Top Notch Tips About Understanding P&l And Balance Sheet Fasb Not For Profit

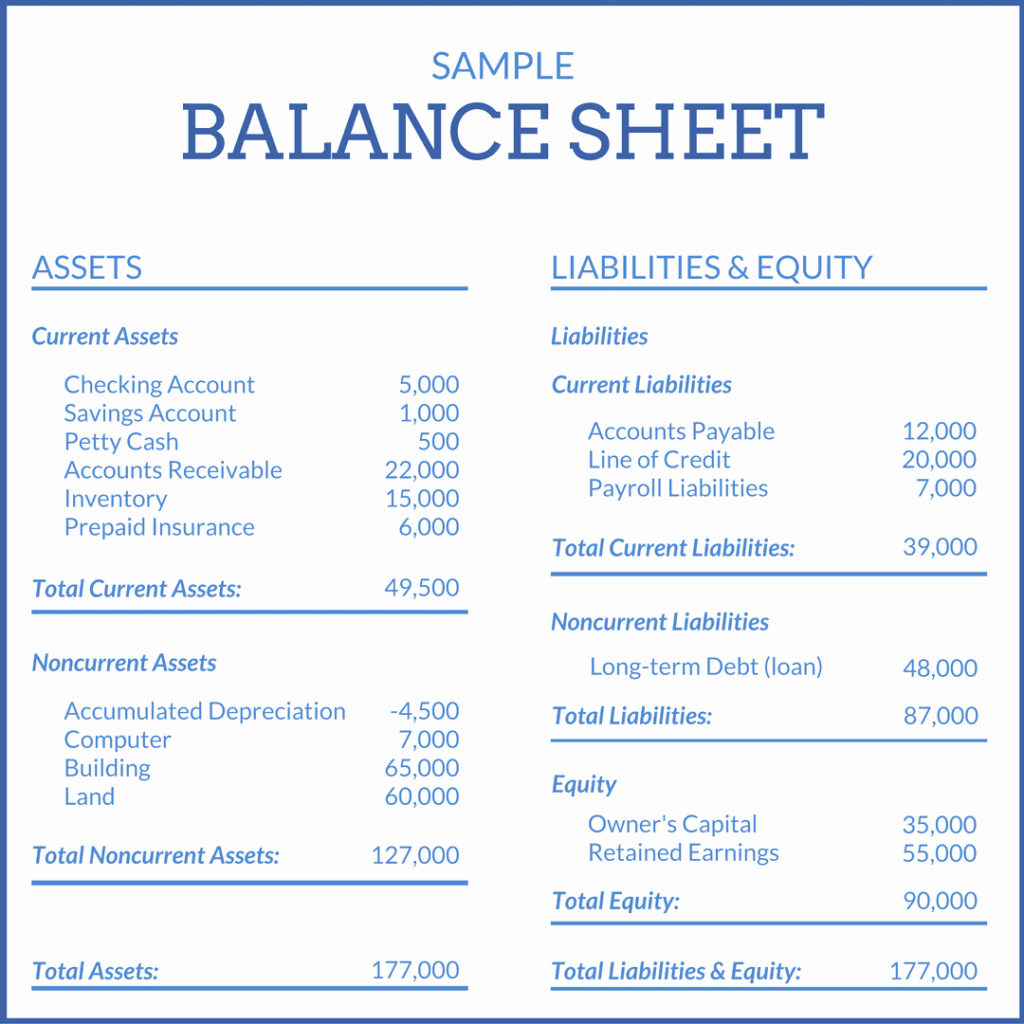

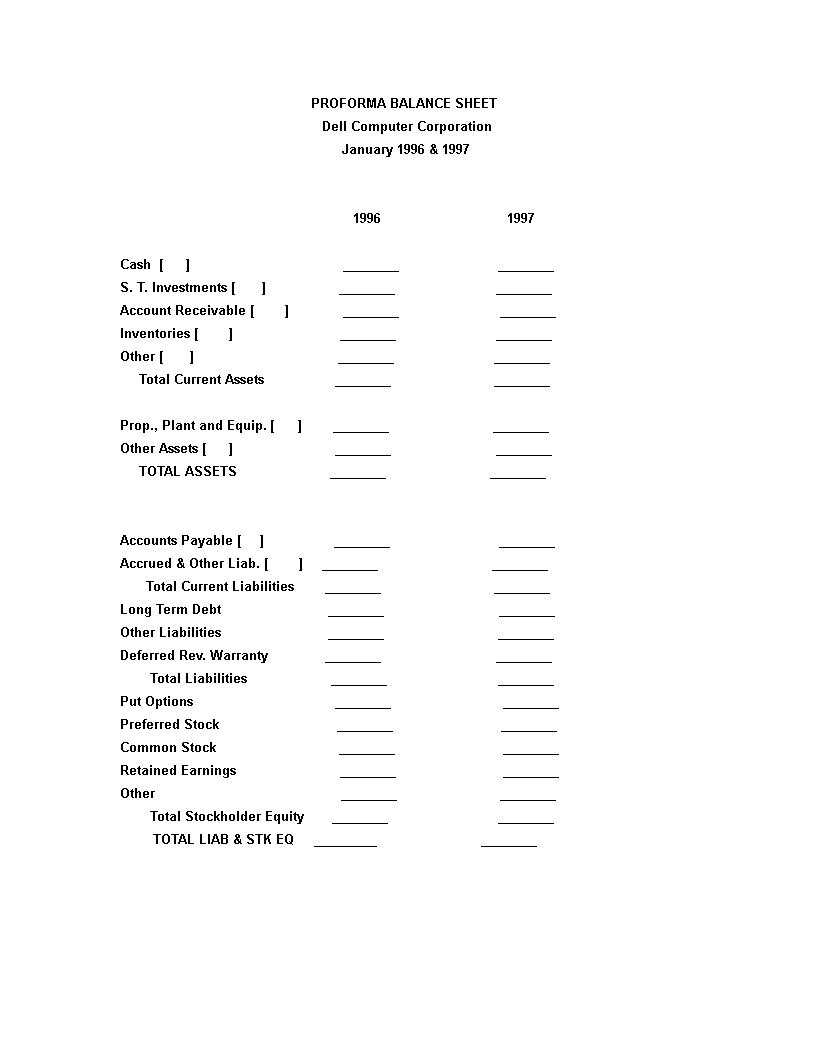

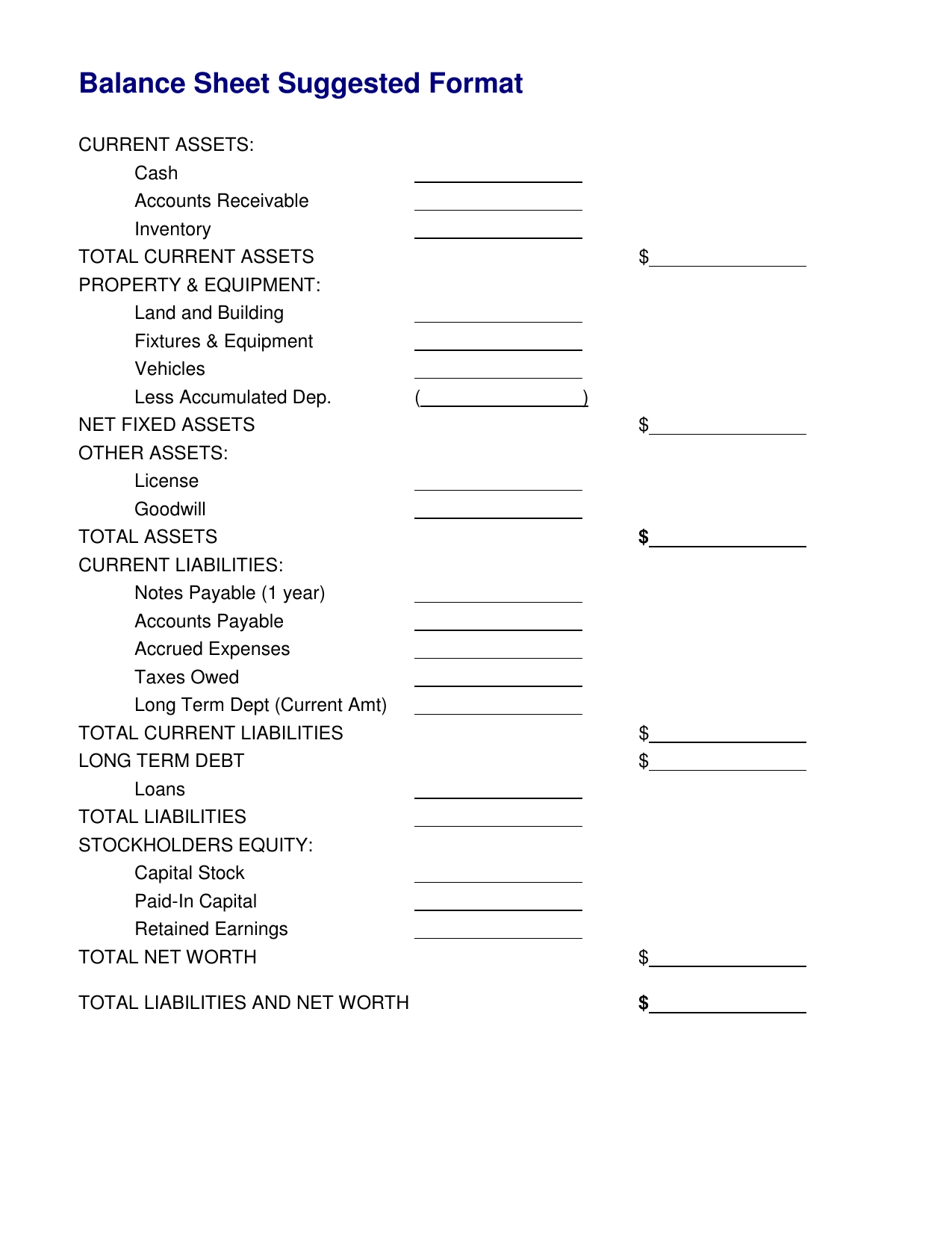

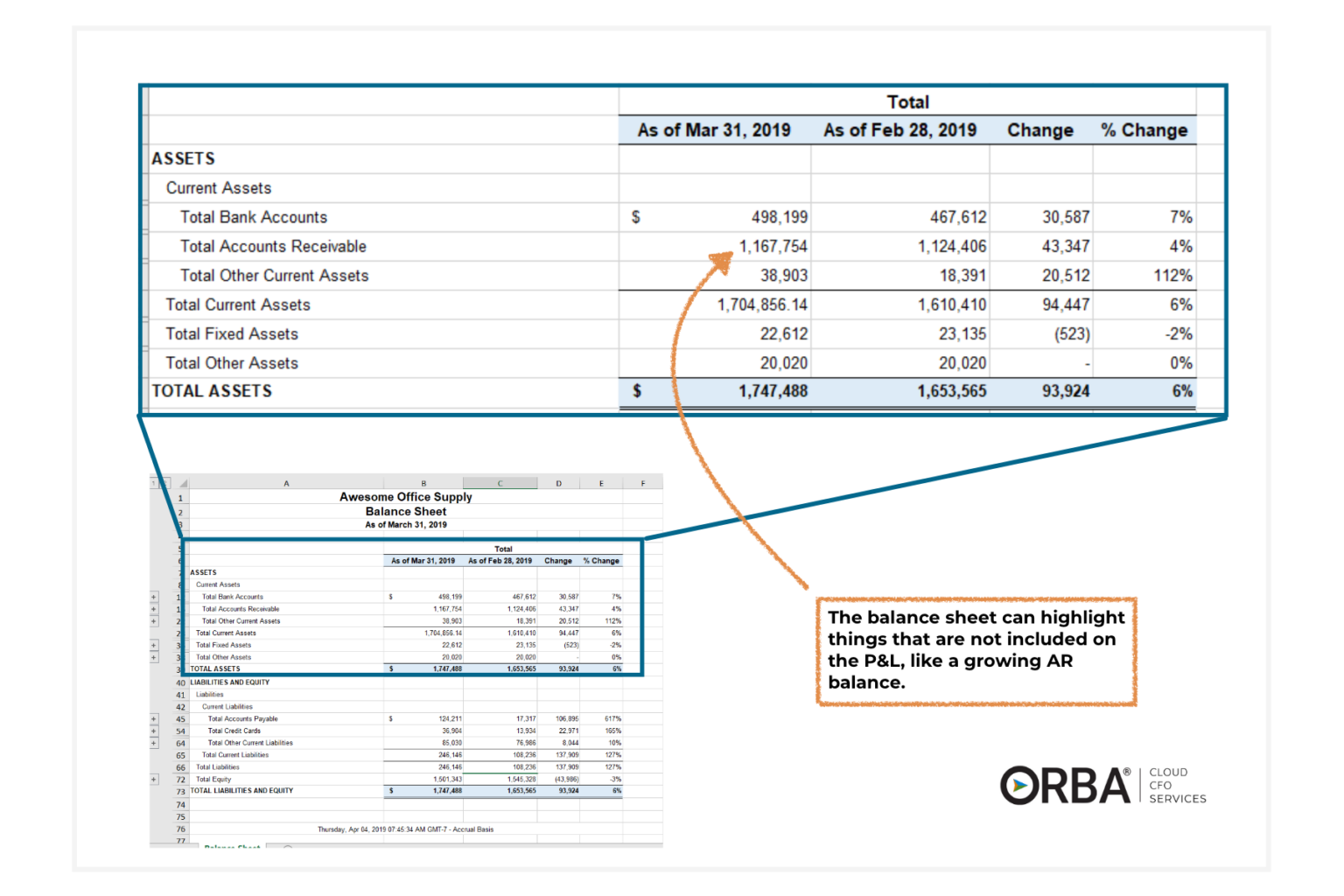

The balance sheet is a snapshot of what your business looks like on a specific date, while the p&l statement shows how your business changed over a.

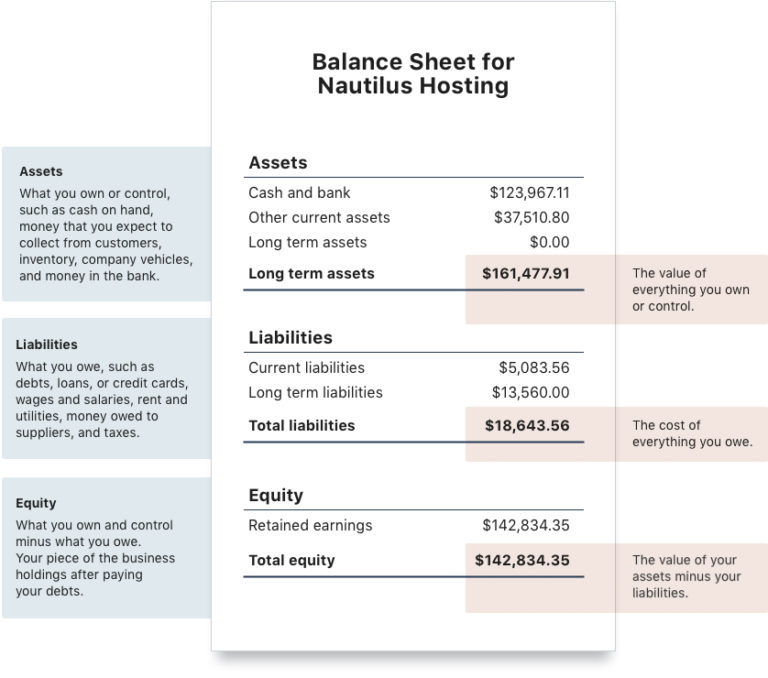

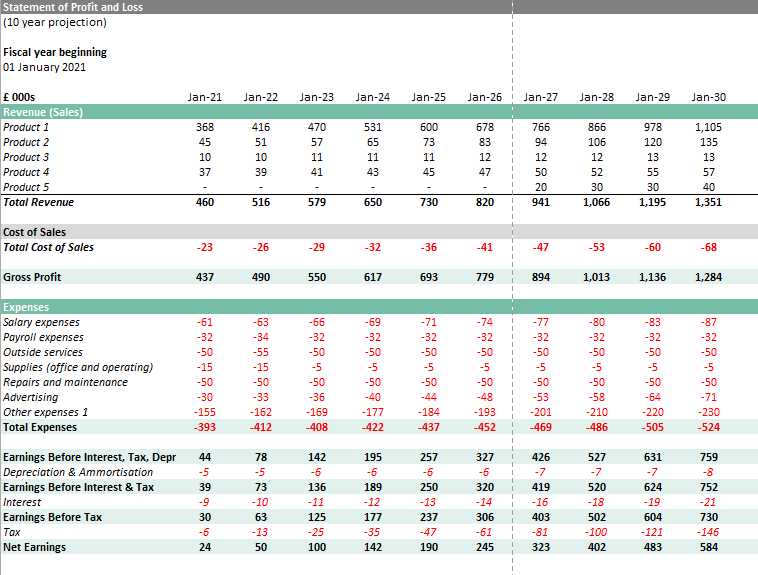

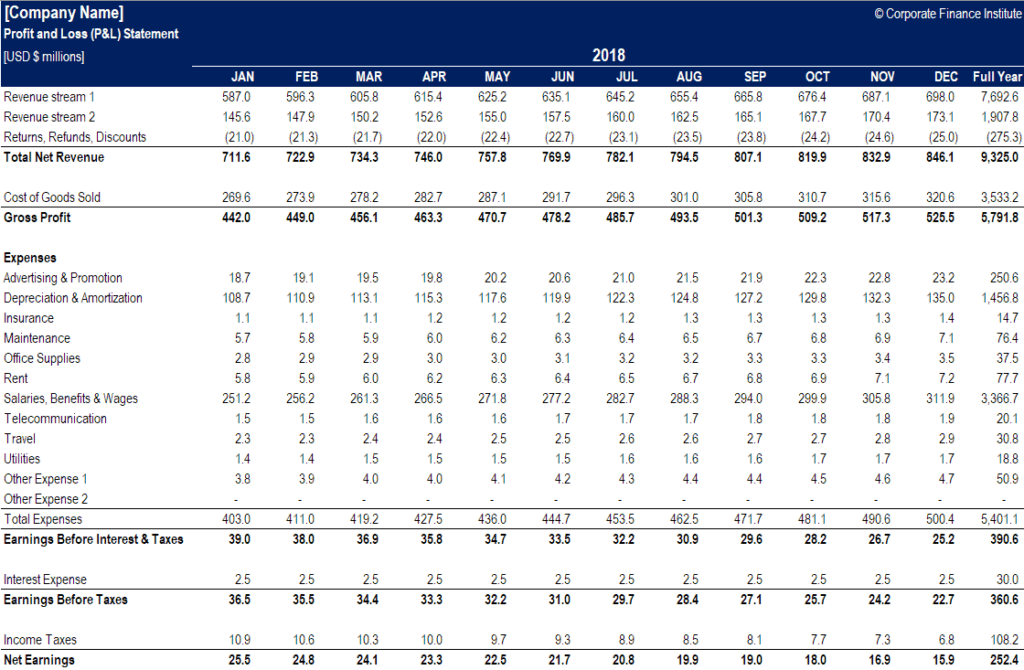

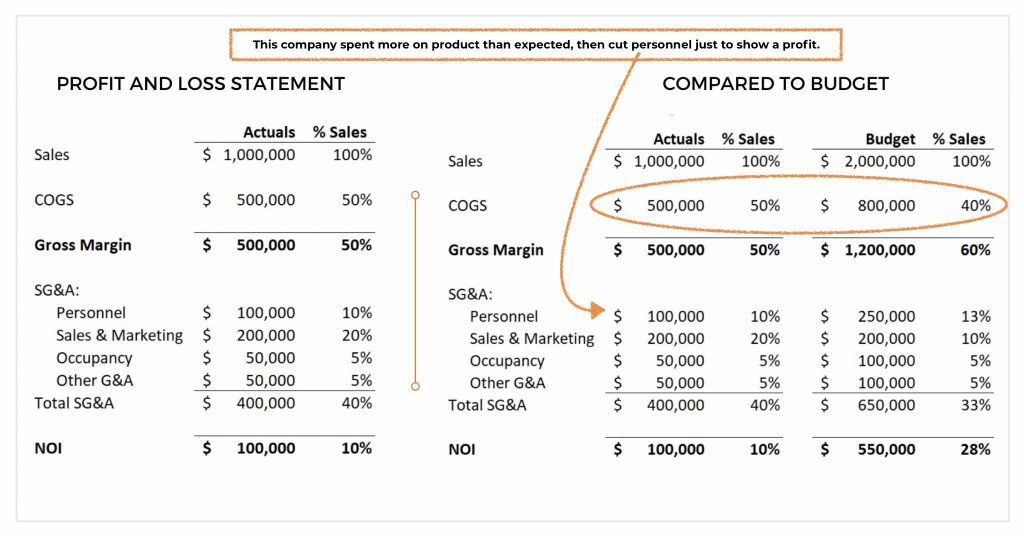

Understanding p&l and balance sheet. Your p&l statement shows your. Share share share the p&l statement (aka profit and loss statement) is one of the primary financial statements that companies must prepare and publish. While the p&l statement gives us information about the company’s profitability, the balance sheet gives us information about the assets,.

We then look at the annual report and how to extr. To recap, we started with understanding the difference between technical analysis and fundamental analysis. In the previous video, we looked at the p&l statement and how to understand it.

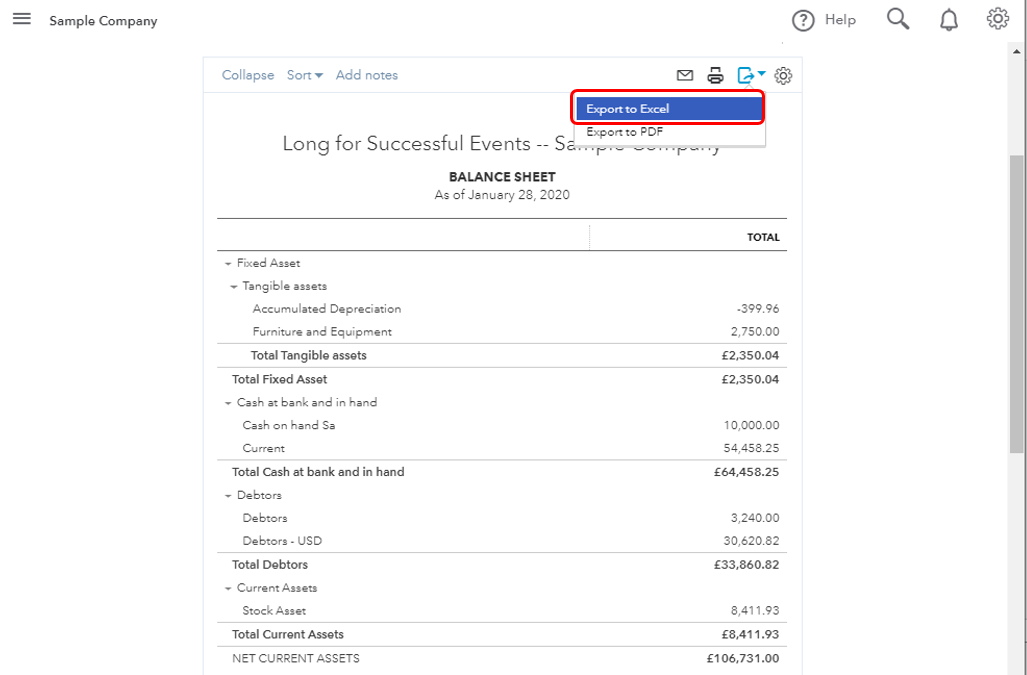

The balance sheet is split into two columns, with each column. Integrating the p&l statement with the balance sheet allows for a more comprehensive evaluation of the company’s finances. There are several key differences between the p&l and balance sheet, particularly the information presented and what it means.

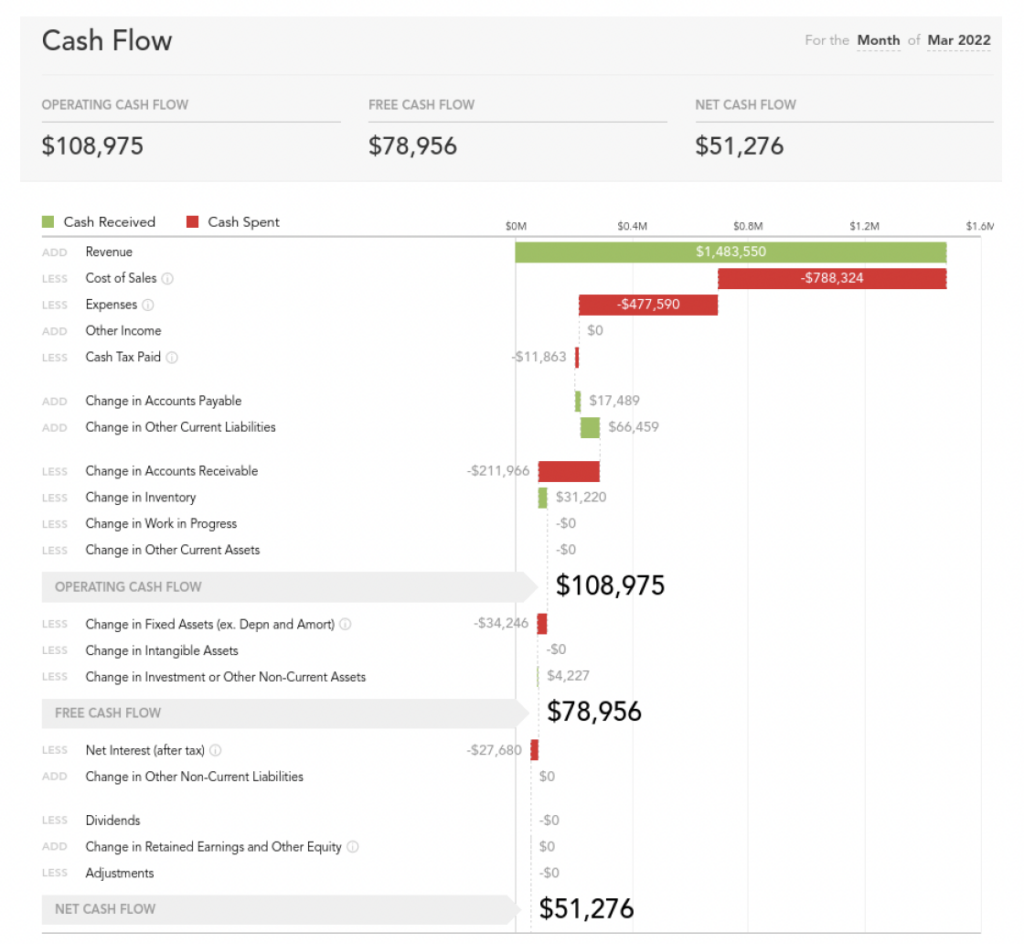

On the balance sheet, it feeds into retained earnings and on the cash flow statement, it is the starting point for the cash from operations section. A profit and loss (p&l) report is a critical piece of information for a company that states whether a company is profitable. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and.

The balance sheet can be used to assess your business’ liquidity and solvency, compare your financial position to previous years, and identify trends over. Companies record the value of their assets and debt on the balance sheet (bs). Although the balance sheet and the p&l statement contain some of the same financial information—including revenues, expenses and profits—there are important differences between them.

The p&l report lists revenue, expenses and. Profit after tax flows from p&l. Essential items to look at under the balance sheet are;

Here are some key connections: In this video, we look at balance sheets learn and how to analyze them.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)