Stunning Tips About Profitability Ratio Calculation Insurance Expense Balance Sheet

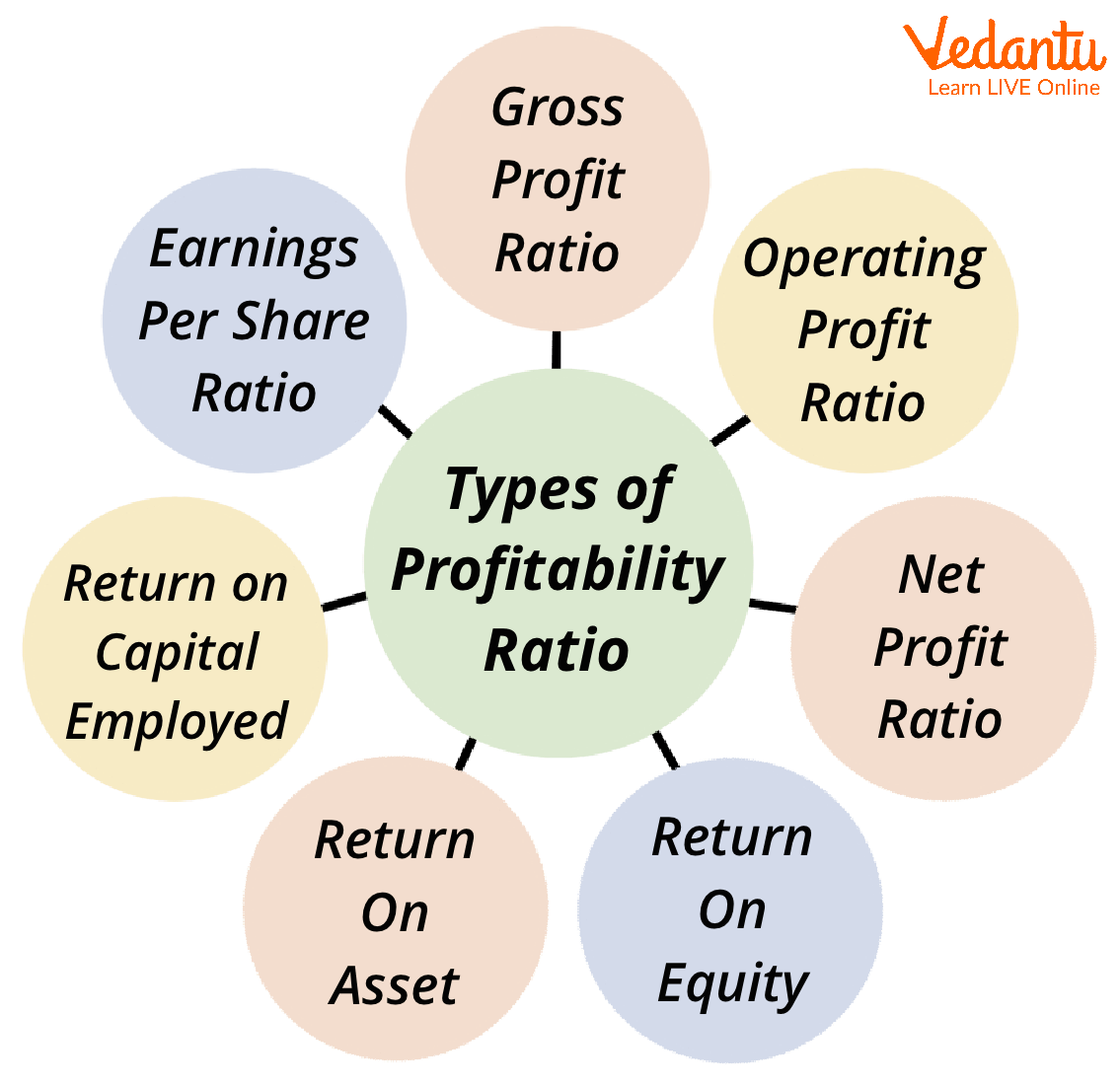

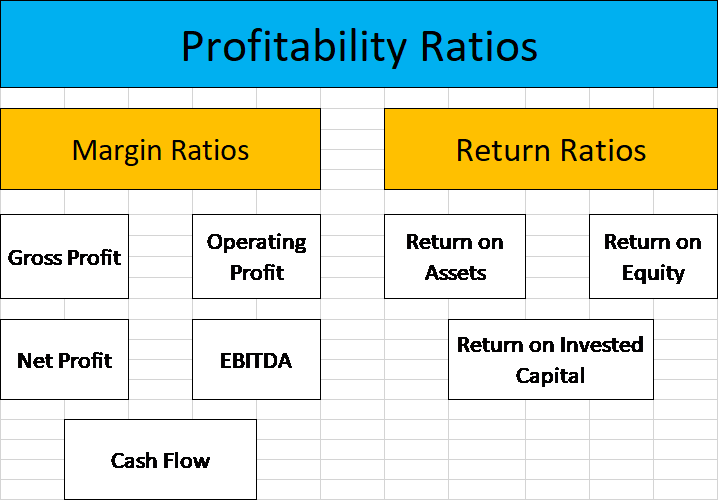

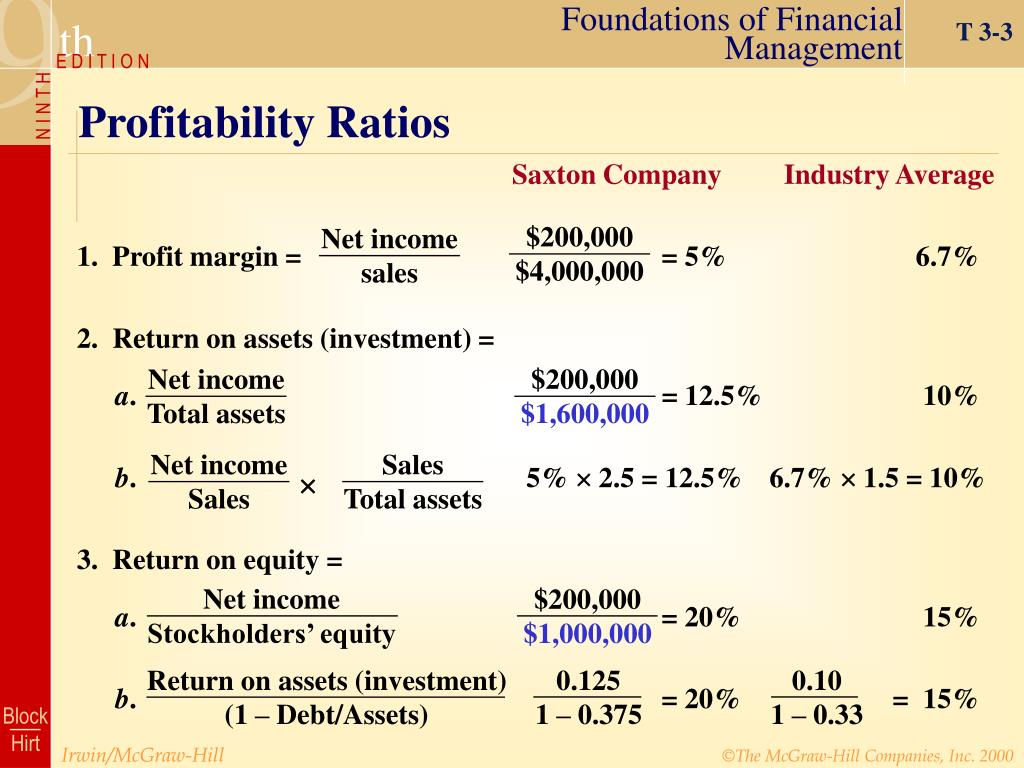

The most common profitability ratios include;

Profitability ratio calculation. Last year, the company's dcf of ca$11.3 billion rose by ca$0.3 billion from 2022. The three profitability ratios that. It is usually measured using ratios like.

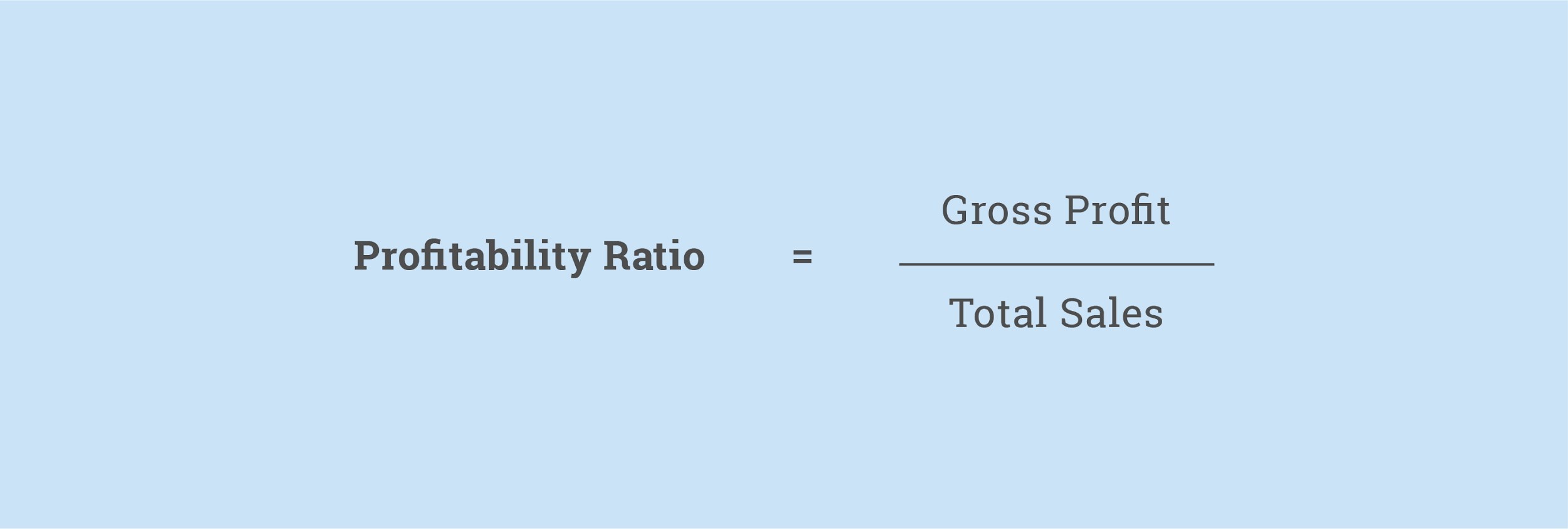

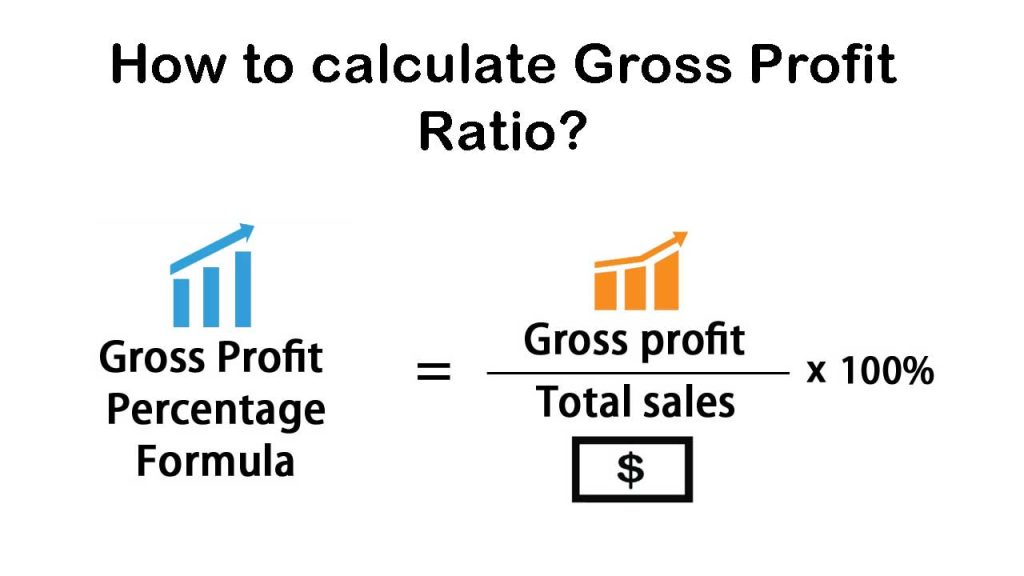

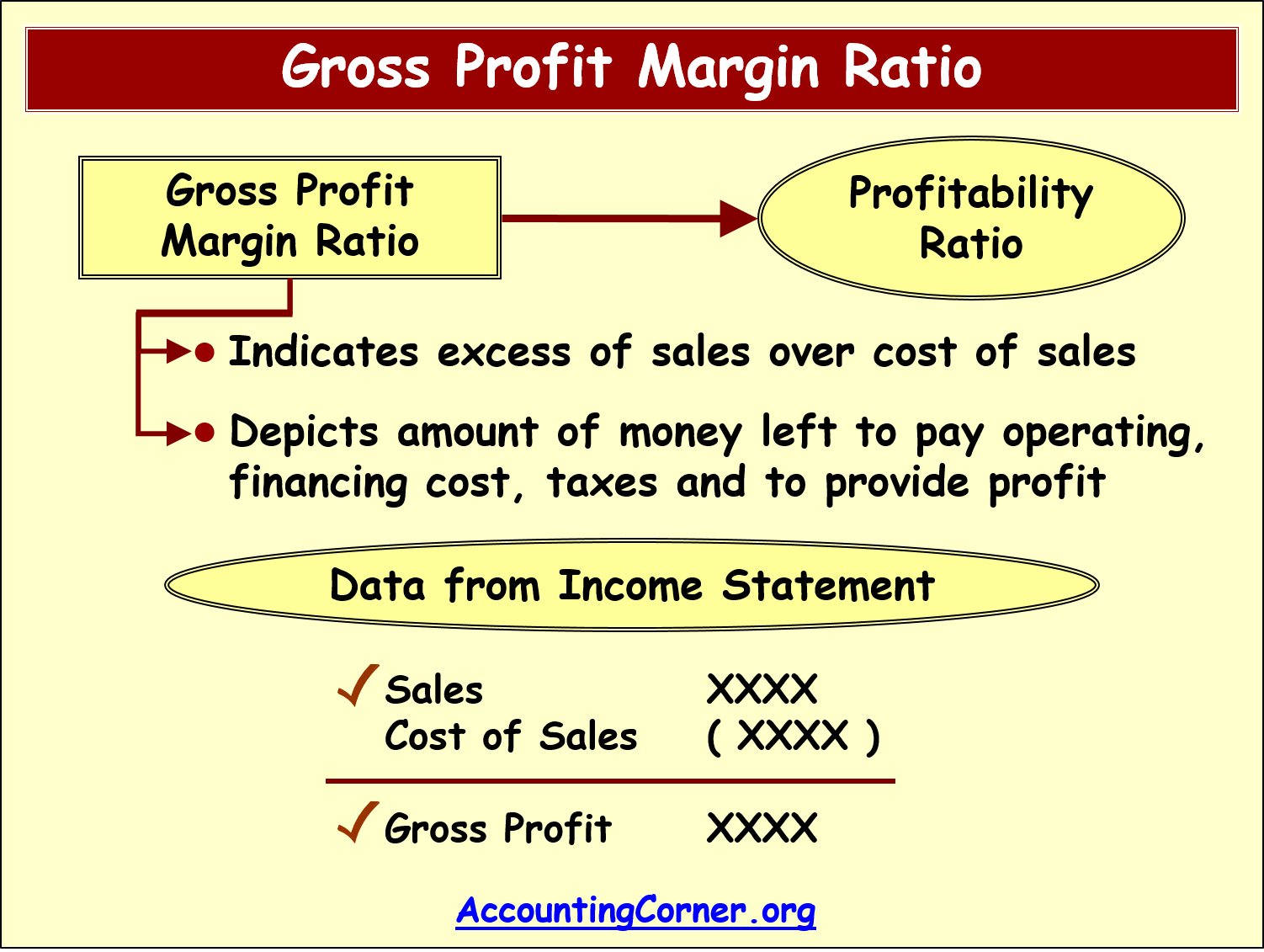

In the 1900s, the gross profit margin was the primary method used to calculate the profitability ratio. This comprehensive tutorial covers everything you need to know about profitability ratios, from their definitions to formulas, calculations, and interpretations. Gross, profit after taxes (pat) and.

Return on assets is a profitability ratio that provides how much profit a company is able to generate from its assets. There are various types of profitability ratios. A company’s profit is calculated at three levels on its income.

Gross profit margin ratio, net profit margin ratio, return on total assets ratio, and the return on equity ratio. A profitability ratio calculator is a financial tool used to evaluate and assess the profitability of a business or investment. Let’s see all those ratios one by one :

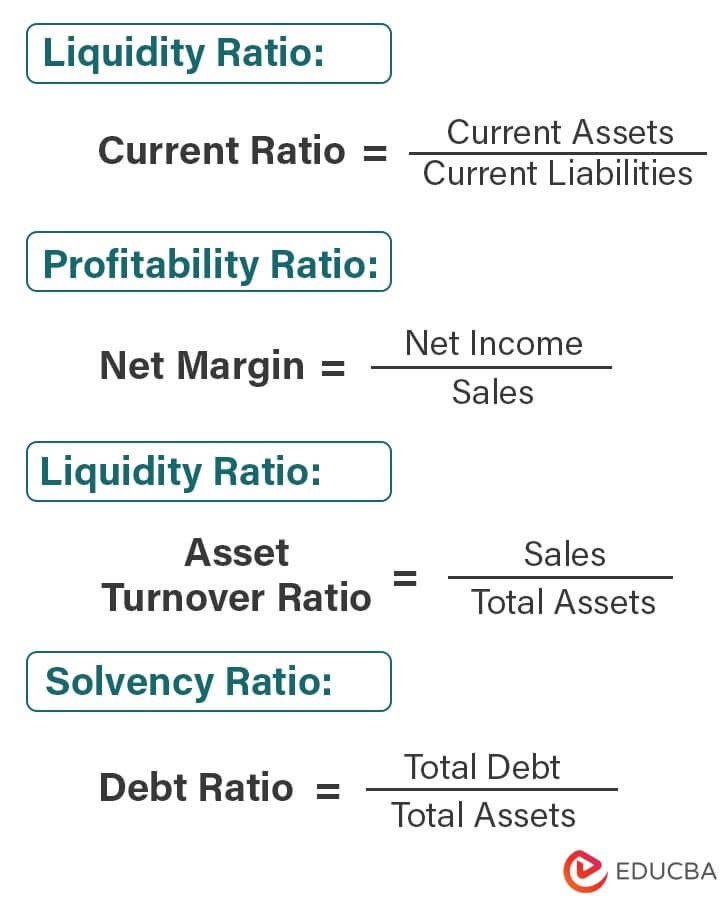

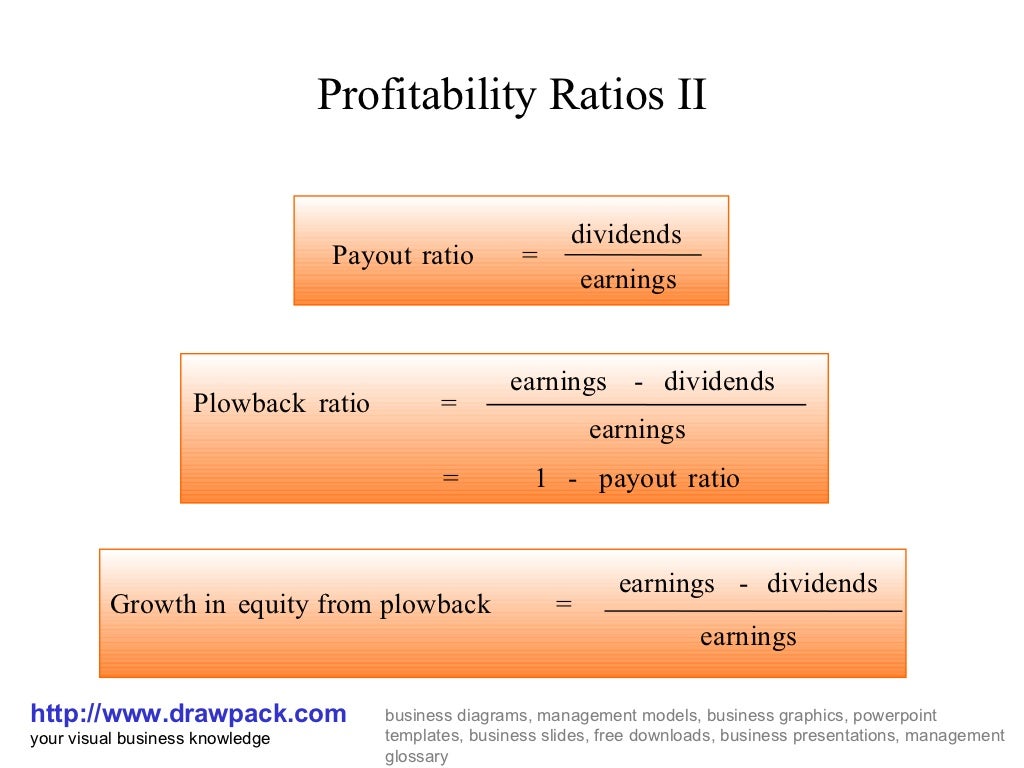

The formula for calculating operating profit ratio is: Profitability ratios help assess the company’s performance by calculating the profitability at different levels, i.e. Margin ratios are those kinds of profitability ratios that aim to measure the organization's ability to convert its revenue generated from the sale of goods into.

It helps stakeholders, including investors,. What is the formula for. Profit after tax ÷ net worth where, net worth = equity share capital, and reserve and surplus earnings per share this ratio measures profitability from the.

Once standardized, the ratio can subsequently be used for purposes of comparability, either to the. Profitability ratios are simple calculations that break down the numbers from your financial statements into percentages. The resulting figure must then be multiplied by 100 to convert the ratio into percentage form.

Return on assets (roa) measures how. This is a calculation that more closely resembles cash flow than accounting profits. Formulaically, the structure of a profitability ratio consists of a profit metric divided by revenue.

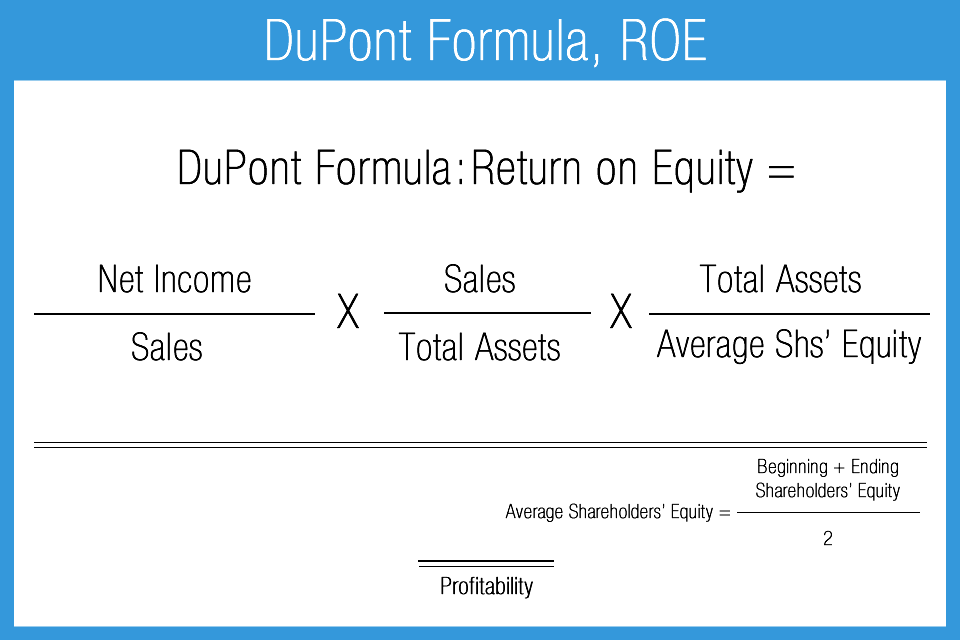

These ratios compare various profits of the business. The concept of profitability ratio calculation has evolved over time. Roe unveils how much profit a company produces for shareholders.

It’s computed by dividing net income by average shareholder equity.