Stunning Info About The Statement Of Profit Or Loss Is Normally Completed Deferred Revenue Account Type

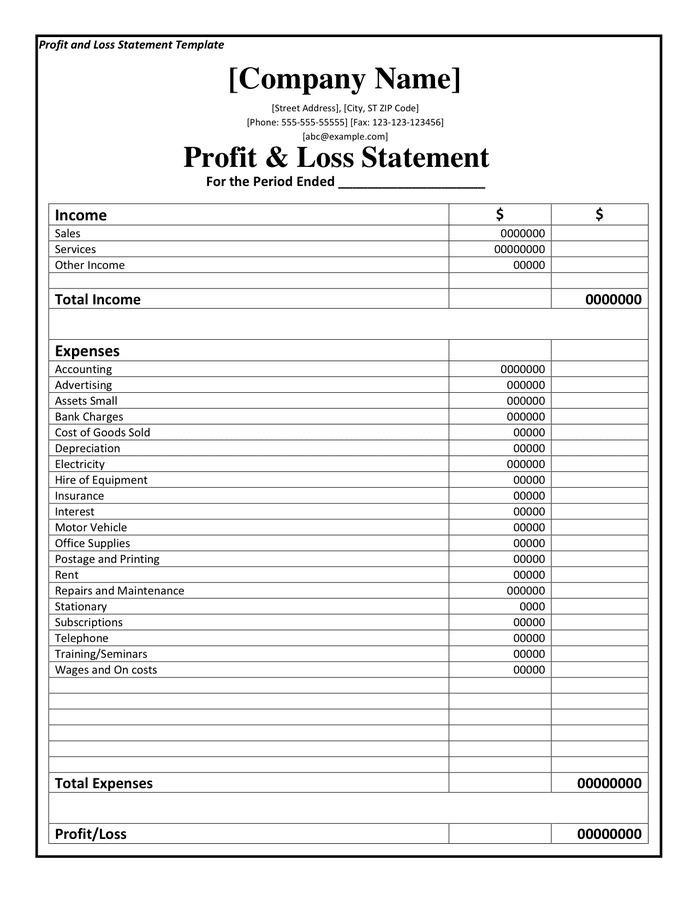

A profit and loss statement is also called an income statement, a statement of profit, or a profit and loss report.

The statement of profit or loss is normally completed. Why you need a profit and loss statement. Net income (net loss) is determined by comparing revenues and expenses. A profit and loss (or income) statement lists your sales and expenses.

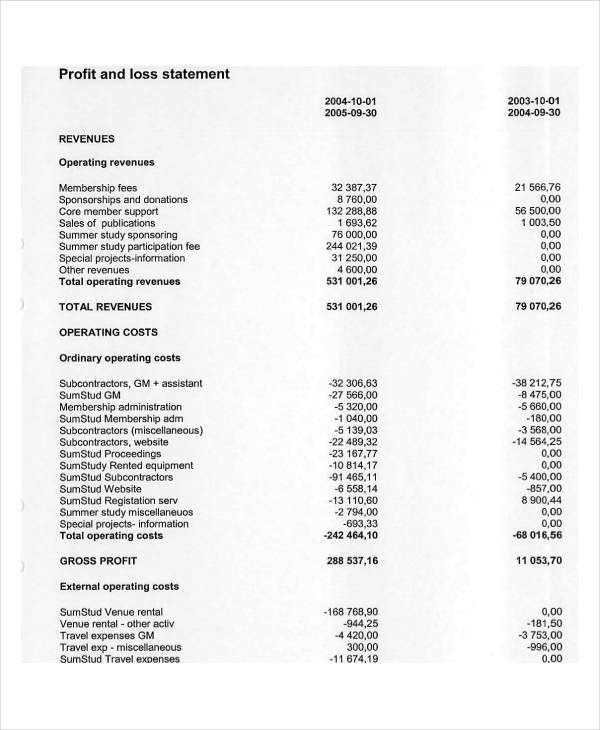

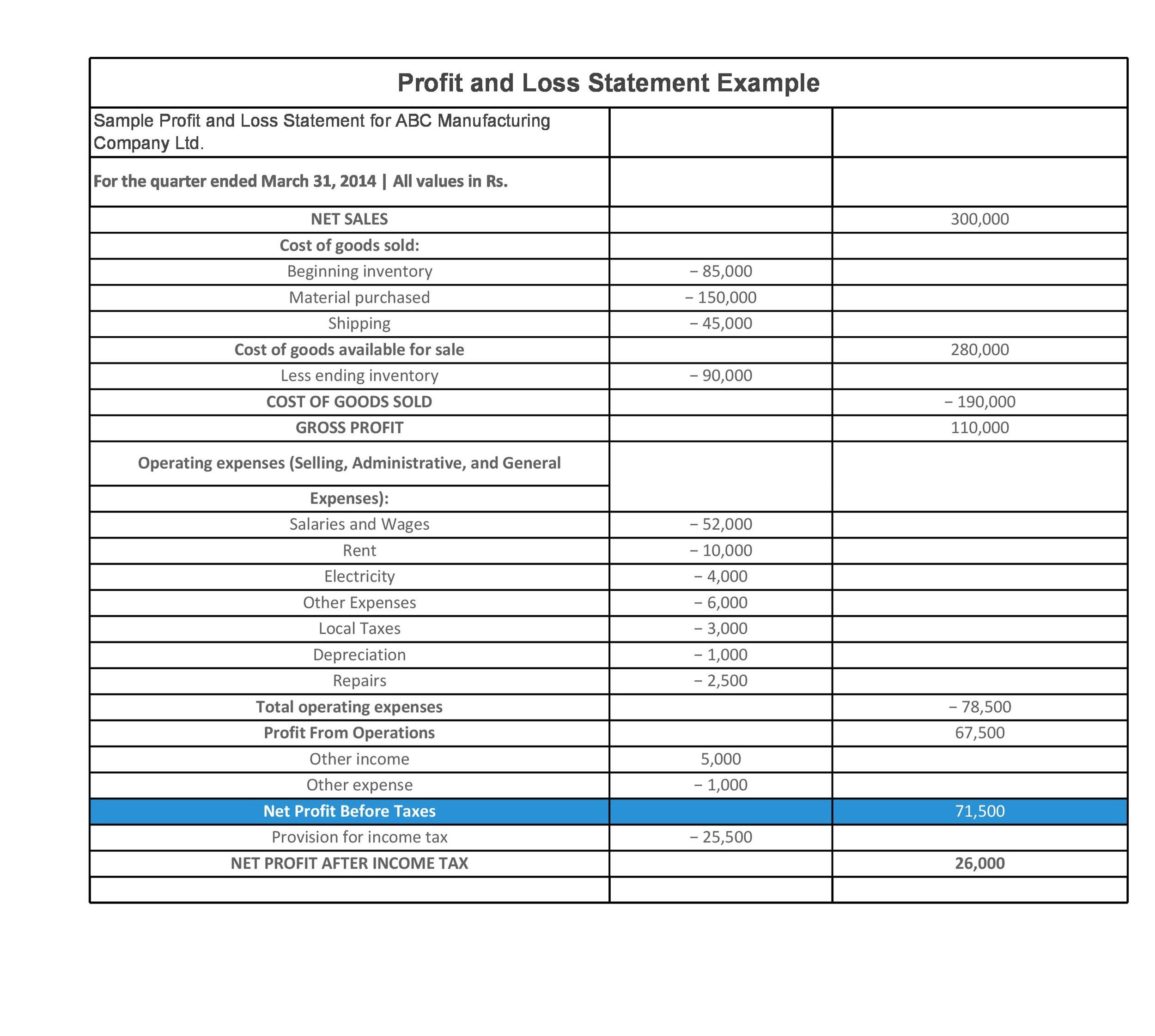

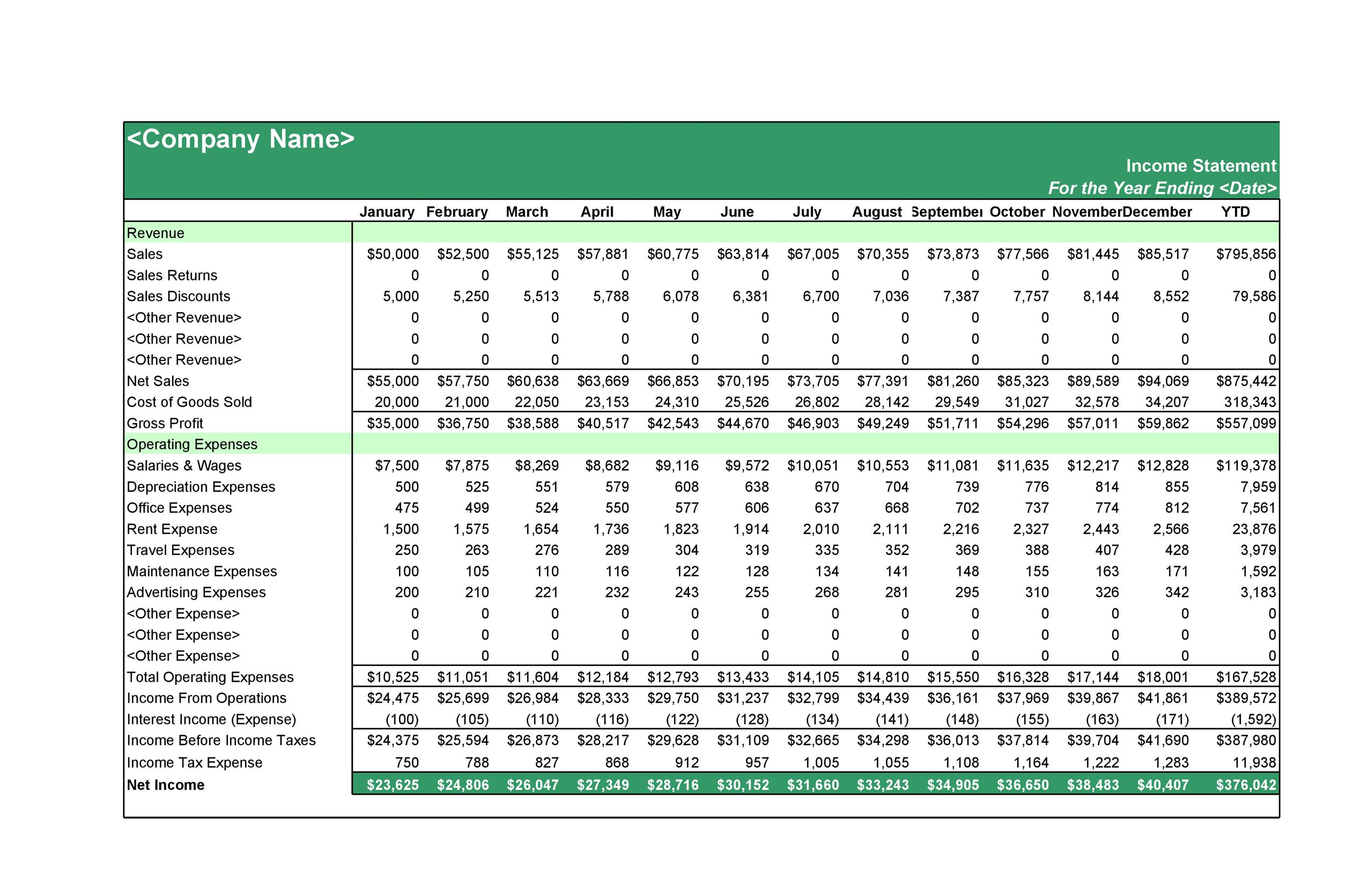

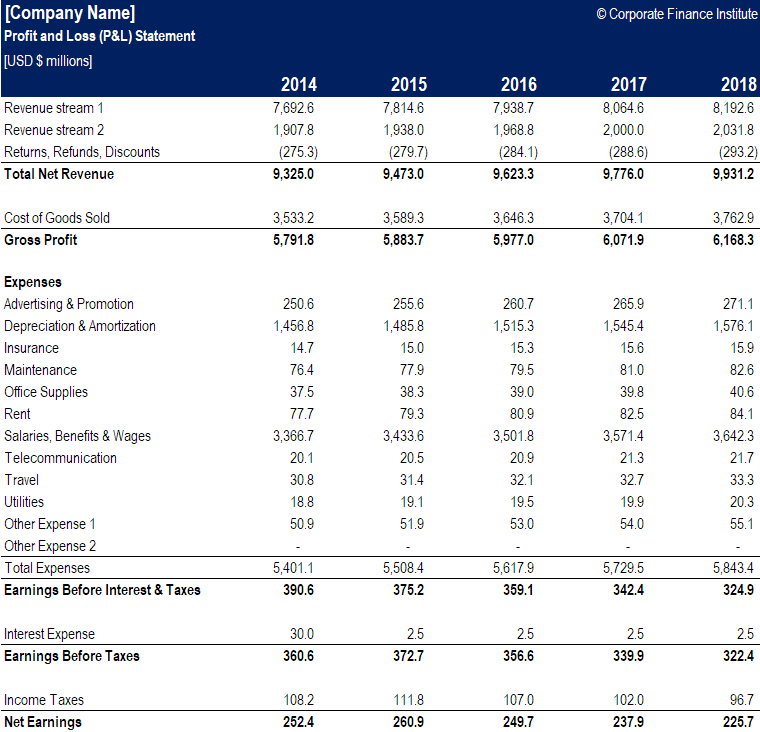

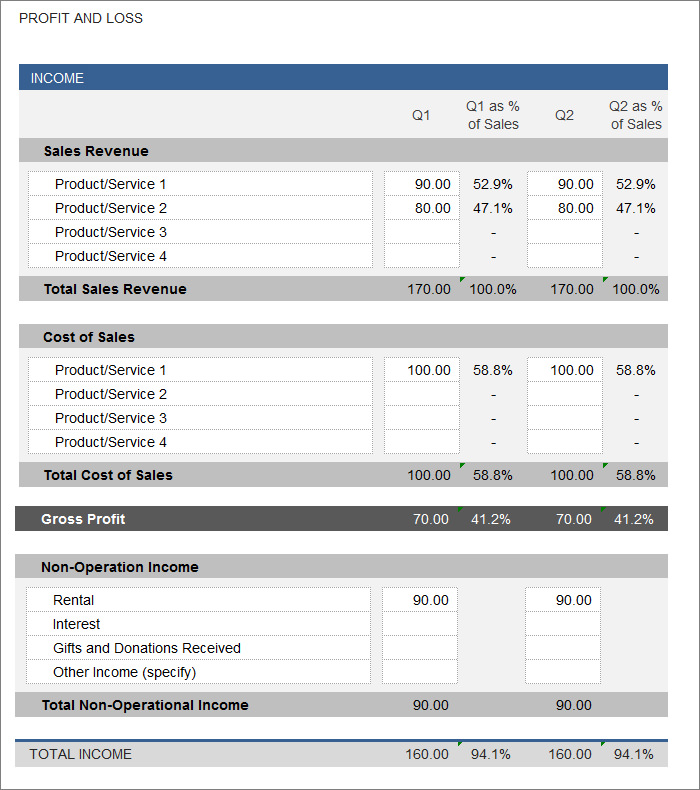

The statement of profit or loss is normally completed before the statement of financial position.the statement of profit or loss, also known as the. When is the statement of profit or loss normally completed? A profit and loss statement (p&l) is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period of time, usually a fiscal quarter.

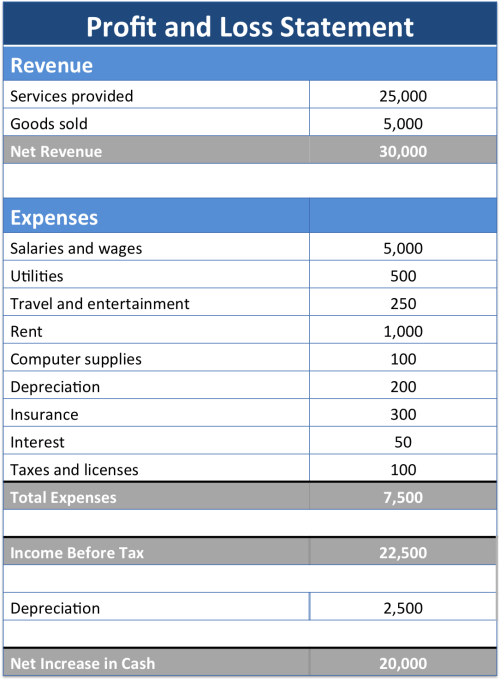

Net income is a result of revenues (inflows) being greater than expenses (outflows). It tells you how much profit you're making, or. A profit and loss statement, formally known as an income statement or simply as a p&l, tracks the amount of profit that remains after a business subtracts all of its costs from its.

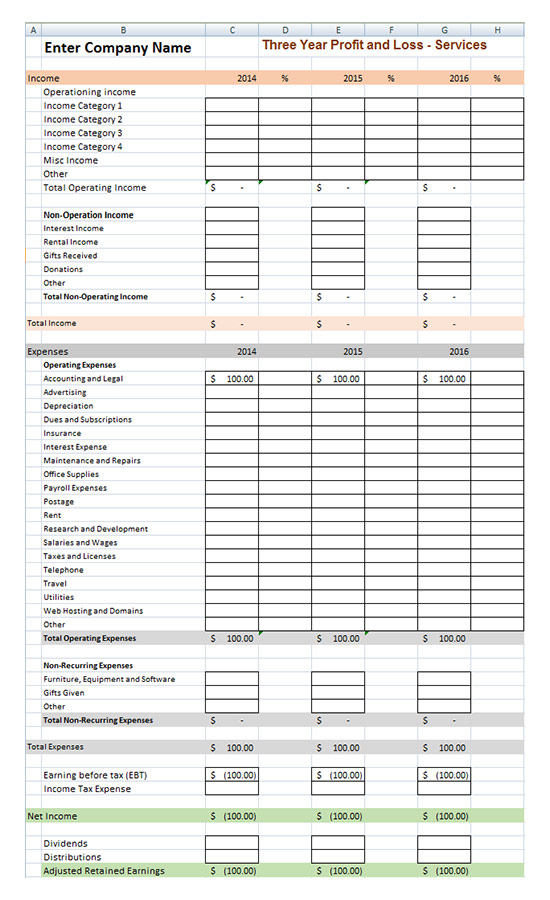

The main categories that can be found on the p&l include: When is the statement of profit or loss normally completed? Designed to provide business owners with revenue and expense details, the profit and.

The purpose of the statement of profit or loss and other comprehensive income (ploci) is to show an entity’s financial performance in a way that is useful to a wide range of. The profit and loss (p&l) statement (also known as an income statement) is one of the four basic financial statements that presents the revenues, expenses, and. Study with quizlet and memorize flashcards containing terms like the profit and loss statement, cash flow statement, limitations of a transaction list p&l statement.

Shown as a formula, the net income (loss) function is: Cost of goods sold (or cost of sales) 3. Statement of profit or loss and other comprehensive income 81a statement of changes in equity 106 statement of cash flows 111 notes 112.

Creating one is a standard way to. The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly. A profit and loss (p&l) statement is among the three key financial statements prepared by businesses, alongside the balance sheet and the cash flow statement.

A company’s statement of profit and loss is portrayed over a period of time, typically a month, quarter, or fiscal year. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

.png)