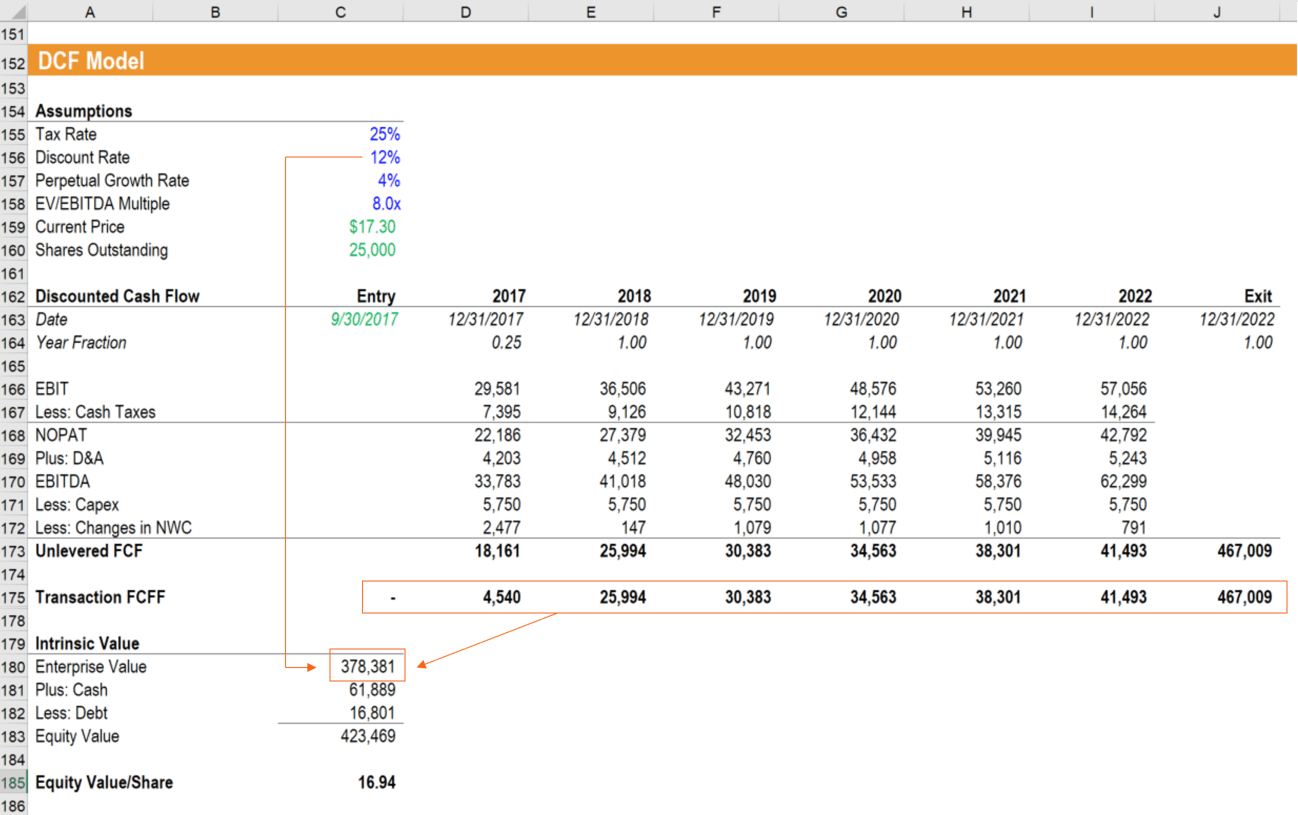

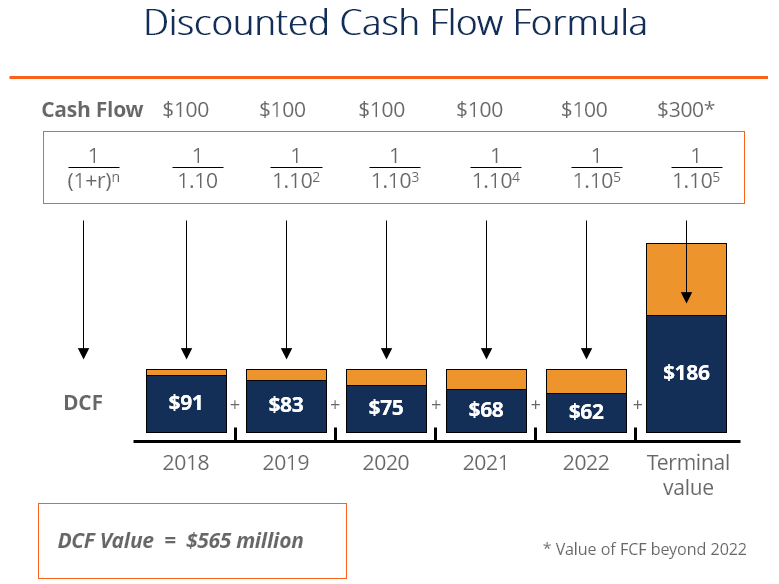

Present value of cash flow = cash flow / (1 + discount rate) ^ discounting period

Discounted cash flow statement. Conducting a discounted cash flow (dcf) analysis is the best way to arrive at an educated estimate, whether you’re assessing the cost of a specific project, purchasing shares of a publicly traded company, or investing in a private business. Calculating discounted cash flow can be beneficial for many reasons for a business or investors. Cfn is the last year in the forecast.) r = the discount rate.

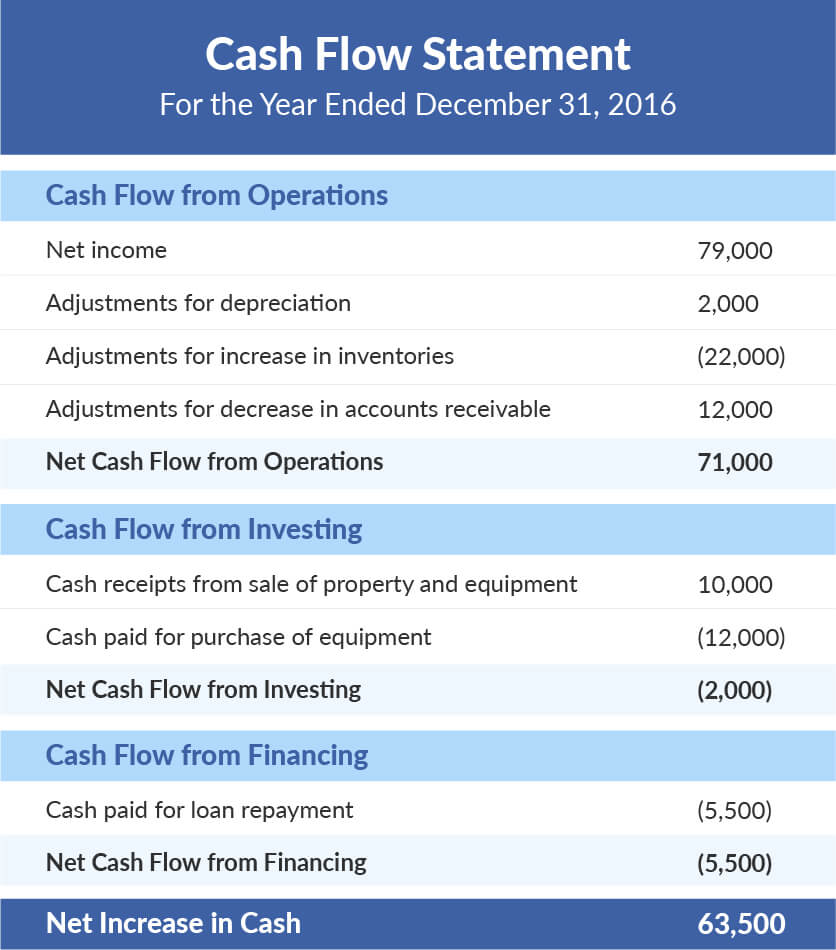

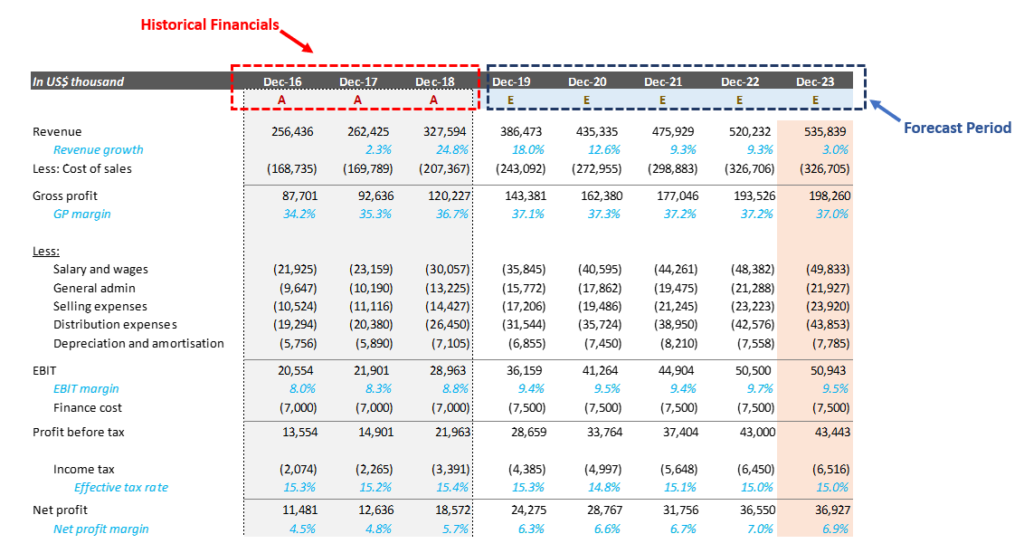

Identify and gather financial data for the entity. For the fy19 cash flow, we need to discount 0.5 year; Find out how you can define the valuation of a startup, by applying the discounted cash flow in six easy steps.

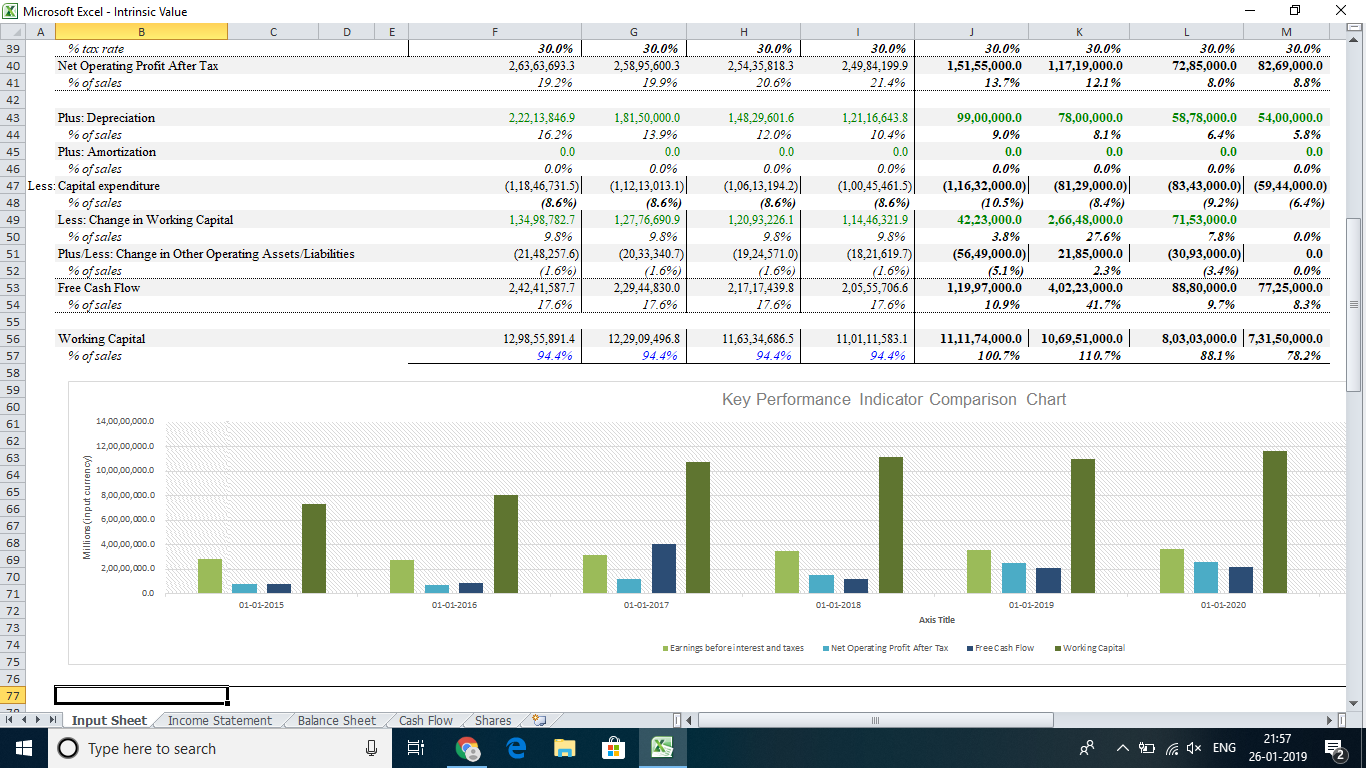

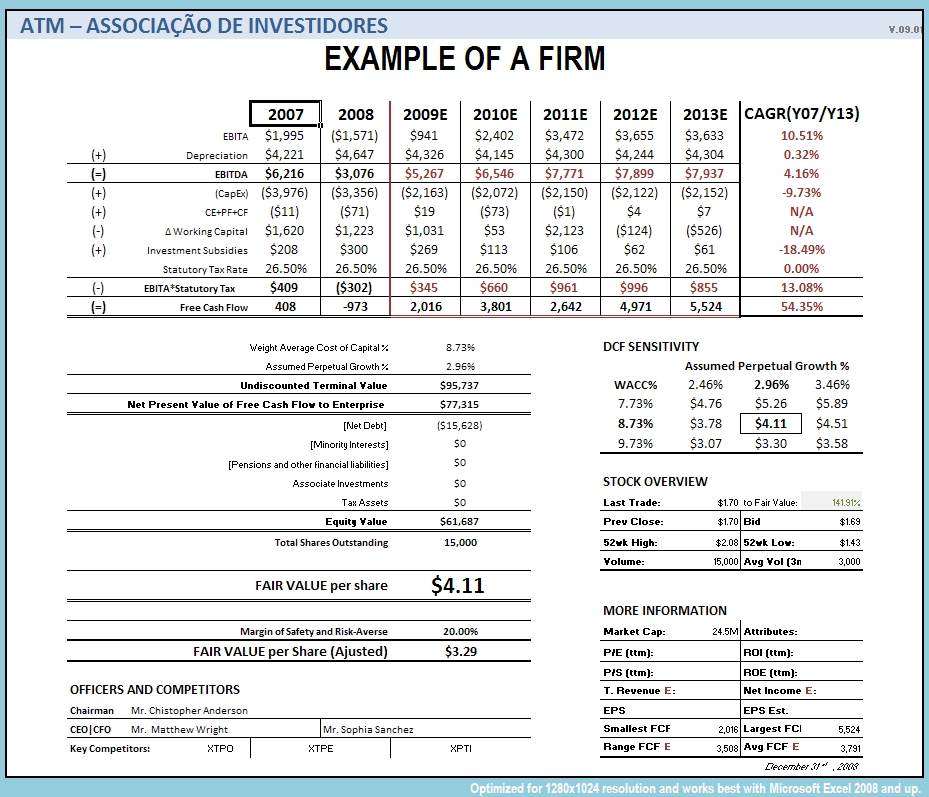

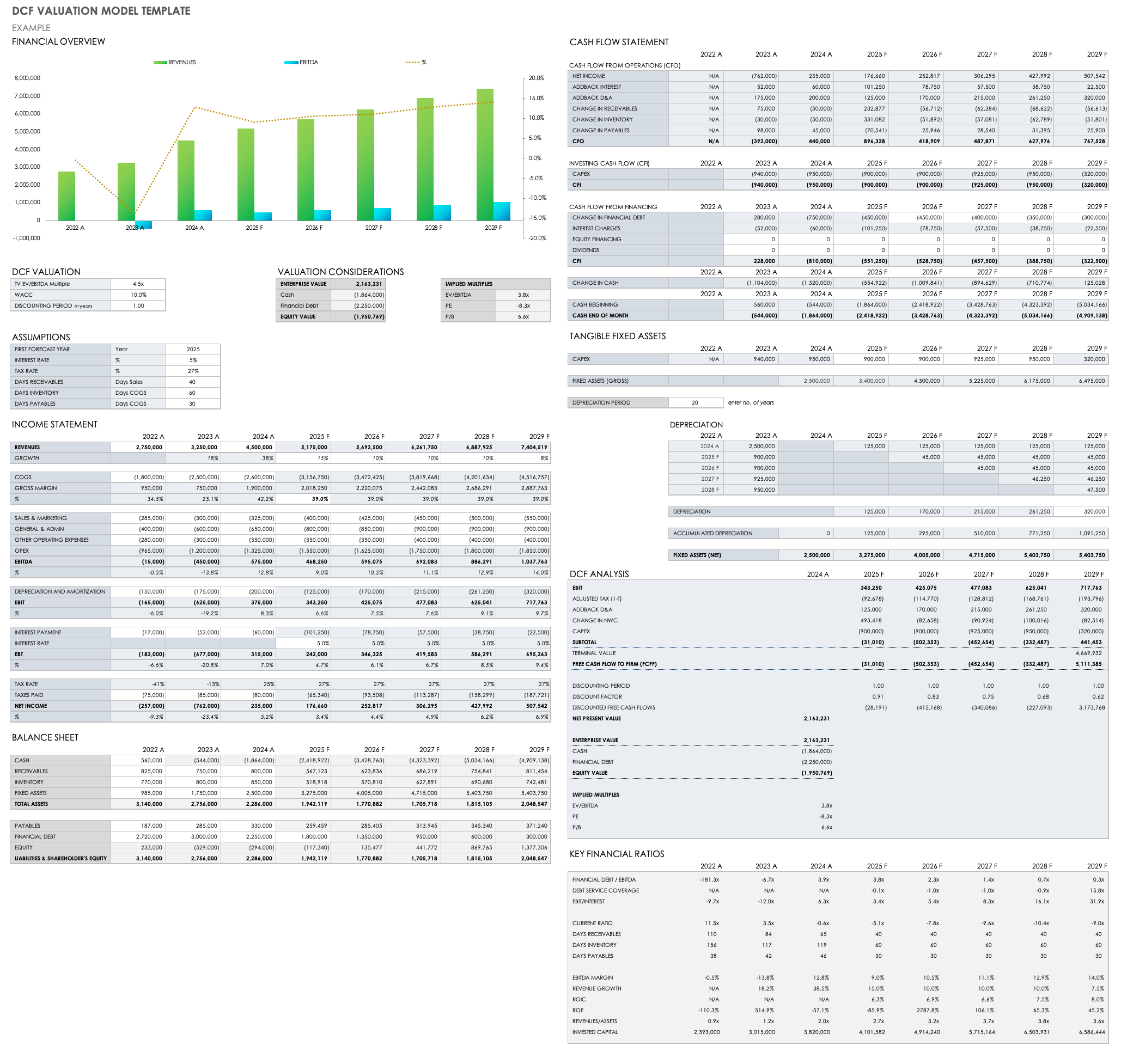

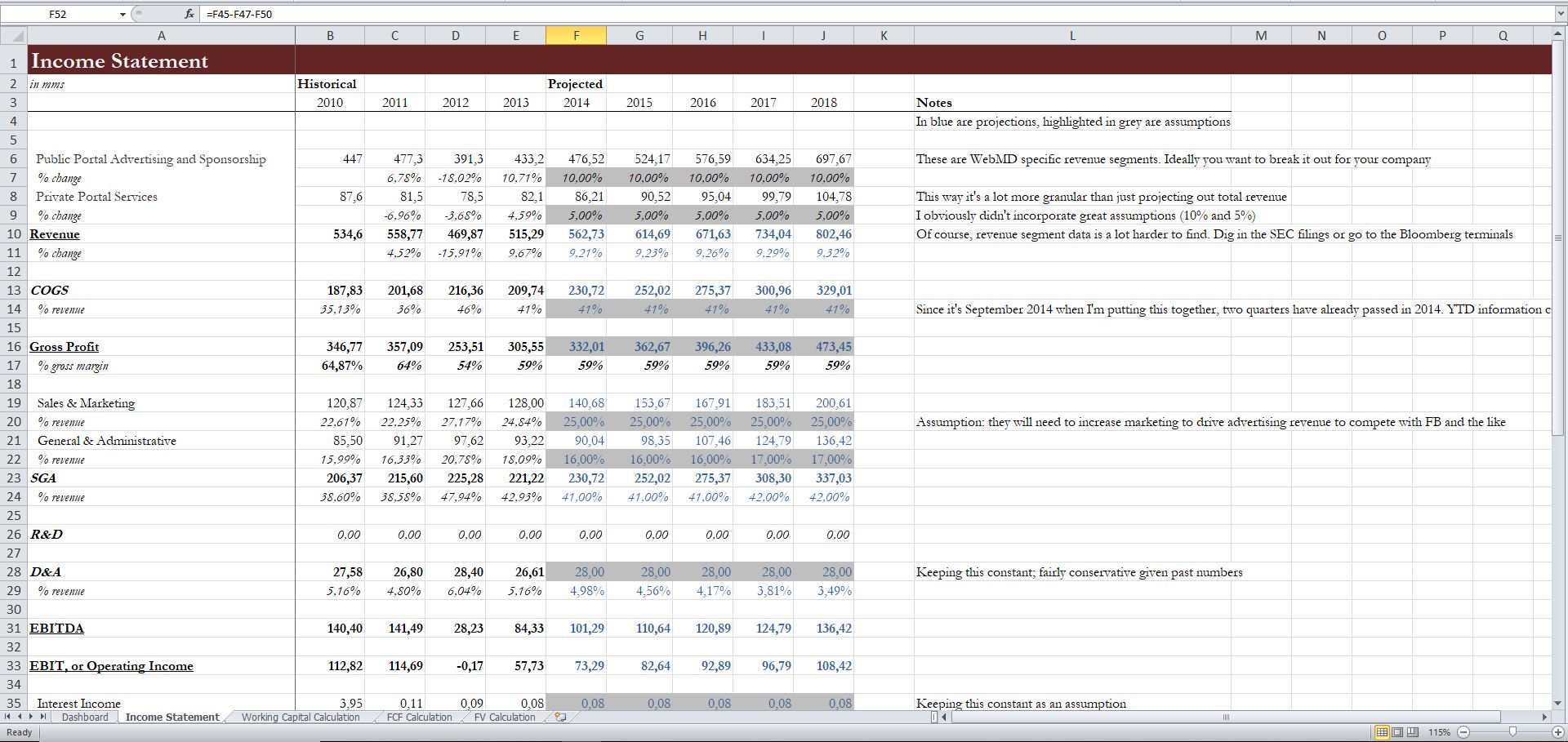

Determine future cash flow estimates. Discounted cash flow statement (dcf) change input and create cutom dcf, gme stock. You can find all financial models and valuation techniques that is used in corporate finance to get companies intrinsic valuation.

Step one is knowing to calculate present value, which is what i’ll cover next: For the fy20 cash flow, we need 1.5 year and so on. Then we will compute the discounting factor, which basically follow the formula below:

A dcf model is a specific type of financial modeling tool used to value a business. Most investment banking firms follow our guidelines to get discounted cash flow statement of companies to see if they are undervalued, overvalued or simply at par value. Most investment banking firms follow our guidelines to get discounted cash flow statement of companies to see if they are undervalued, overvalued or simply at par value.

Cf = cash flow in the period r = the interest rate or discount rate n = the period number analyzing the components of the formula 1. Discounted cash flow template. Sap s/4hana cloud for finance.

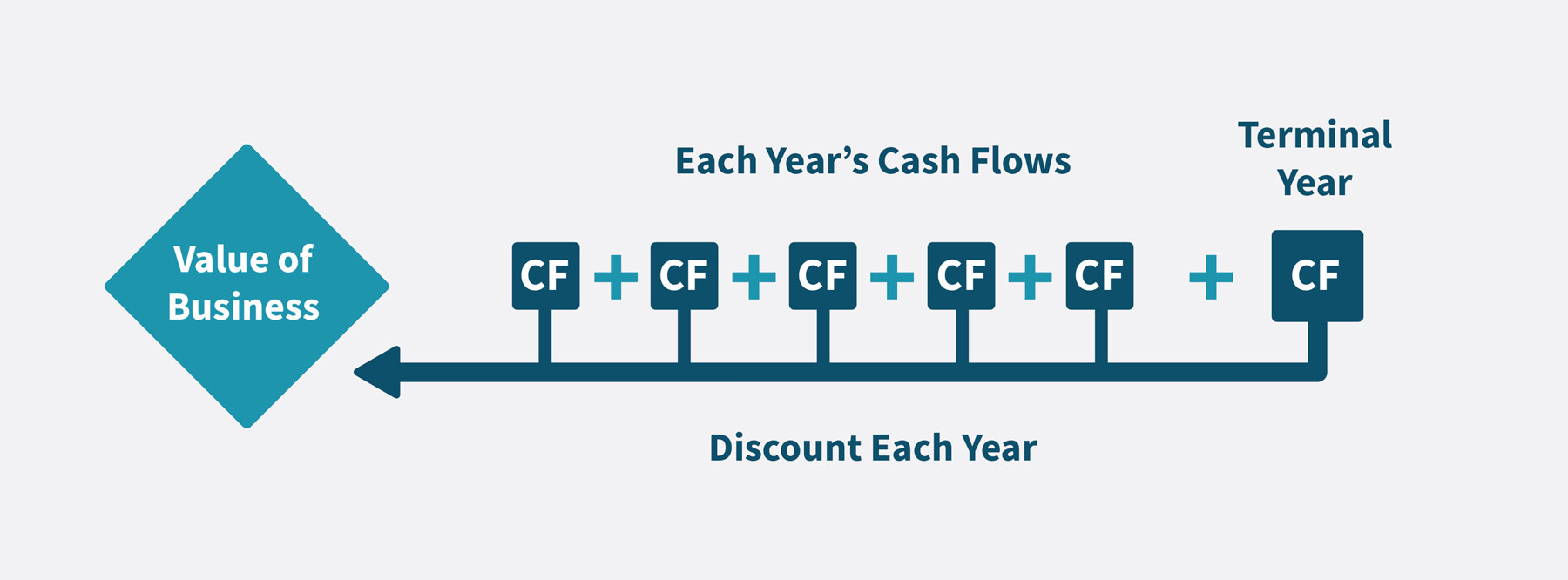

Cf = the cash flow in a given year (cf1 is year one. Basic discounted cash flow formula: Dcf = cf1 / (1 + r)1 + cf2 / (1 + r)2 + cf3 / (1 + r)3+ cfn / (1 + r)n.

Dcf stands for d iscounted c ash f low, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is called the net present value (npv). You can find all financial models and valuation techniques that is used in corporate finance to get companies intrinsic valuation. Calculating the value of shares in a company

The seven steps involved in dcf analysis include projecting financial statements, calculating free cash flow to the firm, determining the discount rate, calculating the terminal value, performing present value calculations, making necessary adjustments, and conducting sensitivity analysis. The valuation of an asset is typically based on the present value of future cash flows that are generated by the asset. It is no different with common stock, which brings us to another form of stock valuation:

Enhance your financial analysis with our discounted cash flow template: This guide show you how to use discounted cash flow analysis to determine the fair value of most types of investments, along with several example applications. Dcfs are widely used in both academia and in practice.