Spectacular Info About Pro Forma Statement Of Comprehensive Income Walmart Financial Performance

Updated july 13, 2023 what is pro forma income statement?

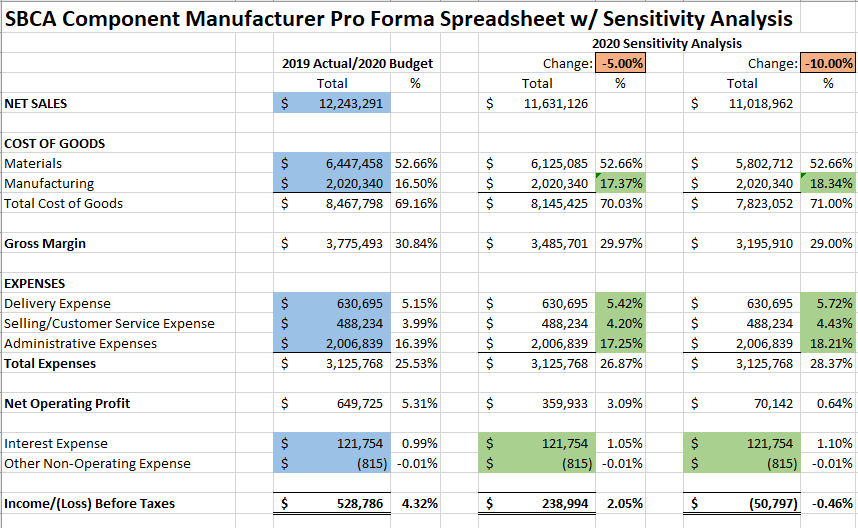

Pro forma statement of comprehensive income. Pro forma income statement refers to the projected income statement by using assumptions and special projections by analysts. Let’s say you want to increase your income by $18,000 over the course of one year. *every financial statement should inform the reader that the notes are an integral part of the financial statements and should be read for important information.

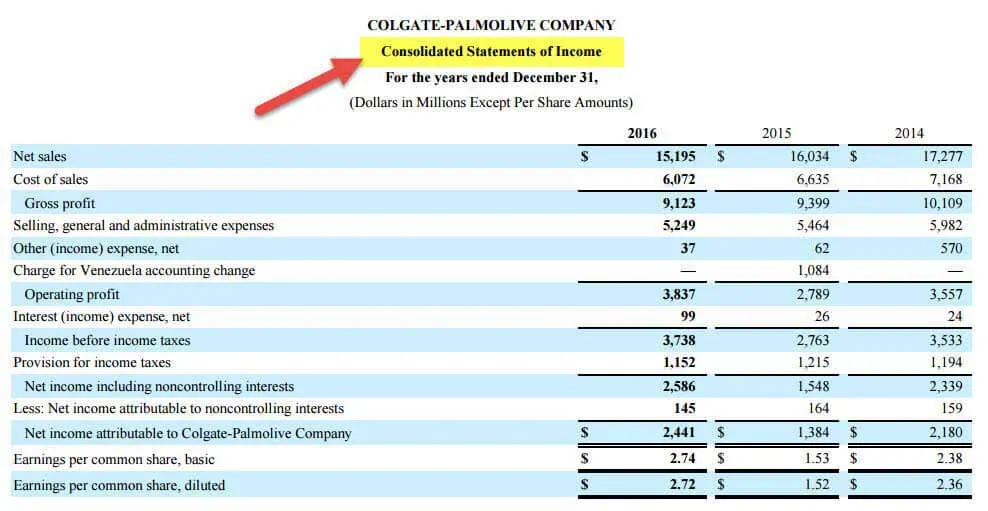

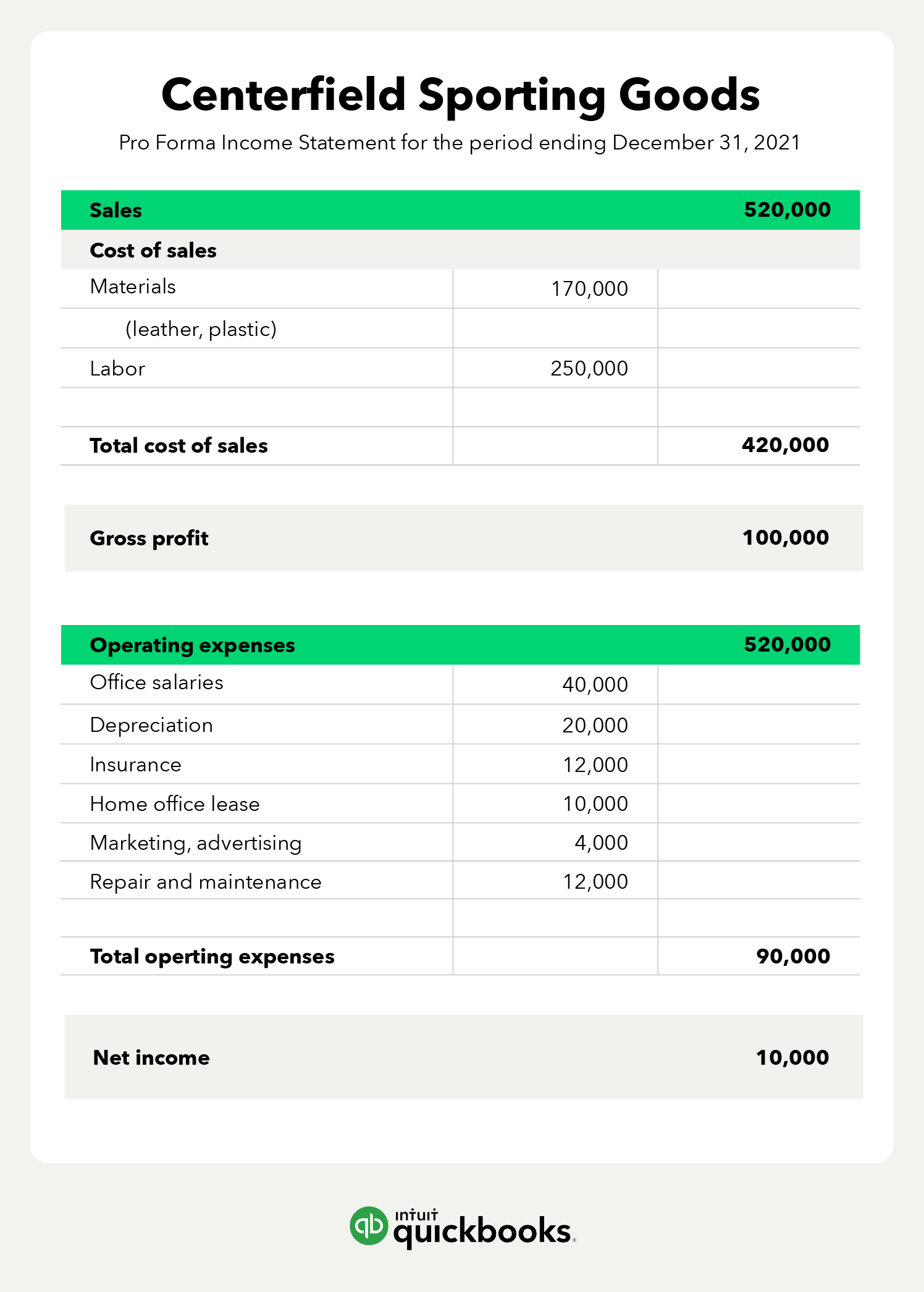

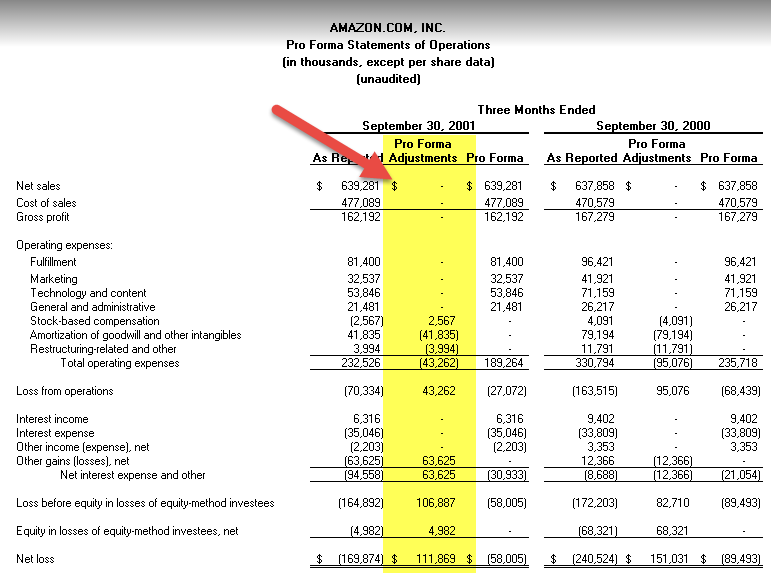

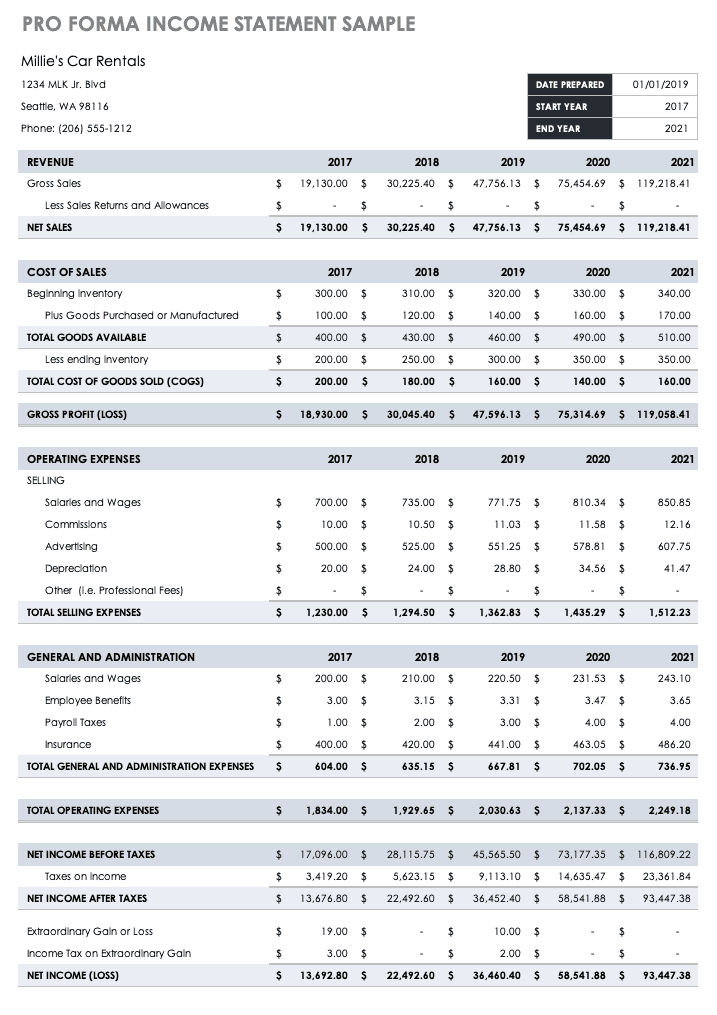

Creating a pro forma income statement. Pro forma statements can cover a wide range of scenarios, from potential mergers to changes in capital structure, allowing for flexibility in forecasting. Gaap financial statements follow a standardized format, including the income statement, balance sheet, and cash flow statement, providing a comprehensive view of a company.

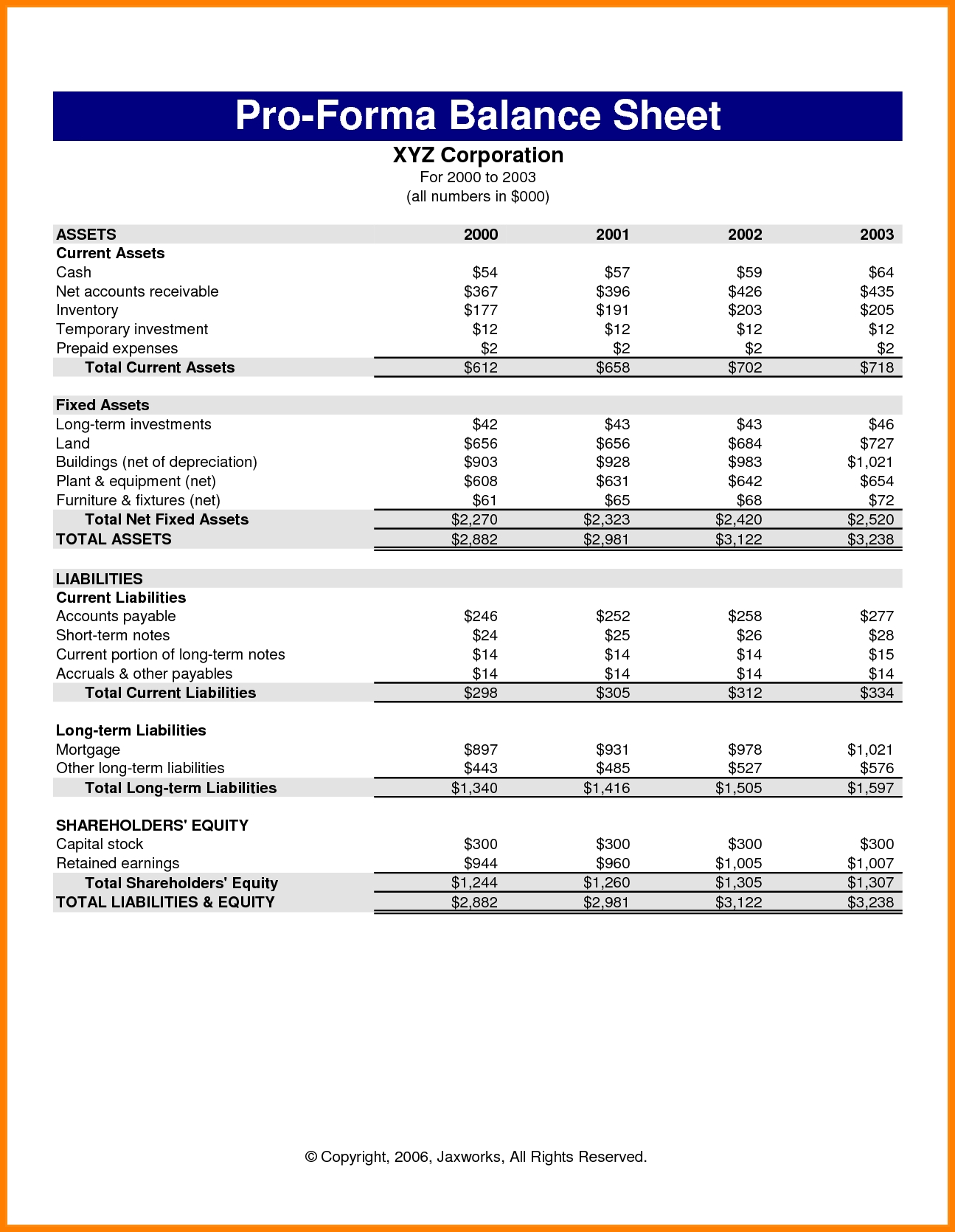

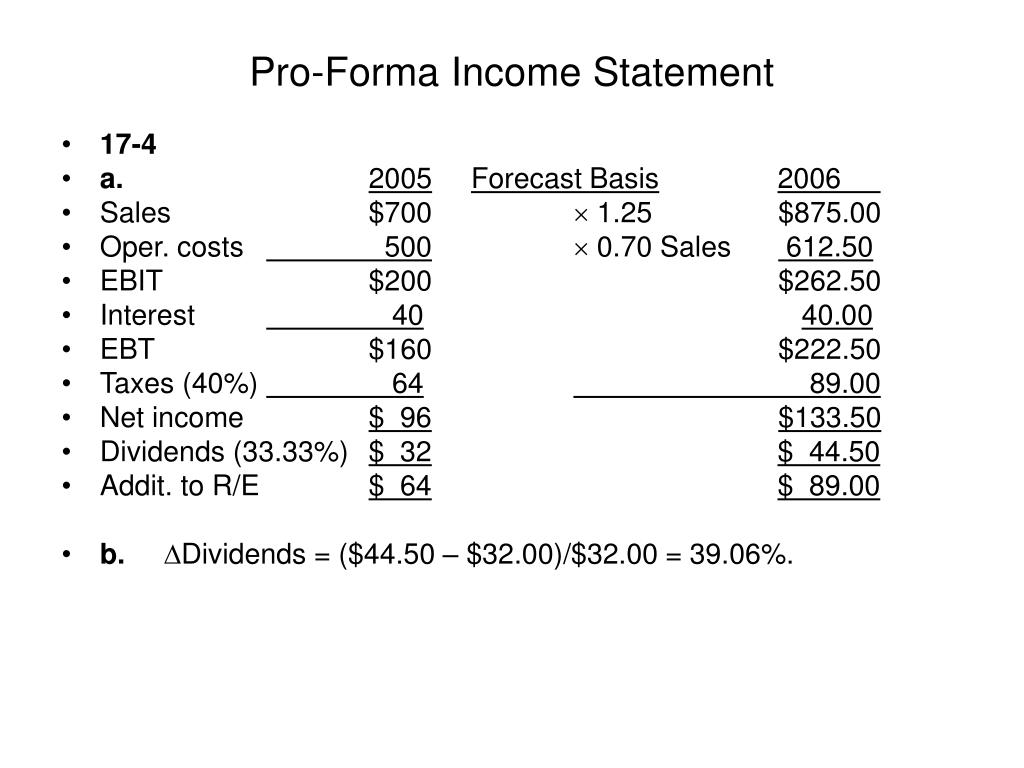

Whether you’re trying to interpret pro forma financial statements or prepare them, these projections can be useful in guiding important business decisions. Pro forma statement of comprehensive income for the y/e 31 december 2020 particulars amount 2019 amount 2020 sales 6,240,000 6,864,000 cost of sales (3,744,000) (4,118,400) gross profit 2,496,000 2,745,600 o.view the full answer Pro forma financials may not be.

In the pro forma condensed statements of comprehensive income for the year ended december 31, 2022 and the interim period ended march 31, 2023, adjustments should be made to depict the effects of the transaction accounting adjustments that were made to the pro forma balance sheet assuming the adjustments were made as of the. The claimed rationale should include the current income and the general schedule that follows the bill payment. Comprehensive income based on its latest 31 december year end results for inclusion in a circular for a category 1 acquisition.

This type of financial statement has the following characteristics: 3300 special problems and issues. Following this statement are the specific working assumptions with which to plan the financial results for the next year.

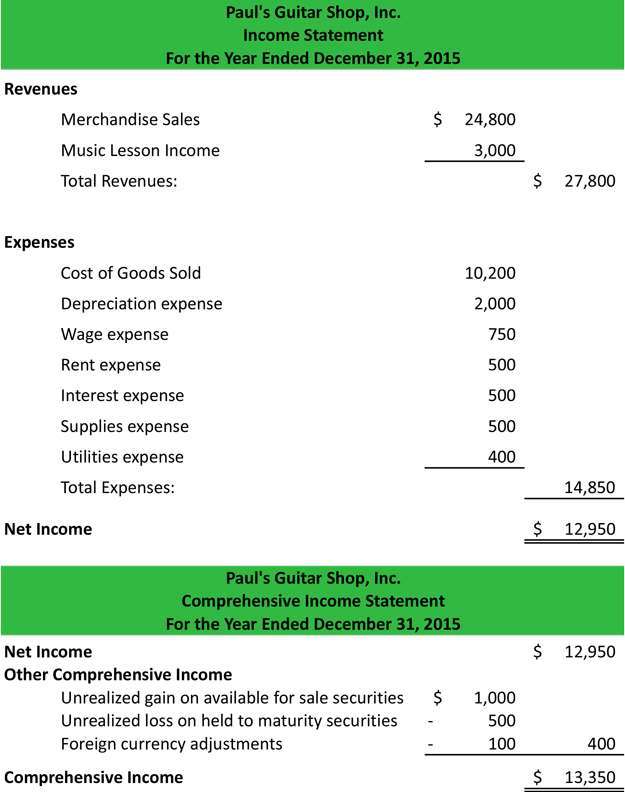

Statement of comprehensive income refers to the statement which contains the details of the revenue, income, expenses, or loss of the company that is not realized when a company prepares the financial statements of the accounting period, and the same is presented after net income on the company’s income statement. The best estimates of the operating results for the current year (20) are shown in the statement of comprehensive income below. Pro forma statements of comprehensive income are typically required for each fiscal year for which the registrant's historical financial statements are provided and the subsequent interim period.

Pro forma statement of comprehensive income or cash flow information for two or more entities or business undertakings. Since the term “pro forma” refers to projections or forecasts, it can apply to a variety of financial statements, including: The following shows the format of the statement of comprehensive income:

These income statements are not always prepared by following universally accepted accounting principles as the line items can’t be backed by proper. Pro forma is a type of income statement that contains projections and presumptions. A pro forma income statement in business plan is the statement prepared by the business entity to prepare the projections of income and expenses, which they expect to have in the future by following certain assumptions such as competition level in the market, size of the market, and growth rate, etc.

There are five steps to creating a pro forma income statement: The pro forma income statement is a document that is a way to show your company's income if you exclude some costs. The statement of retained earnings includes two key parts:

Net income, and other comprehensive income, which incorporates the items excluded from the income statement. For example, an entity may be preparing a pro forma statement of. One single statement statement of comprehensive income for the year ended 31 march 20x8 proforma 2: