Build A Tips About Outstanding Income In Balance Sheet Deutsche Post Financial Statements

Let’s create a balance sheet for cheesy chuck’s for june 30.

Outstanding income in balance sheet. Show on the liability side (usually under the head current liabilities) suppose a company paid rs 10,000 in salaries during the year and evaluates outstanding salaries at rs 2,000 at the end, showing the adjustment of. ($1,000 + 500 + 1,500) + 4,000. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it.

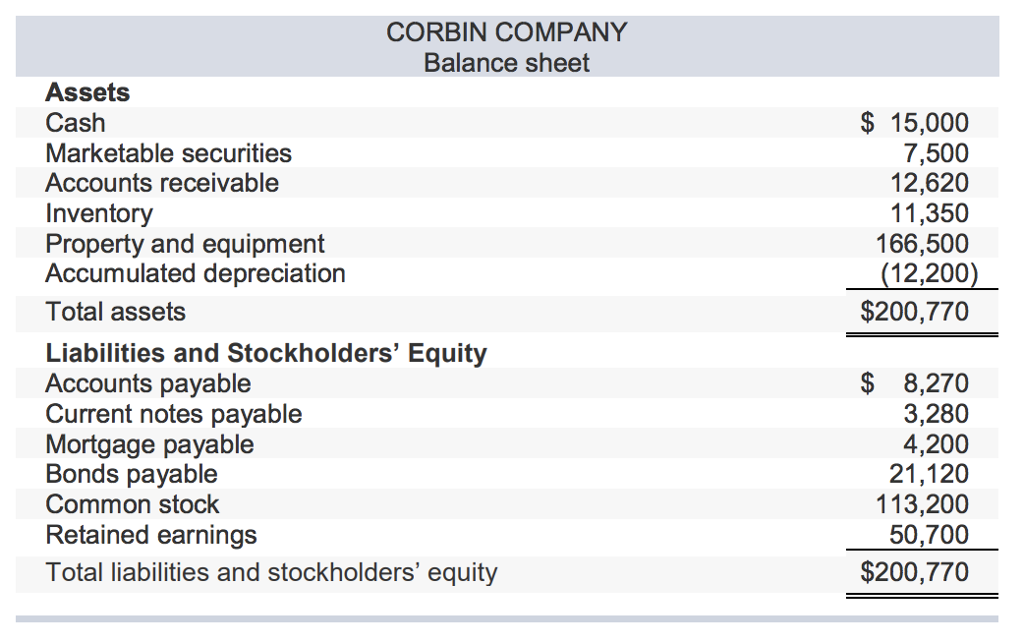

Outstanding salary is a personal representative account. There are two main parts to an income statement: To begin, we look at the accounting records and determine what assets the business owns and the value of each.

Add total liabilities to total shareholders’ equity and compare to assets. Subtract your expenses from your revenues to get your net operating income. To perform accounting with accuracy, these expenses are required need to be realized whether they are paid or not.

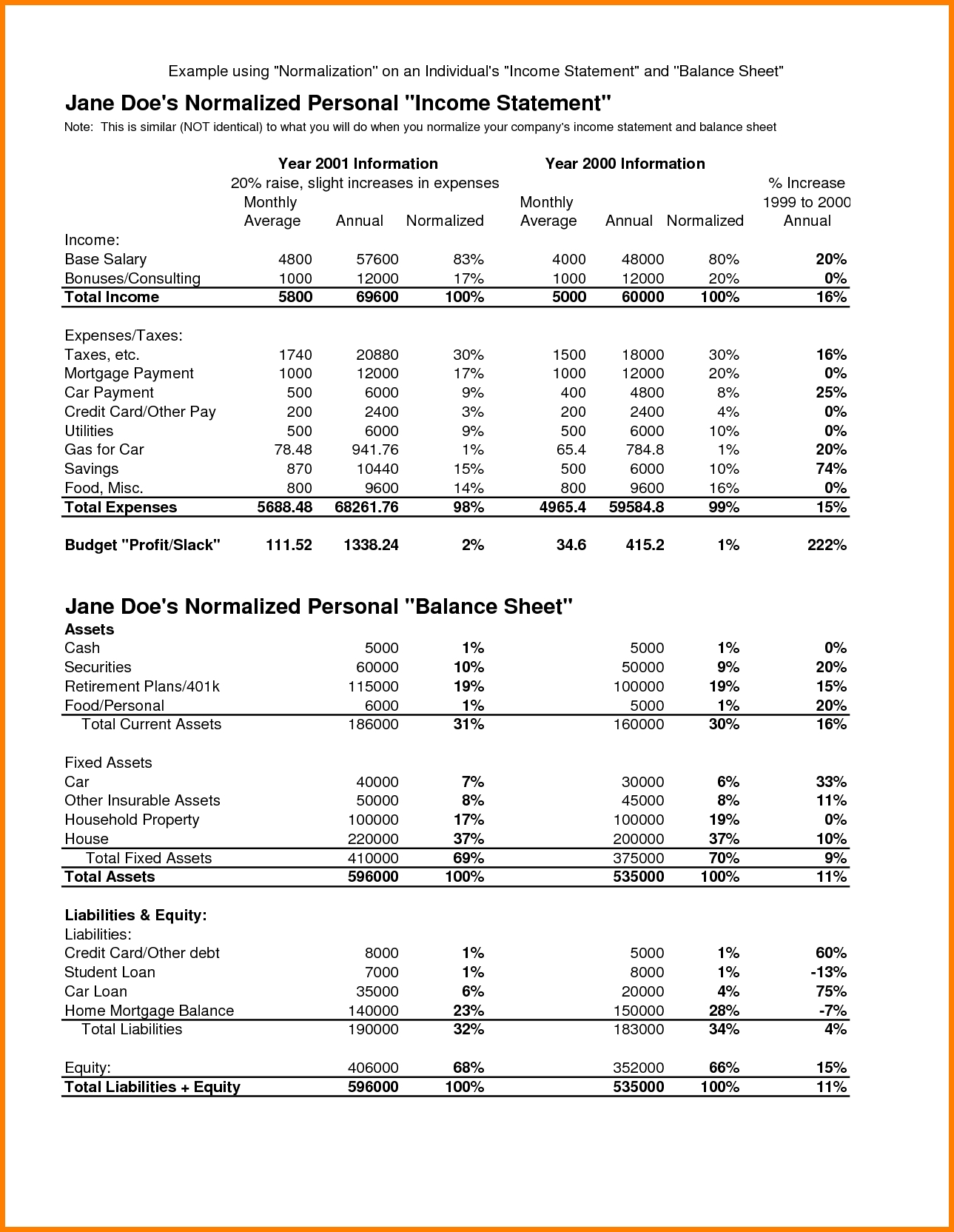

Cash came to roughly $20.3 billion. The total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. The outstanding expense is represented on the liability side of the balance sheet of a business.

Income statements and balance sheets are reliable ways to measure the financial health of your business. An outstanding expense is a type of expense that is due but has not been paid. Bank of america earned $58.5 billion in interest income from loans and investments while paying out $12.9 billion for deposits.

A balance sheet, along with an income statement and cash flow statement, is an integral part of your financial reporting. So, unpaid salary to be shown as liability under ‘expenses payable’ or ‘salary payable’ in the balance sheet on liabilities side and on another aspect of dual entry to be placed in profit & loss account. The salary outstanding is considered as the liability on the balance sheet while the expense is recorded on the income statement.

The income statement and balance sheet follow the same accounting cycle, with the balance sheet created right after the income statement. The numbers on the liabilities side of your balance sheet look like this: To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity.

Adjust outstanding expenses in final accounts at the end of the period. This is the amount that flows into retained earnings on the balance sheet, after deductions for any dividends. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable education (save) repayment plan.

To do this, you’ll need to add liabilities and shareholders’ equity together. In the year, a company paid rs 10,000 in salaries and estimated the outstanding salaries to be rs 2,000. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

Income statement an example of bank of america's income. The balance sheet provides a snapshot of a company’s financial position and consists of three main elements: The outstanding expense a/c appears on the liability side of the balance sheet.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)