Breathtaking Info About Irs Form 413 Ola Income Statement

Form 4137 is only one page in length and requires two straightforward calculations.

Irs form 413. Tax time guide: First, you must report all unreported tips—even if under $20—which are. You must pay medicare and.

You received cash and charge tips of $20 or more in a calendar month and didn’t report all of those. Information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. You must file form 4137 if:

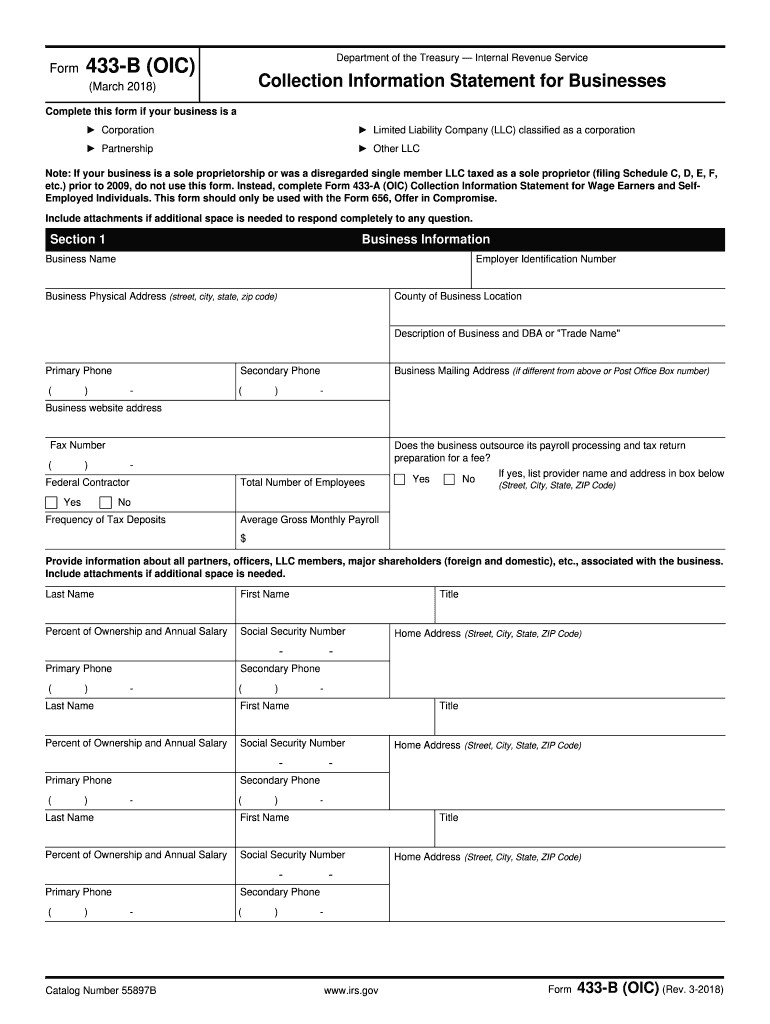

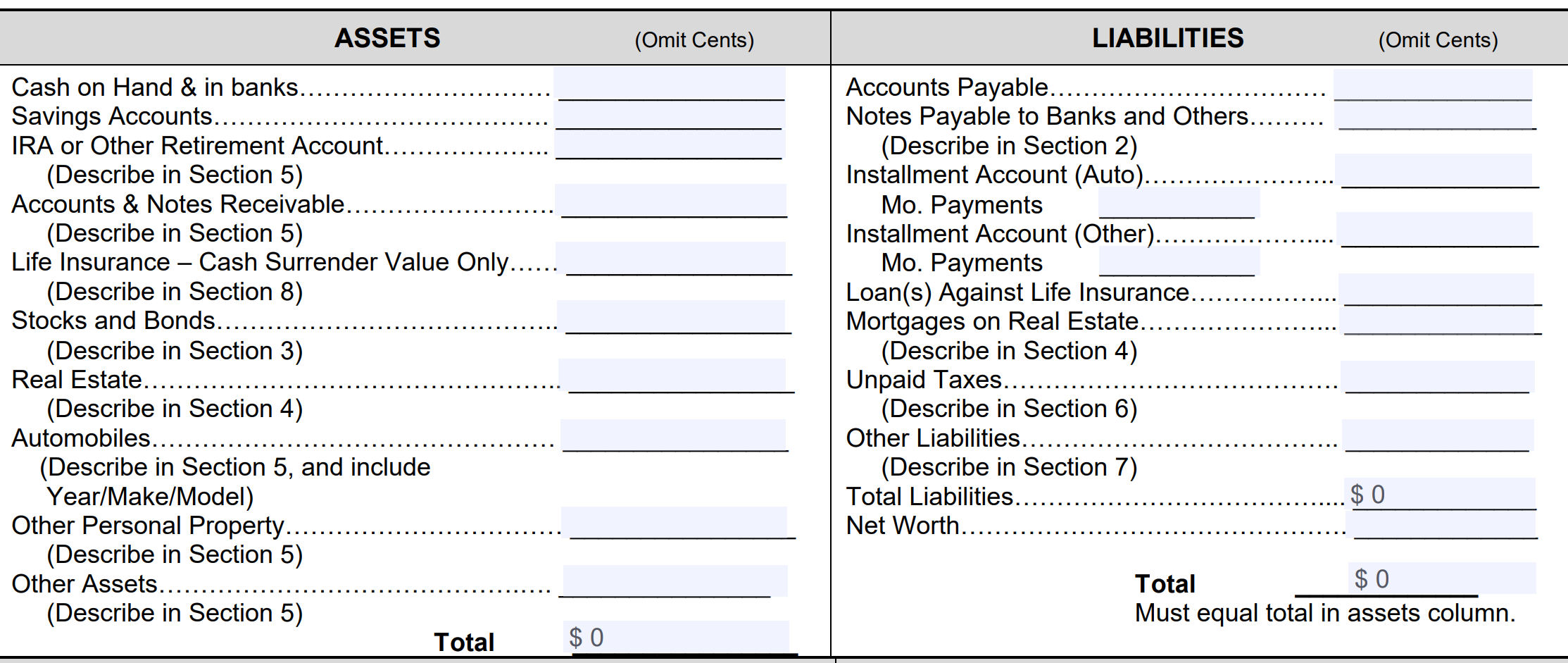

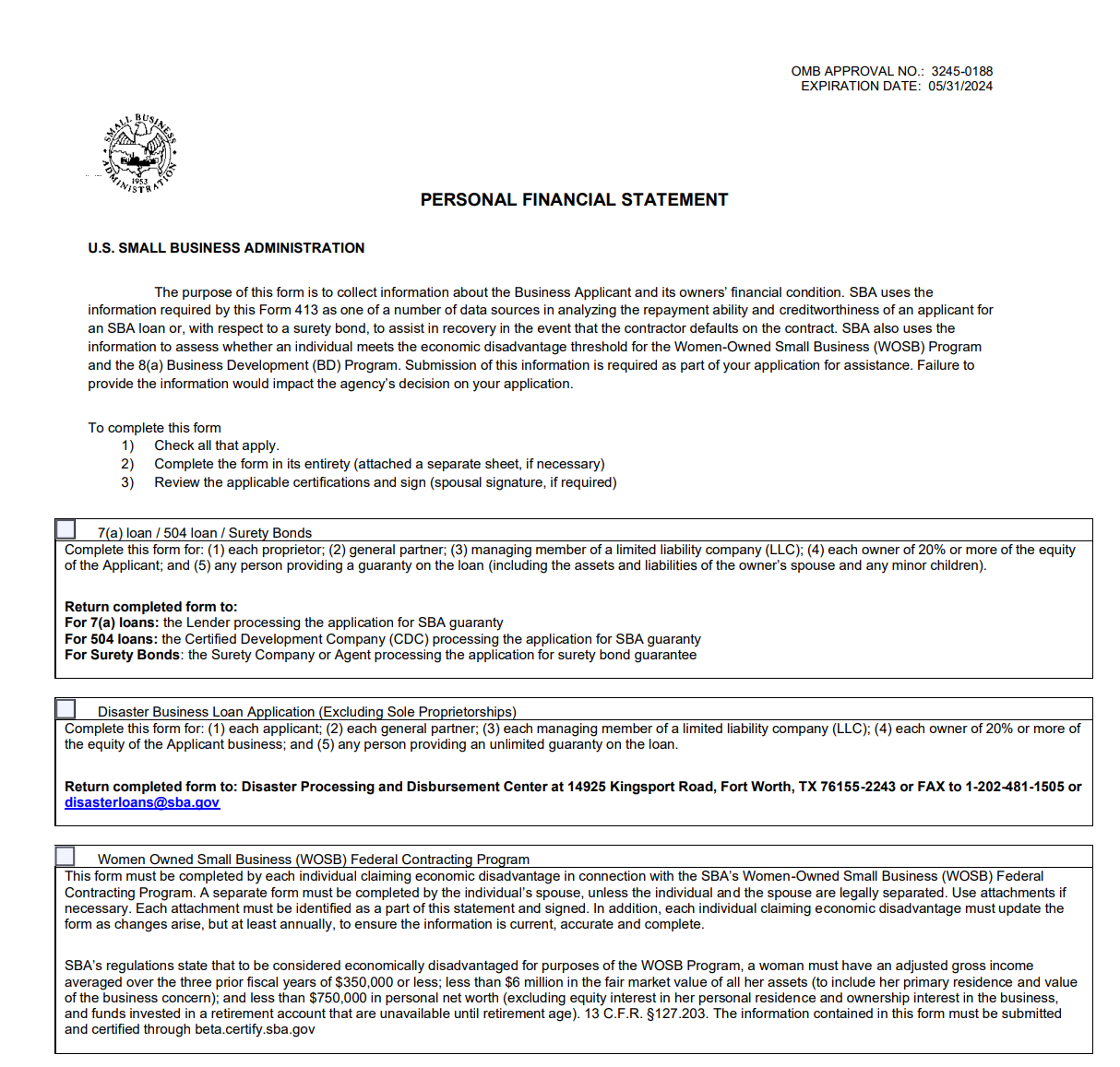

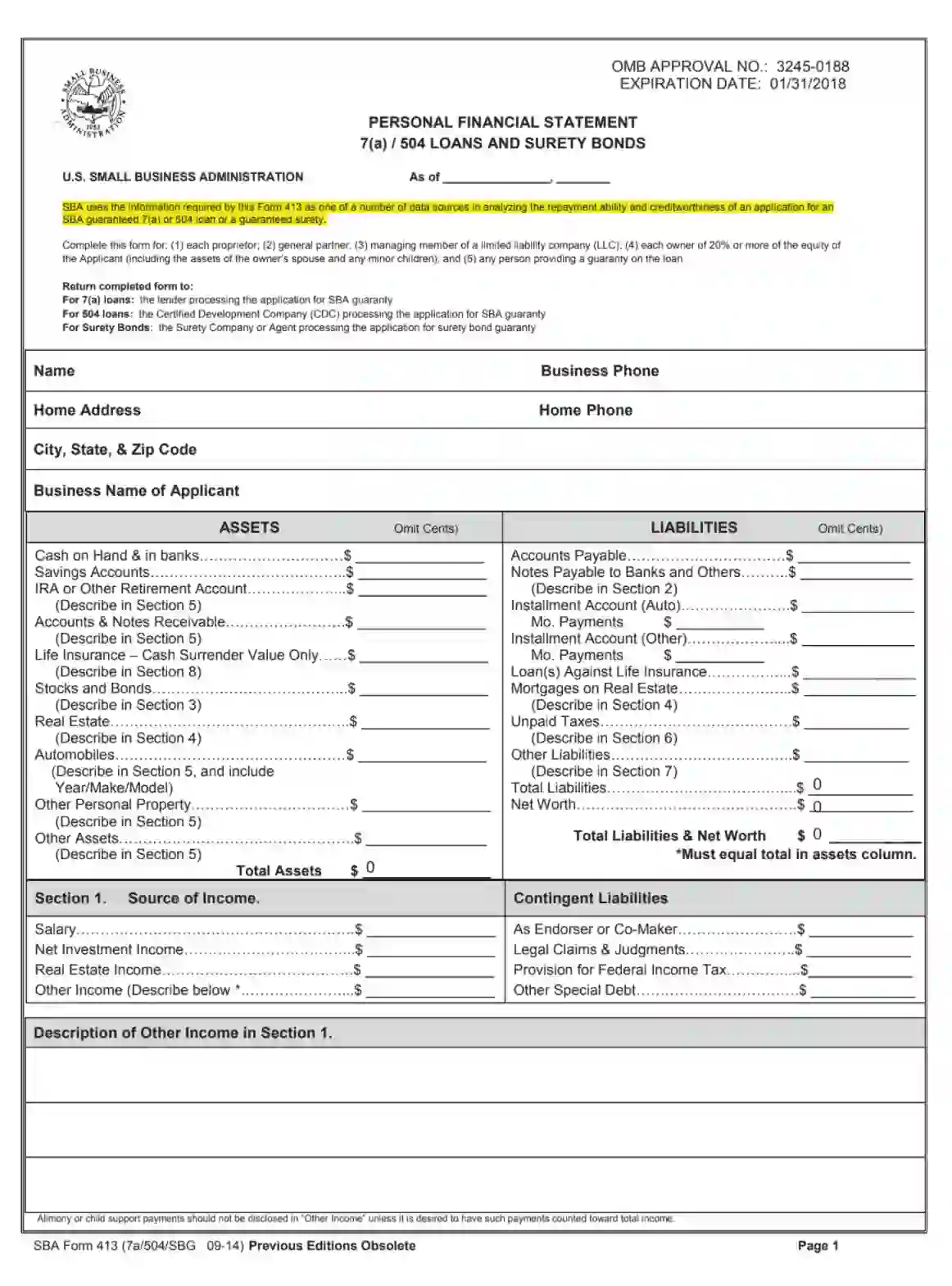

A rollover occurs when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of it, within 60 days, to another eligible retirement plan. Sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an applicant for. Collection information statement for wage earners.

A determination letter for a multiple employer plan issued under revenue procedure (rev. The section 413(c) plan administrator must also report the spinoff to the irs (in the manner prescribed by the irs in forms, instructions, and other guidance). Also called the personal financial statement (pfs), form 413 allows lenders to see what you already owe, and evaluate your creditworthiness.

A refund of one of the taxes (other than income taxes or an employer’s claim for fica tax, rrta tax, or income tax withholding). This rollover transaction isn't taxable, unless the rollover is to a roth ira or a designated roth. 413, rollovers from retirement plans.

This form is also available for download at umass.edu/fi nancialaid *fdvere* financial aid services academic year. Sba form 413 personal financial statement sba uses this form to assess the financial situation of applicants for multiple sba programs and certifications. Use form 843 if your claim or request involves:

Sources of income (rental property, dividends, investments, business income,. Using electronic payment and agreement options for taxpayers who owe can help avoid penalties and interest. On an sba form 413, you’ll report your personal financial information, including:

Department of the treasury internal revenue service credit for federal tax paid on fuels go to www.irs.gov/form4136 for instructions and the latest information.