Beautiful Tips About Receivable In Balance Sheet Bank Financial Statement

Unlike received, receivable adheres to the future prospects of the payment.

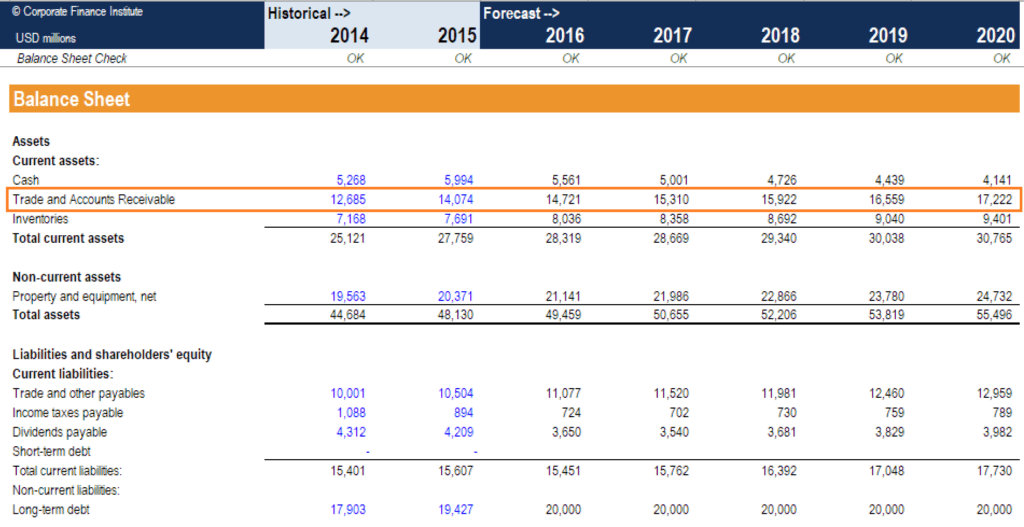

Receivable in balance sheet. If the balance is going down, that means you're collecting customer payments from previous invoices. Accounts receivables refer to the amounts a company would receive from customers who have bought goods and services from the company on credit. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

The balance sheet, also known as the statement of financial position, is one of the three key financial statements. You use accounts receivable as part of accrual basis accounting. Examples of financing receivables include trade accounts receivable, notes receivable, credit card receivables, loans, and certain receivables relating to a lessor’s.

Typically, the period of credit ranges from short to a few months and, in some cases, a year. This money is typically collected after a few weeks and is recorded as an asset on your company’s balance sheet. This is because you are liable to receive cash against such receivables in less than one year.

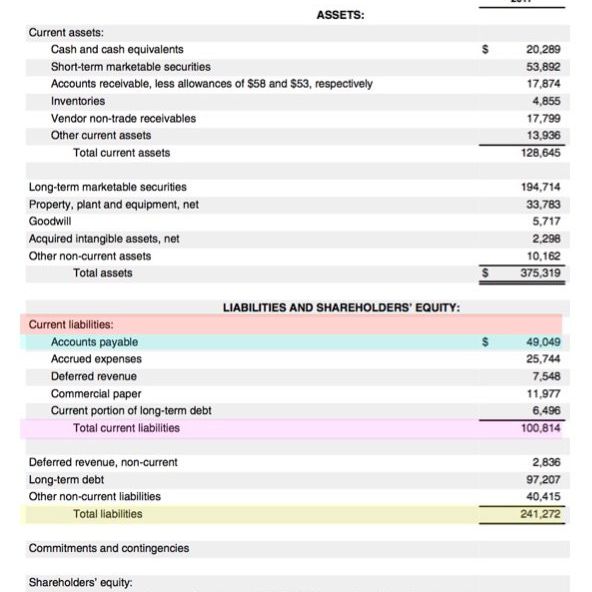

Accounts receivables (ar) as the term receivable suggests accounts receivables are the amount or sum that your customers owe you. Assets = liabilities + equity. Accounts receivable appears as a current asset on the balance sheet.

Accounts receivables, like cash, are considered a current assets. Accounts payable is listed on a company's balance sheet. Accounts receivable is the next best thing to cash so it is highly important by being near the top of the balance sheet.

These amounts are expected to be settled in less than 12 months. June 10, 2022 calculating accounts receivable on the balance sheet is not a formula, rather it is the sum of all unpaid credit invoices that have been issued to customers. Next to cash, accounts receivable is the most important number on the balance sheet.

They are recognized as assets on the balance sheet. Accounts receivable is located in the asset section of the balance sheet usually right underneath cash or bank accounts. Accounts receivable is an asset —a plus on your company’s balance sheet—symbolizing money owed by customers for products or services already delivered.

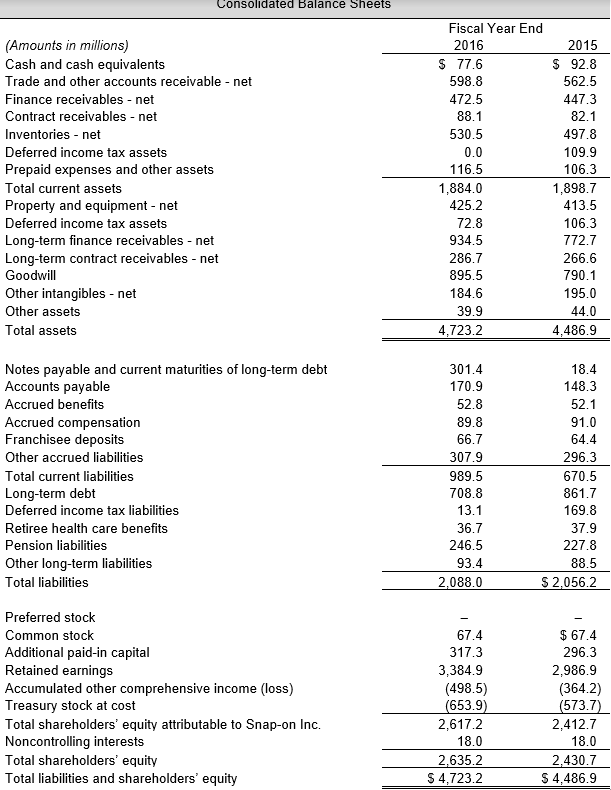

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The balance sheet is one of the three core financial statements that are used to. Trade and other receivables are categorized or classified as current assets on the company’s balance sheet at the specific reporting period.

As fixed assets age, they begin to lose their value. Trade receivables and other receivables in the balance sheet. The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time.

The balance sheet is based on the fundamental equation: In many instances, companies will give goods or services to customers and have them pay afterward. Accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e.