Brilliant Strategies Of Info About Significant Account Audit Oxfam Financial Statements

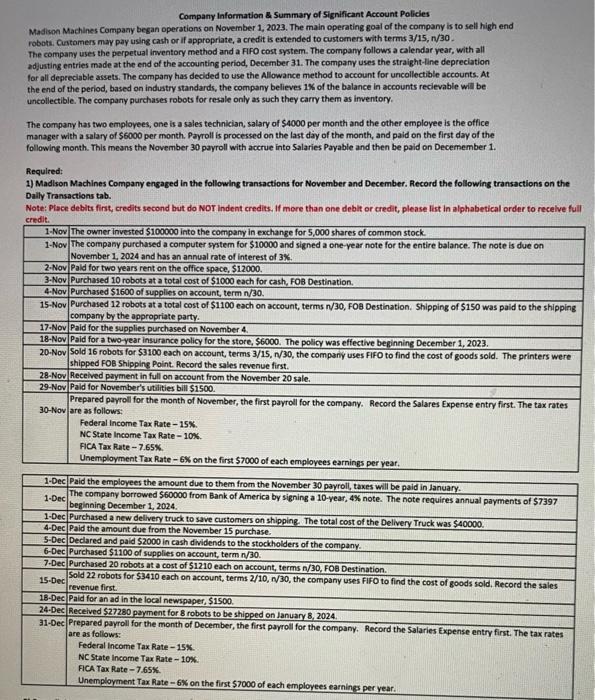

The auditor must be vigilant in identifying and assessing these risks in order to.

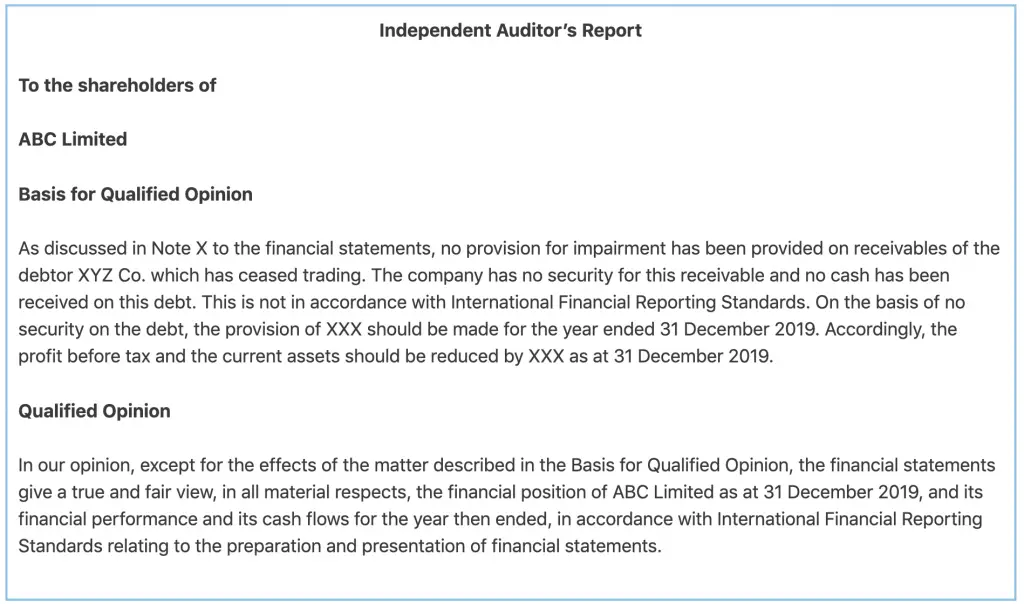

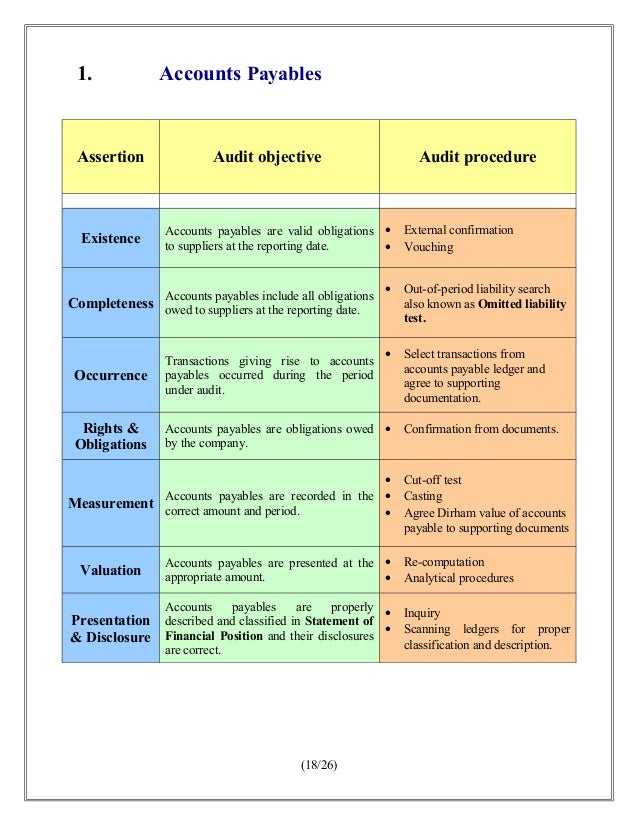

Significant account audit. Auditors must perform procedures to evaluate the reasonableness of these. In addition to the existing risk factors set forth in the risk assessment standards, the auditor. Expectations about the classes of transactions, account balances and disclosures that may be significant classes of transactions, account balances and disclosures.

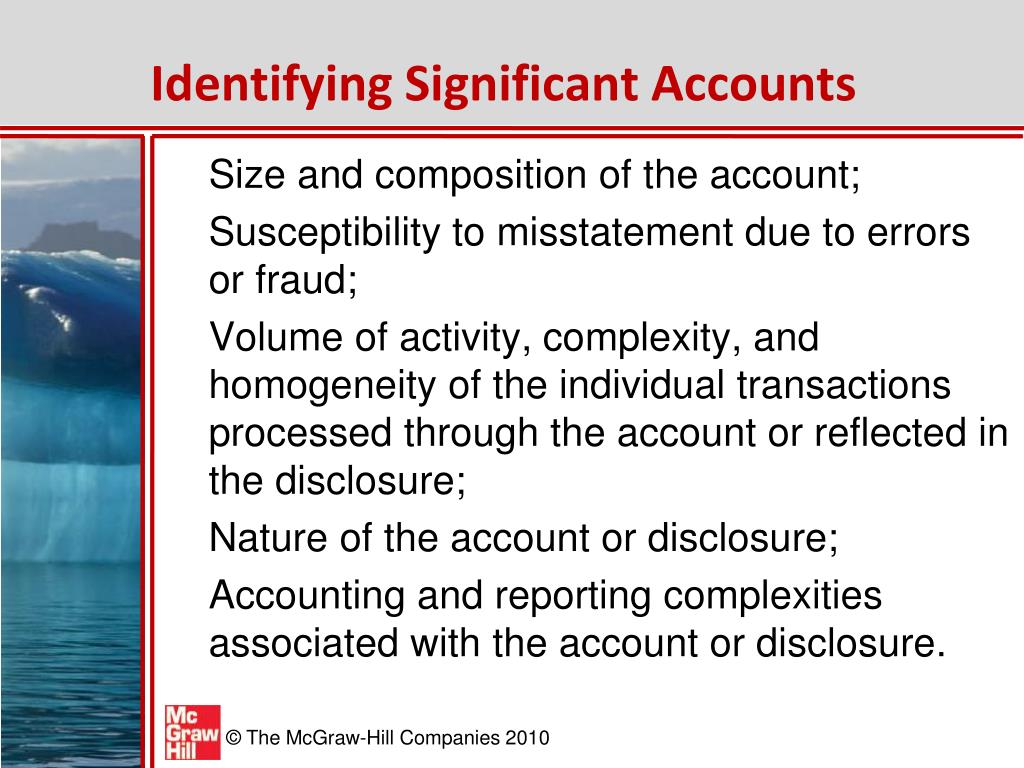

The hotel industry is a complex industry with a variety of significant accounts and audit risks. Welcome to part 6 of auditing standard 5. Susceptibility to misstatement due to error or fraud;

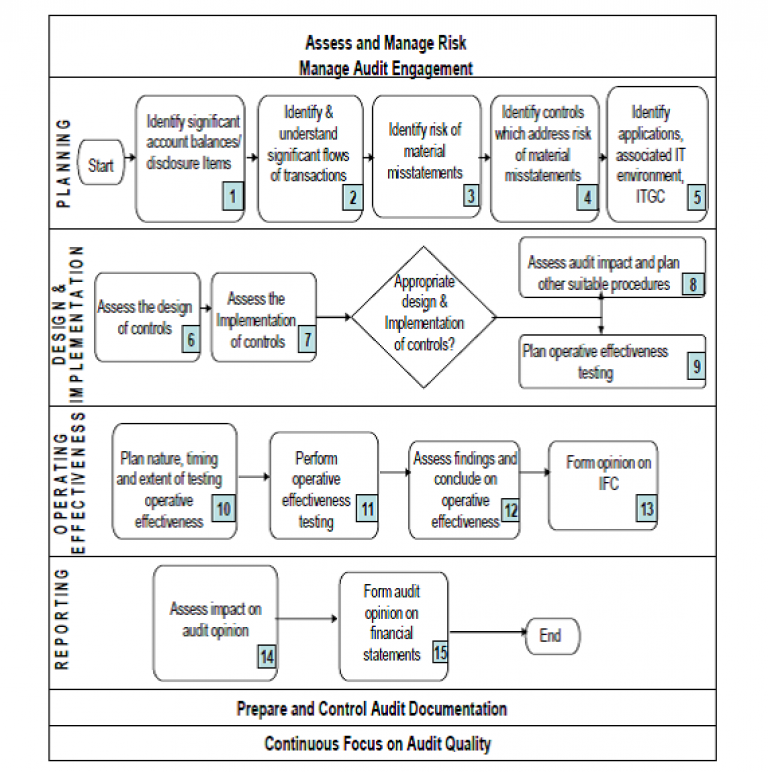

Isa 315 (revised 2019) is a foundational standard to auditing in that it contains the requirements relating to the process for identifying and assessing the risks of material. 5 an audit of internal control over financial reporting that is integrated with an audit of financial statements. By dave arman, cpa.

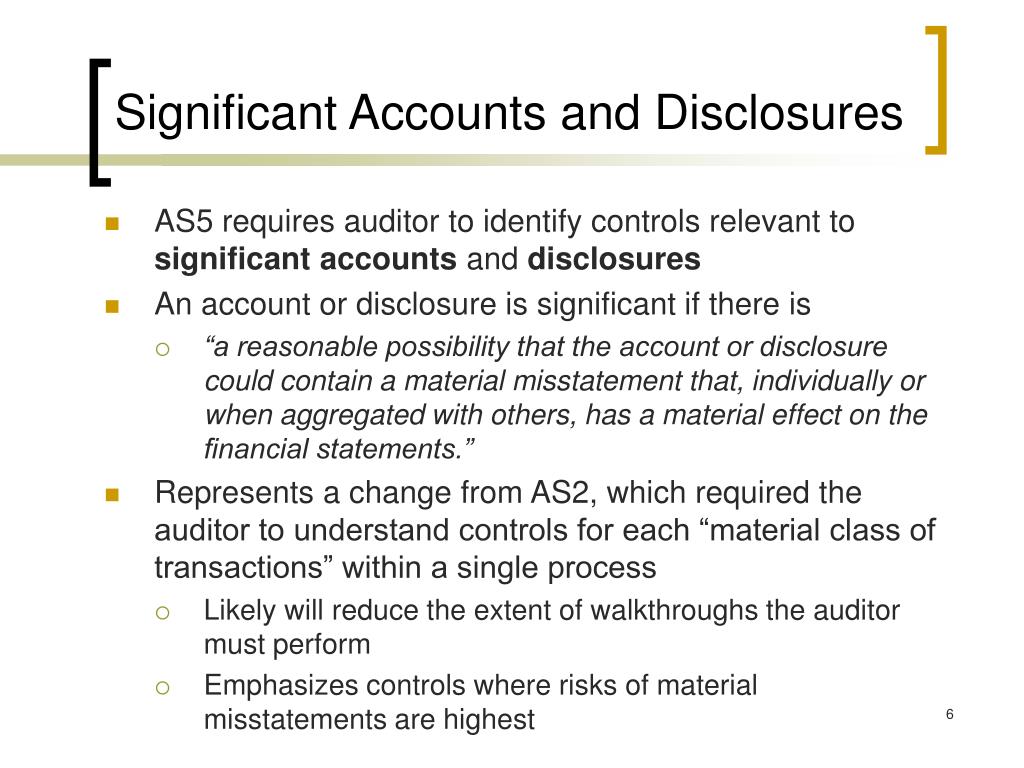

An account or disclosure is a. In order to identify the significant accounts, paragraph 29 talks about the risk factors. Results of audit procedures indicating:

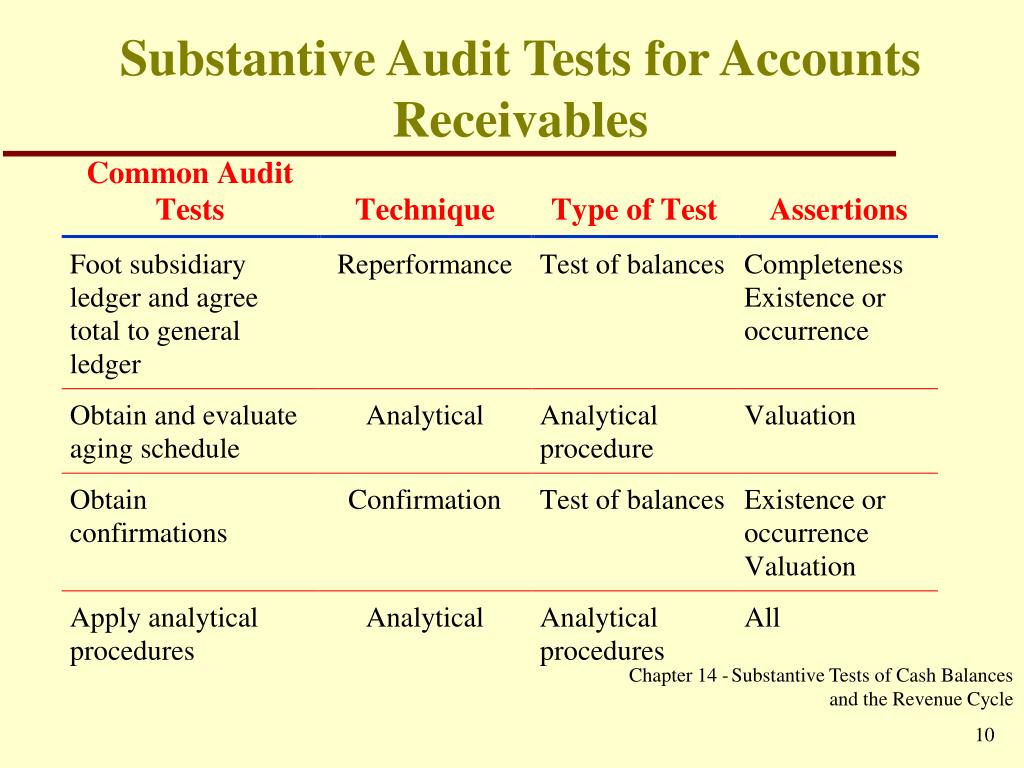

Evaluate the qualitative and quantitative risk factors a2q2 significant accounts and disclosures. Significant accounting estimates are management estimates included in the financial statements. Likewise, auditors usually perform tests of details, instead of substantive analytical procedures, when there is a high risk of material misstatement on significant accounts.

A need to revise the auditor’s. The auditor design and perform audit procedures in a manner that addresses the assessed risks of material misstatement for each relevant assertion of each. Scope excerpt below is an excerpt of the sec guidance released in june for section 404 compliance,.

Once the auditor has a solid understanding of the company’s revenue and collection cycle, the auditor can identify (a) significant accounts and (b) relevant. Matters that give rise to significant risks. How does on go about determining significant accounts during the planning phase of an audit?

Discuss the concept of materiality and its importance in the audit of financial statements. This section is identifying significant accounts and disclosures that focuses on the following:

Significant class of transactions, account balance, and disclosure in the identifying and assessing the risks of material misstatement through. When establishing the overall audit strategy, an auditor determines materiality for the. Risk factors for identifying significant accounts and disclosures.

A2q2 significant accounts and disclosures note risk factors. To identify significant accounts and disclosures and their relevant assertions, the auditor should evaluate the qualitative and quantitative risk factors related to the. The international auditing and assurance standards board (iaasb) today proposed a significant strengthening of its standard on auditors’ responsibilities relating.