Divine Tips About The Retained Earnings Statement Shows Available For Sale Financial Assets Accounting Treatment

Retaining earnings help provide the company with funds for future.

The retained earnings statement shows. It is structured as an equation,. Home > finance > accounting retained earnings: On the bottom line of your income statement (also called the profit and.

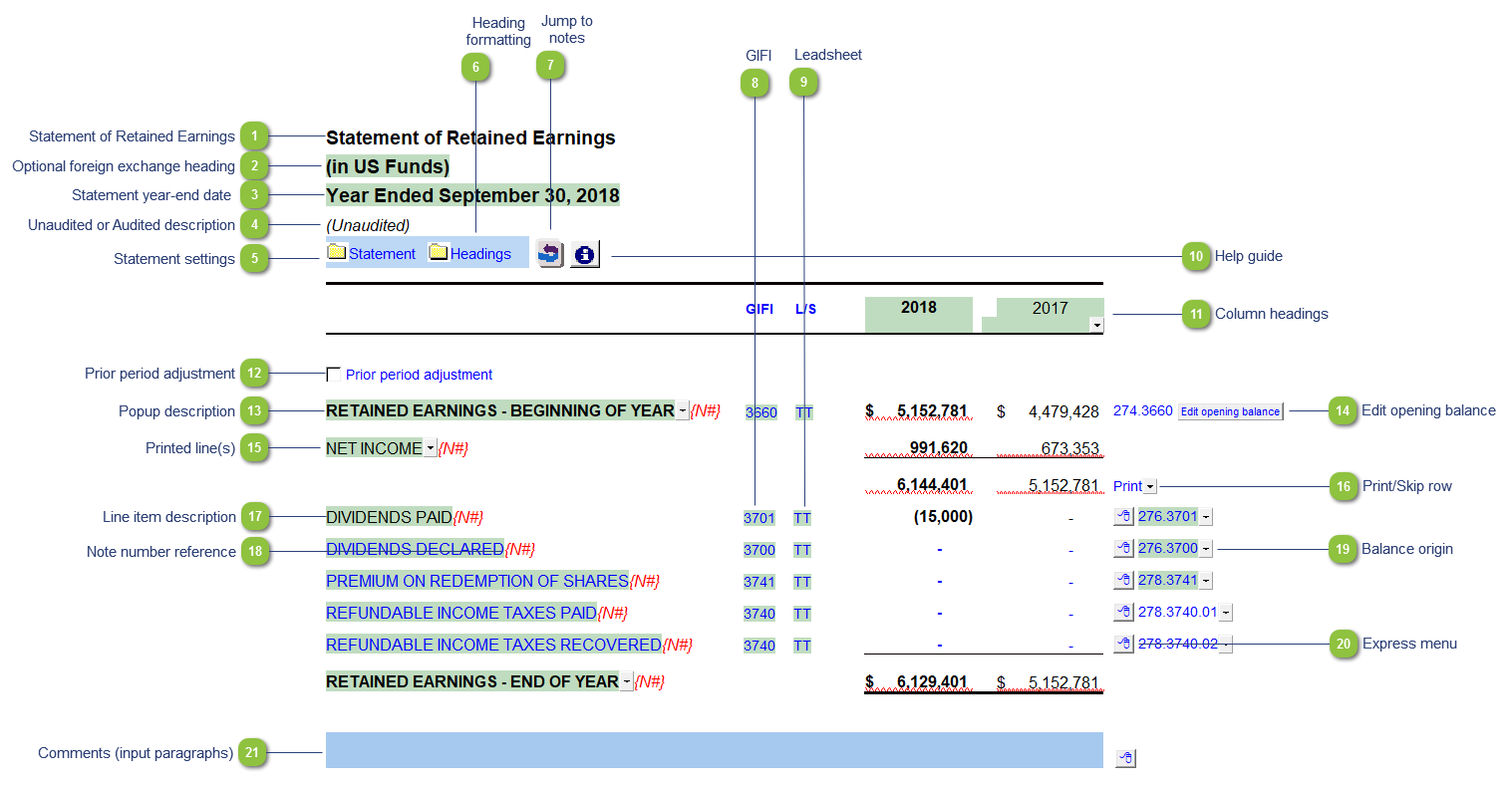

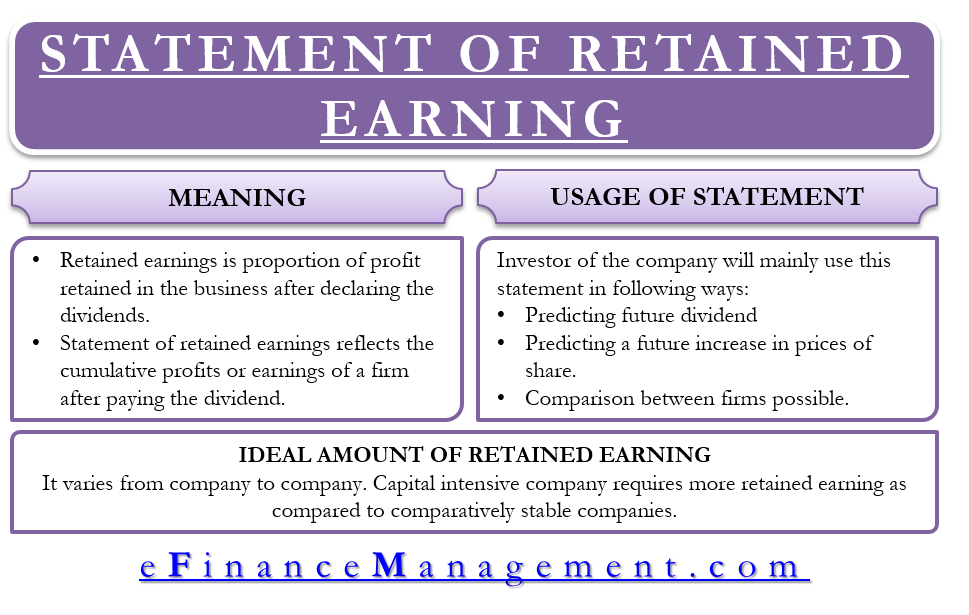

A statement of retained earnings is a financial statement that shows how the retained earnings have changed during the financial period and provide details of the beginning. Statement of retained earning definition. 4 rows a statement of retained earnings shows the changes in a business' equity accounts over time.

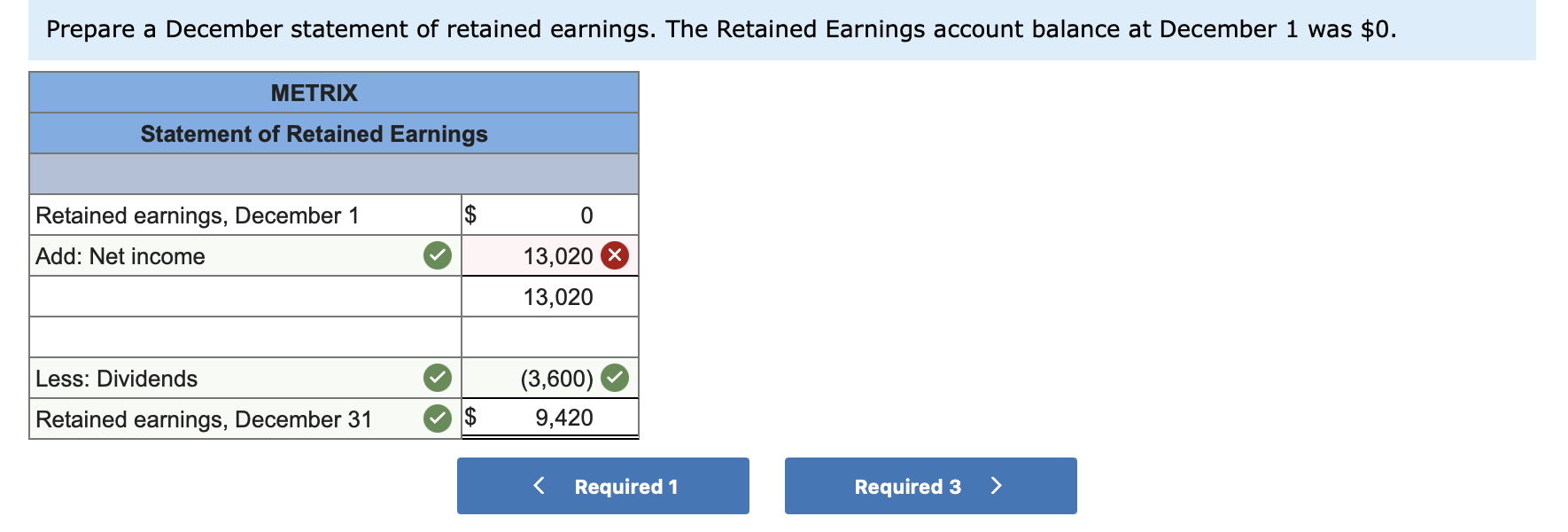

The statement of retained earnings provides an overview of the changes in a company’s retained earnings during a specific accounting cycle. To find retained earnings, you add the past period’s retained earnings to net income (or loss) and then subtract dividend payouts. The statement of retained earnings (which is often a component of the statement of stockholders’ equity) shows how the equity (or value) of.

Everything you need to know for your small business want to understand how much revenue remains after. The statement of retained earnings (retained earnings statement) is a financial statement that outlines the changes in retained earningsfor a company over a specified period. Retained earnings is a component of shareholder’s equity on the balance sheet.

The net income has been split between 10,000. The retained earnings are given by: This statement reconciles the beginning and ending retained earnings for the period, using information such as net income.

Here is the retained earnings formula:. Equity is a measure of your business’s worth, after adding up assets and taking. Your accounting software will handle this.

Retained earnings refer to the residual net income or profit after tax which is not distributed as dividends to the shareholders but is reinvested in the business. A key advantage of the statement of retained earnings is that it shows how management chooses to redirect the retained earnings of a business. Next, the statement of retained earnings shows the beginning and ending retained earnings balances and the reasons for any change in this balance.

The retained earnings formula is fairly straightforward: Retained earnings are the portion of a company's net income that is not paid out as dividends. A statement of retained earnings shows the changes in a business’ equity accounts over time.

:max_bytes(150000):strip_icc()/statement-of-retained-earnings-final-8500839aff40433dba054ce0af9f9f42.png)